The upcoming discussion will update you about the difference between relevant costs and irrelevant costs.

In order to exercise cost control, managers must be able to make distinction between relevant costs and irrelevant costs. Costs that are affected by the managerial decisions are known as relevant costs and those costs that are not affected are treated as irrelevant costs. Irrelevant costs are not affected by the managerial decisions and hence are ignored while taking decisions.

Only relevant costs are affected and are taken into consideration for taking a particular decision. Decision making is the process of evaluating various alternatives available and making a choice of the best alternative giving maximum profit or least cost. Relevant costs for decision making are expected future costs that will differ under various alternatives.

Historical costs are irrelevant to the decision even though they may be the best available basis for predicting relevant costs.

ADVERTISEMENTS:

Costs that are uniform for various alternatives such as fixed costs remaining same for all alternatives are ignored and only those costs such as variable costs that are different for each alternative are the relevant costs and are considered for making a choice of the best alternative out of various alternatives.

It is wrong to conclude that all variable costs are relevant costs and all fixed costs are irrelevant. Fixed costs can also be relevant if they are expected to change by the decision to be taken. For example, if a decision is to be taken whether idle capacity should be utilized or not.

The costs that are relevant in this decision are the additional costs that will be incurred for utilizing idle capacity. The costs that are already incurred will be irrelevant costs and will be ignored for taking this decision.

Additional costs incurred will be compared with the additional revenue arising by utilizing idle capacity. If the additional revenue is more than the additional cost, it will be advantageous to utilize the idle capacity and if the additional cost exceeds the additional revenue, the idea of utilizing the idle capacity will be dropped.

ADVERTISEMENTS:

Examples of relevant costs are marginal or variable cost, specific or avoidable fixed costs, incremental costs, opportunity costs, out of pocket costs etc. On the other hand, the irrelevant costs are general or absorbed fixed costs, committed costs, sunk costs etc.

With this classification of costs as to cost relevance, management can make important decisions e.g. make or buy process further or not, extra shift decision, exploring the foreign market, plant replacement, accepting or rejecting an offer, adding or deleting of departments (products), shut down etc.

For taking the sound managerial decisions, non-cost factors (i.e., qualitative considerations) should also be taken into consideration in addition to cost factors. For example, if the decision of replacing labour by machinery is to be taken, labour unrest on installation of automatic machines should also be considered.

It is difficult to measure non-cost factors in numerical terms. Relevant costs (also referred to as differential costs) are expected future costs relevant to a decision and also differ among different alternatives.

ADVERTISEMENTS:

Illustration 1:

ACE Ltd. has an inventory of 5,000 units of a product left over from last year’s production. This model is no longer in demand. It is possible to sell these at reduced prices through the normal distribution channels. The other alternative is to ask someone to take them on “as is where is” basis. The latter alternative will cost the company Rs.5,000.

The company produced 2, 40,000 units of the product last year, when the unit costs were as under:

Should the company scrap the items or sell them at a reduced price? If you suggest the latter, what minimum price would you recommend?

ADVERTISEMENTS:

Solution:

Computation of Minimum Recommended Price of an Obsolete Product:

Following points will be taken into consideration for recommending the minimum price:

ADVERTISEMENTS:

(i) Historical cost of Rs.11.50 per unit of 5,000 units of product produced last year (which is no longer in demand) is irrelevant cost being a sunk cost. Hence, this cost will not be considered for recommending the minimum price.

(ii) If this product is sold in the market through the normal distribution channel at reduced prices, it will involve a variable selling and distribution cost of Rs.3 per unit. It will be taken into consideration for determining the minimum price.

(iii) If the items are scrapped and someone is asked to take them on “as is where is” basis, the company would have to spend Rs.5,000 over 5,000 units i.e. Rs.1 per unit.

Keeping in view points (ii) and (iii), the items should be sold through normal distribution channels which will involve a differential cost of Rs.2 (i.e. Rs.3 – Rs.1) per unit. Hence, the minimum recommended price is more than Rs.2 per unit so that there may be some addition to the profit of the company.

ADVERTISEMENTS:

Illustration 2:

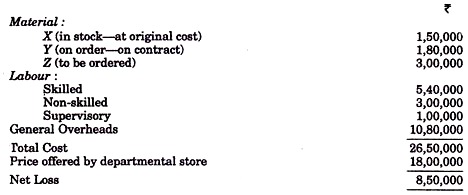

Mahila Griha Udyog Industries is considering to supply its products—a special range of namkeens—to a departmental store. The contract will last for 50 weeks, and the details are given below:

Should the contract be accepted if the following additional information is considered?

ADVERTISEMENTS:

(i) Material X is an obsolete material. It can only be used on another product, the material for which is available at Rs.1, 35,000 (Material X requires some adaptation to be used and costs Rs.27,000).

(ii) Material Y is ordered for some other product which is no longer required. It now has a residual value of Rs. 2,10,000.

(iii) Skilled labour can work on other contracts which are presently operated by semi-skilled labour at a cost of Rs.5,70,000.

(iv) Non-skilled labour is specifically employed for this contract.

(v) Supervisory staff will remain whether or not the contract is accepted. Only two of them can replace other positions where the salary is Rs.35,000.

(vi) Overheads are charged at 200% of skilled labour. Only Rs. 1,25,000 would be avoidable, if the contract is not accepted.

ADVERTISEMENTS:

Solution:

Statement Showing Relevant Cost for a Contract to be Accepted or Rejected

Net profit on accepting the contract = Rs.3,35,000 – Rs.1,83,000 = Rs.1,52,000. The contract should be accepted as it, jives net benefit of Rs.1,52,000.

Working Notes:

(1) Material V is ordered for some other product which is no longer required but payment for material will have to be made. Therefore, its cost is relevant but the relevant cost is the residual value of Rs.1,35,000 which can be realized.

(2) Cost of skilled labour Rs.5,70,000 is the extra cost to the company because of this contract. It is the replacement cost of semi-skilled labour by skilled labour.

(3) Rs.35,000 paid as salary to two members of the supervisory staff who can replace other positions is the relevant cost for the contract.

(4) Cost of avoidable overheads Rs. 1,25,000 is the relevant cost to the contract and as such it has been added to the cost of the contract.