The most important asset for banks is “loans and advances” comprising cash credits and overdrafts, bills discounted and purchased and term loans. The banks have to classify their advances as follows in order to arrive at the amount of the provision to be made against them, into the following groups:- 1. Standard Assets 2. Sub-Standard Assets 3. Doubtful Assets and 4. Loss Assets.

(1) Standard Assets:

Standard assets are those which do not pose any problems and which do not carry more than normal risk attached to the business. They are non-performing assets (NPA). No provision is required to be made against them. However, banks have been asked to make provision at the rate of 0.25% on their standard advances also from the year ending 31st March, 2000.

(2) Sub-Standard Assets:

ADVERTISEMENTS:

Sub-standard assets are those which have been classified as NPA for a period not exceeding 18 months. In such cases, the security available to the bank is inadequate and there is a distinct possibility that the bank will suffer some loss, if deficiencies are not corrected. Provision has to be made at the rate of 10% of the total outstanding amount of substandard assets.

However, in respect of accounts where there are potential threats of recovery on account of erosion in the value of security or non-availability of security and existence of other factors, such as frauds committed by borrowers, it will not be prudent for banks to classify them first as substandard and then as doubtful after expiry of two years from the date the account has become NPA. Such accounts should straightaway be classified as doubtful assets, or loss asset, as appropriate, irrespective of the period for which it has remained as NPA.

(3) Doubtful Assets:

Doubtful assets are those which have remained NPA for a period exceeding 18 months. This period of two years is being reduced to 18 months by 31st March, 2001. These assets are so weak that their collection or liquidation in full is considered highly improbable. A loan classified as doubtful has all the weaknesses inherent in the classified as substandard with the added characteristic that the weaknesses make collection or liquidation in full, high questionable and improbable, on the basis of currently known facts, condition and values.

ADVERTISEMENTS:

In order to arrive at the amount provision to be made against doubtful assets, the unsecured portions and the secured portions of these assets have to be considered separately. The unsecured portion has to be fully provided for, i.e., provision has to be made equal to 100% of the amount by which the advance is not covered by the realisable value of the security.

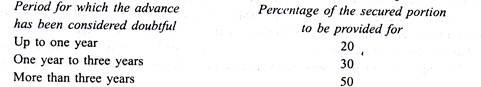

In addition to this, provision has to be made even against the secured portion on the following basis:

(4) Loss Assets:

ADVERTISEMENTS:

Loss assets are those where loss has been identified by the bank or internal or external auditors or RBI inspectors but the amount has not been written off wholly or partly. These assets are uncollectible and, therefore, they must be written off even though there may be a remote possibility of recovery of some amount.

Provision of 100% of the outstanding balance should be made.