In this article we will discuss about the accounting entries for the issue of shares at premium, explained with the help of an illustration.

A company likely to be very successful and enjoying a good reputation, asks intending shareholders to pay, on each share, a sum higher than the face value. In other words, when shares are issued at a price higher than the face value of the shares, it is said that the shares are issued at a premium.

Such issue is possible only for those companies which are paying high dividends. The excess amount received over the face value is called Securities Premium. For instance, if a company issues its shares of Rs. 100 at Rs. 120 per share. Then Rs. 20 is credited to Securities Premium Account.

This amount can be utilised by the company only for the following purposes (Sec. 78 of Companies Act, 1956):

ADVERTISEMENTS:

(a) For the issue of bonus shares to the members of the company;

(b) For writing off preliminary expenses;

(c) For writing off the expenses of, or the commission paid or discount allowed on any issue of shares or debentures of the company;

(d) For providing the premium payable on the redemption of any redeemable preference shares or debentures of the company.

ADVERTISEMENTS:

The Premium may be collected either with application or on allotment or along with other calls. By an amendment in Section 78, the companies (Amendment) Ordinance 1999, the name of this account has been changed from “Share Premium Account” to “Securities Premium Account” w.e.f. 31st October 1999.

The following points may be noted:

1. Securities Premium Account cannot be distributed as dividend in cash.

2. The annual balance sheet must disclose the amount of securities premium as a separate item.

ADVERTISEMENTS:

3. Securities premium money cannot be treated as free reserves and it is a part of capital reserve.

Accounting Entries:

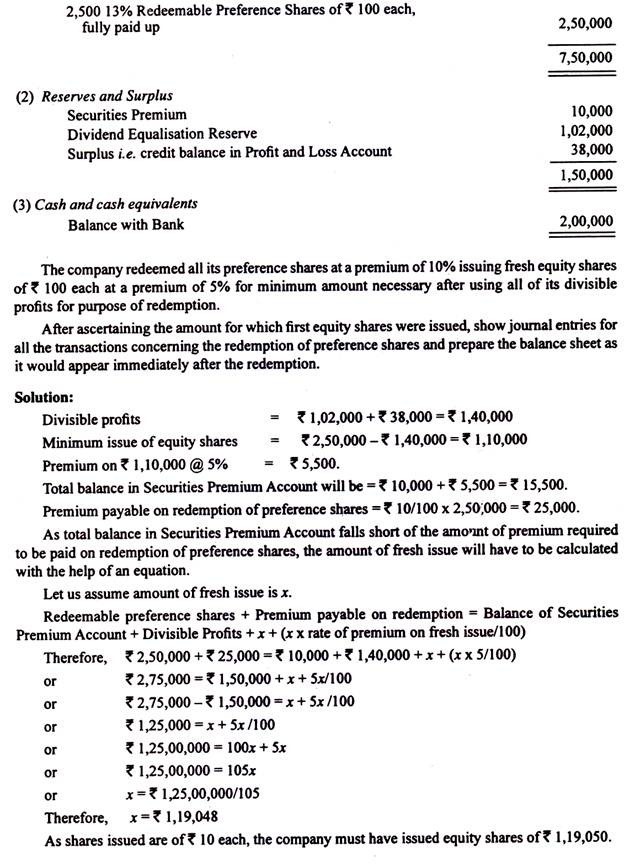

Illustration:

ADVERTISEMENTS:

Asian Ltd. issued 5,000 Preference Share of Rs. 10 each at a premium of Rs. 4 per share, payable Re 1 per share on application; Rs. 6 per share on allotment including premium; Rs. 3 per share on first call and Rs. 4 per share on final call. The shares were all subscribed and money was duly received.

Give the journal and Cash Book entries and Balance sheet.

Solution: