Cost of capital is perhaps the most important ingredient in capital budgeting and plays a vital role in evaluation of any investment proposal. It has been defined as the minimum rate of return that a company must earn on an equity financed portion of its investments so that market value per share remains unchanged.

In other words, cost of capital is the minimum return expected by the investors on their investment to invest the money in the proposal under consideration. The cost of capital is also called a “magic number” to decide whether a proposed corporate investment will increase or decrease the firm’s stock price.

The cost of capital is the minimum rate of return expected by the investors which will maintain the market value of shares constant at particular level.

The cost of capital of a firm refers to the cost that a firm incurs in retaining the funds obtained from various sources (i.e., equity shares, preference shares, debt and retained earnings).

ADVERTISEMENTS:

“The cost-of-capital is a concept which should be expressed in quantitative terms like R.O.I (Return on Investment) etc. It represents a minimum rate of return. If the risk is involved, then the minimum rate of return should be higher in order to cover business risk as well as financial risk.” – RM.S Wilson

“Cost of Capital is the minimum required rate of earning or the cut-off capital expenditures.” – Solomon Ezra

The Cost of Capital becomes a guideline for measuring the profitabilities of different investments. Another way to think of the cost of capital is as the opportunity cost of funds, since this represents the opportunity cost for investing in assets with the same risk as the firm. When investors are shopping for places in which to invest their funds, they have an opportunity cost.

Contents

- Introduction to Cost of Capital

- Meaning of Cost of Capital

- Definitions of Cost of Capital

- Concept of Cost of Capital

- Significance of Cost of Capital

- Importance of Cost of Capital

- Factors Affecting Cost of Capital

- Factors Determining Cost of Capital

- Classification of Cost of Capital

- Types of Cost of Capital

- Kinds of Cost of Capital

- Assumptions of Cost of Capital

- Computation of Cost of Capital

- Measurements of Cost of Capital

- Important Components for the Measurement of Cost of Capital

- Basic Assumptions Underlying Measurement of Cost of Capital

- Weighted Average of Cost of Capital

- Cost of Retained Earnings

- Cost of Capital Across Countries

- Role of Cost of Capital in the Uses of Funds

- Features of an MNC

- Marginal Cost of Capital

- The Case of Public Enterprises

What is Cost of Capital: Introduction, Meaning, Definition, Concept, Importance, Factors, Types, Components, Weighted Average of Cost, Cost of Equity Capital and Formula

Cost of Capital – Introduction

Commenting on “Cost”, A. W. Willsmore has said that it has different connotations and the cost of business operations may be combined in many different ways for many different purposes. Ralph Jones has described it as a Protean Word.

ADVERTISEMENTS:

Its shift in meanings in a changed context makes it very handy, though a rather slippery term. Like value, to which it is closely related, this is a generic term applicable to the whole family of ideas. Implicit in the cost concepts are ideas of sacrificing something such as time, money or materials invested in or devoted to the production of goods or services.

The cost of capital is an important concept in formulating a firm’s capital structure. It is one of the cornerstones of the theory of financial management. In recent years, it has received considerable attention from both theorists and practitioners.

Two major schools of thought have emerged, each having a basic difference on the relevance of this concept. In both the camps, the optimal policy is taken as the policy which maximises the value of a company. In their camp of thought, Modigliani-Miller have argued that a corporation’s cost of capital is constant and that it is independent of the method and level of financing.

ADVERTISEMENTS:

Optimal policy is the investment that equates marginal returns on investment with this capital. The unavoidable conclusion is that a financing policy is not a problem. The opposite point of view is that the corporation’s cost of capital varies with the method and level of financing.

The cost of capital is still largely an academic term, and the problem of measuring it in operational terms is a recent phenomenon. Prior to this development, the problem was either ignored or bypassed. The focus of traditional economic theory was on refinements to the certainty or certainty equivalent models of investment analysis.

Business firms have not been able to solve the problem of fixing financial standards in an uncertain world. The management of a progressive enterprise, however, sets the minimum standards of the required performance to determine the size and composition of its capital structure.

Whether these standards are expressed in international terms of cost capital or not, a management has to develop some basis for making these decisions. Basic to the theoretical and applied science of financial management, a study of cost of capital is both exciting and complex.

ADVERTISEMENTS:

Not long ago, such a study was considered only as an academic exercise, not having any significance in the framing of the capital structure of a business concern. Today, however, financial managers formulate an optimal policy by which they may maximise the value of their companies by striking at a variable financial structure.

The most deep-seated conceptual problems of any capital budgeting today centres round the term cost of capital, a phrase that has caused as much confusion as the expression rate of interest in the literature of theoretical economics.

This confusion stems from the simple fact that the term has been used for two distinct ideas:

(i) The rate at which funds can be borrowed on new equity capital and

ADVERTISEMENTS:

(ii) The rate at which future cash flows are discounted to measure its present value.

The term cost of capital is often defined as the rate of return on investment projects necessary to leave unchanged the market price of a firm’s stocks. It is the rate of return required by those who supply the capital. The cost of capital of a firm is a weighted average of the cost of each type of capital.

If a firm’s cost of capital is the rate of return on an investment, the latter must increase the value of a firm. From this point of view, it may be said that the cost of capital is not a cost as such. It is merely a hurdle rate and represents a minimum rate of return, which depends upon whether a firm operates at a zero- risk level or at some business or financial risk.

Where risk is involved, the minimum rate of return is higher. The cost of capital is clearly related to the break-even point, which relates to the operating cost, while the optimum cost of capital is the financial break-even point and in this connection, R.M.S. Wilson has stated that the cost of capital is a concept which should be expressed in quantitative terms, if it is to be useful.

ADVERTISEMENTS:

It is a technical term which can be defined in one of the following several ways:

(i) The minimum required rate of interest for proposals for using capital funds,

(ii) The cut-off rate for capital expenses ,

(iii) The target Return on Investment which must be serviced if the capital used is to be justified, and

ADVERTISEMENTS:

(iv) The financial standard.

Cost of Capital – Meaning

Cost of capital is perhaps the most important ingredient in capital budgeting and plays a vital role in evaluation of any investment proposal. It has been defined as the minimum rate of return that a company must earn on equity financed portion of its investments so that market value per share remains unchanged.

In other words, cost of capital is the minimum return expected by the investors on their investment to invest the money in the proposal under consideration. The cost of capital is also called a “magic number” to decide whether a proposed corporate investment will increase or decrease the firm’s stock price.

The cost of capital is the minimum rate of return expected by the investors which will maintain the market value of shares constant at particular level.

Similarly, to achieve the important objectives of financial management such as, wealth maximization a firm has to necessarily earn a rate of return more than its cost of capital. The cost-of-capital in turn depends on the risk involved in the firm. Generally the higher will be the cost-of-capital.

The cost of capital of a firm refers to the cost that a firm incurs in retaining the funds obtained from various sources (i.e., equity shares, preference shares, debt and retained earnings).

Cost of Capital – Definitions

“The cost-of-capital is a concept which should be expressed in quantitative terms like R.O.I (Return on Investment) etc. It represents a minimum rate of return. If the risk is involved, then the minimum rate of return should be higher in order to cover business risk as well as financial risk.” – RM.S Wilson

ADVERTISEMENTS:

“Cost of Capital is the minimum required rate of earning or the cut-off capital expenditures.” – Solomon Ezra

“Cost of Capital is the minimum rate of return which a firm requires as a condition for undertaking any investment.” – Milton. H. Spencer

No serious efforts were made to define the term cost of capital precisely.

In general, the cost of capital is the measurement of sacrifice made by an investor, in order to capital formation with a view to get a fair return on his investment, as a reward of postponement of his present needs.

In an operational terms it is defined as “the minimum rate of return that a firm must earn on its investment for market value of the firm to remain unchanged”.

In economic terms, it is defined as the weighted average of the cost of each type of capital.

According to Solomon Ezra “the cost of capital is the minimum required rate of earnings or the cut off rate of capital expenditure”.

In the words of Hunt, William and Donaldson “It (cost of capital) may be defined as the rate that must be earned on the net proceeds to provide the cost elements of the burden at the time they are due”.

Net proceeds here means, the gross investment less any expenditure made at the time of investment as the cost of collection of the funds.

According to James C. Van Home “The cost of capital represents a cut off rate, for the allocation of capital to investments of projects. It is the rate of return on a project that will have unchanged the market price on the stock”.

In this way, cost of capital is that minimum rate of return, which a company is expected to earn from a proposed project, so as to make a reduction in the earning per share to equity shareholders and its market price. Thus the cost of capital is combined cost of each type of source by which a firm raises the funds.

Concept of Cost of Capital

The important concept that the expected return on an investment should be a function of the “market risk” embedded in that investment – the risk-return tradeoff.

The firm must earn a minimum rate of return to cover the cost of generating funds to finance investments; otherwise, no one will be willing to buy the firm’s bonds, preferred stock, and common stock.

This point of reference, the firm’s required rate of return, is called the Cost of Capital.

The cost of capital is the required rate of return that a firm must achieve in order to cover the cost of generating funds in the marketplace. Based on their evaluations of the riskiness of each firm, investors will supply new funds to a firm only if it pays them the required rate of return to compensate them for taking the risk of investing in the firm’s bonds and stocks.

If, indeed, the cost of capital is the required rate of return that the firm must pay to generate funds, it becomes a guideline for measuring the profitabilities of different investments. When there are differences in the degree of risk between the firm and its divisions, a risk-adjusted discount-rate approach should be used to determine their profitability.

The Cost of Capital becomes a guideline for measuring the profitabilities of different investments. Another way to think of the cost of capital is as the opportunity cost of funds, since this represents the opportunity cost for investing in assets with the same risk as the firm. When investors are shopping for places in which to invest their funds, they have an opportunity cost.

The firm, given its riskiness, must strive to earn the investor’s opportunity cost. If the firm does not achieve the return investors expect, investors will not invest in the firm’s debt and equity. As a result, the firm’s value will decline.

Other basic concepts of Cost:

1) It is not a Cost as Such:

A firm’s cost of capital is really the rate of return that it requires on the projects available.

2) It is the Minimum Rate of Return:

A firm’s capital represents the minimum rate of return that will result in at least maintaining (if not increasing) the value of its equity shares.

3) Cost Comprises Three Components:

i. Return at zero risk level.

ii. Premium for business risk.

iii. Premium for financial risk.

The above three components of cost of capital may be put in the form of the following equation:

K = ro + b + f

Where:

K = Cost of capital

ro = return at zero risk level

b = premium for business risk

f = premium for financial risk

i. Return at Zero Risk:

Cost of capital includes the expected or projected rate of return on investment when the projected does not involve any financial risk.

ii. Premium for Business Risk:

Business risk refers to the changes in operating profit on account of changes in sales. Business risk is determined while taking capital budgeting decisions. The projects, involving higher risk than the average risk, can be financed at a higher rate of return than the normal rate. The suppliers of funds for such projects will expect a premium for increased business risk.

iii. Premium for Financial Risk:

Premium for financial risk arising on account of higher debt content in capital structure requiring higher operating profit to cover periodic payment of interest and repayment of principal amount on maturity.

Significance of Cost of Capital – Capital Budgeting Decisions and Capital Structure Decisions (With Steps)

The determination of the firm’s cost of capital is important from the point of view of both capitals budgeting as well as capital structure planning decisions.

Significance # (i) Capital Budgeting Decisions:

In capital budgeting decisions, the cost of capital is often used as a discount rate on the basis of which the firm’s future cash flows are discounted to find out their present values.

Thus, the cost of capital is the very basis for financial appraisal of new capital expenditure proposals. The decision of the finance manager will be irrational and wrong in case the cost of capital is not correctly determined. This is because the business must earn least at a rate which equals its cost capital in order to make at least a break-even.

Significance # (ii) Capital Structure Decisions:

The cost of capital is also an important consideration in capital structure decisions. The finance manager must raise capital from different sources in a way that it optimises the risk and cost factors.

The sources of funds which have less cost involve high risk. Raising of loans may, therefore, be cheaper on account of income tax benefits, but it involves heavy risk because a slight fall in the earning capacity of the company may bring the firm near to cash insolvency.

It is, therefore, absolutely necessary that the cost of each source of funds is carefully considered and compared with the risk involved with it.

In order to compute the overall cost of capital, the manager of funds has to take the following steps:

1. To determine the type of funds to be raised and their share in the total capitalisation of the firm.

2. To ascertain the cost of each type of funds.

3. To calculate the combined cost of capital of the firm by assigning weight to each type of funds in terms of the quantum of funds raised.

Importance of Cost of Capital – Capital Budgeting Decisions, Capital Structure Decisions, Performance of Top Management and Other Areas

The concept of cost of capital has attained great importance in the modern days from the point of view of both capital budgeting and capital structure planning decisions.

The importance of cost of capital may be ascertained from the following points:

Importance # 1. Capital Budgeting Decisions:

The concept of cost of capital is very useful in the allocation of capital to various investment proposals. It is in fact the cornerstone of investment decisions. The primary goal of financial management is to maximise the value of its equity share.

Therefore the firm must choose only those investment opportunities which are financially beneficial to the shareholders. It must not invest in the projects which yield a rate of return less than the cost incurred for financing them.

It must earn at least a rate which equals the cost of capital used for financing a project in order to make at least a break-even. Thus cost of capital is the basic measure of financial performance and it determines the acceptability of all investment opportunities.

Importance # 2. Capital Structure Decisions:

The cost of capital is a significant factor in designing a sound and economical capital structure of the firm. While designing the capital structure, the finance manager must keep in mind three factors viz. the cost of capital, the risk factor and the control factor. In this process, he must find out a financing mix which results in optimising all the three factors.

The financial manager has to keep a close eye on the fluctuations in the prices of securities continuously and analyse the interest rates, investors’ expectations and trends in the capital market. Such an analysis and measurement of the cost of different sources help him to arrive at a very useful conclusion in respect of his firm’s capital structure.

By comparing relevant specific costs of different sources of capital, he will be able to select the best and the most economical source of finance and design a sound and viable capital structure.

Importance # 3. Performance of Top Management:

The cost of capital can be used to evaluate the financial performance of the top executives of the management. Evaluation of the financial performance involves a comparison of the actual profitability of the projects undertaken with the projected overall cost of capital and appraisal of the actual cost incurred in raising the required funds.

Importance # 4. Other Areas:

The cost of capital is also very useful in many other areas of decision-making such as dividend policy, working capital policy, capitalisation of a new company etc.

4 Major Factors Affecting Cost of Capital of a Company

Various factors affect a company’s cost of capital.

The cost of capital of a company or a specific source of fund depends upon the following common factors:

Factor # (a) Risk Free Rate (RF):

Risk free rate is the compensation for time. The lender or investor is providing money to the company to finance its projects. Therefore he requires compensation for time. This is known as the time value of money. This is the return that a risk free asset such as T-Bills provides.

Factor # (b) Business Risk Premium (b):

Every company is exposed to business risk i.e. the risk of not being able to meet its fixed operating costs. Therefore cost of capital has some compensation for bearing business risk. This is known as business risk premium.

Factor # (c) Financial Risk Premium (f):

Financial risk is the risk of the company not being able to meet its fixed financial costs. This requires further compensation in terms of financial risk premium.

Factor # (d) Liquidity Risk Premium and Other Factors (e):

Every source of fund has different degrees of liquidity. If the source or instrument is highly liquid then liquidity risk premium is negligible. On the other hand liquidity risk premium is high for illiquid securities or sources of funds. Other factors may include size, profitability, inflation etc.

Hence K = RF + b + f + e

Where,

K = Cost of Capital

Rf = Risk free rate

b = Business Risk premium

f = Financial Risk premium

e = Other factors like liquidity, size etc.

Top 4 Factors Determining Cost of Capital – Risk Profile of the Project, Market Conditions and Amount of Financing

Cost of capital, like all other costs, is a variable term, subject to changes in a number of factors.

The various factors that play a part in determination of cost of capital are described as follows:

Factor # 1. Risk Profile of the Project:

Given a particular set of economic conditions, the Cost of Capital might vary between industries and between firms in the same industry. This happens because of variation in the risk profile of the firm. A project considered risky would attract capital at a higher cost than a project in the same industry having lesser risk.

Factor # 2. Market Conditions:

If the security is not readily marketable when the investor wants to sell, or even if a continuous demand for the security exists but the price varies significantly, an investor will require a relatively high Rate of Return.

Conversely, if a security is readily marketable and its price is reasonably stable, the investor will require a lower Rate of Return and the company’s Cost of Capital will be lower.

Factor # 3. Amount of Financing:

As the financing requirements of the firm become larger, the weighted Cost of Capital increases for several reasons. For instance, as more securities are issued, additional flotation costs, or the cost incurred by the firm from issuing securities, will affect the percentage cost of the funds to the firm.

Also, as management approaches the market for large amounts of capital relative to the firm’s size, the investors’ required Rate of Return may rise. Suppliers of capital become hesitant to grant relatively large sums without evidence of management’s capability to absorb this capital into the business.

4 Main Classification of Cost of Capital

The cost of capital may be classified as follows:

(a) Average Cost and Marginal Cost:

The average cost of capital refers to the weighted average cost of each component of funds employed by business undertaking. A marginal cost is the additional cost incurred to produce one more unit. The marginal cost of capital is the weighted average cost of new funds required to be raised by the business firm.

(b) Explicit Cost and Implicit Cost:

Explicit cost of capital is the rate of return of the cash flows of the financing opportunity. The explicit cost will rise when capital is raised, which is also the Internal Rate of Return of financing opportunity. The Implicit cost means the rate of return associated with the best investment opportunity for the firm. It is also called opportunity cost.

(c) Future Cost and Historical Cost:

The expected cost of funds for financing a project is called Future cost. It plays an important role in the process of financial decisions. The cost that has been already incurred for financing a project is called as Historical cost. Historical costs are useful while projecting the future costs.

(d) Specific Cost and Combined Cost:

The cost of components of capital i.e. equity shares, preference shares, loans, debentures is known as Specific cost of capital. The combined cost of capital is inclusive of all cost of capital from all sources.

4 Types of Cost of Capital – Explicit Cost and Implicit Cost, Future Cost and Historical Cost, Specific Cost and Combined Cost and More…

There are four types of cost of capital:

1. Explicit cost and Implicit cost

2. Future cost and Historical cost

3. Specific cost and Combined cost

4. Average cost and Marginal cost

Type # 1. Explicit Cost and Implicit Cost:

Explicit Cost:

Explicit cost of capital is the rate of return either stated or otherwise that a firm pays to procure finance. As per Porterfield, “explicit cost of any source of capital is the discount rate that equates the present value of the cash inflows that are cash inflows that are incremental to the taking of the financing opportunity with the present value of its incremental cash outflow.”

It is also called the cost of raising funds. For example interest payment on debt and dividend payment on equity capital can be regarded as explicit cost of capital of these sources of funds.

The explicit cost of capital involves both cash inflows (when funds are raised) and cash outflows (in terms of payment of interest and principal or dividend). The rate which equates the present value of cash inflows with the present value of cash outflows is called the explicit rate.

It can also be called the internal rate of return of raising finance from a particular source. It can be explained with the help of an example. For example, a company raised a sum of Rs. 10 lakhs by way of debentures carrying interest at 10% and redeemable after 5 years. The cash inflow will be Rs. 10 lakh followed by annual cash outflow of Rs. 1,00,000 for 5 years by way of interest.

The explicit cost will be that internal rate of return which equates to Rs. 10,00,000, the initial cash inflow with Rs. 1,00,000 payable every year as interest for 5 years and Rs. 10,00,000 as the principal amount at the end of 5th year.

This is shown as under:

Explicit cost of an interest free loan is zero percent as there is no outflow of funds by way of interest payment although principal must be repaid. Similarly investment of retained earnings do not have any explicit cost to the firm because there is no cash outflow associated for use of this fund. However retained earnings have implicit cost of capital.

Implicit Cost:

Implicit cost is like opportunity cost. In other words, it arises when a firm considers alternative use of funds. According to James Porterfield implicit cost may be defined as “the rate of return associated with the best investment opportunity for the firm and its shareholders that will be foregone if the project presently under consideration by the firm is accepted.”

Explicit cost arises when funds are raised whereas implicit cost arises when funds are used. A true example of implicit cost is retained earnings. Implicit cost of retained earnings is title opportunity cost which is equal to the earnings forgone by shareholders, had retained earnings been distributed to them as dividends.

Difference between Explicit and Implicit Cost:

(i) Explicit cost involves cash outflow in firms of interest, dividends etc. whereas implicit cost does not involve any such cash outflows.

(ii) Explicit costs are called out-of-pocket costs whereas implicit costs are called economic costs.

(iii) Explicit costs can be measured and therefore can be recorded in the books. However, implicit costs cannot be measured exactly and hence not recorded in the books.

Type # 2. Future Cost and Historical Cost:

Future cost is the expected cost of financing a project. Future costs are important while deciding any future financial commitment. Historical costs are the costs which have already been incurred. These costs are very useful for calculating the projected future costs. These are also required for making comparison between actual and projected costs.

Type # 3. Specific Cost and Combined Cost:

There are various sources of finance i.e. equity share capital, preference share capital, debentures, long-term loans or retained earnings. The cost of each source of finance is called specific cost.

For example, cost of equity (ke), cost of preference capital (kp), cost of debenture or loan (kd) and cost of retained earnings (kr). When the specific cost of each source of finance is combined together, it becomes combined cost or composite cost.

Specific cost is generally used for judging the profitability of a project when it is financed from a specific source of finance. Combined cost is used to judge the profitability of a project when it is financed from more than one source.

The composite cost or the overall cost of capital can be calculated by using the following formula:

k0 = ke x we + kp x wp + kd x wd + kr x wr

Where, w is the weights assigned to various sources of finance.

Type # 4. Average Cost and Marginal Cost:

The average cost of capital is the weighted average of the costs of each component of funds employed by the firm. The weights are in proportion of the share of each component of capital in the total capital structure.

The capital structure includes debt capital carrying fixed interest rate, preference shares carrying fixed dividend rate, equity share capital carrying variable cost of capital (no fixed rate of dividend) and reserve funds on which the company does not pay any explicit cost.

In order to compute the average cost of capital we have to:

(i) Measure the cost of each specific source of capital

(ii) Assign weights to each component of capital

(iii) Calculate the sum of the product of specific costs and weights to find a weighted average cost.

Marginal cost of capital is incremental or differential cost. It is also called the weighted average cost of new funds required to be raised by a company. Marginal cost is an important concept in financial management for capital budgeting decisions.

It is the differential cost of capital of the additional finance raised by a firm. It is used in evaluating those long-term projects which are financed exclusively from additional funds raised at specific cost.

Top 4 Kinds of Cost of Capital

Kinds of cost of capital are as follows:

1. Future Cost and Historical Cost:

Future cost of capital refers to the expected cost of funds to be raised to finance a project. In contrast, historical cost represents cost incurred in the past in acquiring funds.

In financial decisions future cost of capital is relatively more relevant and significant. While evaluating viability of a project, the finance manager compares expected earnings from the project with expected cost of funds to finance the project.

Likewise, in taking financing decisions, the attempt of a finance manager is to minimise future cost of capital and not the costs already defrayed. This does not imply that historical cost is not relevant at all. In fact, it may serve as a guideline in predicting future costs and in evaluating the past performance of the company.

2. Component Cost and Composite Cost:

A company may contemplate raising the desired amount of funds by means of different sources including debentures, preferred stock, and common stocks. These sources constitute components of funds. Each of these components of funds involves cost to the company. Cost of each component of funds is designated as a component or specific cost of capital.

When these component costs are combined to determine the overall cost of capital, it is regarded as composite cost of capital, combined cost of capital, or weighted cost of capital.

The composite cost of capital, thus, represents the average of the costs of each source of funds employed by the company. For capital budgeting decisions, composite cost of capital is relatively more relevant even though the firm may finance one proposal with only one source of funds and another proposal with another source.

This is for the fact that it is the overall mix of financing over time which is materially significant in valuing firm as an ongoing overall entity.

3. Average Cost and Marginal Cost:

Average cost represents the weighted average of the costs of each source of funds employed by a firm, the weights being the relative share of each source of funds in the capital structure. Marginal cost of capital, by contrast, refers to incremental cost associated with new funds raised by the firm.

Average cost is the average of the component marginal costs, while the marginal cost is the specific concept used to comprise additional cost of raising new funds. In financial decisions the marginal cost concept is most significant.

4. Explicit Cost and Implicit Cost:

Cost of capital can be either explicit cost or implicit. The explicit cost of any source of capital is the discount rate that equates the present value of the cash inflows that are incremental to the taking of the financing opportunity with the present value of its incremental cash outlay. Thus, the explicit cost of capital is the internal rate of return of the cash flows of financing opportunity.

A series of each flows are associated with a method of financing. At the time of acquisition of capital, cash inflow occurs followed by the subsequent cash outflows in the form of interest payment, repayment of principal money or payment of dividends.

Thus, if a company issues 10 per cent perpetual debentures worth Rs.10,00,000, there will be cash inflow to the firm of the order of 1,00,000. This will be followed by the annual cash outflow of Rs.1,00,000. The rate of discount, that equates the present value of cash inflows with the present value of cash outflows, would be the explicit cost of capital.

The technique of determination of the explicit cost of capital is similar to the one used to ascertain IRR, with one difference. In the case of computation of the IRR, the cash outflows occur at the beginning followed by subsequent cash inflows, while in the computation of explicit cost of capital, cash inflow takes place at the beginning followed by a series of cash outflows subsequently.

The formula used to compute the explicit cost of capital is –

The explicit cost of an interest bearing debt will be the discount rate that equates the present value of the contractual future payments of interest and principal with the net amount of cash received today. The explicit cost of capital of a gift is minus 100 percent, since no cash outflow will occur in future.

Similarly, explicit cost of retained earnings which involve no future flows to or from the firm is minus 100 percent. This should not tempt one to infer that the retained earnings is cost free. Cost of retained earnings is the opportunity cost of earning on investment elsewhere or in the company itself.

Opportunity cost is technically termed as implicit cost of capital. It is the rate of return on other investments available to the firm or the shareholders in addition to that currently being considered.

Thus, the implicit cost of capital may be defined as the rate of return associated with the best investment opportunity for the firm and its shareholders that will be foregone if the project presently under consideration by the firm were accepted. In this connection it may be mentioned that explicit costs arise when the firm raises funds for financing the project.

It is in this sense that retained earnings have implicit cost. Other forms of capital also have implicit costs once they are invested. Thus in a sense, explicit costs may also be viewed as opportunity costs. This implies that a project should be rejected if it has a negative present value when its cash flows are discounted by the explicit cost of capital.

Assumptions of Cost of Capital (with Concepts and Equation)

Cost of capital is based on certain assumptions which are closely associated while calculating and measuring the cost of capital.

It is to be considered that there are three basic concepts:

1. It is not a cost as such. It is merely a hurdle rate.

2. It is the minimum rate of return.

3. It consists of three important risks such as zero risk level, business risk and financial risk.

Cost of capital can be measured with the help of the following equation:

K = rj + b + f.

Where,

K = Cost of capital.

rj = The riskless cost of the particular type of finance.

b = The business risk premium.

f = The financial risk premium.

2 Main Computation of Cost of Capital For Different Sources of Capital

Computation of cost of capital for different sources of capital are as follows:

I) Computation of cost of specific source of finance

II) Computation of weighted average cost of capital.

I) Computation of Cost of Specific Source of Finance:

Specific sources of finance includes:

1) Cost of debt

2) Cost of preference Capital

3) Cost of equity capital

4) Cost of retained earnings

1) Cost of Debt:

It is the rate of interest payable on debt. While computation of cost of capital the cost of debt should be an important aspect.

For Calculating real cost of debt, it is necessary to consider not only contractual costs but also imputed costs.

In simple terms, cost debt is a rate of return expected by lenders. Therefore, cost of debt (before tax) is equal to the rate of interest payable on debt.

Generally the cost of the debt (i.e., debentures and long term debt) is defined in terms of the required rate of return that the debt investment must yield to protect the shareholders interest. Hence cost of the debt is contractual interest rate, adjusted further for the tax liability of the firm as per formula –

Kd = (1 – T) R

Kd = Cost of debt capital

T = Tax/marginal rate of tax applicable to company

R = Rate of Interest

Cost of Redeemable Debt:

When the debt is issued to be redeemed after a certain period during the lifetime of a firm. Such a debt issue is known as Redeemable debt.

So the cost of redeemable debt capital is calculated is as follows:

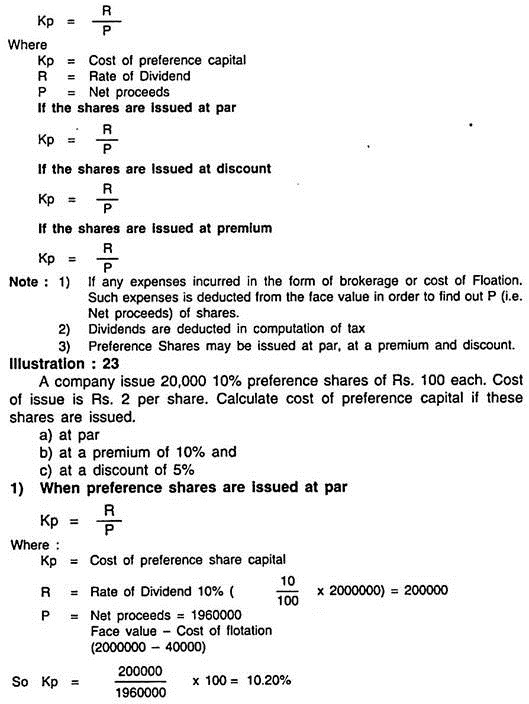

2) Cost of Preference Capital:

A fixed rate of dividend is payable on preference shares. But payment of dividend is no legal binding, it is generally paid whenever the company makes sufficient profits.

If the dividend is not paid to preference shareholders it will affect the fund raising capacity of the company. Hence, dividends are regularly paid on preference shares except when there is no profits to pay dividends. But preference capital is not cost free.

The cost of preference share capital can be calculated as-

Cost of Redeemable Preference Shares:

Redeemable preference shares are issued which can be redeemed or cancelled on maturity date.

The cost of redeemable preference share capital can be calculated as:

3) Cost of Equity Share Capital:

Equity shareholders are not paid a dividend at a fixed rate every year. The distribution of dividend depends upon the profitability of the company.

Moreover payment of dividend is not a legal binding. It may or may not be paid. But it does not mean that equity share capital is a cost free capital. Shareholders invest money in Equity shares on the expectation of getting dividend and the company must earn this minimum rate.

So that the market price of the shares remains unchanged. Whenever a company wants to raise additional funds by the issue of new equity shares, the expectations of the shareholders have to be evaluated.

The cost of Equity share is the minimum rate of return a company has to earn.

For calculation of cost of equity capital several models have been proposed. Some of the most notable models are Ezra Soloman, M.J. Garden, James and water and the team of modigliani and miller.

So the cost of equity capital is calculated based on the following approaches:

a) Dividend price Ratio Approach.

b) Earning Price Ratio approach

c) Dividend price + Growth Rate of Earnings (p + g) Approach.

d) Realised yield approach.

a) Dividend Price Ratio Approach (Dividend Yield Method) (Dividend Capitalisation Model Approach):

Before investing the money in equity shares the investors think of the rate of return or Dividend. If the dividend rate expected by the equity shareholders is presumed to be constant. In this case the investors arrive at the market price for a share, by capitalising the expected dividend at a normal rate of return.

Advantages:

1) It is simple

2) Risk in the firm remains unchanged

Disadvantages:

1) It does not consider future earnings or retained earnings

2) It does not take into account the capital gains.

Suitability/Application:

This method is suitable only when the company has stable earnings and stable dividend policy over a period of time.

The cost of equity capital is calculated as:

b) Earning Price Ratio Approach:

According to this approach it is the earning per share which determines the market price of the shares –

Thus, the cost of capital should be related to that earning percentage which could keep the market price of the equity shares constant.

Advantages:

1) This method considers dividend as well as retained earnings.

Disadvantages:

1) All the earnings are not distributed along the shareholders in the form of dividend.

2) Earnings per share cannot be assumed to be constant.

3) Share figures of price does not remain constant.

4) This approach differs regarding the use of both earning and the market price.

Some simply use the current earnings rate and current market price of share of the company for calculations of cost of equity.

While others recommend average rate of earning and the average market price.

Suitability:

This approach is suitable when the earnings will be equal to the present earnings. It means that the growth rate is zero.

The cost of equity capital is computed by the following formula:

c) Dividend/Price plus Growth Rate of Earning Approach (D/P + Q):

This approach emphasises what the investors actually receive as dividend plus the rate of growth (g) in dividend. The growth rate in dividend is assumed to be equal to the growth rate in earnings per share.

The earnings per share increase at the rate of 20% per share, the dividend per share and the market price per share will also increase at the rate of 20%.

In short, this method the cost of Equity Capital is based on the dividends and the growth rate. This approach has been supported by a number of authorities like Soloman Ezra, Gordon and Shapiro.

Advantages:

1) It is the best approach to measure the cost of capital

2) It helps the capital budgeting decisions

Disadvantages:

1) Determining the rate of growth of price increase is a difficult task.

Formula for calculating cost of equity capital under this approach is as follows:

d) Realised Yield Method:

Under this approach the realised yield is discounted at the present value factor and then compared with tire value of investment.

4) Cost of Retained Earnings:

Undistributed profits are called Retained earnings. Some people argue that retained earnings do not involve any cost because a company is not required to pay dividends on retained earnings.

However, the shareholders expect a return on retained profits. Retained earnings accrue to a firm only because of some sacrifice made by the shareholders is not receiving the dividends out of the available profits.

Thus the cost of retained earnings is the earnings foregone by the shareholders. This means that the opportunity cost of retained earnings may be taken as the cost of retained earnings.

The opportunity cost of retained earnings to the shareholders is the rate of return which they can get by investing the Net dividend (i.e. after tax and brokerage cost) in alternative opportunity of some quality.

Further, it is important to note that the shareholders cannot receive the entire amount of retained profits by way of dividend. Because shareholders have to pay tax, incur brokerage cost for investing in the new share and bear such other expenses.

Therefore, the amount received by the shareholders as dividend would be less than the amount which the company would have retained with itself as retained earnings. Hence the cost of the retained earnings to the company would always be less than the cost of new equity shares issued by the company.

The cost of retained earning is calculated as:

II) Weighted Average Cost of Capital (WACC):

(Overall cost of capital = Ko)

Weighted average cost of capital is the average cost of the costs of various sources of financing. Weighted Average cost is also known as composite cost of capital or overall cost of capital or Average cost of capital.

The different methods of calculating cost of capital of each source of funds separately, this is called specific cost.

Meaning of Weighted Average Cost of Capital:

Weighted Average cost is the average of the costs of specific sources of capital employed in a business, properly weighted by the proportion they hold in the firm’s capital structure.

According to ICMA London –

“Weighted average cost of capital is the average cost of company’s finance weighted according to the proportion each element bears to the total pool of capital, weighing is usually based on market valuations current yield and costs after tax.”

Thus the weighted average cost of capital is the composite or combined or overall cost of various sources of funds, weights being in the proportion of each source of funds in the capital structure.

Computation of Weighted Average Cost:

The concept of weighted average cost is simple but a number of problems arise in its computation.

Its computation required three steps:

1) Computation of weights to be assigned to each type of funds.

2) Assignment of costs of various sources of capital.

3) Adding the weighted cost of all sources of funds to get an overall weighted average cost of capital.

Once these values are known the calculation of weighted Average cost becomes very simple. It may be obtained by adding up the products of specific cost of all types of capital multiplied by their appropriate weights.

But Actual practice financial decision making the cost of capital should be calculated on after tax. Therefore, the component costs to be used to measure the weighted cost of capital should be after tax cost.

Computation of Weights (Determination of Proportions):

The following are the steps to be taken into consideration while calculating weighted average cost:

1) Calculation of the Cost of Each Specific Source of Funds:

The cost of each source of capital viz., Equity capital, Debt capital and preference capital is ascertained either on the basis of before tax, after tax. However, it will be more appropriate to measure the cost of capital on “after tax basis”. Because the return to the equity shares i.e., dividend only after the payment of taxes.

2) Assigning Weights to Specific Costs:

This involves determination of the proportion of each source of funds in the total capital structure of the company.

This may done according to any of the following methods:

a) Marginal weights method

In this method weights are assigned to each source of funds in the proportions in which they are to be employed.

b) Historical weights method

In this method, the relative proportions of various sources of funds in the existing capital structure are assigned weights.

While computing the weights (Proportions) the question arises as to what value should be applied i.e., Book value or Market value.

Book Value:

Value shown in the balance sheet is called book value. Weightage to each source of finance is given on the basis of book value as recorded in the balance sheet.

Advantages:

1) It is simple

The calculation of the proportion of each source of finance is very simple.

2) Weighted Average cost of capital is stable

The book value remains fixed; the weighted average cost of capital on book value remains stable over a period of time.

3) It gives real situation of the company

A company ascertained its capital structure in terms of book values. So weighted average cost of capital gives real situation of the company

4) Records are available easily

Book values can be easily ascertained by referring to the published accounts.

Demerits:

1) The book values of different sources of finance may not have relevance to their economic values.

2) The main aim of cost of capital is that it is the minimum rate of return expected to maintain the market value of the shares, where in the book values are insignificant.

Market Values Method:

Market value represents prices prevailing in the stock market for securities. So current market prices are applied in ascertaining the weightage.

Advantages of Market of Value:

1) Market values of securities can be easily ascertained by referring to the Newspapers, Journals, Magazines etc.

2) Market values of the Securities are closely related to the actual amount that can be received from the sale of such securities.

3) The use of market values in computation of weighted average cost of capital is more appropriate

4) Market value represents actual present value of the firm. So present Net worth of the firm can be easily ascertained.

Disadvantages of Market of Value:

1) The market values of the securities are likely to Fluctuate widely.

2) The market values of the securities are not readily available as compared to book values.

3) The analysis of the capital structure of a company in terms of debt equity ratio is based on the book values.

Measurements of Cost of Capital (With Examples and Solutions)

Measurements of cost of capital are as follows:

Measurement # 1. Cost of Debt:

A security or instrument which bears a fixed financial charge is generally known as debt. For example, debentures, bonds, long-term loans etc. bear a fixed interest rate. The interest rate a firm pays on its new debt is defined as it’s before tax cost of debt. Thus, cost of debt is the rate of return demanded by the lenders or debenture holders of the firm who lend the money to the firm.

The basic purpose is to maximise the value of the firm. Since stock price depends on after tax cash flows, we should consider after tax cash flows. We adjust the interest rate downward due to debt’s preferential tax treatment.

The after tax cost of debt is calculated as given below:

After tax cost of debt = interest rate on debt – tax savings

= i – it

= i (1 – t)

Where, i is the interest rate of debt, and t is tax rate.

The rate at which the firm has borrowed in the past is irrelevant when cost of new capital is concerned. For these reasons, the yield to maturity on outstanding debt (which reflects the current market conditions) is a better measure of the cost of debt than coupon rate.

Debt is considered to be the cheapest source of finance due to preferential treatment given to it in regard to tax and payments. The cost of debt should be adjusted for floatation costs associated with issuing new debt.

The debt may be of two types:

1. Irredeemable debt

2. Redeemable debt.

1. Irredeemable Debt:

Irredeemable debt is also known as perpetual debt.

The calculation of cost of irredeemable debt is very simple as explained below:

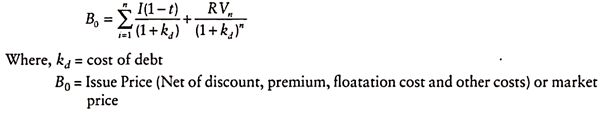

2. Redeemable Debt:

The time of maturity of redeemable debt is specified and at the time of maturity the principal amount is repaid back to the lender or bondholder.

The rate of discount which makes the present value of cash inflows from the debt equal to the present value of cash outflows (issue price) is the cost of debt. In case of bonds, it is known as Yield to Maturity (YTM) of the bond.

Present value of cash inflows = Present value of cash outflows

Example:

Avon Ltd. issues 12% debentures of Rs.100 each to be redeemed after 10 years. The debenture is expected to be sold at 5 % discount. Floatation cost of 1 % is also incurred. The applicable tax rate is 40%. Compute the cost of debt.

Measurement # 2. Cost of Preference Shares:

In case of preference shares, dividend is paid to the shareholders at a stipulated rate if the company earns the profit. Out of the profit earned by the company, dividend is first paid to preference shareholders and thereafter, the remaining profit may be distributed to the equity shareholders. In case of cumulative preference shares, unpaid dividend gets accumulated over the years.

There are two types of preference shares, irredeemable preference shares and redeemable preference shares. In case of redeemable preference shares, the time maturity is specified whereas in case of irredeemable preference shares the time of maturity is not specified. In India, irredeemable preference shares are not allowed.

The dividend paid to preference shareholders is not a tax deductible expense. Unlike the debt, where the interest paid on debt reduces the tax liability of the firm, the dividend paid to the preference shareholders does not reduce the tax liability of the firm as dividend paid is riot the charge on profit, rather it is an appropriation of profit.

The cost of preference shares is calculated as explained below:

1. Irredeemable Preference Share Capital:

The cost of irredeemable preference shares or security is calculated by applying the following formula:

Example:

A company issues 12% irredeemable preference shares of Rs. 100 each. Floating costs are 5% of sales price. Compute the cost of preference shares, if

(i) Shares are issued at par

(ii) Shares are issued at 10 % premium

(iii) Shares are issued at 10% discount.

2. Redeemable Preference Share Capital:

The time of maturity of redeemable preference share capital is specified and at the time of maturity the principal amount is repaid back to the preference capital investors.

The calculation of cost of preference share capital is similar to calculation of cost of debt except that no adjustment of tax is made. The rate of discount which makes the present value of cash inflows from the preference shares equal to the present value of cash outflows (issue price) of preference shares is the cost of preference shares.

Present value of cash inflows = Present value of cash outflows

The cost of Preference Capital can be calculated by following equation:

Example:

A company issues 12% redeemable shares having a face value of Rs. 100 at a discount of 10% to be redeemed after 10 years at par. Find the cost of preference shares.

Measurement # 3. Cost of Equity Shares:

The cost of equity shares is most difficult to compute as it involves measuring what the equity shareholders expect from the firm. It is also argued that the equity capital is cost free because the firm is not legally bound to pay the dividend to equity shareholders. This is not true because the investors invest in the equity share capital of the firm with the expectations of getting the dividend.

The market value of equity share capital depends on the dividend expected, growth of the firm and book value of the firm. Thus, the rate of discount which equates the present value of expected dividends with the market value of equity share is the cost of equity share capital.

In brief, the cost of equity is equal to the minimum rate of return that must be earned by the firm on new share capital financed investment in order to maintain its share price to the satisfaction of its equity shareholders.

There are two approaches to calculate the cost of equity share capital:

(i) Dividend approach

(ii) Capital Asset Pricing Model (CAPM).

1. Dividend Approach:

The cost of capital depends on the future streams of dividends which the shareholders expects to receive from the firm. The viewpoint of this method is that equity shareholders expect not only a certain dividend per share but also an increase every year in such dividend.

The following formula is used to find the cost of capital:

The main limitation of the approach is that the cost of equity capital cannot be determined if the company is not paying the dividend.

Example:

Find the cost of equity capital in the following cases:

(i) An ordinary share currently selling at Rs. 110 and paying dividend of Rs. 10 which is expected to grow at a rate of 10 percent.

(ii) A company’s share is being quoted at Rs. 20 in the market. The company pays dividend of Rs. 2 per share and investors expect growth of 10 percent in dividends per year. Compute the cost of equity.

2. Capital Asset Pricing Model Approach:

The CAPM was originated by Professor William F. Sharpe in his article, “Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk” in Journal of Finance, 1964. The CAPM is an extremely important theory in finance. The CAPM provides an alternative approach for the calculation of the cost of equity.

There are two types of risks associated with any equity stock:

(i) Systematic risk

(ii) Unsystematic risk.

(i) Systematic Risk:

This risk arises due to systematic factors such as change in government policy, change in trade policy, political issues. The risk that is not diversifiable and linked to the system is called systematic risk. This type of risk affects the whole market.

For example, economic down turn in the economy, political changes affect the whole system. This risk is also known as market risk. Since the risk is related to the system, it is not possible for an individual firm to avert this risk.

(ii) Unsystematic Risk:

Unsystematic risk arises due to the particular factors related to the firm. These factors can be controlled so as to avoid the risk. For example- factors like, change in the demand of products of the firm, labour strike, management inefficiency, increase in the competition in the market etc. Unsystematic risk can be averted by diversifying the investment portfolio.

The CAPM is based on the proposition that any stock’s required rate of return is equal to the risk-free rate of return plus a risk premium that reflects only the risk remaining after diversification.

The cost of equity capital is calculated by applying the following formula:

Capital Asset Pricing Model is an equilibrium model used to forecast expected return on a capital stock. It is assumed that in a market portfolio there is no unsystematic risk as it is a fully diversified portfolio. According to this model, only systematic risk is priced in the capital market.

The following three parameters are required to estimate a firm’s cost of equity:

(i) Risk free rate of return

(ii) The market risk premium

(iii) The beta of the firm’s share.

(i) Risk Free Rate of Return:

The rate of return on securities which carry no risk of default on payments is known as risk free rate of return. The yields on the government Treasury securities are used as a risk free rate of return. The interest rate on 91 days Treasury bills is usually used as a risk free rate of return.

To determine the cost of capital, current risk free rate of return is used rather than historical risk free rate of return. The risk free rate of return is a compensation paid for time factor.

(ii) The Market Risk Premium:

Rm – Rf is market risk premium. The market risk premium is calculated as the difference between the long-term, historical arithmetical average of market returns and long-term, historical arithmetic average of risk free rate of returns.

There should be consistency in respect of the time horizon of returns. The market risk premium is compensation for investing in the market rather than in risk free securities.

(iii) The Beta of the Firm’s Share:

Beta is a measure of systematic risk of returns on a specific stock in relation to the market returns. This risk cannot be eliminated through diversification. Beta shows the sensitivity of a company’s returns in relation to market returns.

Beta can be measured by regressing stock returns to the market returns. The stock risk premium is calculated by multiplying beta with the market risk premium.

Assumptions:

The model is based on following assumptions:

(i) All the investors hold efficiently diversified portfolios having no unsystematic risk. The systematic risk is the only relevant risk in estimating returns.

(ii) There is perfect competition in the capital market.

(iii) Investors are risk averse.

(iv) There are no transaction costs or taxes.

The capital market is efficient.

Limitations:

The CAPM model has following limitations:

(i) The model is based on unrealistic assumptions.

(ii) Beta does not remain stable over time.

(iii) It is difficult to test the validity of the capital asset pricing model.

Measurement # 4. Cost of Retained Earnings:

The companies generally do not distribute the entire profit as dividend to the shareholders. The portion of profit which remains undistributed is called retained earnings. The retained earnings are also termed as “internal equity”. The retained earnings are used for development and future expansion of the company.

The retained earnings, like equity funds, have no accounting cost but have an opportunity cost. The opportunity cost of retained earnings is the dividend foregone by the shareholders. If retained earnings had been distributed to the shareholders then they would have invested it somewhere and earned profit on it.

Thus, retained earnings are like fresh capital provided by the shareholders. Hence, the shareholders’ required rate of return would be the same whether they supply the capital by purchasing the shares of the company or by foregoing the dividend in the form of retained earnings. In other words, the cost of retained earnings is the same as the cost of equity capital except the other charges incurred in raising the equity capital.

The following formula is used to calculate the cost of retained earnings:

Thus, the cost of retained earnings, kr is slightly lower than cost of equity, because the issue of equity share capital involves floatation charges, commission etc.

Cost of Capital – 4 Important Components for the Measurement of Cost of Capital

A company obtains its capital from three major sources- debt, preference shares and equity shares. It is important to determine the cost of a specific source of capital because of the differences in risk of various securities. The holders of these securities have different claims on the assets and cash flows of the firm.

As the company is under a legal obligation to pay debt holders, they have the first claim on the firm’s assets and cash flows; preference shareholders have a claim prior to that of equity shareholders but only after debt holders have been paid in full. Equity shareholders claim the residual assets and cash flow.

They may be paid dividends from the cash remaining after interest and preference dividend is paid. Thus, equity share is riskier than both preference share and debt. Since the securities have risk differences, investors will want different rates of return on various securities.

The cost of each component of capital is called its specific cost. It is determined by the market and it takes into consideration the degree of perceived risk of the investors.

The measurement of the cost of all the four important components of capital is discussed in the following paragraphs:

1. Cost of Bonds and Debentures:

Bonds and debentures are used synonymously in many countries. However, there are inherent differences between the two. For instance, bonds are generally issued by government agencies and large corporations while debentures are issued by companies. In the present context, the two are used to mean ‘debt’.

Debt is the external source of finance. Firms borrow debt through the issuance of debenture and bonds. Thus, the cost of debt is the cost associated with the interest payment and other cost of issuing the debenture and bonds. It is also defined as the rate of return that must be earned on the debt financed portion of investments so as to leave the earnings available to equity shareholders unchanged.

A debenture is characterized by fixed interest costs, may be sold at par, premium or discount and its maturity value is normally at par or premium. The value mentioned in the debenture certificate is known as the par value or face value of the debenture. The debenture can be issued at any price; however, the amount of interest is calculated on the basis of face value.

The interest rate stated in the debenture certificate is known as the coupon rate. The time period of the loan or life of the debenture is known as the maturity period of the debt. Sometimes a firm incurs floatation costs such as brokerage, commissions, and legal and accounting fees.

These costs are to be subtracted from the gross proceeds of the debentures issue to arrive at the net proceeds. The amounts received by the firm issuing a debenture after deducting all issuing expenses (except interest) are called net proceeds.

Net proceeds are computed on the basis of the following information:

(a) Face value of the debenture

(b) Discount or premium on issue

(c) Issuing cost or floatation cost

Net proceeds (NP) = Gross selling price – Floatation cost

= Face value + Premium (or – discount) – Floatation cost

The measurement of the cost of debt involves a procedure that uses the timings of payment of interest and principal, the rate of interest, and tax-adjustment.

It is important to note that the cost of debt is computed on after tax basis because interest is a tax deductible expense. In other words, the firm can deduct the interest from income while calculating tax. Payment of interest saves taxes, which is called a tax shield.

The amount of this tax benefit is equal to interest multiplied by the tax rate. Thus, the net cost of debt is computed on the basis of interest x (1 – tax rate). This rule does not apply in case of equity and preference shares.

The cost of bonds or debentures can be computed both for irredeemable (theoretical situation) and redeemable types.

i. Cost of Irredeemable (or Perpetual) Debt:

It is computed as the amount of interest on a debt security divided by the net proceeds of the issuance of such debt.

Mathematically, it is expressed as:

However, perpetual debt is a theoretical situation because in practice, there cannot be a debt without its maturity period.

ii. Cost of Redeemable Debenture:

In most cases, the face value of debt is refunded at the end of maturity period. However, when bonds and debentures are repayable at premium or discount, the amount of interest is computed on the basis of face value and the cost is computed on the basis of interest payment and payment on redemption.

Given that the principal amount is repaid in lump-sum at the time of maturity, the computation of cost of debt can be expressed as:

2. Cost of Preference Shares:

Preference shares represent a special type of ownership interest in the firm. They are entitled to a fixed dividend, but subject to availability of profit for distribution. The preference shareholders have to be paid their fixed dividends before any distribution of dividends to the equity shareholders.

They get a preferential right as regards payment of dividend as well as a return of principal, compared to equity shareholders. However, their dividends are not allowed as an expense for the purpose of taxation.

In fact, the preference dividend is a distribution of profits of the business. There is no adjustment for corporate tax in computing the cost of preference shares. As a result of this, the cost of preference capital is more as compared to that of debt capital.

Like debt, preference share is of two types as well: redeemable and irredeemable. However, issuance of irredeemable preference shares has been banned by Sec. 55 of the Companies Act, 2013. The cost of the preference shares is computed in the same manner as that of debt capital, except for tax adjustment.

i. Cost of Irredeemable Preference Capital:

The irredeemable preference share is not required to be repaid during the lifetime of the firm. The only liability of the firm is to pay the annual dividends. Since the shares may be issued at par, premium or a discount, the cost of preference shares is the yield on preference shares.

The cost of irredeemable preference shares is computed with reference to dividends paid and the amount received by the firm on account of preference capital.

Mathematically, its computation is expressed as:

There is no need for adjustment for tax because preference dividend is not tax deductible. The net proceeds are computed by deducting the cost of floatation and the discount value from the par value or adding the premium to the par value of preference share capital. The computation may be performed for a single preference share or for all the preference shares issued.

ii. Cost of Redeemable Preference Capital:

Redeemable preference shares are those that are repaid after a specific period of time. Hence, the cost of redeemable preference shares is calculated after giving due consideration to the maturity period of the preference shares and their redeemable value. Redeemable preference shares may also be issued at par, discount or at a premium.

Moreover, there may be floatation costs that are adjusted in the net proceeds. The redeemable value may differ from its face value depending on whether the preference shares are redeemed at par, discount or at a premium.

Therefore, when the preference shares are redeemable at some future date, their cost is computed by taking into consideration the amount payable at maturity besides expected regular payment of dividend.

Mathematically, it is expressed as:

3. Cost of Equity Share Capital:

Equity shares do not carry any explicit cost. They neither have a predetermined dividend or interest rate nor a specified maturity period. Equity shareholders receive the residual income, that is, the income left after paying the interest to debt-holders and dividend to preference shareholders.

However, the equity shareholders expect a dividend and/or capital gains against their investment and such expectations give rise to an opportunity cost of capital. The market value of a share is a function of the return which a shareholder expects.

The equity holders’ required rate of return is a cost from the firm’s perspective because if the firm does not deliver this expected return, shareholders will simply sell their shares, causing a decrease in share prices.

The equity shareholders take the highest degree of financial risk, that is, they receive a dividend after paying off all the business obligations. Therefore, they expect a higher return and, as such, higher costs are related to them.

The computation of the cost of equity capital is a cumbersome process as compared to computation for cost of debt and preference capital. This is mainly because of the unknown and uncertain character of return on equity.

Cost of equity refers to a shareholder’s required rate of return on an equity investment. It is defined as the minimum rate of return that a firm must earn on the equity financed portion of an investment project so as to leave unchanged the market price of the shares. The cost of equity is basically what it costs the firm to maintain a share price that is theoretically satisfactory to investors.

On this basis, the present value of the expected future stream of dividend on shares plus sale proceeds realized on sale of such shares should be the current market price of the share.

Mathematically –

It is very difficult to know the expected rate of return which the shareholders expect from their investment as they may have different perceptions.

However, some of the approaches by which the cost of equity capital may be computed are:

(a) Dividend-Price Approach

(b) Dividend-Price Plus Growth Approach- Both uniform and varying growth rates

(c) Earnings-Price Approach v.

(d) Capital Asset Pricing Model (CAPM)

(e) Realized Yield Approach

4. Cost of Retained Earnings:

The amounts of undistributed profits, which are available for investment, are called retained earnings. Retained earnings are considered as an internal source of long-term financing and are a part of shareholders’ equity. Generally, retained earnings are considered as a cost free source of financing.

It is because neither dividend nor interest is payable on retained profits. However, this is not true. The shareholders of the firm that retains more profit expect more income in the future than the shareholders of the firm that pays more dividends and retains less profit.

All the profits earned by the firm belong to the shareholders and if the firm decides to reserve some, the shareholders deserve to get a return on the reserved amount.

Therefore, there is an opportunity cost of retained earnings. In other words, retained earnings are not a cost free source of financing. They just do not have an explicit cost. The cost of retained earnings must be at least equal to the shareholders rate of return that they may earn on reinvestment of dividend paid by the company.

The cost of retained earnings or internal funds within a capital structure is similar to the cost of equity capital since it is a component of equity. Generally, the cost of retained earnings is slightly less than the cost of equity capital. This is because the firm neither has to incur transaction costs to obtain it, nor has to pay the taxes associated with paying dividends.

In the absence of any information relating to addition of the cost of reinvestment and extra burden of personal tax, the cost of retained earnings is considered to be equal to the cost of equity.

However, the cost of retained earnings differs from the cost of equity when there is a floatation cost to be paid by the shareholders on reinvestment and there exists a personal tax rate of shareholders.

(a) Cost of retained earnings when there is no floatation cost and no personal tax rate applicable for shareholders –

(ii) Cost of retained earnings when there is floatation cost and personal tax rate applicable for shareholders –

The computation of cost of retained earnings on the basis of its alternative use is in accordance with ‘external yield criterion’. According to this approach, the alternative to retained earnings is external investment of funds by the firm itself. The cost of retained earnings thus, can be computed on the basis of returns expected from investing these retained earnings in another firm.

That is, the cost of retained earnings would be the same as the cost of equity, Ke. This approach represents an economically justifiable opportunity cost that can be applied in actual practice. The cost of retained earnings is not to be adjusted for tax and floatation cost. The firm does not incur any such cost on retained earnings. Also, earnings to be retained are already after tax has been deducted.

Weighted Average Cost of Capital:

Once the specific cost of different sources of capital is computed, the composite or overall cost of capital is ascertained by finding the weighted average of the cost of all the components of capital. The weighted average is used instead of a simple average to give due consideration to the proportion of various sources in the capital structure of the company.

The computation of this cost involves inter-alia the following steps:

(i) Ascertaining the specific cost of each source of fund.

(ii) Calculating the weights of each source of capital on the basis of their contribution to the overall capital generally either on book value or market value basis.

(iii) Computing the sum of the product of specific costs and the weights of each source of capital fund.

Assigning Weights:

There are three types of weights that are applied to compute Weighted Average cost of Capital.

These are:

1. Historical Weights

2. Marginal Weights

3. Target Weights

1. Historical Weights:

Historical weights make two assumptions- first that the existing capital structure is optimum and second that the firm will finance its future projects without changing the existing capital mix. The existing or actual proportion of different sources of funds in the capital structure, are historical weights which can be computed either on book value or market value basis.

(a) Book Value Weights:

The relative proportion of different kinds of sources in the existing capital structure at values given in the financial statements of the firm is termed as book value weights. These are readily available from balance sheets for all types of firms and are very simple to calculate. They do not fluctuate on a daily basis. These are the weights used by banks and financial institutions.

(b) Market Value Weights:

The relative proportion of different kinds of sources in the existing capital structure at their current market price is termed as market value weights. They are preferred over book value weights as they are a close approximation of the actual amount to be received from the sale of such securities.

As the fresh capital can be raised at the market price, such weights reflect the current and true cost. However, there are practical difficulties in finding the market value of some sources like retained earnings and in case securities are not traded regularly. Also, the market value is subject to fluctuations in the stock market. Hence, the weighted average cost of capital will also vary.