Cash management is a broad term that refers to the collection, concentration and disbursement of cash. It encompasses a firm’s level of liquidity, its management of cash balance and its short-term investment strategies. In some ways, managing cash flow is the most important job of a finance manager.

If at any time, the firm fails to pay an obligation when it is due because of lack of cash, the firm is insolvent. Obviously, the prospect of such a dire consequence should compel firms to manage their cash with care.

Moreover, efficient cash management means more than just preventing bankruptcy. It improves the profitability and reduces the risk to which the firm is exposed.

The main objective of cash management is to bring equilibrium between liquidity and profitability of business to maximise its long-term profits. The greater the amount of cash balance, more will be the liquidity of the firm and lesser will be its profitability.

ADVERTISEMENTS:

On the other hand, lesser the amount of cash balance, more will be the profitability and lesser will be the liquidity of business. This is true to a certain limit. After this limit, lesser liquidity will reduce profitability.

Cash management assumes more importance than other current assets because cash is the most significant and the least productive asset that the firm holds. It is significant because it is used to pay firm obligations.

However, cash is unproductive and as such, the aim of cash management is to maintain an adequate cash position to keep the firm sufficiently liquid to use excess cash in some profitable way.

Management of cash is also important because it is difficult to predict cash flows accurately and that there is no perfect coincidence between inflows and outflows of cash.

ADVERTISEMENTS:

Thus, during some periods, cash outflows exceed cash inflows, because payments for taxes, dividends, excise duty, seasonal inventory buildup, etc. At other times cash inflows will be more than cash payments, because there may be large cash sales and debtors may be realised in large sums promptly.

Cash Management: Meaning, Objectives, Strategies, Importance, Factors, Motives for Holding Cash, Models, Technique, Cash Flows, Cash Budget, Advantages, Problems, Examples and More…

Overview – Cash Management

The term cash is a wider concept even though most of the time it is perceived in a narrow sense. The economic dentition of cash includes currency, savings account deposits at banks, and undeposited cheques.

However, financial managers often use the term cash to include short- term marketable securities. Short-term marketable securities are frequently referred to as cash equivalents and include Treasury bills, certificates of deposit, and repurchase agreements.

The balance sheet item ‘cash’ usually includes cash equivalents. A highly profitable company might collapse if without adequate cash flow due to the tying up of company’s funds with the accounts receivable and worsened by the needs to make regular payments like wages, rent & utilities, taxes. Therefore managing cash flow is an important task.

Cash Management – Introduction

The main objective of working capital management is to manage each component of current assets efficiently so that liquidity of the firm could be maintained. The main task in the management of a specific asset is to determine the optimum level of investment in it.

ADVERTISEMENTS:

Cash is the most important current asset for the operation of business. Cash is the basis to keep the business going on continuously. It is the most liquid asset. Business should keep adequate cash which should neither be in excess of the requirements nor should it be inadequate.

The shortage of cash can put obstacles in the production process of business and excessive cash will remain useless which will affect the profitability adversely. In any business firm cash does not earn any profits itself.

Cash is the least productive asset of business. It is important because it is used to pay business liabilities. Therefore, the main objective of cash management is to maintain liquidity at optimum level and to invest surplus cash in profitable manner.

ADVERTISEMENTS:

The term ‘cash’ is used in two ways. In the narrow sense, it includes coins, currency notes, cheques, bank drafts, demand deposits, etc. In the wider sense the near cash assets like marketable securities and time deposits are also included in it because they can be converted quickly into cash. In cash management both cash and near cash assets are included.

Cash management is concerned with the management of collection and disbursement of cash, determination of optimum amount of cash and investment of surplus cash.

Cash Management – Meaning of Cash

Cash is the most liquid asset which a firm or an individual holds. By spending this asset, all other assets in the business can be acquired. In other words, cash can be converted into any form of asset. In a narrow sense cash includes coins, currency notes, bank balance and other bank instruments like cheques and bank drafts.

While in a broader sense it also includes near cash assets like time deposits in banks, treasury bills, marketable securities etc. Near cash assets can be converted into cash easily. Cash in a firm can be compared to the blood in a human body. A business firm cannot survive without managing its cash requirement properly. Therefore, it is crucial for the solvency of a business.

What is Cash Management – Meaning

Cash management is a broad term that refers to the collection, concentration and disbursement of cash. It encompasses a firm’s level of liquidity, its management of cash balance and its short-term investment strategies. In some ways, managing cash flow is the most important job of a finance manager.

ADVERTISEMENTS:

If at any time, the firm fails to pay an obligation when it is due because of lack of cash, the firm is insolvent. Obviously, the prospect of such a dire consequence should compel firms to manage their cash with care.

Moreover, efficient cash management means more than just preventing bankruptcy. It improves the profitability and reduces the risk to which the firm is exposed.

Nature of Cash Management

The exact nature of cash management would depend upon the organizational structure of a firm. In a highly centralized organization, the system would be such that the central or head office controls the inflows and outflows of cash on a routine and daily basis.

ADVERTISEMENTS:

In a decentralized form of organization, where the divisions have complete responsibility for conducting their affairs, it may not be possible and advisable for the central office to exercise a detailed control over cash inflows and outflows.

Objectives of Cash Management

Objectives of Cash Management:

The main objective of cash management is to bring equilibrium between liquidity and profitability of business to maximise its long-term profits. The greater the amount of cash balance, more will be the liquidity of the firm and lesser will be its profitability.

On the other hand, lesser the amount of cash balance, more will be the profitability and lesser will be the liquidity of business. This is true to a certain limit. After this limit, lesser liquidity will reduce the profitability.

ADVERTISEMENTS:

The following are two main objectives of cash Management:

(1) To make payment according to the payment schedule.

(2) To minimise cash balance.

(1) To Make Payment According to Payment Schedule:

One basic objective of cash management is to meet the cash requirements of business i.e., to pay its liabilities in time. In other words, firm needs cash to meet its routine expenses including wages, salary, interest, dividend, taxes, etc.

Following are the main advantages of adequate cash:

ADVERTISEMENTS:

(i) It prevents the firm from being insolvent.

(ii) The relation of the firm with bank does not deteriorate.

(iii) It helps the firm to maintain good relations with the suppliers.

(iv) Advantage of trade discount can be taken by making payment in time.

(v) Advantage of favourable business opportunities can be taken

(vi) Contingencies can be met easily.

(2) To Minimise Cash Balance:

The second objective of cash management is to minimise cash balance. In order to minimise cash balance, there is need to co-ordinate two contradictory aspects. Excessive amount of cash balance helps in quicker payments and all advantages relating to such payments can be taken. But it would mean that a large amount of cash funds will remain unused. It will reduce profitability of business.

Contrarily, when cash available with firm is less, the firm is unable to pay its liabilities in time. Therefore, the level of cash in the firm should be optimum. Firm should, therefore, determine its cash requirements considering all the factors affecting such requirement.

Efficient Cash Management

In an efficient cash management, cash at hand and at bank, in spite of all its significance, should be optimum. That is, it should be at a minimum level that will take care of the immediate needs and the contingent requirements of the firm.

For an overall efficient, effective and economical cash management, one needs to emphasise on efficient collections, efficient use of short-term money, discouragement of idle funds, efficient disbursements and monitoring of cash movement from the firm’s bank branch to its headquarter.

Efficient cash management is supported by the fact that the firm develops and uses different sources of short-term money that are flexible enough and readily available at nominal cost.

The firm discourages usable funds (collections or borrowed capital) to stand idle for more than a day.

For profitable and flexible investment of cash, surplus that arises should be profitably invested in marketable securities so that as long as this cash is not required it generates profits, and as soon as it is needed it can be encashed quickly.

Effective cash management involves the following:

i. Efficient collections

ii. Efficient disbursements

iii. Continuous and dynamic monitoring of cash movement.

Collections are the sale receipts received by the firm from its customers by selling its products or services to them. More efficient the collection of the sale proceeds, the more cash the firm has, and the availability of funds increases as collection time decreases.

Efficient collection management can be done by speeding up collections, decentralisation of collection systems, etc. There are two popular decentralised collection systems that speed up cash collection and reduce the float time.

These are as follows:

1. Lockbox System,

2. Concentration Banking.

1. The Lockbox System:

It is a simple method used in reducing collection float and accelerating firm’s collections or remittances. When a firm adopts the lockbox system, it takes a post office box in its name, called lockbox, and requests its customers to mail their payments to these lockboxes.

These lockboxes are attended by local collection banks or local branch or depot personnel one or more times every day (if possible even on holidays). These cheques are deposited directly into the local bank account of the firm. If it is through the local bank, then the company authorises its bank to collect its sale receipts from the lockboxes.

The bank then sends particulars of cheques along with letters or other accompanying materials to the firm for information. After the cheques are realised, surplus funds from the local banks are transferred (usually by wire) to the central account or accounts of the firm.

Thus the lockbox system helps to reduce the mailing time, because cheques are received at a nearby post office instead of at corporate headquarters, and deposited and cleared locally. It also helps in reducing the processing time as the deposits are made by the local bank.

Hence, firm saves on its time and efforts for processing the mails and reduces the availability delay as the firm encourages its customers to draw the cheque on local banks.

In this way, the firm is in a better position to use its collections immediately. This system reduces mail float, clearing float as well as processing float. Banks do charge some fee against these services.

Whenever firms analyse the possibility of adopting such systems, they must evaluate the cost and benefits attached. The benefits derived from the speeding up of collections must be greater than the costs of the lockbox system.

Lockboxes are widely dispersed because they are usually adopted by multinationals, large and big companies, which have their branches in many states.

Advantages:

i. A lockbox system reduces the mail float because lockboxes can be established at different geographical locations and thus reduces mailing time.

ii. To ensure that check processing time is minimised, some banks offering lockbox services pick up and process mail on a continuing basis and process checks on a 24-hour basis.

iii. Another advantage is that the bank performs the clerical work for processing the incoming cheques prior to deposits. In this respect, it is superior to the concentration banking system.

iv. The lockbox system enjoys the additional advantages of eliminating the cheque processing float completely because they do not record the checks until it has been deposited.

Disadvantages:

The main disadvantage of this system is the cost. The bank will provide a number of additional services, to the usual clearing of cheques.

Accordingly, it will require compensation for the additional services—usually in the form of increased deposits from the firm. Because the cost is almost directly proportional to the number of cheques deposited, this system is not profitable if the average remittance is small.

2. Concentration Banking:

In concentration banking, the company establishes a number of strategic collection centres in different regions instead of a single collection centre at the head office. When the firms open up different collection centres in different parts of the country in order to reduce the postal delays, it is known as concentration banking.

It is one of the important and popular ways of reducing the size of the float. Here the firm requests its customers to mail their payments to a local or regional collection centre instead of mailing it to the head office.

This system reduces the period between the times a customer mails in his remittances and the time when they become spendable funds with the company. Payments received by the different collection centres are deposited with their respective local banks, which in turn transfer all surplus funds to the concentration bank of the head office.

The concentration bank with which the company has its major bank account is generally located at the headquarter.

Surplus funds from the local banks are transferred by mail or wire form the local bank accounts to a concentration bank or banks. The choice between a wire or mail transfer depends on two factors – the amount involved and the cost of finance.

In general, wire transfers are economical only when large sums of money are involved and the firm can earn a reasonable return on short term, low risk and highly liquid investments.

Advantages:

i. It reduces mail float significantly. The customers receive the bills from the collection centres instead of from head office, and secondly when they send their cheques to the collection centres, the mailing time is shorter than the time required for mailing them to the head office.

ii. Average bank float is also reduced. This is mainly because of reduction in the volume of outstation cheques as most of the cheques deposited in the collection centre’s bank are drawn on banks in that area.

iii. This system reduces the time of collection and hence results in better cash management.

iv. Cash concentration improves the control of the firm over inflows and outflows of cash.

v. Disbursing cash from one place becomes easier and efficient.

vi. Cash concentration also reduces idle cash balances.

vii. The balance at regional offices is kept low, which is almost equal to the actual total expenses of the regional branches.

viii. Any excess funds are moved to the concentration bank(s). Excess funds in concentration banks(s) are invested for short-term periods to provide better yields to the firm.

However, cash concentration is encouraged by timely transfer of funds to and from concentration banks and regional branches. For efficient fund transfer, firms use cheques and drafts as a payment and receipt mode. The other methods like automated clearing house (ACH), electronic transfer and wire transfer are also used for remitting funds.

The main issue here is selecting the collection centres, which largely depends on the volume of billing/business in a particular geographical area. However, the cost of concentration system is the minimum account balance required to be maintained in these current accounts.

Importance of Cash Management

Sydney Robbins, while emphasising the importance of cash in a business, said “Cash-what a strange commodity! A business wants to get hold of it in the shortest possible time but to keep the least possible quantity on hand. Increased sophistication in the handling of cash has enabled companies to cut down on the balances needed to sustain any given level of operations”.

Cash is the most liquid asset that a business owns. It includes money and such instruments as cheques, money orders or bank drafts which banks normally accept for deposit and immediately credit to the depositor’s account. The main preoccupation of a businessman is cash, which is the starting point and the finishing point.

It is the sole asset at the commencement and the termination of a business. It should be remembered that a want of cash contributes more towards non-existence of a business than any other single factor.

What is required is cash, and, if it is not available, shareholders can only conclude that the financial affairs of the company have been mismanaged, howsoever, satisfactory the balance in the Profit and Loss Account may be.

Cash imparts life and strength-profits and solvency to the business organisation. It should be understood that though firms differ in considerable degree in terms of nature of business, capital structure, personnel employed, risk technology and so on, one thing which they have in common is the basic mechanism involving the conversion of funds into saleable products and back into liquid form.

Cash in its ultimate state yields no returns and as such is barren. The idea that a large bank balance reveals a sound position financially has long since been disproved, leading as it does, to the holding of an asset which is devoid not only of earning power but is on the contrary, expensive to retain an important position in the structure of working capital.

Cash is the beginning as well as the end of the operating cycle of a manufacturing concern. It is the basic input needed to keep the business running on a continuing basis and is also the ultimate output expected to be realised by’ selling the product.

The cash balance of a company is a ‘safety valve’ or shock absorber, protecting the company against short-run fluctuations in funds requirements.

One of the most urgent and important demands confronting the corporate financial management is making the synchronisation of the rates of inflow of receipts with the rates of outflow of cash disbursements.

Planning for cash requirements is an essential management function of any business. It is not enough for an undertaking to make a profit. Cash resources should be planned to finance a cash flow, without which, otherwise efficient and profitable businesses would have encountered financial difficulties.

A corporate financial officer should plan his cash and credit sources in such a way that the normal operations of the corporation are not disrupted by a shortage of cash and that opportunities for capital expenditure are not lost because of the inability to finance them.

The creditworthiness of a business is one of its most valuable assets. A management should, therefore ensure that there are no hold-ups in the payment of its dues because it would earn the reputation of being a bad paymaster, or even more importantly, its creditors may resort to litigation.

Unfortunately, the inflow and outflow of funds cannot be synchronised completely. If this were possible, it would not be necessary to maintain more than a minimum of cash or near cash resources. A control of the cash position is a vital aspect of the financial management of a concern.

There should be a balance between both cash and cash-demanding activities —operations, capital additions etc. The objectives of cash management are to make the most effective use of funds, on the one hand, and accelerate the inflow and decelerate the outflow of cash on the other.

The traditional approach to a determination of technical solvency, which stresses on the availability of current assets to discharge current liabilities, is viewed as incomplete. In this connection, James Walter has rightly observed that the appropriate topic for discussion appears rather to be whether prevailing cash inflow (plus cash resources) and the cover existing cash outflows by a sufficient margin to protect against possible reduction in inflows or increments in outflows.

A financial manager has to adhere to five ‘Rs’ of money management. These are, the right quality of money for liquidity considerations, the right quantity whether own or borrowed, the right time to preserve solvency, the right source, and the right cost of capital the organisation can afford to pay.

Significance of Cash Management

Cash management assumes more importance than other current assets because cash is the most significant and the least productive asset that the firm holds. It is significant because it is used to pay firm obligations. However, cash is unproductive and as such, the aim of cash management is to maintain adequate cash position to keep the firm sufficiently liquid to use excess cash in some profitable way.

Management of cash is also important because it is difficult to predict cash flows accurately and that there is no perfect coincidence between inflows and outflows of cash. Thus, during some periods, cash outflows exceed cash inflows, because payments for taxes dividends, excise duty, seasonal inventory buildup, etc. At other times cash inflows will be more than cash payments, because there may be large cash sales and debtors may be realised in large sums promptly.

Cash management is also important because cash constitutes the smallest portion of the total current assets, even then, considerable time of management is devoted to it.

Strategies regarding the following four factors of cash management should be evolved by the firm-

1. Cash planning- Cash inflows and outflows should be planned to project cash surplus or deficit for each period of planning. Cash budget should be prepared for this purpose.

2. Managing the cash flows- The inflow and outflow of cash should be properly managed. The inflows of cash should be accelerated, while the outflow of cash should be decelerated as far as possible.

3. Optimum cash level- The firm should decide on the appropriate level of cash balances. The cost of excess cash and the danger of cash deficiency should be matched to determine the optimum level of cash balances.

4. Investing idle cash- The idle cash or precautionary cash balances should be properly invested to earn profit. The firm should decide on the division of such cash balances between bank deposits and marketable securities.

Operational Goals of Cash Management

Precisely speaking, the primary goal of cash management in a firm is to strike trade-off between liquidity and profitability in order to maximize profit. This is possible only when the firm aims at optimizing the use of funds in the working capital pool.

This overall objective can be translated into the following operational goals:

(i) To satisfy day-to-day business requirements;

(ii) To provide for scheduled major payments;

(iii) To face unexpected cash drains;

(iv) To seize potential opportunities for profitable long-term investments;

(v) To meet requirements of bank relationships;

(vi) To build image of creditworthiness;

(vii) To earn on cash balance;

(viii) To build reservoir for net cash inflows till the availability of better uses of funds by conscious planning;

(ix) To minimize the operating costs of cash management.

4 Facets of Cash Management

Cash inflows and outflows do not always match. There could be either surplus or shortage. Surplus cash arises when the cash inflows are excess over cash outflows and deficit will arise when the cash inflows are less than the cash outflows.

The balance known as synchronization firm should develop appropriate strategies for resolving the uncertainty involved in cash flow prediction and in balance between cash receipts and payments.

Firms have to come up with some cash management strategies regarding the following four facets of cash management:

1. Cash Planning:

Cash planning is required to estimate the cash surplus or deficit for each planning period. Estimation of cash surplus or deficit can be arrived at by preparation of cash planning (budget).

2. Cash Flows Management:

Cash flow means cash inflows and cash outflows. The cash flows should be properly managed, the cash inflows should be accelerated (collected as early as possible) and cash outflows should be decelerated (cash payments should be delayed without affecting firm name).

3. Determination of Optimum Cash Balance:

Optimum cash balance is that balance at which the cost of excess cash and danger of cash deficiency will match. In other words, it is the cash balance at which the total cost (total cost equals to transaction cost and opportunity cost) is minimum. Firm has to determine the optimum cash balance.

4. Investment of Surplus Cash:

Whenever there is surplus cash it should be properly invested in marketable securities, to earn profits. Firms should not invest in long-term securities, they cannot be converted into cash within a short period.

Factor for Efficient Cash Management

Factor # (1) Prompt Billing and Mailing:

A time lag occurs from the date of despatching goods to the date of preparing invoice documents and mailing the same to the customers. If this time gap can be minimized early remittances can be expected otherwise remittances get delayed.

In the case of one organization it had been observed that the time lag was as high as one week; subsequent scrutiny revealed that the reason for delay was due to practice of preparing bills and mailing them in ‘bunches’.

As a result the bills on earlier sales got delayed resulting in late realization once the reason for the delay was identified corrective measures were taken to prevent the bunching bottleneck of bills. This resulted in the reduction of delay in remittances. Thus accelerating the process of preparing and mailing bills held will reduce the delay in remittances and early realization of cash.

Factor # (2) Collection of Cheques and Remittances of Cash:

Delay in the receipt of cheques and depositing the same in the bank will be inevitably by taking measures for hastening the process of collection and depositing cheques/cash from customers. The following example will prove the point.

Example:

An Organization having branches in all the districts of West Bengal had been selling fertilizers to a great extent by a vast network of consignees who will get a margin for their services. Quite often the consignees were making remittances to the head office in Calcutta resulting in delays in cash realization.

An in-depth study revealed that delays can be considerably reduced by adopting the following procedure:

i. The consignees should be asked to prepare challan-cum-invoice on Credit sales which would cut-short the work of raising separate bills.

ii. Non-operating collection accounts had to be opened in the District-Level branches of the head-office bank into which cheques and cash from sales are to be deposited by the consignees under advice to the branch manager.

The amounts so deposited are to be transferred to the main bank account of the head office telegraphically under advice to the head-office. The branch managers/their assistants should make occasional visits to the bank branches and also to the consignees for ensuring compliance with the instructions issued.

The above practice considerably reduces the delay in receipts with a resultant decrease in the incidence of interest on the cash-credit account of the head-office.

Cash Management – 10 Important Factors Affecting Cash Requirements of a Firm

The following are the important factors affecting cash requirements of a firm:

(1) Matching of Cash Flows:

The need for maintaining cash arises when cash inflows do not take place at one time. If cash inflows match the cash outflows i.e., they take place at one time, there is no need for a cash balance. When cash outflows exceed the cash inflows, a need for cash arises so that the firm can be saved from technical insolvency.

What is this technical insolvency? When the firm is unable to pay its short term liabilities due to shortage of cash, such a situation is called technical insolvency.

Therefore, to determine the requirements of cash, the difference between cash inflows and cash outflows should be estimated. For this purpose cash inflows and cash outflows should be forecasted. It can be done through the Cash Budget.

(2) Non-Recurring Expenditure:

In the non-recurring expenditure those expenditures are included which are incurred for the purchase of fixed assets. Fixed assets are acquired for implementing new projects or for expanding the existing production and marketing capacity or for diversification of business.

The plan for such type of expenditure is prepared once in several years. The quantum of such expenditure is very high. Therefore, while determining the cash requirement, such expenses should also be taken into consideration.

(3) Cash Short Costs:

Cash short costs are those costs which are incurred due to shortage of cash. With the help of cash budget the timings of cash deficiency and its quantum can be forecasted.

Cash short costs include:

(i) The expenses relating to management of cash to fulfill shortage of cash, for example brokerage on sale of marketable securities.

(ii) Credit costs like interest on debentures and commitment charges.

(iii) Loss of trade discount.

(iv) Loss of goodwill costs like more bank expenses, decrease in supply of raw material, decrease in profits and sales, etc.

(4) Cost of Excessive Cash Balance:

If a firm keeps cash balance more than its requirement, it means that management loses the opportunity to invest it elsewhere. It causes loss of interest. This loss of interest income is called the cost of excessive cash balance. Therefore, firm should consider this factor too while determining the level of cash.

(5) Management Costs:

These are the cost which are meant for management of cash, For example- salary, clerical expenses, etc. These are generally of fixed nature.

(6) Uncertainty:

Sometimes, there is uncertainty in the forecasts of cash inflows. Cash inflows can be estimated correctly but there may be delay in collection from debtors. To meet these contingencies, firm must keep additional cash balance.

(7) Payment of Loans:

Firm has to repay its long term loans. Therefore, while determining cash requirements adequate cash arrangements must be made for the repayment of loans. Normally, to pay the long-term loans, new shares or debentures are issued.

(8) Firm’s Capacity to Borrow in Emergencies:

If a firm can take loans quickly at the time of its need, a low level of cash can be maintained. Firm’s ability to borrow depends on various factors. For example- relations of the firm with banks, the quantum of assets on whose security loans can be undertaken, rate of interest and demand and supply conditions for short-term loans, etc. are a few among them.

(9) The Attitude and Policy of Management:

The attitude and policy of the management towards liquidity, risk of technical insolvency, credit sales, etc. affect the level of cash. If management gives more importance to liquidity instead of profitability, the level of cash will be high. On the other hand, if management attaches more significance to profitability instead of liquidity, the level of cash will be lower.

(10) Efficiency of Management in Managing Cash:

If management follows such policies and procedures which help in easy collection of cheques from debtors and payment to creditors is delayed, the balance of cash in business can be minimised.

Cash Management – Factors Determining Cash Needs

Following are some of the factors which are to be considered for determining cash needs of a firm:

Factor # 1. Nature and Size of Business

The cash requirements of a firm mainly depends on the nature and size of a business. Trading and manufacturing concerns require more cash while service concern’s need for cash is much less. Size of business operations also affects the cash needs of a firm.

Factor # 2. Production Policies

Production policies of a firm affects the purchase of material and other components and the level of finished goods. More production for inventory means more purchases of raw material resulting into higher cash needs.

Factor # 3. Credit Policies

Policies on trade receivables like credit period allowed, cash discount offered affect the cash flow in a firm. Also, ability of a firm to get favourable credit terms from its suppliers of materials and services affects the cash needs of the firm at a particular point of time. A tight credit policy on debtors and favourable credit policies from suppliers will reduce the cash needs of a firm.

Factor # 4. Manufacturing Cycle

Cash needs of a firm also depend upon the length of manufacturing cycle of a firm. A longer manufacturing cycle will involve more investment in raw material, work-in- progress and finished goods resulting in higher cash needs. Further cash cycle will require investment in debtors before cash is reconverted again after passing through manufacturing and cash cycles.

Factor # 5. Growth and Expansion Policies

If a firm is pursing active growth and expansion strategies, then its cash needs will also increase manifold. Stability strategy will stabilize the cash needs of a firm. Hence, cash need of a firm is affected by the kind of business strategies adopted by a firm.

Factor # 6. Monetary and Fiscal Policies

Monetary and fiscal policies of the government do affect the availability of money supply in the country. These policies affect the quantum of money available from banking system to the industry.

If banks are liberal in offering loans to the business firms, these firm will keep cash only for transaction motive. For other motives, the firms can approach the banks and can get the necessary cash at a short notice.

Factor # 7. Synchronisation of Cash Flows

If a firm has done proper planning for its cash inflows and outflows for a particular period, then it is in a position to find out cash surplus or deficit for that period. Therefore, a proper planning of cash through cash budget will help to find out the exact need of cash and it will also reduce idle cash in the system.

Factor # 8. Consideration of Short Costs

For determining an appropriate level of cash, consideration of short costs is also important. The term short costs may be defined as costs, expenses, or loss incurred as a result of deficiency of cash at a particular point of time.

Some of the costs which may be included in short costs are as follows:

(i) Loss of discounts

A firm may lose an opportunity of availing trade and cash discount due to shortage of cash.

(ii) Cost associated with restoration of required liquidity

When a firm is confronted with shortage of cash, it needs to involve in emergency borrowings at a higher rate of interest and may be required to pay penalty for not meeting its obligations on time. It may also suffer losses in liquidating its marketable securities. These will result in huge costs to the firm.

(iii) Costs of defending legal suit

When a firm fails to meet its obligations on time, it may face a legal action from creditors. Firm has to incur costs in defending the legal action besides arresting fall in its reputation.

Cash Management – Motives for Holding Cash: Transaction, Precautionary, Speculative and Compensation Motive

Although cash does not generate any profit itself, yet certain firms maintain some amount of cash balance. It is because of the fact that is maintained for making several types of payments. There are four main motives of holding cash.

These are:

(1) Transaction Motive

(2) Precautionary Motive

(3) Speculative Motive

(4) Compensation Motive

(1) Transaction Motive:

One of the important reasons for maintaining cash is to facilitate business transactions. Business needs cash for various payments in ordinary course of its operation. It includes payment for purchase of material, and payment of wages, salary, interest, dividend, taxes and other expenses.

Similarly, business gets cash from its selling activities and other external investments. But there is no coordination between the inflow and outflow of cash. Sometimes, inflows of cash are more than the outflows and sometimes outflows of cash are more than its inflows.

When the expected cash receipt is short of the required payment, cash is needed by the firm so that liabilities could be paid. If cash receipts match with the cash payments, business does not need cash for the transactional purposes.

(2) Precautionary Motive:

Firm needs cash to combat some contingencies.

Some of the contingencies for which additional cash is required include:

(i) Strikes, floods, failure of important customers.

(ii) Slow rate of cash collection from debtors.

(iii) Rejection of orders by customers due to their dissatisfaction.

(iv) Rise in cost of raw materials, etc.

(3) Speculative Motive:

It means to make use of profitable opportunities by firm. Sometimes, the firm wants to make use of such profitable opportunities which are outside the operation of the business. For this purpose, firm retains some cash.

Some of these opportunities are:

(i) Opportunity to purchase raw material at low price by payment of cash immediately.

(ii) Opportunity to purchase securities at falling prices.

(iii) Purchasing raw material at a time when its prices are the lowest.

(4) Compensation Motive:

One more objective to maintain cash is to compensate for providing free services by banks to the business. Banks provide a number of services to its customers, like clearance by cheques, credit information about other customers, transfer of funds, etc.

For certain services banks charge commission but some of the services are provided by them free of cost for which they require indirect compensation.

For this purpose they wish their customers to maintain minimum cash balance. This bank balance cannot be used by the firm for its business transactions but the bank can use it to earn profit and thus compensates itself for the cost of services to the customers.

Functions of Cash Management

Cash planning, managing the cash flows, determining optimum cash level and proper utilisation of surplus cash are the important areas/functions of cash management. Let us discuss each in detail.

Function # 1. Cash Planning:

Planning is the first activity for any area of management. Hence, for efficient cash management, a proper cash planning is required as a first step. Cash planning refers to a precise determination of position of all cash inflows and outflows during the planning period and a proper synchronization of all such cash inflows and outflows.

Through cash planning, a statement of all receipts (cash inflows) and payments (outflows) at different points of time during the budgeted period is prepared. It helps the management to find out the deficit or surplus of cash at different points of time. The statement so prepared is known as cash budget.

Function # 2. Cash Budget:

Cash budget is the most important tool to plan and control cash inflows and outflows. A cash budget may be defined as a statement consisting the summary of the firm’s estimated cash inflows and outflows for the budget period. It is a summary statement of future estimated receipts and payments over a defined period of time.

It gives us detailed information regarding timings and quantity of expected cash inflows and outflows for the future period. Cash budget can be prepared on weekly, monthly, quarterly, half yearly or yearly basis. Cash budgets for a longer period can be prepared if longer period cash forecast are made with reasonable certainty.

Cash forecasts are needed to prepare a cash budget. It is the technique of estimating cash receipts and payments for a future period. By preparing a cash budget, finance manager can fairly estimate the cash needs of the firm at different point of time of a budget period.

He can plan for the expected shortage of cash and can also invest the surplus cash profitably. Through cash budget, he can exercise control over cash and maintain the required liquidity for the firm.

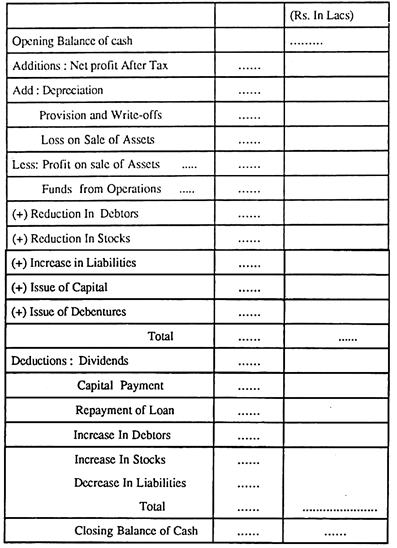

A cash budget is usually prepared by writing opening cash balance as the starting point. All receipts for the periods are added to the opening balance to find the total cash available during the period. The receipts may consist of both revenue and capital nature. These may belong to any period whether future, current or past.

In nutshell, all receipts whether of capital or revenue nature or belonging to any period has to be taken into account. From the total cash available, all payments for the period whether of capital or revenue nature or belonging to any period are deducted to find the closing cash balance.

Function # 3. Managing Cash Flows /Floats:

Cash flow management is the management of collection and disbursement of cash.

The cash flows are managed with following objectives in mind:

1. Collection of cash inflows from customers as quickly as possible so that funds are available to the firm as soon as possible.

2. Payment to creditors and other parties as slowly as possible so that funds remain available to the firm as long as possible.

Managing Cash Inflows:

The first objective of efficient cash flow management is to speed up the process of cash inflows. This can be done to collect the cash from customers as early as possible. Customers should be billed promptly and should be encouraged to pay within the period of payment allowed to them. Possibility of offering them cash discounts can also be considered for those who wants to make early payment.

Managing Cash Outflows:

The second objective of efficient cash flow management is to slow down the disbursements of accounts payable so that the funds remain available to the firm as long as possible. Firstly, firms should avoid early payment in all cases. Also, firms should use credit terms to the fullest extent possible.

The firm should pay its obligations on the due dates. Secondly, the firm should adopt a system of centralised controlled disbursement. All payment should be made through a centralised payment account. This will also help the firm to slow down its disbursement and in the process conserve cash for the firm.

Centralised disbursement system will increase the transit time for the cheques. This will result in delay in presentation of cheques for encashment by the parties which are located away from the centralised disbursement system.

Delaying payments results in more availability of funds at a particular point of time. However, the firm should not delay in making payments at the cost of its goodwill. When the firm fails to meet its obligation on time, it may face difficulty in obtaining the required trade credit. Finally, the objective should be to keep cash available in the right amount and at the right time to meet the financial obligations at the minimum cost.

Function # 4. Collection Float Management:

A firm receives most of its payments in the form of cheques. Once a cheque is received, the process of its encashment starts. Money in the form of cheques is called a deposit float or collection float. Attempts should be made to reduce this float.

The deposit float is caused by:

(i) Postal float

It is due to postal delays i.e. time taken by the cheque to reach through post.

(ii) Processing float

It is due to accounting time, i.e. the time taken by the firm to do necessary entries in the books of accounts.

(iii) Processing float

It is because of the time taken by the banking system to clear the cheque and credit the firm’s account.

In India, usually, a relatively longer time is taken in converting these floats into actual funds. A larger firm can adopt cash management techniques like concentration banking and lock-box system to speedily convert deposit float into cash.

Function # 5. Concentration Banking:

A large firm having business interest over a larger geographical area i.e. in different cities or towns across a country like India, can adopt concentration banking procedure to minimise time starting from collection of cheques to the availability of funds. Concentration banking, first adopted in the U.S.A, is a system of decentralising collections of accounts receivable.

Under this system, a large number of collection centres are established by the firm in different cities or towns. The collection centres will be required to collect cheques from the customers in their areas and deposit them in the local bank account opened for the purpose.

In this way local banks will receive the funds against these local cheques immediately. The local bank will send the funds telegraphically on a daily basis over a stipulated minimum balance to a concentration bank account usually opened at the head office of the company.

Hence, this procedure will help speedy collection of cheques and their encashment from large geographical area and immediate transfer of such funds to the company. This will be done through reducing mailing, processing time and encashment time by banks.

Function # 6. Lock-Box System:

This is another system of speeding up collection of cheques and their encashment. Under this system a firm hires a post-office lock-box at important collection centres established by it. Customers in their respective centre’s area are instructed to mail their cheques to these boxes.

The firm’s local bank are instructed to collect these cheques from these boxes daily or many times a day depending upon the volume of transactions and deposit the cheques in firm’s local bank account. Standing instructions are given to the local banks to send the funds over a fixed balance immediately to the head office account.

This system not only reduces the mailing time but also helps in reducing the processing time usually taken for depositing these cheques. The lock-box system has a cost. A cost-benefit analysis can be done before taking a decision to adopt the system.

Function # 7. Disbursement Float Management:

Efficient management of float is an important step in slowing disbursement. The term disbursement float refers to the amount of money tied up in the cheques that have been written, but have not yet been collected, presented or encashed.

This may arise because of following stages a cheque goes through:

(i) Billing float

Time elapsed between the sale transaction and mailing of the bill or invoice is called billing float. As a result payment is delayed for some days.

(ii) Mailing float

Once a cheque has been prepared, it is sent to the creditor by post. Time taken by postal authorities to deliver the cheque to its addressee is known as mailing float. Centralised disbursement system will increase this float and hence more availability of funds in firm’s account.

(iii) Cheque processing float

This is the time taken by the supplier firm to process and pass necessary journal entries in their account before cheque is deposited in the bank account for encashment.

(iv) Bank processing float

This refers to the time taken by the bank for its clearing and encashment through the banking system.

Managing Floats under Modern Banking System:

Money in the form of a cheque, starting from its writing stage to its ultimate realization and credit in a firm’s account represents idle funds in the banking system. This is due to the fact that when a firm writes a cheque, it is required to maintain sufficient balance in its account. The funds cannot be used by any of the firms during the banking processing time.

The focus of the banking sector reforms have been to speed up the process of transfer of funds i.e. both liquid funds in the form of cash and float funds in the form of cheques. These were intended to improve the availability of more funds to the business firms and to reduce the idle funds tied up in the banking system.

With the advent of Core Banking System in Commercial Banks, RBI launched services of faster tools of remittances like RTGS / NEFT / CTS etc. to develop alternate delivery channel and minimize the processing time for clearance of the financial instruments like cheques etc., which in fact has resulted in making the concept of Float Funds as a concept of past.

RBI’s initiatives were launched in a systematic manner and the major components of system for faster remittances are as under:

(a) Development of Indian Financial System Codes (IFSC);

(b) Development of Structured Financial Messaging System (SFMS);

(c) Putting in place the –

(i) Application Platform for launching ECS, RTGS & NEFT etc.

(ii) Cheque Truncation System (CTS); and

(iii) Necessary statutory modifications to incorporate changes in banking system.

(a) The mother of all Changes is the Introduction of IFSC Code for the Banks:

IFSC stands for Indian Financial System Code. The code consists of 11 Characters – First 4 characters represent the entity; Fifth position has been defaulted with a ‘0’ (Zero) for future use; and the Last 6 character denotes the branch identity.

The banks devise branch wise codes to be placed in last 6 character slot. IFSC is being identified by the RBI as the code to be used for various payment system projects within the country, and it covers all networked branches in the country.

(b) Structured Financial Messaging System (SFMS):

Structured Financial Messaging System (SFMS) is a secure messaging standard developed to serve as a platform for intra-bank and inter-bank applications. It is an Indian standard similar to SWIFT (Society for World-wide Interbank Financial Telecommunications) which is the international messaging system used for financial messaging globally.

In the Structured Financial Messaging System (SFMS), IFSC is being used as the addressing code in user- to-user message transmission. SFMS can be used practically for all purposes of secure communication within the bank and between banks.

RBI applications like Real Time Gross Settlement (RTGS), Negotiated Dealing System (NDS), Security Settlement System (SSS) and Integrated Accounting System (IAS) have interface with SFMS. The intra-bank part of SFMS, which is most important, is used by the banks to take full advantage of the secure messaging facility it provides.

The inter-bank messaging part is useful for applications like Electronic Funds Transfer (EFT), Real Time Gross settlement System (RTGS), Delivery Versus Payments (DVP), Centralized Funds Management System (CFMS) etc. Now, the SFMS is also being utilized by the Banks for advising Inland Letters of Credit as well as Domestic Bank Guarantees, to replace the Hard Copy of the Document for minimizing the process time involved in the transaction.

(c) The Applications Platform Developed by RBI:

(i) The acronym RTGS stands for Real Time Gross Settlement. RTGS system is a funds transfer mechanism where transfer of money takes place from one bank to another on a real time and on gross settlement basis. This is the fastest possible money transfer system through the banking channel. RTGS uses SFMS for messaging.

Settlement in real time means payment transaction is not subjected to any waiting period. The transactions are settled as soon as they are processed. Gross settlement means the transaction is settled on one to one basis without bunching with any other transaction. Considering that money transfer takes place in the books of the Reserve Bank of India, the payment is taken as final and irrevocable.

Under normal circumstances the beneficiary branches are expected to receive the funds in real time as soon as funds are transferred by the remitting bank. The beneficiary bank has to credit the beneficiary’s account within two hours of receiving the funds transfer message.

(ii) Electronic funds Transfer System (EFT) or National Electronics Funds Transfer (NEFT) System facilitates transfer of funds electronically from any bank branch to any other bank branch in the country. For being part of the NEFT funds transfer network, a bank branch has to be NEFT- enabled.

Individuals, firms or Corporates maintaining accounts with a bank branch can transfer funds using NEFT. Even such individuals, firms or Corporates who do not have a bank account (walk in customers) can also deposit cash at the branch with instructions to transfer funds using NEFT. A separate Transaction Code (No. 50) has been allotted in the NEFT system to facilitate walk-in customers to deposit cash and transfer funds to a beneficiary.

(iii) The CTS stands for CHEQUE TRUNCATION SYSTEM. It eliminates the need to move the physical instruments (i.e., cheques/DDs etc.) across branches and substitutes the traditional clearing system with the Image-based Clearing System (ICS).

ICS is basically an online image- based cheque clearing system where cheque images and Magnetic Ink Character Recognition (MICR) data are captured at the collecting bank branch and transmitted electronically, thus speeding up the process of collection or realization of cheques and the cheques may effectively be cleared in T+1 i.e. the next day.

(iv) Along with the launch of IFSC code, the SFMS regime and CTS clearing system, the Government have passed various amendments in Negotiable Instrument Act, Banking Regulation Act and IT Act etc. to recognize and legalize the transactions underlying the RTGS / NEFT / CTS clearing systems.

Because of the introduction of a system of faster transfer of funds, overall availability of funds to the business has increased. This has also drastically reduced the float funds in the banking system. Now the firm should use these modern means to manage its cash flows/floats efficiently.

Function # 8. Optimum Cash Balance:

The liquidity position of a firm will suffer if it keeps a lower cash balance. In order to increase the liquidity position it has to sell some marketable securities incurring loss of interest and transaction costs. However, profitability may be higher because of maximum utilisation of funds.

On the other hand, if the firm keeps higher cash balance, its liquidity will improve but profitability will decrease because of loss of interest on idle funds. Thus, more liquidity involves an opportunity cost. For a finance manager, who is managing the cash, it is necessary to know the optimum level of cash and the investment in marketable securities.

Optimum cash balance can be determined after taking into account the relevant cost involved in cash management i.e. transaction cost, opportunity cost etc. A number of cash management models have recently been developed to determine optimum level of cash balance.

2 Critical Functions of Cash Management – Cash Budget and Minimum Cash Balance

Cash Management usually involves two critical functions:

(i) Monitoring cash situation i.e., forecasting the receipt and payment of cash and

(ii) Managing the cash balance i.e., investing the cash when a surplus is there or raising the cash quickly when it is urgently needed.

Let us look at these two functions.

1. Cash Budget:

Cash Budget involves both forecasting and cash planning on a short term basis. A cash budget is prepared by a firm to estimate the inflow and outflow of cash, usually on a monthly basis, for the coming months. The objective is to know what are the sources from which cash is expected and what are the items on which cash needs to be paid in the coming few months? Although there is no fixed period for which cash budget is prepared but it does not, normally, exceed one year.

By looking at the estimates of cash inflows and outflows we know that in which month we earn a surplus and in which month there is a deficit. This helps us manage both the surplus and deficit. If we are expected to earn a surplus which is not expected to be needed in the coming months, we may plan for its short term investment and if a deficit is expected, we may plan for arranging the cash for this deficit period. The whole purpose is that we are not caught unaware in any given situation and are ready for any eventuality.

For preparing a cash budget, we first identify the sources of cash receipts. They are usually from cash sales, collection from receivables, receipt of cash by way of interest or dividend, refund of short term advances by debtors or from monies raised from different long term sources of funds like term loans, bonds, equity or preference shares, sale of assets and short term sources like bank overdrafts, cash credits, bills discounting etc.

The payment of cash is usually on account of cash payment for raw material, labour, power/ fuel, general maintenance, office expenses and salaries, interest, dividend, taxes, payment of loan installments etc. Here we do not make any distinction whether it is a revenue or a capital item of receipt or payment. After identifying all the items of cash receipts and cash payments, a cash budget is prepared, usually, on a monthly basis.

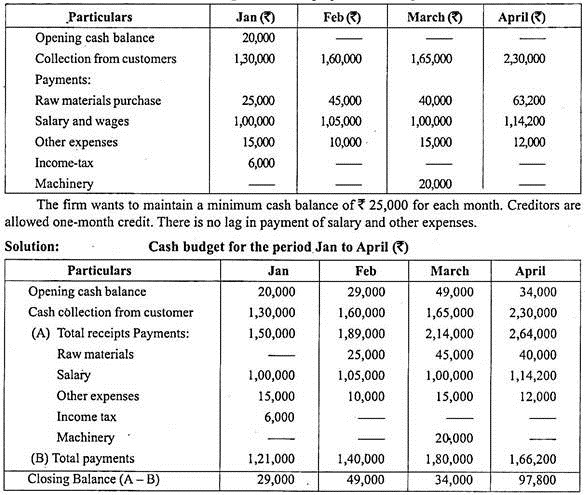

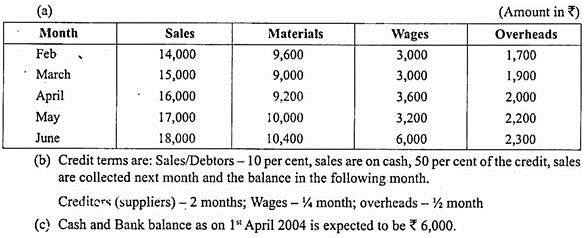

The following illustration will explain how a cash budget is prepared.

Illustration:

ABC Stores is a departmental store which is a retail house selling a variety of goods to customers in Lucknow.

The following information is available about its financial transactions:

(i) Its sales figures are as follows –

May and June Rs. 90,000 per month

July and August Rs. 1, 00,000 per month.

September and October Rs. 1, 20,000 per month.

November and December Rs. 1, 30,000 per month.

(ii) The sales are 50% on cash and 50% credit. 50% of receivables are collected in one month while 50% are collected in two months.

(iii) The purchase of goods is as follows –

June and July – Rs. 60,000 per month.

August, September and October – Rs. 80,000 per month.

November and December – Rs. 1, 00,000 per month.

(iv) The purchases are on one month credit.

(v) The salary payments are Rs. 25,000 per month.

(vi) Other expenses are Rs. 15,000 per month.

(vii) The Store is required to make a payment of Rs. 5,000 as municipal taxes in October.

(viii) The Store is to receive a dividend of Rs. 18,000 from its investments in October.

(ix) The repair of certain equipment is likely to cost Rs. 5,000 in December.

(x) The store is likely to have a cash balance of Rs. 5000 as on July 1, 2014.

Prepare a cash budget of ABC Store for a period of 6 months from July 2014 to December 2014 and show the surplus or deficit in each month. Calculate cash balance as on December 31, 2014.

Solution:

Before making the cash budget we need to calculate cash sales and collections for each month. Cash sales are 50 % of given sales figures.

Collections will be calculated as follows:

July – 50% of credit sales for May and 50% of credit sales of June

August – 50% of credit sales of June and 50% of credit sales for July and so on.

Similarly payments for goods purchased will be in the next month of the purchase. All other receipts and payments are to be shown in the given month. Now, we make the given cash budget.

Thus, we find that the cash budget is helpful to us in finding the whole pattern of cash receipts and cash payments for each month of the given six months. It also shows the surplus or deficit of cash receipts or payments for each month and finally, it presents a summary statement which tells us the opening and closing balance of cash for each month. We get the closing balance of Rs. 6,500 at the end of December 2013.

In the above example, we find that there is surplus in some months and deficit in some. However, the deficit is met by the opening balance for the given months. Thus, there is no problem of meeting our liabilities for any month. This may not always be the case. In real life, there may sometimes be a liability which can neither be met out of the receipts nor by the opening balance for the month. The cash budget is helpful in such situations also.

If such an eventuality is likely to arrive, we have enough prior notice to arrange for the funds. Such funds may be arranged by a short term advance from a bank or through the sale of some marketable securities or by postponing some payments with the consent of the creditors.

Cash budget helps us by forewarning about such an eventuality and gives us time to do the needful. In the absence of a cash budget we would be caught unawares and the failure to meet the liability will seriously jeopardize the credibility and reputation of a firm.

In the following example such a situation has been presented:

Illustration:

Delhi Plastics is a manufacturer of plastic goods.

Its estimates of revenue and expenditure for the six months starting October 2013 are as follows:

(i) Sale of products are as follows –

November and December Rs. 80,000 thousand per month

January and February Rs. 1, 00,000 per month

March and April Rs. 1, 20,000 per month

(ii) Sales are 60% on cash and 40% on credit. Half the credit sales are collected within one month and half in two months.

(iii) Raw Material purchase is Rs. 50,000 per month for the first 3 months and Rs. 65,000 in the next 3 months. Raw material suppliers provide a credit line of one month.

(iv) Labour expenses are Rs. 30,000 per month which is to be paid in the same month.

(v) Power expenses and other sundry expenses are Rs. 15,000 per month.

(vi) The Company is likely to have a tax liability of Rs. 15,000 in March.

(vii) The Company is expected to receive Rs. 5,000 as refund of loan in February and Rs. 15,000 as dividend in April.

(viii) The Company is expected to have an opening balance of Rs. 15,000 as on January 1, 2014.

Prepare a cash budget for four months starting from January 2014. Find the surplus or deficit for each month and find the cash balance on the closing date of April.

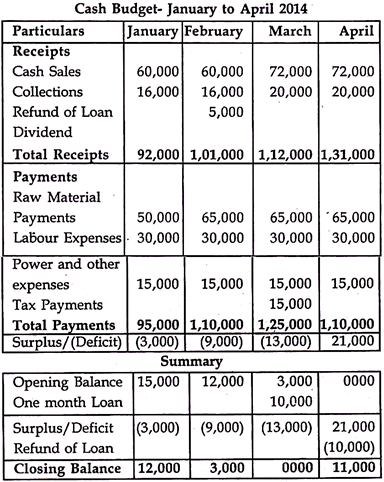

In the given example, we find that the company has a deficit in its receipts and payments but they can be met out of the initial cash balance for two months i.e. January and February. However, it is not sufficient to meet the deficit of March which is Rs. 13,000. We need to borrow Rs. 10,000 only for one month to meet this liability.

There is enough surplus in April to pay out this short term loan. Accordingly, we show a loan of Rs. 10,000 in March and its refund in April. If we do not show the raising of the loan and its refund then the closing balance for March will be – 10,000 which is illogical because the cash balance cannot be negative.

2. Minimum Cash Balance:

In the above illustration, we see that the closing cash balance in March is zero. This is again not a satisfactory situation. Companies would always like to keep some minimum cash balance to meet any unforeseen expenditure.

Suppose, the company has a policy to keep minimum cash balance of Rs. 5,000, it would, then, have to borrow Rs. 2,000 in February and Rs. 13,000 in March to have a minimum balance of Rs. 5,000 both in February and March. The whole of this can be paid back in April and the closing balance in April would still be the same i.e. Rs. 11,000.

The summary, then, would appear as follows:

Just as we borrow when there is a shortage of funds, we also have to take into account that there may be situations when we have good cash balance which is not required in the short run. In such a situation, it is not prudent to let that cash remain idle with us. There are always some short term investments opportunities which will earn us interest and maintain liquidity at the same time.

Such short term investment opportunities are – fixed deposits in commercial banks, purchase of commercial papers, investment in treasury bills and other money market instruments. Thus, cash budget is very useful in forecasting the situations of both a surplus and a deficit of cash receipts and the consequent cash position. This surely helps us either to arrange for cash whenever there is a shortage or to invest the cash fruitfully whenever there is unused money.

Cash Management Models – Inventory type Model and Stochastic Models

In recent years, several types of mathematical models have been developed that help to determine the optimum cash balance to be carried by a business organisation. The purpose of all these models is to ensure that cash does not remain idle unnecessarily and at the same time the firm is not confronted with a situation of cash shortage.

All these models can be put in two categories:

1. Inventory type models or William J. Baumol’s Cash Management Model

2. Stochastic models or Miller and Orr Model.

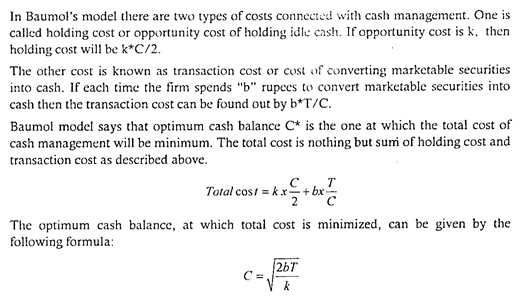

Model # 1. William J. Baumol’s Cash Management Model:

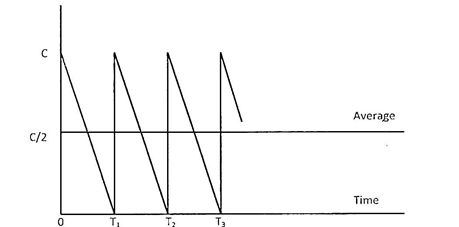

Inventory type models have been constructed to aid the finance manager to determine optimum cash balance of his firm. William J. Baumol’s Economic Order Quantity (EOQ) model applies equally to cash management problems under conditions of certainty or where the Cash Flows are predictable. However, in a situation where the EOQ Model is not applicable, stochastic model of cash management developed by Miller and Orr helps in determining the optimum level of cash balance.

Inventory Type Models or William J. Baumol’s Cash Management Model or Baumol’s EOQ Cash Management Model (1952):

This model was developed by William J. Baumol. In November 1952, he published this model in Quarterly Journal of Economics, titled ‘The Transactions Demand for Cash – An Inventory Theoretical Approach’. This was the first formal model of cash management that incorporated opportunity cost and transaction costs.

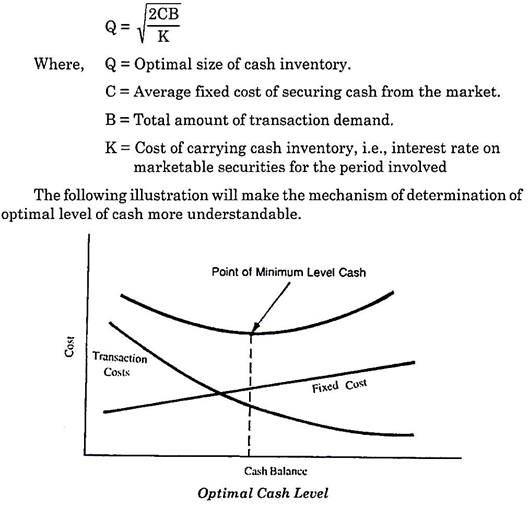

According to this model, optimum cash level is that level of cash where the carrying costs and transactions costs are the minimum. The carrying costs refer to the cost of holding cash, namely, the interest foregone on marketable securities.

The transaction costs refer to the cost involved in getting the marketable securities converted into cash. This happens when the firm falls short of cash and needs to sell the securities resulting in clerical, brokerage, registration and other costs.

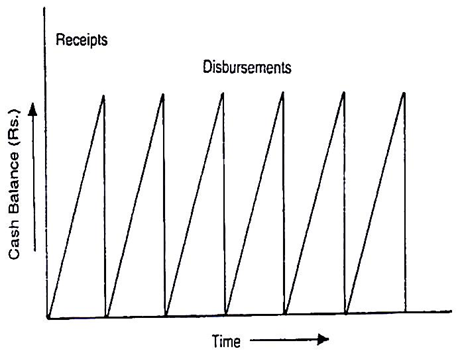

The optimum cash balance according to this model will be that point where these two costs are minimum. The Baumol’s model finds a correct balance by combining holding cost and transaction costs, so as to minimise the total cost of holding cash (Figure 6.4) –

(a) Assumptions:

The following are the assumptions of Baumol’s model:

1. The first assumption of this model is that the firm is able to forecast correctly and precisely the amount of cash required by it. Cash needs of the firms are known with certainty.

2. The firm makes its cash payments uniformly over a period of time. Thus, the cash payments arise uniformly over the future time period.

3. The firm very well understands the opportunity cost of the cash held by it. The opportunity cost of interest forgone by not investing in marketable securities. Such holding cost per annum is assumed to be constant.

4. The transaction cost of the firm is constant and known. The transaction cost is the cost incurred whenever the firm converts its short-term securities to cash.

5. The surplus cash is invested into marketable securities and those securities are again disposed of to convert them again into cash. Such purchase and sale transactions involve certain costs such as – clerical brokerage registration and other costs. The cost to be incurred for each such transaction is assumed to be constant/fixed. In practice, it would be difficult to calculate the exact transaction cost.

6. The short-term marketable securities can be freely bought and sold. Existence of free market for marketable securities is a perquisite of the Baumol model.

(b) Limitations:

The limitations in Baumol’s model are as follows:

1. The model can be applied only when the payments position can be reasonably assessed.

2. The major demerit of this model is that it does not allow the Cash Flows to fluctuate. The Cash Flows are assumed to be constant and known over the time period, which practically is not possible in real world. Firms are unable to use their cash balance uniformly.

3. Similarly the firms cannot predict their daily Cash Inflows and outflows.

4. Degree of uncertainty is high is predicting the Cash Flow transactions. Behaviour of Cash Inflow and outflow is assumed to be too smooth and certain. Cash Inflow and outflow of businesses are too erratic. Daily cash balance may fluctuate, leading to an unpredictable pattern of Cash Flow. Thus at no point an ideal optimum cash balance C be maintained practically.

5. The model merely suggests only the optimal balance under a set of assumptions. But in actual situation it may not hold good. Nevertheless it does offer a conceptual framework and can be used with caution as a benchmark.

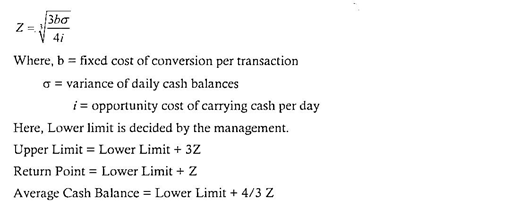

Model # 2. Stochastic Models or Miller-Orr Cash Management Model (1966):

The Miller and Orr Model (MO) model overcomes the demerits of the Baumol model. This model assumes that the Net Cash Flows are normally distributed with a zero value of mean and Standard Deviation.

In other words, the MO model extended the existing Baumol model and stated that cash balances take too erratic a pattern of distribution over a time period. However, over long periods, they tend to show normal distribution.

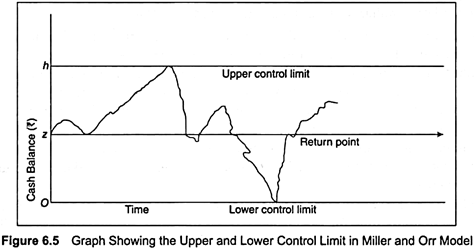

(a) The MO model basically states that there are two control limits:

1. The upper control limit

This states the upper limit for cash balance. If at any time the cash balance exceeds this limit, the extra cash is transferred to marketable securities and investments.

2. The lower control limit along with the return point

This states the lower limit for cash balance. If at any time the cash balance reach this limit, the investments are liquidated and liquidity of the firm is enhanced.

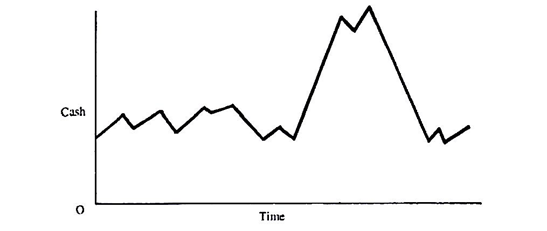

Thus, when the Cash Flows of the firm deviate randomly, they hit the upper limit. At this point, the firm purchases adequate amount of marketable securities, which helps the firm to reduce its free cash and thus return to a normal level of cash balance (return point).

In the same way, when the firm’s Cash Flows deviate lower and hit the lower limit, the firm liquidates its investments (marketable securities) so that its cash balance returns to the normal level (return point).

(b) Assumptions:

The basic assumptions of the model are as follows:

1. The major assumption with this model is that there is no underlying trend in cash balance over time.

2. The optimal values of ‘h’ (upper limit) and ‘z’ (return point) depend not only on opportunity costs, but also on the degree of fluctuation in cash balances.

(c) Limitations:

The model is having the following limitations:

1. The first and important problem is in respect of collection of accurate data about transfer costs, holding costs, number of transfers and expected average cash balance.

2. The model does not take into account the cost of time devoted by financial managers in dealing with the transfers of cash to securities and vice versa.

3. The model does not take into account the short-term borrowings as an alternative to selling of marketable securities when cash balance reaches lower limit.

This model is designed to determine the time and size of transfers between an investment account and cash account. In this model, control limits are set for cash balances. These limits may consist of h as upper limit, ‘z’ as the return point and ‘0’ (zero) as the lower limit (Figure 6.5) –

When the cash balance reaches the upper limit (h), the transfer of cash equal to h-z is invested in marketable securities account. Then the new cash balance is z. When cash balance touches lower control limit (0), marketable securities to the extent of Rs. (z- 0) will be sold. Then the new cash balance again return to point z.

During the period when cash balance stays between (h, z) and (z, 0), i.e., high and low limits, no transactions between cash and marketable securities account is made.

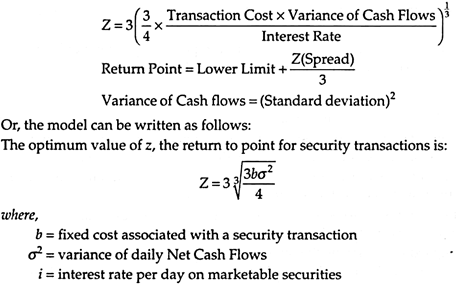

(d) The spread between the upper and lower cash balance limits can be computed using Miller and Orr Model as follows:

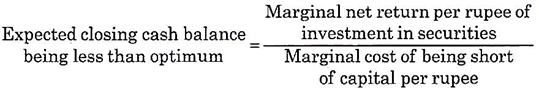

With the control limits the Miller-Orr model will minimise the total costs—fixed and opportunity—of cash management. The average cash balance is approximately (z + h)/3. However, for obvious reasons, this balance will be higher than that under the inventory model.

The MO Model is more realistic since it allows variations in cash balance within the lower and upper limits. The finance manager can set the limits according to the firm’s liquidity requirements, i.e., maintaining the minimum and maximum cash balance

Cash Management – Determining the Optimum Cash Balance under Certainty and Uncertainty

1 Optimum cash balance under certainty:

(A) Baumol’s Model

This model considers cash management similar to an inventory management problem.

Assumptions of Baumol’s model

1. The firm is able to forecast it cash need with certainty

2. The firm cash payments occur uniformly over a period of time

3. The opportunity cost of holding cash is known and it does not change over a period of time

4. The firm will incur the same transaction cost whenever it converts its securities to cash.

Let’s assume that the firm sells securities and starts with a cash balance of C rupees. As the firm spends cash, its cash balance decreases steadily and reaches to zero.

The firm at this point sells enough marketable securities so that cash balance becomes C again. This process keeps repeating over time. The average cash balance at any point in time will be C/2.

This can be graphically represented as:

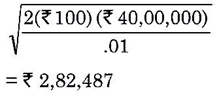

Where C* is the optimum cash balance, b is the conversion cost per transaction, T is the total cash needed during the year and k is the opportunity cost of holding cash balance. The optimum cash balance will increase with the increase in conversion cost “b” and total funds required and decrease with the opportunity cost.

Limitations of Baumol’s model

The biggest limitation of the Baumol model is that it assumes that the cash flows are certain and known in advance. It does not allow the cash flows to fluctuate. Also, it assumes uniform spending of cash. Firms in practice do not use their cash balance uniformly nor are they able to predict daily cash inflows and outflows.

2. Optimum Cash Balance under uncertainty:

(B) The Miller-Orr Model

The Miller-Orr Model overcomes the shortcomings present in the Baumol’s model. It assumes that net cash flows are not certain and not known in advance. In fact, cash flows follow normal distribution with a zero mean & standard deviation.

The MO model talks about a ceiling and a floor within which cash flows are assumed to fluctuate. They are called control limits. These two control limits are known as upper control limit & the lower control limit. There is a return point as well.

What happens if the firm’s cash flow reaches the upper limit? Here, firm buys sufficient marketable securities so that its cash balance reduces and comes down to return point. Similarly, when the firm’s cash flows go down and reach the lower limit, it sells marketable securities to the extent that its cash balance goes up to return point.

Graphically the Miller Orr model can be depicted as follows:

The assumptions of this model are more realistic. It allows for random fluctuations in cash balances within a preset limit. The manager can find out the variance of daily cash balances from the past data of the firm.

Cash Management – Cash Budget: Meaning, Parts and Utility

Meaning of Cash Budget:

A cash budget is an estimate of cash receipts and cash payments for a future period of time. It is prepared to forecast the cash requirements for a given period and indicates the surplus or shortage of cash during the budget period.

There are two parts of cash budget:

a. Cash Receipts – Cash is mainly received from cash sales, collection from debtors, income from investments etc.

b. Cash Payments – Cash is mainly paid for cash purchases, payment to creditors, payment for expenses etc.

By estimating the cash receipts and cash payments for a future period it can be estimated that in which months there will be surplus cash and in which months there will be deficiency of cash resources.

Utility of Cash Budget:

(i) Helpful in Estimating the Future Cash Requirements:

A cash budget estimates the excess or shortage of cash at the end of each month. As such, it enables the management to make a suitable plan to arrange the cash at the required time.