In this article we will discuss about the preparation of cash flow statement, explained with the help of suitable illustrations.

The Cash Flow Statement should report cash flows during the period classified by operating, Investing and Financing Activities. An enterprise presents its cash flows from operating, investing and financing activities in a manner which is most appropriate to its business. Classification by activity provides information that allows users to assess the impact of those activities on the financial position of the enterprise and the amount of its cash and cash equivalents. This information may also be used to evaluate the relationships among those activities.

A single transaction may include cash flows that are classified differently. For example, when the installment paid in respect of fixed assets acquired on deferred “payment basis includes both interest and loan, the interest element is classified under financing activities and the loan element is classified under investing activities.

(A) Reporting Cash Flows from Operating Activities:

An enterprise should report cash flows from operating activities using either:

ADVERTISEMENTS:

(i) The direct method, whereby major classes of gross cash receipts and gross cash payments are disclosed; or

(ii) The indirect method, whereby net profit or loss is adjusted for the effects of transactions of a non-cash nature, any deferrals or accruals of past or future operating cash receipts or payments, and items of income or expense associated with investing or financing cash flows. The direct method provides information which may be useful in estimating future cash flows and which is not available under the indirect method and is, therefore, considered more appropriate than the indirect method.

Under the direct method, information about major classes of gross cash receipts and gross cash payments may be obtained either:

(a) From the accounting records of the enterprise; or

ADVERTISEMENTS:

(b) By adjusting sales, cost of sales (interest and similar income and interest expense and similar charges for a financial enterprise) and other items in the statement of profit and loss for:

(i) Changes during the period in inventories and operating receivables and payables;

(ii) Other non-cash items; and

(iii) Other items for which the cash effects are investing or financing cash flows.

ADVERTISEMENTS:

Under the indirect method, the net cash flows from operating activities is determined by adjusting net profit or loss for the effects of:

(a) Changes during the period in inventories and operating receivable and payables;

(b) Non-cash items such as depreciation, provisions, deferred taxes, and unrealised foreign exchange gains and losses; and

(c) All other items for which the cash effects are investing or financing cash flows. Alternatively, the net cash flows from operating activities may be presented under the indirect method by showing the operating revenues and expenses excluding non-cash items disclosed in the statement of profit and loss and the changes during the period in inventories and operating receivables and payables.

ADVERTISEMENTS:

(B) Reporting Cash Flows from Investing and Financing Activities:

An enterprise should report separately major classes of gross cash receipts and gross cash payments arising from investing and financing activities, except to the extent that cash flows described below are reported on a net basis.

(C) Reporting Cash Flows on a Net Basis:

Cash flows arising from the following operating, investing or financing activities may be reported on a net basis:

ADVERTISEMENTS:

(a) Cash receipts and payments on behalf of customers when the cash flows reflect the activities of the customer rather than those of the enterprise; and

(b) Cash receipts and payments for items in which the turnover is quick, the amounts are large, and the maturities are short.

Examples of cash receipts and payments referred to in paragraph (a) above are:

(a) The acceptance and repayment of demand deposits by a bank;

ADVERTISEMENTS:

(b) Funds help for customers by an investment enterprise; and

(c) Rents collected on behalf, and paid over to, the owners of properties.

Examples of cash receipts and payments referred to in paragraph (b) are advances made for, and the repayments of:

(a) Principal amounts relating to credit card customers;

ADVERTISEMENTS:

(b) The purchase and sale investments; and

(c) Other short-term borrowings, for example, those which have a maturity period of three months or less.

Cash flows arising from each of the following activities of a financial enterprise may be reported on a net basis:

(a) Cash receipts and payments for the acceptance and repayment of deposits with a fixed maturity date;

(b) The placement of deposits with and withdrawal of deposits from other financial enterprises; and

(c) Cash advances and loans made to customers and the repayment of those advances and loans.

ADVERTISEMENTS:

Other Items:

In addition to the cash flows described, AS-3 (Revised) also deals with certain other items as shown below:

1. Foreign Currency Cash Flows:

Cash flows arising from transactions in a foreign currency should be recorded in an enterprises reporting currency by applying to the foreign currency amount the exchange rate between the reporting currency and the foreign currency at the date of the cash flow:

A rate that approximates the actual rate may be used if the result is substantially the same as would arise, if the rates at the date of cash flows were used. The effect of changes in exchange rates on cash and cash equivalents held in a foreign currency should be reported as a separate part of the reconciliation of the changes in cash and cash equivalents during the period.

Cash flows denominated in foreign currency are reported in a manner consistent with Accounting Standard (AS) 11, According for the Effects of Changes in Foreign Exchange Rates. This permits the use of an exchange rate that approximates the actual rate. For example, a weighted average exchange rate for a period may be used for recording foreign currency transactions.

Unrealized gains and losses arising from changes in foreign exchange rates are not cash flows. However, the effect of exchange rate changes on cash and cash equivalents held or due in a foreign currency is reported in the cash flow statement in order to reconcile cash and cash equivalents at the beginning and the end of the period. This amount is presented separately from cash flows from operating, investing and financing activities and include the differences, if any, had those cash flows been reported at the end-of-period exchange rates.

2. Extraordinary Items:

The cash flows associated with extraordinary items should be classified as arising from operating, investing or financing activities as appropriate and separately disclosed. The cash flows associated with extraordinary items are disclosed separately as arising from operating, investing or financing activities in the cash flow statement, to enable users to understand their nature and effect on the present and future cash flows of the enterprise.

These disclosures are in addition to the separate disclosures of the nature and amount of extraordinary items required by Accounting Standard (AS) 5, Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies.

3. Interest and Dividends:

Cash flows from interest and dividends received and paid should be disclosed each separately. Cash flows arising from interest paid and interest and dividends received in the case of a financial enterprise should be classified as cash flows arising from operating activities.

In the case of other enterprises, cash flows arising from interest paid should be classified as cash flows from financing activities while interest and dividends received should be classified as cash flows from investing activities. Dividends paid should be classified as cash flows from financing activities.

The total amount of interest paid during the period is disclosed in the cash flow statement whether it has been recognized as an expense in the statement of profit and loss or capitalized in accordance with Accounting Standard (AS) 10, Accounting for Fixed Assets.

Interest paid, interest and dividends received are usually classified as operating cash flows for a financial enterprise. However, there is no consensus on the classification of these cash flows for other enterprises.

Some argue that interest paid, and interest dividends received may be classified as operating cash flows because they enter into the determination of net profit or loss. However, it is more appropriate that interest paid, interest and dividends received are classified as financing cash flows and investing cash flows respectively, because they are cost of obtaining financial resources or returns on investments.

Some argue that dividends paid may be classified as a component of cash flows from operating activities in order to assist users to determine the ability of an enterprise to pay dividends out of operating cash flows. However, it is considered more appropriate that dividends paid should be classified as cash flows from financing activities because they are cost of obtaining financial resources.

4. Taxes on Income:

Cash flows arising from taxes on income should be separately disclosed and should be classified as cash flows from operating activities unless they can be specially identified with financing and investing activities. Taxes on income arise on transactions that give rise to cash flows that are classified as operating, investing or financing activities in a cash flow statement. While tax expense may be readily identifiable with investing or financing activities, the related tax cash flows are often impracticable to identify and may arise in a different period from the cash flows of the underlying transactions.

Therefore, taxes paid are usually classified as cash flows from operating activities. However, when it is practicable to identify the tax cash flow with an individual transaction that gives rise to cash flows that are classified as investing or financing activities, the tax cash flow is classified as an investing or financing activity as appropriate. When tax cash flow are allocated over more than one class of activity, the total amount of taxes paid is disclosed.

5. Investments in Subsidiaries, Associates and Joint Ventures:

When accounting for an investment in an associate or a subsidiary or a joint venture, an investor restricts its reporting in the cash flow statement to the cash flows between itself and the investee/joint venture, for example, cash flows relating to dividends and advances.

6. Acquisitions and Disposals of Subsidiaries and Other Business Units:

The aggregate cash flows arising from acquisitions and from disposals of subsidiaries or other business unit should be presented separately and classified as investing activities.

An enterprise should disclose, in aggregate, in respect of both acquisition and disposal of subsidiaries or other business units during the period each of the following:

(a) The total purchase or disposal consideration; and

(b) The portion of the purchase or disposal consideration discharged by means of cash and cash equivalents.

The separate presentation of the cash flow effects of acquisitions and disposals of subsidiaries and other business units as single line items helps to distinguish those cash flows from other cash flows. The cash flows effects of disposals are not deducted from those of acquisition.

7. Non-Cash Transactions:

Investing and financing transactions that do not require the use of cash or cash equivalents should be excluded from a cash flow statement. Such transactions should be disclosed elsewhere in the financial statements in a way that provides all the relevant information about these investing and financing activities.

Many investing and financing activities do not have a direct impact on current cash flows although they do affect the capital and asset structure of an enterprise. The exclusion of non-cash transactions from the cash flow statement is consistent with the objective of a cash flow statement as these items do into involve cash flows in the current period.

Examples of non-cash transactions are:

(a) The acquisition of assets by assuming directly related liabilities;

(b) The acquisition of an enterprise by means of issue of shares; and

(c) The conversion of debt to equity.

8. Components of Cash and Cash Equivalents:

An enterprise should disclose the components of cash and cash equivalents and should present a reconciliation of the amounts in its cash flow statement with the equivalent items reported in the balance sheet.

In view of the variety of cash management practices, an enterprise discloses the policy, which it adopts in determining the composition of cash and cash equivalents.

The effect of any change in the policy for determining components of cash and cash equivalents is reported in accordance with Accounting Standard (AS) 5, Net Profit or Loss for the Period, prior period items and changes in Accounting Policies.

Other Disclosures:

An enterprise should disclose, together with a commentary by management, the amount of significant cash and cash equivalent balances held by the enterprise that are not available for use by it. There are various circumstances in which cash and cash equivalents balances held by an enterprise are not available for use by it.

Examples include cash and cash equivalent balances held by a branch of the enterprise that operates in a country where exchange controls or other legal restrictions apply as a result of which the balances are not available for use by the enterprise. Additional information may be relevant to users in understanding the financial position of liquidity of an enterprise.

Disclosure of this information, together with a commentary by management, is encouraged and may include:

(a) The amount of undrawn borrowing facilitates that may be available for future operating activities and to settle capital commitments, indicating any restrictions on the use of these facilities; and

(b) The aggregate amount of cash flows that represent increases in operating capacity separately from those cash flows that are required to maintain operating capacity.

The separate disclosure of cash flows that represent increase in operating capacity and cash flows that are required to maintain operating capacity is useful in enabling the user to determine whether the enterprise is investing adequately in the maintenance of its operating capacity. An enterprise that does not invest adequately in the maintenance of its operating capacity may be prejudicing future profitability for the sake of current liquidity and distributions to owners.

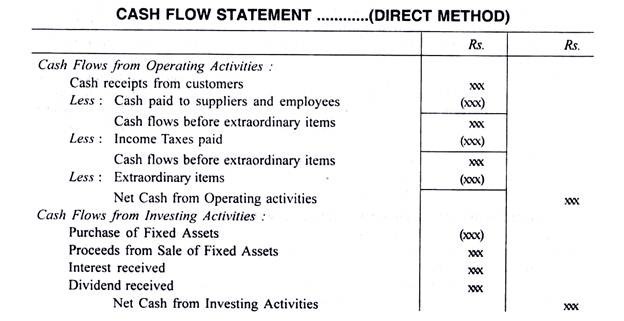

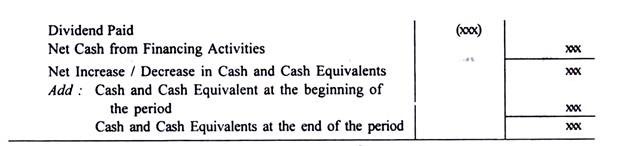

Format of Cash Flow Statement:

‘AS-3’ has not provided any specific format for the preparation of Cash Flow Statement. However, SEBI, which amended clause 32 of the Listing agreement in 1995 requiring all listed companies to prepare a Cash Flow Statement, has provided format for Cash Flow Statement.

The following is widely used format of Cash Flow Statement:

Cash flows shown in bracket are treated as minus figures while making total.

NB : Indirect method is more popular and usually followed, unless ‘Direct Method’ is specifically asked.

Illustration 1:

The following is the summarised income statement of ABC Ltd. for the year ended 31st March 2005:

You are required to ascertain Net Cash Flow from Operating activities by :

(A) Direct Method

(B) Indirect Method

Illustration 2:

The Balance Sheets of Thirugnanam Ltd., for the years 2004 and 2005 were as follows:

Additional Information:

(a) Net profit for the year 2005 Rs. 60,000.

(b) During the year a plant costing Rs. 25,000. (accumulating depreciation Rs. 10,000) was sold for Rs. 13,000.

(c) The provision for depreciation against plant as on 31-12-2004 was Rs. 50,000 and on 31- 12-2005 was Rs. 85,000.

You are required to prepare a cash flow statement.

Illustration 3:

From the following summarised financial statement of Abec Ltd. as at 31st March, 2005 and 2006 respectively, prepare a Cash Flow Statement.

During 2005 – 2006 depreciation provided on assets amounted to Buildings Rs. 30,000, Plant and Machinery Rs. 2,40,500.

The final dividend for the year 2004 – 2005 amounting to Rs. 1,00,000 was paid on 8th October, 2005.