The following points highlight the top approaches of working capital management strategies. They are:- 1. Conservative Approach 2. Aggressive Approach 3. Matching Approach 4. Zero Working Capital Approach 5. Working Capital Policies.

1. Conservative Approach:

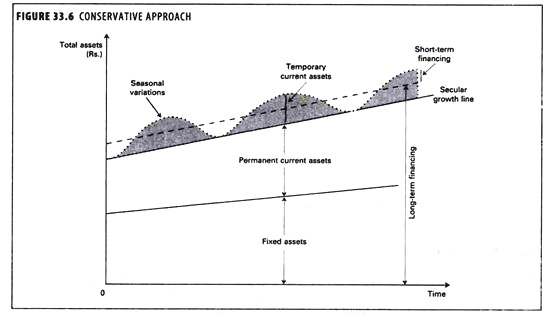

A conservative strategy suggests not to take any risk in working capital management and to carry high levels of current assets in relation to sales. Surplus current assets enable the firm to absorb sudden variations in sales, production plans, and procurement time without disrupting production plans. It requires to maintain a high level of working capital and it should be financed by long-term funds like share capital or long-term debt.

Availability of sufficient working capital will enable the smooth operational activities of the firm and there would be no stoppages of production for want of raw materials, consumables. Sufficient stocks of finished goods are maintained to meet the market fluctuations. The higher liquidity levels reduce the risk of insolvency.

But lower risk translates into lower return. Large investments in current assets lead to higher interest and carrying costs and encouragement for inefficiency. But conservative policy will enable the firm to absorb day to day business risks and assures continuous flow of operations.

ADVERTISEMENTS:

Under this strategy, long-term financing covers more than the total requirement for working capital. The excess cash is invested in short-term marketable securities and in need, these securities are sold-off in the market to meet the urgent requirements of working capital.

Financing Strategy

Long-term funds = Fixed assets + Total permanent current assets + Part of temporary current assets

ADVERTISEMENTS:

Short-term funds = Part of temporary current assets

2. Aggressive Approach:

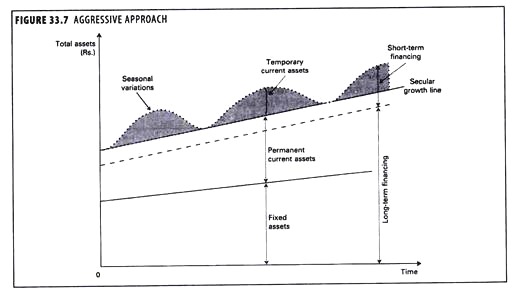

Under this approach current assets are maintained just to meet the current liabilities without keeping any cushion for the variations in working capital needs. The core working capital is financed by long-term sources of capital, and seasonal variations are met through short-term borrowings. Adoption of this strategy will minimize the investment in net working capital and ultimately it lowers the cost of financing working capital.

The main drawbacks of this strategy are that it necessitates frequent financing and also increases risk as the firm is vulnerable to sudden shocks. A conservative current asset financing strategy would go for more long-term finance which reduces the risk of uncertainty associated with frequent refinancing.

The price of this strategy is higher financing costs since long-term rates will normally exceed short term rates. But when aggressive strategy is adopted, sometimes the firm runs into mismatches and defaults. It is the cardinal principle of corporate finance that long-term assets should be financed by long-term sources and short-term assets by a mix of long and short-term sources.

Financing Strategy

Long-term funds = Fixed assets + Part of permanent current assets

Short-term funds = Part of permanent current assets + Total temporary current assets

3. Matching Approach:

Under matching approach to financing working capital requirements of a firm, each asset in the balance sheet assets side would be offset with a financing instrument of the same approximate maturity.

ADVERTISEMENTS:

The basic objective of this method of financing is that the permanent component of current assets, and fixed assets would be met with long-term funds and the short-term or seasonal variations in current assets would be financed with short-term debt.

If the long-term funds are used for short-term needs of the firm, it can identify and take steps to correct the mismatch in financing. Efficient working capital management techniques are those that compress the operating cycle. The length of the operating cycle is equal to the sum of the lengths of the inventory period and the receivables period.

Just-in-time inventory management technique reduces carrying costs by slashing the time that goods are parked as inventories. To shorten the receivables period without necessarily reducing the credit period, corporate can offer trade discounts for prompt payment. This strategy is also called as hedging approach.

Financing Strategy:

ADVERTISEMENTS:

Long-term funds = Fixed assets + Total permanent current assets

Short-term funds = Total temporary current assets

4. Zero Working Capital Approach:

This is one of the latest trends in working capital management. The idea is to have zero working capital i.e., at all times the current assets shall equal the current liabilities.

Excess investment in current assets is avoided and firm meets its current liabilities out of the matching current assets. As current ratio is 1 and the quick ratio below 1, there may be apprehensions about the liquidity, but if all current assets are performing and are accounted at their realizable values, these fears are misplaced.

ADVERTISEMENTS:

The firm saves opportunity cost on excess investments in current assets and as bank cash credit limits are linked to the inventory levels, interest costs are also saved. There would be

a self-imposed financial discipline on the firm to manage their activities within their current liabilities and current assets and there may not be a tendency to over borrow or divert funds.

Zero working capital also ensure a smooth and uninterrupted working capital cycle, and it would pressure the Finance Managers to improve the quality of the current assets at all times, to keep them 100% realizable. There would also be a constant displacement in the current liabilities and the possibility of having over-dues may diminish.

The tendency to postpone current liability payments has to be curbed and working capital always maintained at zero. Zero working capital would call for a fine balancing act in Financial Management, and the success in this endeavour would get reflected in healthier bottom lines.

Total Current Assets = Total Current Liabilities

ADVERTISEMENTS:

or Total Current Assets – Total Current Liabilities = Zero

5. Working Capital Policies:

The degree of current assets that a company employs for achieving a desired level of sales is manifested in working capital policy.

In practice, the business concerns follow three forms of working capital policies which are discussed in brief as follows:

Restricted Policy:

It involves the rigid estimation of working capital to the requirements of the concern and then forcing it to adhere to the estimate. Deviations from the estimate are not allowed and the estimate will not provide for any contingencies or for any unexpected events.

Relaxed Policy:

ADVERTISEMENTS:

It involves the allowing of sufficient cushion for fluctuations in funds requirement for financing various items of working capital. The estimate is made after taking into account the provision for contingencies and unexpected events.

Moderate Policy:

The working capital level estimated in between the two extremes i.e. restricted and relaxed policies. The relationship of sales and corresponding levels of investment in current assets is shown in figure 33.8.

When the company adopts ‘restricted policy’, for a sales level of ‘S’ it maintains the current assets level of ‘C’. Under this policy the company maintains lower investments in current assets represent aggressive approach, intend to yield high return and accepting higher risk.

The management is ready to counter any financial difficulties arising out of restricted policy. Under relaxed policy, the company maintains current assets upto the level of ‘C2‘ for the same level of sales (S) as in restricted policy.

This policy represents conservative approach. It allows the company to have sufficient cushion for uncertainties, contingencies, seasonal fluctuations, changes in activity levels, changes in sales etc. The level of investment in current assets is high, which results in lesser return, but the risk level is also reduced.

In moderate policy, the investment in currents lies in between ‘C’ and ‘C2‘. With this policy, the expected profitability and risk levels fall between relaxed policy and restricted policy. The higher the level of investment in current assets represents the liberal working capital policy, in which the risk level is less and also the marginal return is also lesser.

In restricted policy the level of investment in current assets is lesser and high risk is perceived for increase of marginal return on investment. The determination of level of investment in currents is dependant on risk-return perception of the management.

Illustration:

The financing pattern, current ratio, profitability net working capital position is explained under conservative, moderate and aggressive working capital policies are explained by way of hypothetical figures as follows:

Analysis:

We can observe from the above analysis that current ratio is 4 times if conservative policy is followed, it has dropped to 1.5 in management of working capital under aggressive policy. However, the return on investment has increased from 16.95% to 19.71%, if aggressive approach is adopted. Higher risk is attached with the higher return, under aggressive policy.

In conservative approach majority of current assets are financed from long-term sources of finance. When it comes to financing current assets under aggressive approach, majority of current assets are financed from short-term sources.

The moderate policy stands in between two extremes of conservative and aggressive financing approaches. Majority of the corporate follow the moderate policy of working capital financing, which enables to avoid higher risk and to earn moderate profit margin on additional investments in current assets.