Each and everything you need to know about Sales Variance.

Sales Value Variance: It is the difference between budgeted sales revenue and actual sales revenue. In other words, this variance represents the difference between expected sales revenue and actual sales revenue achieved. It is also called Total Sales Variance.

Sales Price Variance: It is the difference between actual and expected unit selling price multiplied by actual quantity.

Volume Variance: It is the difference between actual sales volume and budgeted sales volume multiplied by standard selling price (budgeted selling price). This variance represents the effect on sales of actual quantity and budgeted quantity.

ADVERTISEMENTS:

Sales Quantity Variance: It is the difference between ‘Budgeted Sales’ (BS) and ‘Revised Standard Sales’ (RSS). Budgeted sales is calculated in the usual manner (i.e., Budgeted quantity x Standard selling price). Revised standard sales (RSS) is the rearrangement of standard sales (SS) in the budgeted ratio.

Sales Mix Variance: It is the difference between ‘Revised Standard Sales’ and ‘Standard Sales’. It relates to the change in ratio of sales.

Learn about how to calculate sales variance – 1. Turnover/Value Method 2. Margin/Profit Method.

Also learn about turn/value method – 1. Sales Value Variance 2. Sales Price Variance 3. Sales Volume Variance 4. Sales Quantity Variance 5. Sales Mix Variance and More…

ADVERTISEMENTS:

Additionally also learn about margin/profit method – 1. Total Sales Margin Variance 2. Sales Margin Price Variance 3. Sales Margin Volume Variance 4. Sales Margin Quantity Variance 5. Sales Margin Mix Variance and More…

Sales Variance: Formula,Value, Price, Volume, Quantity and Mix Variance,Sales Volume Variance Formula, Sales Variance Formula Sales Price Variance Formula, Sales Mix Variance, Sales Mix Variance Formula and Sales Margin Volume Variance Formula

Sales Variance – Learn about- Turnover Methods, Profit or Sales Margin Method, Sales Volume Variance Formula, Sales Variance Formula Sales Price Variance Formula, Sales Mix Variance, Sales Mix Variance Formula and Sales Margin Volume Variance Formula

There are two methods of calculating sales variances:

(1) Turnover Method

(2) Profit or Sales Margin Method

ADVERTISEMENTS:

(1) Turnover Method:

Under this method all variances are calculated on the basis of Sales Revenue.

Generally, the following sales variances are calculated under this method:

(i) Sales value variance

ADVERTISEMENTS:

(ii) Sales price variance

(iii) Sales volume variance

(iv) Sales quantity variance

(v) Sales mix variance.

ADVERTISEMENTS:

(i) Sales Value Variance:

It is the difference between budgeted sales revenue and actual sales revenue. In other words, this variance represents the difference between expected sales revenue and actual sales revenue achieved. It is also called Total Sales Variance.

Formula to Learn:

Sales Value Variance = (Budgeted Sales) – (Actual Sales)

ADVERTISEMENTS:

Or (BS-AS)

Budgeted Sales = Budgeted Quantity x Standard Selling Price (Budgeted Selling Price)

Actual Sales = Actual Quantity x Actual Selling Price

(ii) Sales Price Variance:

ADVERTISEMENTS:

It is the difference between actual and expected unit selling price multiplied by actual quantity.

Formula to Learn:

Sales Price Variance = Actual Quantity x (Standard Selling Price – Actual Selling Price)

Alternatively,

Sales Price Variance = Standard Sales – Actual Sales

Or (SS-AS)

ADVERTISEMENTS:

Standard Sales = Actual Quantity x Standard Selling Price (Budgeted Selling Price)

Actual Sales = Actual Quantity x Actual Selling Price

(iii) Volume Variance:

It is the difference between actual sales volume and budgeted sales volume multiplied by standard selling price (budgeted selling price). This variance represents the effect on sales of actual quantity and budgeted quantity.

Formula to Learn:

Sales Volume Variance = Standard Selling Price x (Budgeted Sales Volume – Actual Sales Volume)

Alternatively,

Sales Volume Variance = (Budgeted Sales – Standard Sales)

Or (BS-SS)

Budgeted Sales = Budgeted Sales Volume (Budgeted quantity) x Standard Selling Price

Actual Sales = Actual Sales Volume (Actual quantity) x Actual Selling Price

When more than one product is sold, sales volume variance is subdivided into –

(a) sales quantity variance; and

(b) sales mix variance.

(iv) Sales Quantity Variance:

It is the difference between ‘Budgeted Sales’ (BS) and ‘Revised Standard Sales’ (RSS). Budgeted sales is calculated in the usual manner (i.e., Budgeted quantity x Standard selling price). Revised standard sales (RSS) is the rearrangement of standard sales (SS) in the budgeted ratio.

Formula to Learn:

Sales Quantity Variance = (Budgeted Sales) – (Revised Standard Sales)

Or, (BS – RSS)

Alternatively,

Sales Quantity Variance = Budgeted Selling Price per Unit x (Standard / Budgeted Quantity – Revised Standard Quantity)

(v) Sales Mix Variance:

It is the difference between ‘Revised Standard Sales’ and ‘Standard Sales’. It relates to the change in ratio of sales.

Formula to Learn:

Sales Mix Variance = (Revised Standard Sales) – (Standard Sales)

Or (RSS – SS)

Summary of Formulas:

(i) Sales Value Variance or Total Sales Variance = BS – AS

(ii) Sales Price Variance = SS – AS

(iii) Sales Volume Variance = BS – SS

(iv) Sales Quantity Variance = BS – RSS

(v) Sales Quantity Variance = RSS – SS

Where,

BS = Budgeted Sales

AS = Actual Sales

SS = Standard Sales

RSS = Revised Standard Sales.

(2) Profit or Sales Margin Method:

Under this method all variances are calculated on the basis of sales margin /profit. It shows the effect of changes in selling price and quantities sold on the profit of the organization. All variances are calculated in the similar way as we do in case of Turnover method. However, there is a change in terminology as far as the variances are concerned.

Generally, the following variances are calculated:

(i) Total sales margin variance;

(ii) Sales margin price variance;

(iii) Sales margin volume variance;

(iv) Sales margin quantity variance;

(v) Sales margin mix variance.

(i) Total Sales Margin Variance:

It is the difference between budgeted profit and actual profit. It is to be noted here that both budgeted profit and actual profit are calculated on the basis of standard cost (It is to be noted that actual cost is not taken into consideration for calculation of actual profit).

Budgeted Profit = Budgeted Selling Price – Standard Cost Actual Profit = Actual Selling Price – Standard Cost

The logic of using the standard cost to calculate both budgeted profit and actual profit is that it eliminates the effect of cost variance on sales variances. The sales manager is responsible for sales quantity and selling price but not for manufacturing cost of the product.

Formula to Learn:

Total Sales Margin Variance = Budgeted Profit – Actual Profit or, (BP – AP)

Budgeted Profit (BP) = Budgeted Quantity x Budgeted Profit per Unit

Actual Profit (AP) = Actual Quantity x Actual Profit per Unit

If the actual profit is more than the budgeted profit, it is a favourable variance. Similarly, if the actual profit is less than the budgeted profit, it is an adverse variance.

(ii) Sales Margin Price Variance:

It is the difference between the standard profit and actual profit. In other words, it is the difference between actual and expected profit per unit multiplied by actual quantity sold.

Formula to Learn:

Sales Margin Price Variance = Actual Quantity x (Standard / Budgeted Profit per Unit – Actual Profit per Unit)

Alternatively,

Sales Margin Price Variance = Standard Profit – Actual Profit or (SP – AP)

Standard Profit (SP) = Actual quantity x Budgeted profit

Actual Profit (AP) = Actual quantity x Actual profit

(iii) Sales Margin Volume Variance:

It is the difference between actual sales quantity (volume) and budgeted sales quantity (volume) multiplied by standard profit. This variance represents the effect on profit of actual quantity and budgeted quantity.

Formula to Learn:

Sales Margin Volume Variance = Standard / Budgeted Profit x (Standard / Budgeted Quantity – Actual Quantity)

Alternatively,

Sales Margin Volume Variance = (Budgeted Profit – Standard Profit) or, (BP-SP)

Budgeted Profit (BP) = Budgeted quantity x Budgeted profit per Unit

Standard Profit (SP) = Actual quantity x Budgeted profit per Unit

When more than one product is sold, sales margin volume variance is subdivided into –

(a) Sales Margin Quantity Variance; and

(b) Sales Margin Mix Variance.

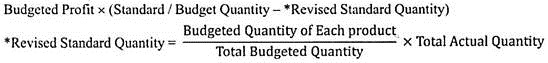

(iv) Sales Margin Quantity Variance:

It is the difference between budgeted profit and revised standard profit. Budgeted profit is calculated in the usual manner (i.e., budgeted quantity x budgeted profit per unit). Revised Standard Profit (RSP) is the re-arrangement of actual quantity in the budgeted ratio, multiplied by standard profit per unit.

Formula to Learn:

Sales Margin Quantity Variance = (Budgeted Profit) – (Revised Standard Profit) or, (BP – RSP)

Alternatively,

Standard Margin Quantity Variance:

(v) Sales Margin Mix Variance:

It is the difference between revised standard profit and standard profit. It related to the change in the ratio of quantity of sales.

Formula to Learn:

Sales Margin Mix Variance = (Revised Standard Profit – Standard Profit) or, (RSP – SP)

Alternatively,

Budgeted profit per unit x (Revised Standard Quantity – Actual Quantity)

Summary of Formulas:

(i) Total sales margin variance = (BP – AP)

(ii) Sales margin price variance = (SP-AP)

(iii) Sales margin volume variance = (BP – SP)

(iv) Sales margin quantity variance = (BP – RSP)

(v) Sales margin mix variance = (RSP – SP)

Where,

BP = Budgeted profit

AP=Actual profit

SP= Standard profit

RSP = Revised standard profit

Sales Variance – Turnover and Profit Method of Calculating Sales Variances (With Formulas for All)

There are two methods of calculating sales variances:

1. With reference to turnover, and

2. With reference to profits.

The turnover method is used more frequently but the profit method is more informative.

1. Sales Variances Based on Turnover:

Before calculating sales variances based on turnover, it is desirable to understand the following terms very clearly:

i. Budgeted Sales = Budgeted quantity of sales x Standard selling price.

ii. Standard Sales = Actual quantity of sales x Standard selling price.

iii. Actual Sales = Actual quantity of sales x Actual selling price.

(a) Sales Value Variance:

It is the difference between the budgeted sales and actual sales.

The formula is:

Sales Value Variance = Budgeted Sales – Actual Sales

If actual sales are more, a favorable variance would be shown and vice versa. The difference in value may be on account of difference in price or volume of sales which need to be analysed further.

(b) Sales Price Variance:

It is that portion of sales value variance which is due to the difference between standard selling price and actual selling price.

The formula is:

Sales Price Variance = Standard Sales – Actual Sales

= (Standard Price – Actual Price) x Actual quantity sold

(c) Sales Volume Variance:

This is that portion of sales value variance which is due to difference between budgeted and actual quantities of goods sold. It is calculated like material usage variance.

The formula is:

Sales Volume Variance = Budgeted Sales – Standard Sales

= (Budgeted Quantity – Actual Quantity) x Standard price

Sales Volume Variance can further be classified into-

(a) Mix Variance and

(b) Quantity Variance

(a) Sales Mix Variance = (Revised standard sales – Standard sales)

= Standard value of revised standard mix – Standard value of actual mix

(b) Sales Quantity Variance- It is that part of sales volume variance which arises due to the difference between revision of a standard sales quantity and budgeted sales quantity.

The formula is:

Sales Quantity Variance = (Revised Std. Sales Quantity – Budgeted Sales Quantity) x Std. Selling price.

It may be noted that sales price variance and sales volume variance would be equal to sales value variance.

Sales Value Variance = Sales Price Variance + Sales Volume Variance

2. Sales Variances Based on Margin:

This method is based on the assumption that the sales function is responsible for the sales volume and the unit selling price but not the unit manufacturing costs. Therefore, standard cost of sales and not the actual cost of sales is deducted from the actual sales revenue.

The method shows the effect of changes in sales quantities and/or selling price on the profit expected by a company from its sales.

Total Sales Margin Variance:

The total sales margin variance is the difference between the budgeted profit and the actual profit (both based on standard unit costs).

The formula is:

Total Sales Margin Variance = Budgeted profit – Actual profit.

The total sales margin variance is analysed into-

(i) Sales Margin Price Variance, and

(ii) Sales Margin Volume Variance.

(i) Sales Margin Price Variance:

It is the difference between the standard margin and the actual margin (both based on standard unit costs) multiplied by the actual sales volume.

The formula is:

(Standard Margin – Actual Margin) x Actual quantity

(ii) Sales Margin Volume Variance:

It is the difference between the budget sales volume and the actual sales volume multiplied by standard profit margin.

The formula is:

Sales Margin Volume Variance = (Standard Quantity – Actual Quantity) x Standard Margin

When there are two or more products, sales margin volume variance is further analysed into-

(a) Sales Margin Mix Variance, and

(b) Sales Margin Quantity Variance.

(a) Sales Margin Mix Variance:

It is that part of sales margin volume variance which is due to difference between standard profit and revised standard profit.

The formula is:

Sales Margin Mix Variance = (Revised Std. Quantity – Actual Quantity) x Standard Margin

(b) Sales Margin Quantity Variance:

It is that portion of sales margin volume variance which is due to the difference between the budgeted profit and revised standard profit.

The formula is:

Sales Margin Quantity Variance = (Revised Std. Quantity – Standard Quantity) x Standard Margin.

Sales Variance – Formula and Calculations of Sales Price Variance, Sales Volume Variance, Sales Mix Variance and Sales Quantity Variance

Sales Variances:

While standard costing principles are mainly applied in the area of costs i.e., Material cost, Labour cost and overheads cost. Some companies calculate the sales variances also which is the difference between budgeted sales and actual sales and its impact on profits.

There may be two ways to calculate sales variances:

1. The turnover/value method.

2. The margin/Profit method.

1. The Turnover/Value Method:

The common method of analysing sales variances under this method is shown in the chart below:

i. Sales Value Variance:

It is the difference between the budgeted sales and the actual sales.

It is calculated as

Actual Sales – Budgeted Sales

ii. Sales Price Variance:

It is that portion of sales variance which is due to the difference between standard price specified and the actual price charged.

It is calculated as

Actual Sales Volume x [Actual Price – Standard price]

iii. Sales Volume Variance:

It is that portion of sales variance which is due to the difference between the standard quantity specified and the actual quantity sold.

It is calculated as

Standard Price x [Actual sales volume – Standard sales volume]

iv. Sales Mix Variance:

It is that portion of sales volume variance which may arise due to change in actual composition of sales mix from the standard composition of sales mix, where more than one product is dealt with.

It is calculated as

Standard Sales – Revised Standard Sales

Where

Standard Sales are actual quantity sold at budgeted price. Revised Budgeted sales are standard sales rearranged in the budgeted ratio.

It should be observed that the sales mix variance under turnover method will always be zero. This is so because though the sales mix is varied, the actual sales at budgeted price are rearranged in the budgeted ratio.

v. Sales Quantity Variance:

It is that portion of sales volume variance, which may arise due to the difference between standard value of actual sales at standard mix and budgeted sales. It is calculated as –

Revised Standard Sales – Budgeted Sales.

2. The Margin / Profit Method:

This method of sales variances measures the effect of actual sales and budgeted sales on profit. As this method does not consider the cost variances, all costs are assumed to be standard costs.

The common method of analysing sales variances under this method are as follows:

i. Total Sales Margin Variance:

It is the difference between actual margin (by considering standard costs) and budgeted margin.

It is calculated as

Actual Profit – Budgeted Profit

ii. Sales Margin Price Variance:

It is that portion of total sales margin variance which is due to the difference between standard price of actual sales made and actual price.

It is calculated as

Actual Profit – Standard Profit

iii. Sales Margin Volume Variance:

It is that portion of total sales margin variance which is due to the difference between standard profit and budgeted profit.

It is calculated as

Standard Profit – Budgeted Profit

iv. Sales Margin Mix variance:

It is that portion of sales margin volume variance which is due to the difference between standard profit and revised standard profits.

It is calculated as

Standard Profit – Revised Standard Profit.

v. Sales Margin Quantity variance:

It is that portion of sales margin volume variance which is due to the difference between budgeted profit and revised standard profits.

It is calculated as

Revised Standard Profits – Budgeted Profit.

Sales Variance – The Value or the Turnover Method and The Profit or the Margin Method (with Formula and Calculations)

Sales variances can be calculated by using two important methods:

1. The Value or the Turnover Method.

2. The Profit or the Margin Method.

1. The Value or the Turnover Method:

Under this method variances are calculated with reference to their effect on sales or sales value. A change in sales may be due to –

a. Change in selling price, i.e., the actual selling price may be higher or lower than standard selling price; and/or

b. Change in volume, i.e., quantities of sales attained may be higher or lower than those budgeted or actual mixture of sales may be different from standard mixture of sales.

As such, sales variances can be analysed as follows:

Sales Value Variance:

Sales Value Variance is the difference between the actual sales and the budgeted sales. If the actual sales exceed the budgeted sales, the variance is favourable. But if the actual sales are less than the budgeted sales, the variance is treated as adverse or unfavourable.

Sales Value Variance is calculated as follows –

Sales Value Variance = Actual Value of Sales – Budgeted Value of Sales.

i. Sales Price Variance:

It is that portion of Sales Value Variance which arises due to the difference between the actual price and standard price of sales. If the actual price attained is more than the standard price, the variance shall be favourable and vice-versa.

Sales Price Variance is calculated as follows –

Sales Price Variance = (Actual Sale Price – Standard Sale Price) x Actual Quantity Sold.

ii. Sales Volume Variance:

It is that portion of Sales Value Variance which arises due to the difference between the actual quantity sold and the standard quantity of sales.

It is calculated as follows –

Sales Volume Variance = (Actual Quantity – Standard Quantity) x Standard Price.

a. Sales Quantity Variance:

It is a sub-variance of Sales Volume Variance and represents that portion of sales volume variance which is due to the difference between standard value of actual sales at standard mix and the budgeted sales.

It is calculated as follows –

Sales Quantity Variance = Standard Value of Revised Standard Mix – Budgeted Sales

or

Sales Quantity Variance = (Revised Standard Mix – Standard Mix) x Standard Price

b. Sales Mix Variance:

It is that portion of Sales Volume Variance which arises due to the difference between standard and actual composition of the sales mix. This variance arises only when the business firm deals in more than one product.

It is calculated as follows –

Sales Mix Variance = Standard Sales Value of Actual Mix – Standard Sales Value of Revised Standard Mix.

2. The Profit or Margin Method:

Under this method, sales variance analysis is made to measure the effect of deviations of actual from budgeted sales on profits. The variances to be calculated under this method may be given as follows –

Total Sales Margin Variance:

It represents the difference between the actual margin from sales (valuing cost of sales at standard) and the budgeted margin and can be calculated as follows –

Total Sales Margin Variance = (Actual Sales – Standard Cost of Sales) – Budgeted Profit

or

= Actual Profit – Budgeted Profit

i. Sales Margin Price Variance:

It is that portion of the Total Margin Variance which is due to the difference between the standard price of the quantity of the sales affected and the actual price of those sales. Thus, it is the difference between the standard profit and the actual profit and is calculated as follows –

Sales Margin Price Variance = Actual Profit – (Actual Units Sold x Standard Profit per unit)

or = Actual Profit – Standard Profit

ii. Sales Margin Volume Variance:

It is that portion of Sales Margin Variance which is due to the difference between standard profit and budgeted profit and is calculated as follows –

Sales Margin Volume Variance = Standard Profit – Budgeted Profit

a. Sales Margin Quantity Variance:

It is a part of Sales Margin Volume Variance and represents the difference between the budgeted profit and revised standard profit.

It is calculated as follows –

Sales Margin Quantity Variance = Revised Standard Profit – Budgeted Profit

b. Sales Margin Mix Variance:

It is a part of Sales Margin Volume Variance and arises due to the difference between standard profit and revised standard profit.