Everything you need to know about the types of bonds. A bond is security/instrument that acts as an acknowledgement of a loan advanced to the issuer by the investor.

Thus, when you invest in a bond, you are effectively giving a loan to the issuer of the bond. In respect of this “loan”, the issuer would pay you interest and repay the principal amount at the time of maturity of the loan.

The classification of bonds may be based on:- 1. Coupon Payment 2. Conversion 3. Redemption Time.

Some of the types of bonds are:-

ADVERTISEMENTS:

1. Pure Discount Bonds 2. Level Coupon Bonds 3. Coupon Paying Bonds 4. Floating Rate Coupon Paying Bonds 5. Zero Coupon Bonds 6. Vanilla Convertible Bonds 7. Exchangeable Bonds 8. Contingency Convertible Bonds 9. Mandatory Convertible Bonds 10. Foreign Currency Convertible Bonds;

11. Callable Bonds (or Bonds with Call Option) 12. Putable Bonds 13. Perpetual Bonds 14. Convertible and Non-Convertible Bonds (or Debentures) 15. Deep Discount Bonds (DDBs) 16. Tax Free Bonds 17. Junk Bonds 18. Muncipal Bonds 19. Floating Rate Bonds 20. Inverse Floaters Bonds 21. International Bonds.

Additionally, Some of the types of bonds issued in India are:-

1. Corporate NCD’s/Bond’s in India 2. Secured and Unsecured Debentures 3. Redeemable and Irredeemable Debenture 4. Treasury Bills (T-Bills) 5. Cash Management Bills (CMBs) 6. Dated Government Securities 7. Fixed Rate Bonds 8. Zero Coupon Bonds 9. Capital Indexed Bonds 10. Bonds with Call/Put Options 11. Green Bonds.

Types of Bonds: Corporate Bonds / NCD / Secured / Treasury Bills / Fixed Rate Bonds

Types of Bonds – Pure Discount Bonds and Level Coupon Bonds (With Formula)

There are two types of bonds:

ADVERTISEMENTS:

1. Pure Discount Bonds, and

2. Level Coupon Bonds.

The difference is simple – Pure Discount Bonds do not have regular coupon payments (hence face-value must be higher), while Level Coupon Bonds do have regular coupon payments (hence face-value is lower).

1. Pure Discount Bonds:

ADVERTISEMENTS:

Since there are no regular coupon payments – the value of a pure discount bond is simply the face-value, or the lump sum amount of money the bond holder will receive at maturity – discounted by the appropriate rate of return. As an extension on the above timeline, the one below shows the CFs for a pure discount bond. These are also referred to as zero-coupon bonds.

The Valuation of a Zero Coupon Bond:

2. Level Coupon Bond:

Level coupon bonds offer a fixed coupon payment, usually every six months or one year. The coupon rate determines the percentage of the bond’s face value that must be paid as the coupon payment. Hence the total value of the bond itself becomes the present value of all annuities + present value of the face-value. This is mathematically denoted by the equation;

ADVERTISEMENTS:

Evaluating the Price of a Level Coupon Bond:

The Relationship between Yield (Expected Rate of Return) and Coupon Rate:

In the above equations, (i) denotes the yield or the expected rate of return on the market. (C) denotes the coupon payment, which is calculated by the face-value coupon rate. Hence, there is a relationship between the yield and the coupon rate. In fact, it is an inverse relationship.

This is because, if the yield or the interest rate goes up, then there are more superior investing opportunities elsewhere in the market and hence the value of the bond drops.

This fluctuation of the bond value creates a difference between the bond price and the par value of the bond. In turn giving rise to premium bonds and discount bonds.

Bond Price vs. YTM:

i. When coupon rate (c) = Yield to Maturity (i) —> Bond Price = Par Value

ADVERTISEMENTS:

ii. When coupon rate (c) > Yield to Maturity (i) —> Bond Price > Par Value (Premium Bond)

iii. When coupon rate (c) < Yield to Maturity (i) —> Bond Price = Par Value (Discount Bond)

The interest rate risk is the probability that the Yield-to-Maturity (i) will change in the future. This must be taken into account when making investing decisions.

Types of Bonds – Based on Coupon Payment, Conversion and Redemption Time

Investing in a bond will typically involve a cash outflow at the time of investment. The bond will then generate regular interest inflows over its life and in the year of maturity, will repay the principal amount.

ADVERTISEMENTS:

Gone are the days when bonds would have only two main features: they earn interest and repay principal at maturity. Today, bonds are being issued with myriad different features; so much so that some of them are extremely complex for a not-so-savvy investor and can be difficult to understand.

Nonetheless, a broad introduction to the various types of bonds that could exist and how they are categorized as per their features.

We begin with the classification that is most basic and is almost as old as the concept of bond itself- one based on coupon payment.

1. Types of Bonds Based on Coupon Payment:

Every Bond generates a regular flow of income through its coupon. The rate at which the Bond issuer will pay coupon each year is called as the coupon rate. However, by modifying the timing of coupon payment and the rate of coupon payment, a variety of Bond types can be created.

Most common of them are listed below:

ADVERTISEMENTS:

Coupon paying Bonds are those that earn a specific coupon on a specified coupon date each year based on their par value and the coupon rate. Coupon paying Bonds are the most common types of Bonds in the retail Bond market. In fact they are so pervasive that most small investors relate a bond to be a coupon paying bond. However, you will soon realize that they are just one type of the different varieties of Bonds.

While coupon paying Bonds earn coupon on a specified coupon date each year, these bonds can be classified into two broad categories based on when they pay this coupon to the investor.

Annual Coupon Paying Bonds pay out the coupon earned on each coupon date to the bond holders. For example, a Bond with a 10% coupon rate and a par value of Rs. 1,000 will pay annual interest of Rs. 100 (Rs. 1,000 x 10%). These Bonds provide a steady flow of coupon income to the bond holders each year. A variation of the annual coupon paying bond is where the coupon payments are made at less than annual intervals, say, quarterly (Every three months) or semi-annually (once in six months).

In contrast to the annual coupon paying bonds, the Cumulative Coupon Paying Bonds do not pay coupon to the bond holders on each coupon date. No doubt, they earn coupon on each coupon date but instead of paying it out to the bond holders, the coupon amount is added to the par value of the bond. The result is that this coupon amount goes on to earn further coupon on each coupon date till maturity. On maturity, the bond holder gets, in lump sum, the entire coupon earned during the life of the Bond.

Consider the case of an example bond as below:

This Bond will make only one payout at the very end of the life of the Bond. The payout at the end of the fifth year will be Rs. 1,610.51 (Rs. 1,000 as the original par value of the bond returned and Rs. 610.51 as the accumulated interest of all five years)

So, the thing to keep in mind when selecting a Bond is that you should choose annual coupon paying bond over cumulative coupon paying bond only if:

I. You need a steady stream of cash flows annually

II. You have alternative investment opportunities for the annual coupon payout which will earn you more than the coupon rate (In our example, if you can invest the annual coupon of Rs. 100 in a way that gives you more than 10% return, why chose the cumulative interest paying bond and restrict the earning capacity of the coupon to 10%?)

III. You are willing to accept a higher tax drag.

b. Floating Rate Coupon Paying Bonds:

The annual and cumulative coupon paying bonds represent a classification of Bonds based on when the coupon earned is actually paid out. However, bonds can also be classified based on what is the rate at which coupon is paid out. This classification breeds two varieties of Bonds- Fixed Rate Coupon paying Bonds and Floating Rate Coupon Paying Bonds.

Unlike a Fixed Rate coupon paying Bond, a floating rate coupon paying bond does not pay coupon at the same rate on each coupon date. Instead, the coupon rate is based on some reference rate and is reset periodically on specified dates.

The usual formula for determining coupon rate in each period is as follows:

Coupon Rate = Reference Rate + Predefined Margin

As the reference rate changes each period, the coupon rate changes accordingly. The reset coupon rate becomes the rate at which the bond will pay coupon until the next reset date. The predefined margin is usually some additional percentage points that the issuer agrees to pay over and above the reference rate and is specified at the time of making the bond issue. In some rare cases, the predefined margin may also be negative i.e. the issuer will pay a certain percentage points lower than the reference rate.

Some reference rates are:

I. LIBOR (London Interbank Offer Rate)

II. MIBID (Mumbai Interbank Bid Rate)

III. MIBOR (Mumbai Interbank Offer Rate)

IV. Yield on Benchmark Government Securities

c. Zero Coupon Bonds:

Another variety of bonds, based on both, when the coupon is paid and at what rate the coupon is paid, is the Zero Coupon Bonds. As the name indicates, these bonds pay ‘zero’ or no coupon throughout the life of the bond. Theoretically, these bonds do not even earn any coupon at a specified rate on a specified coupon date.

The concept here is that the bond holder buys the bond at a price significantly below the par value of the bond. At the time of maturity, the par value is paid out to the bond holder. For example, a zero coupon bond with a par value of Rs. 1,000 may be issued to the bond holder at Rs. 800. On maturity, the bond holder will receive the full par value of Rs. 1,000. Thus, Rs. 200 (the difference between par value of Rs. 1,000 and issue price of Rs. 800) is the interest that the bond holder earns over the life of the bond.

Zero coupon Bonds are also called as Deep discount bonds, the name coming from the fact that these bonds are issued at a heavy discount. Zero coupon bonds are not very common in the retail bond market but have been in place for a long time in the wholesale bond market.

Zero coupon bonds are issued at a discount and are redeemed at par on maturity. However, there may be some Zero coupon bonds that may be issued at par value and redeemed at a premium. For example, in the case of the Zero Coupon Bond, the Bond may also be issued at par value of Rs. 1,000 and may mature at a premium value of Rs. 1,200. In either of the cases, the differential amount is the interest.

2. Types of Bonds Based on Conversion:

The first classification of bonds was laid out based on how the bond pays out the ‘regular income’ or the interest component. The second subdivision of bonds can be made based on how the bond repays its principal. The simplest possibility is that the bond pays out principal amount on its maturity. Then there are some bonds that get repaid not by payout but by converting into some other security. We shall discuss this ‘convertibility feature’ of the bond here.

Under the conversion clause, the bond holder can convert the bond into the equity shares of the issuer at an agreed upon price. The number of shares that the bond holder would get on the conversion is called as the conversion ratio.

Such bonds may carry a lower coupon rate as compared to a similar but simple bond. The rationale for an investor to invest in such bond is that he has the option to participate in the potential upward increase in equity share of the issuer. Such securities are often called as hybrid securities since they contain the features of both the ‘risky’ equity investment and the ‘relatively safe’ bond investment.

These securities are usually positioned as best suited for those investors who see a potential in a company but are not willing to take the risk. They want to participate in the possible future growth but not in the possible failure.

This feature of giving investors ‘best of both worlds’ comes at a cost. For one, the coupon rates are usually lower than regular bonds and two, the conversion ratios are usually designed to ensure that there is a conversion premium involved that will take away some of the gains. People who invest in a convertible bond as an alternative to investing in equity will find that their returns would be lower than if they had invested directly in equity because of the conversion premium.

However, in case the issuer company is unable to succeed in its business and the stock falls in price significantly, the convertible bond holder will in fact have a better return than if he had invested in equity because of the regular interest that comes out of the convertible bond.

In sum, you may invest in a convertible bond if you believe in the long term growth of the issuer but want an ‘insurance’ against a possible failure to achieve adequate growth on the part of the issuer.

While what we discussed above is what a convertible bond usually is, there are some variations that may be made in the issue structure.

Some of the common types of convertible bonds are as below:

These are the simple, straight forward convertible bonds. The conversion is at the option of the owner of the bond while the conversion ratio is predetermined in the terms of the issue.

While convertible bonds give you an option to convert them into equity shares of the issuer company, the exchangeable bonds give you an option to convert them into shares of an entity other than the issuer.

c. Contingency Convertible Bonds:

These are convertible bonds that allow the bond holder to convert them into equity shares only if certain criteria are met. (Typically, if the share price is certain percentage above the effective conversion price)

d. Mandatory Convertible Bonds:

These bonds do not give the holder an option to convert them into equity shares but rather have a mandatory convertibility clause. These securities are usually of a shorter duration as compared to other convertible securities.

e. Foreign Currency Convertible Bonds:

These bonds are basically convertible bonds, but are issued in a currency that is different from issuer’s domestic currency. These bonds are often preferred by the issuers since the convertibility option allows them to offer bonds at a lower yield over comparable non- convertible bonds.

However, in some cases, it may be difficult for the issuer to correctly estimate the extent of conversions that may happen and accordingly provide for adequate funds for redemption. It may also be difficult for the investor to decide whether to redeem his bond or convert it into equity, especially when the stock markets are down and the investor has to predict the possible future direction of the company’s stock.

3. Types of Bonds Based on when you can redeem them:

We classified bonds based on how they pay their regular interest and how they may pay their principal. We now classify bonds based on when they repay their principal. On this basis, bonds can be classified into callable bonds and putable bonds. Further, this classification will also include perpetual bonds.

(i) Callable Bonds (or Bonds with Call Option):

These are bonds that allow the issuer an option to ‘call them back’ or redeem them prior to their specified maturity date. In most cases, the call option is activated after a certain period from the issue date. Further, in most cases, the issuer has the option to call back the bond on certain specified dates. The terms of the issue specifies the date on which the issuer may exercise the call option and the amount at which the issuer will call back the option.

The call price is usually higher than the par value of the bond because it takes into account the time value of money between the call date and the maturity date. This premium usually falls as the maturity date approaches.

Example:

A hypothetical callable bond having par value of Rs. 1,000 and maturity of say, April 1, 2020 is issued on April 1, 2011.

The bond may have a call schedule as below:

As you can see, the call price falls as the call date gets closer to the maturity date. Such an established call schedule ensures that the issuer cannot call the bond at any time between the pre specified call dates.

It is important to note that the call feature is a benefit to the issuer. The issuer has the right, but not the obligation to call back the bonds. This option comes handy to the issuer when he has surplus funds with him or when the market interest rates fall.

In case of a fall in interest rates, the issuer would find it convenient to redeem the existing issue and make a fresh issue at a lower interest rate (in line with the then prevailing market rates) this will help him to reduce his periodic interest burden, in some cases substantially.

However, in cases where the issuer calls the issue in falling interest rates, it is the investor who suffers the most.

Let us tell you how:

a. When the issuer exercises his call option in falling interest rate environment, the investor gets his money back at the pre-specified call rates. This rate may be lower than the market rate of bond (the market price may be higher because of the inverse relationship between price and yield).

b. The money that the investor gets back when the issuer calls the issue would then have to be invested at the reduced market interest rates.

Since the call option is a tool in the hands of the issuer, the callable bonds usually offer a higher interest rate than a comparable non-callable bond. This higher interest rate is a compensation for the risk. More formally, this risk is called as ‘call risk’. However, a higher interest rate, or a higher yield results in these bonds trading at a discount as compared to other non-callable bonds.

(Note- the term ‘comparable’ non-callable bond is a relative concept. For e.g. – in case of a 10 year bond with a call option after 5 years, if the market perceives that the issuer will most likely exercise the call, the ‘comparable’ non- callable bond would in fact be, other things being equal, a 5-year non-callable bond instead of a 10-year one).

ii. Putable Bonds (or Bonds with Put Option):

Putable bonds are the exact opposite of callable bonds. The basic nature of the option is the same- an option to redeem the bonds prior to their maturity. However, in the case of putable bonds, this option is in the hands of the investor rather than in the hands of the bond issuer as in the case of callable bond.

Putable bonds act as an exit option in the hands of the investor. Since this option gives a benefit to the investor, the interest rates offered by a putable bond are generally lower than the rate offered by a comparable non-putable bond. The lower interest rate or the lower yield of a putable bond results in these bonds trading at a premium over and above a comparable non-putable bond.

Think of it this way- a seller with a putable bond in the market will demand a higher price over and above another comparable non-putable bond. This higher price is in fact the value of the put option in the hands of the investor.

Perpetual bonds are bonds that don’t have any pre specified maturity date. To compensate for the uncertainty involved with the receipt of principal, these bonds usually offer a higher rate of interest as compared to other comparable bonds having a pre-defined maturity.

The company that issues the perpetual bonds normally has an option to call them which means that they can decide to redeem the bonds at the end of certain time periods say 5 or 10 years.

In the case of perpetual bonds, the issuer never provides liquidity to the investor (Unless these bonds are called back by the issuer at his option). However these bonds are usually listed on exchanges. Therefore, liquidity is provided by the secondary market. Thus, you may not be able to redeem these bonds with the issuer. However, you can always sell these bonds in the secondary market if you want to exit your investment.

Types of Bonds – Issued in India

1. Corporate NCD’s/Bond’s in India:

Corporate bond is a bond issued by a company to raise money from capital market. Bond holders do not have any ownership stake in the company when they acquire corporate bonds.

Corporate bonds are considered as long term investment for an investor. The maturity period of these bonds ranges from 1 year to 20 years. Corporate bonds are mostly listed for trading at BSE and/or NSE stock exchanges in India. Non-Convertible bonds (NCDs) are generally Secured and Redeemable bonds.

2. Secured and Unsecured Debentures:

Secured bonds are backed by some collateral, normally the fixed assets of the issuer company. The collateral (security) reduces the risk of the debt investors. Long term bond are normally secured bonds. Short term bonds with a maturity of less than eighteen months are normally issued without any collateral against them and are therefore called unsecured bonds.

3. Redeemable and Irredeemable Debenture:

When debentures and bonds are redeemed at their nominal value at maturity they are called redeemable debt instruments. There are certain debt securities which do not have a set maturity date. Such securities are called irredeemable/perpetual securities and are more commonly designated as perpetual. HDFC Bank is planning to come out with India’s biggest perpetual debt to bolster its capital base.

Generally the debt investment is considered safer instrument because the coupon rate and principle repayment are assured by the issuer. However, it should not be construed that debt is a risk free investment. An investor in a debt security also has to bear certain types of risks like default risk, interest rate risk, reinvestment risk etc. Recently, bonds issued by Armtek Auto faced default risk.

Indian bonds market comprises of two important segment, state and central government bonds market and corporate bonds market.

Government has to fund the fiscal deficit through public borrowing. For that purpose Reserve Bank of India (RBI) on behalf of Government of India (GOI) floats the fixed income instruments in the market which are subscribed by various institutional and non-institutional investors. These instruments are known as sovereign securities and are default free securities for the investors. They imply debt obligation on the part of GOI. Because of their default free characteristic they are also known as Gilt-Edged securities or risk free securities.

Another category of fixed income instruments include corporate bond, Financial Institutions (FI) bonds and PSU bonds etc. They are not considered as default free instruments and have to be rated by some SEBI authorized rating agency like CRISIL, ICRA or FITCH. The rating assigned to them is an indication of credit risk of those securities.

The Central Government and State Government fixed income securities are tradable instruments. They include short term and long term debt instruments issued by RBI on behalf of GOI. Short term instruments include Treasury Bills of maturity of 91 Days, 183 Days and 364 Days while long term instruments also known as dated securities which include 5 year and 10 year maturity Government bonds.

State Governments in India issue only long term bonds which are known as dated securities or State Development Loans (SDLs). In India, banks have to mandatorily invest a fixed percentage of their deposits in designated government securities which is called Statutory Liquidity Ratio (SLR).

These central and state government debt securities are eligible securities for fulfilling the SLR requirements by banks hence they are also known as SLR securities. Since the debt instruments other than government debt are not eligible for fulfilling the SLR requirements of banks hence corporate bonds are designated as Non-SLR securities.

Government of India also issues savings instruments like National Saving Certificates (NSCs), Kisan Vikas Patra (KVP) etc. and special securities like 11 bonds, fertilizer bonds etc. These securities mobilize the small savings of house-holds and are non-tradable. They are also not qualified as SLR securities.

A large proportion of the Indian debt market is dominated by government securities measured in terms of trade value and volume, and market capitalization etc. It sets a benchmark or reference point of interest rate for the rest of the market.

4. Treasury Bills (T-Bills):

Treasury bills or T-bills are short term debt instruments issued by the Government of India with less than one year maturity. They are money market instruments issued by RBI on behalf of GOI. RBI issues T-bills with 91 days, 182 days and 364 days maturities through the process of auction.

Auction to issue the T-bill is conducted by RBI every Wednesday. Payments for the T-bills purchased takes place on the following Friday. The auction of 91 day T-bills takes place on every Wednesday while the auction of Treasury bills of 182 days and 364 days tenure is conducted on alternate Wednesdays.

Treasury bills are zero coupon debt instruments that do not pay any interest during the tenure. T-Bills are issued at a discount in comparison to their face value and at their maturity they are redeemed at the par value. For example, if a 91 day Treasury bill of Rs.1000 par value is issued at Rs.990.30, which means at a discount of Rs.9.70 and would be redeemed at the face value of Rs.1000. The difference between the redemption value or the face value and the issue price, serves as the return to the investors.

5. Cash Management Bills (CMBs):

Cash Management Bills (CMBs) are issued by Reserve Bank of India on behalf of Government of India. They are issued with the purpose of filling the temporary mismatches in the cash flow of the Government. The CMBs is a short term instrument having the similar characteristics as T-bills but their maturity is less than 91 days. Similar to T-bills, CMBs are also issued at a discount with reference to their face value and redeemed at par on maturity.

The term, size of issue and date of issue of the CMBs are contingent upon the temporary cash flow requirement of the Government. They are tradable instruments issued by GOI and are classified as SLR securities. CMBs were issued for the first time on May 12, 2010.

6. Dated Government Securities:

Long term government securities are known as dated securities. Normally, they have tenure of 5years or 10 years. Government dated securities are issued by RBI through the process of auction. The pronouncement of auction is made by RBI well in advance and advertised in major newspapers.

Government bonds normally carry fixed coupon rate which is payable periodically. However, they may also offer floating coupon rate. Coupon is calculated on face, value of bond and normally paid quarterly, semiannually or annually.

For all the government debt securities, the registry or depository function is performed by Public Debt Office (PDO) of RBI. They ensure the timely allotment of bonds, payment of periodic coupon and redemption of bond etc.

7. Fixed Rate Bonds:

Fixed rate bonds are the bonds which offer the investor the fixed rate of coupon to be paid on face value. This coupon rate will remain fixed through the tenure of bond irrespective of any movements in the market interest rates. Majority of government bonds carry fixed coupon rate.

For example – on 22nd April, 2008, 8.24% GS2018 was issued for a tenor of 10 years with the maturity date as April 22, 2018. Coupon payment frequency on this debt security is half-yearly at 4.12% (which is half of the annual coupon of 8.24%) The coupon is calculated on the face value and paid on October 22 and April 22 of each year.

Floating Rate Bonds Floating rate bonds are the bonds on which coupon is expressed as “Base rate + Spread”. This base rate is reset periodically where the reset period may be three months or six months. This base rate may be weighted average cut-off yield of the last three 364- days Treasury bill or some other rate as decided by RBI.

For example, on 2nd July, 2002 a floating rate bond was issued with a maturity date at 2nd July, 2017 and the tenure of 15 years. The weighted average rate of last six 364 days T-Bills issues was kept as a base rate for these floating rate bonds which was equal to 6.5%. A spread of 34 basis- points was added to this base rate thus the final coupon rate was 6.84% (6.5%+0.34%) for first six months.

8. Zero Coupon Bonds:

Zero coupon bonds are bonds which do not offer any coupon to its investors. They are issued at discount to their par value and they are redeemed at maturity at their face value. The difference between the issue price and redemption value serves as the interest for the investors. Since a long time, zero coupon bonds haven’t been issued by GOI.

9. Capital Indexed Bonds:

These bonds aim at protecting the investor’s capital from inflation. For this purpose principal of bond is linked to some inflation index. In December 1997, a capital indexed bond was issued by RBI for the first time in India in which the principal amount was hedged against inflation.

These bonds matured in 2002. Another issuance of Inflation Indexed Bonds was made, wherein payment of both, the coupon and the principal on the bonds, was linked to an Inflation Index (Wholesale Price Index). For these bonds the principal was indexed with the WPI to protect the principal against the inflation.

10. Bonds with Call/Put Options:

Bonds which are issued by Government with an option to buy back the bond by the GOI prior to their maturity, in case, the general interest rates happen to go down a specified level are known as callable bonds. Thus in case of bonds with call option government has the right to buy back the bond at face value.

Bonds with put option are the bonds which gives the investor the right to sell back the bond to government at face value, prior to their maturity, in case, the market interest rates rises above a specified level.

For example: On 18th July, 2002, 6.72% GS 2012 was issued with a tenure of 10 years. The option on the bond could be exercised by any investor after completion of five years tenure from the date of issuance. The call option could be exercised on any coupon date falling thereafter.

The option was available to government and put option was available to investors. The Government has the right to exercise the call option to buy back the bond at par value while the investor had the right to exercise the put option to sell the bond to the Government at par value at the time of any of the half- yearly coupon dates starting from July 18, 2007. Generally, bonds carry both calls as well as put options.

11. Green Bonds:

It is a new instrument which has come into existence in the financial markets. Green bonds are bonds where the funds raised are used exclusively to fund new and/or existing green projects such as renewable energy ventures, clean transportation systems etc.

Green bonds are structured like any other traditional bonds but with a key difference; the proceeds from the issue must be used to support “green” projects like Energy, Energy Efficiency, Transport, Water, Waste Management, Land Use or Adaptation Infrastructure.

Green bonds are a cheaper way to raise funds for environmental infrastructure investments that may be uneconomic using more expensive capital. Considering the huge investment needed for green projects, existing traditional financing sources such as domestic bank loans may not be sufficient. India aims to install 175 GW of renewable energy by 2022, which will require an estimated USD 264 billion of investments.

Green bonds can easily support deployment of renewable energy projects by providing broader access to domestic and foreign capital as well as better financing terms, including lower interest rates with longer lending terms.

Types of Bonds – With Examples

‘Bond’ is a generic term which signifies a fixed income security. In India, bonds and debentures terms are used interchangeably. Depending upon different types of bond features, we can classify bonds into various categories.

Some commonly available bond types are discussed below:

Type # 1. Convertible and Non-Convertible Bonds (or Debentures):

Convertible bonds (or debentures) may be fully convertible bonds or partly convertible bonds.

Fully convertible bonds (debentures) are the bonds which are fully converted into equity shares after a specified period. The bondholder gets fixed interest income till the time bond remains as bond and after conversion these bonds become equity shares eligible for equity dividend and other rights of equity shareholders. There is no redemption value of the bonds as they are redeemed by converting them into equity shares.

For example, a company issues a convertible 10% bond having face value of Rs.100.

The bond and is fully convertible into five shares of face value Rs.20 each after five years. In this case the bondholder will get interest income of Rs.10 every year for five years. After five years the bond will be converted into five equity shares of the company and the bondholder of the company and enjoy all ownership rights.

Whether the bondholder makes a gain or loss depends upon the market price of the share at the time of conversion. If market price of share at the time of conversion is more than Rs.20, say Rs.25 the bondholder stands to gain because then the market value of his five equity shares would be Rs.125. On the other hand if market price of the share at the time of conversion happens to be Rs.15 then the bondholders stand to lose as the market value of five shares would be Rs.75.

Partly convertible bonds (or debentures) are those bonds for which a part of the face value of the bond is converted into equity shares after a specified time and the balance remains as pure bonds to be redeemed as per the terms and conditions of the bond agreement. For example, a company issues a convertible 10% bond having face value of Rs.100. The bond is partly convertible into three shares of face value Rs.20 each after five years. The total tenure of the bond is 10 years.

This implies that 60% of the total face value (Rs.60 out of Rs.100) of the bond will be converted into equity shares after five years and the remaining 40% (Rs.40 out of 100) will still remain as 10% bonds for another five years. In this case the bondholder will get interest income of Rs.10 every year for first five years. After five years the bond holder will get three equity shares and enjoy all ownership rights as well as dividends. Whether the bondholder make a gain or loss depends upon the market price of the share at the time of conversion.

If market price of share at the time of conversion is more than Rs.20, say Rs.25 the bondholder stands to gain because then the market value of his three equity shares would be Rs.75. On the other hand if market price of the share at the time of conversion happens to be Rs.15 then the bondholders stand to lose as the market value of three shares would be Rs.45.

The remaining Rs.40 face value bond will remain as 10% bond with the bondholder and provide him an interest of Rs.4 (i.e. 10% of Rs.40) for another five years after which it will be redeemed as per the terms and conditions specified in the bond agreement.

It must be noted that the convertible bonds may be compulsorily convertible or convertible at the option of the bondholder/issuing company. Some companies in India have also issued multi option convertible debentures, where the debenture holder is given different options regarding conversion type, mode and timing of conversion.

Non-convertible bonds (or debentures), are those bonds which have no conversion clause i.e. they are not to be converted into equity shares after specified period. These bonds are redeemed at maturity. These bonds may be redeemed at par, at premium or at discount.

Secured Premium Note (SPN):

SPNs are a non-convertible debentures which are issued with detachable warrants and are redeemable after a specified period. It can be issued by the companies with the lock in period of say 4 to 7 years. This implies that the investor can get his SPN redeemed only after the lock in period. During the lock in period, even interest is not paid. SPN is generally redeemed in instalments after the lock in period.

The instalment covers both interest and a part of principal amount.

The detachable warrants are convertible into equity shares within a specified time period. For the conversion of warrants into equity shares, it necessary that the SPN is fully paid up. Therefore SPN is sometimes referred to as hybrid debt instrument.

The advantage of SPN to the issuer company is that the company gets cash inflow immediately and there is no burden of interest payments during the lock in period. Hence during the lock in period there is no cash outflow. After that it can be redeemed in instalments.

TISCO (Tata Iron and Steel Corporation Ltd.) issued SPNs in July 1992.

Type # 2. Redeemable and Irredeemable Bonds:

As the name suggests, redeemable bonds are the bonds which are to be redeemed by the issuing company after the expiry of a specified period known as maturity period. The redemption can be done at premium, par or discount. Irredeemable bonds, on the other hand, have infinite time horizon as no maturity period is specified in this case.

Such bonds are not redeemed by the company during its life. The bondholder continues to get interest income on irredeemable bonds throughout the life of the company or till the time company decides to redeem the bonds. Irredeemable bonds are also referred to as Perpetual Bonds. In real practice irredeemable bonds are a rare phenomenon.

Type # 3. Secured and Unsecured Bonds:

Secured bonds are the bonds for which the issuer company provides some asset (e.g. land, building etc.) as security or mortgage with bond trustee. If the company fails to pay interest or repay the principal amount, then the asset is sold to recover such amount. In case of unsecured bonds no such asset is kept as security or mortgage.

Therefore unsecured bonds are riskier than secured bonds. In case of liquidation, secured bonds get priority payments over unsecured bonds. In India, some of the private sector companies have issued unsecured bonds in the decades of 1990s.

Type # 4. Callable and Putable Bonds:

The peculiar feature of these bonds is that the bond indenture has a ‘call option’ (in case of callable bond) or a ‘put option’ (in case of putable bond). Call option is the right of the issuer company to call off or redeem bonds after a specified period but before maturity. Generally the company exercises its right to redeem or ‘call option’ if the market interest rate declines and becomes less than coupon rate.

In that case it makes sense for the issuer company to redeem early the high coupon rate bearing bonds and issue a new series of bonds with lower coupon rate. Since these bonds are callable at the option of the issuer company, the bondholders are exposed to an additional source of risk i.e. call risk. Hence other things being equal a callable bond is available at a lower price in the market than a normal bond. ICICI Ltd. issued a series of Callable bonds in the year 2003 with a call option after 3 years.

Puttable bonds, on the other hand, have a “put option”. Put option is the right of the bondholder to ask for redemption after a specified period but before maturity. The company is obliged to redeem the bonds on which put option is exercised by the bondholders. Generally bondholders exercise their put option, when market interest rate goes up and becomes significantly higher than the coupon rate.

In such a case it makes sense for the bondholder to get the existing bond carrying lower coupon rate redeemed and instead buy a new series of bonds having higher coupon rate. Since these bonds are redeemable at the option of the bondholder, the bondholder has a privileged position. Hence other things being equal a puttable bond is available at a higher price in the market than a normal bond.

Type # 5. Zero Coupon Bonds (or Zero Interest Fully Convertible Debentures- ZIFCD):

As the name suggests, a zero coupon bonds does not carry any coupon rate and hence no interest is paid/received on such bonds. These bonds are issued at discount and redeemed at par. Therefore the benefit to the bondholder is difference between the redemption price and issue price. For example a Zero Coupon bond having face value of Rs.100 is issued at a price of Rs.95. The redemption is due after 5 years at face value.

Hence the bondholder will pay Rs.95 now to buy this bond but will not get any interest (or coupons) for five years. At the end of fifth year the bondholder will receive Rs.100. The net gain to the bondholder will be the difference between the redemption value Rs.100 and issue price i.e. Rs.95. The holding period return will be 5.26% i.e. (100-95)/95. The effective annualized return will be 1.03% p.a. {(1 + 0.0526)1/5-1}

Zero Interest Fully Convertible Debentures (ZIFCD) are those zero coupon debentures which are compulsorily fully convertible into equity shares at the expiry of a specified period (not exceeding three years) from the date of issue as per SEBI guidelines. These debentures are also issued at discount and for the intervening period the debenture holder does not receive any interest income.

At maturity these debentures are convertible into equity shares and hence the net gain or loss to the debenture holder depends upon the market price of the share at the time of conversion/maturity.

For example a ZIFCD of a company having face value of Rs.100 is issued at a price of Rs.95. After 3 years this debentures is compulsorily converted into 10 equity shares of face value of Rs.10 each. Hence the debenture holder will pay Rs.95 now to buy this bond but will not get any interest (or coupons) for three years. At the end of third year the debenture holder will receive ten equity shares of the company and will become a shareholder enjoying all rights as to dividends and voting.

The net gain (or loss) to the debenture holder will be the difference between the market value of share and issue price i.e. Rs.95. Suppose the market price happens to be Rs.120 per share, then the holding period return on this ZIFCD will be 26.31 % i.e. (120-95)/ 95. The effective annualized return will be 8.09% p.a. (1+0.2631)1/3 – 1}. On the other hand if the market of the share happens to be less than Rs.95 then the debenture holder may suffer a loss.

Type # 6. Deep Discount Bonds (DDBs):

A DDB is a non-convertible zero coupon bond issued at a heavy discount and redeemable at par after a specified period. The return on a DDB is calculated as the difference between the redemption price (and face value) and the discounted issue price. Normally the maturity period of a DDB is longer than that of a zero coupon bond say 20 or more years.

In Jan 1994, Sardar Sarovar Narmada Nigam Limited (SSNNL) issued secured DDB having face value of Rs.110000 at a price of Rs.3600 maturing after 20 years at face value. Although the investors had an option to get redemption at the end of 7th, 11th and 15th years at a price of Rs.12500, 25000 and Rs.50000 respectively. If the bondholder holds this bond up to 20 years the holding period return will be 296% i.e. (110000-3600)/3600 which means that the annualized return will be 18.64% {i.e. (1+29.6) % -1}.

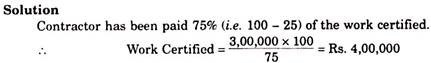

The return of a zero coupon bond or DDB can also be calculated using the following formula:

B = RV/ (1+k)n…………………………………………………………………… (4.1)

Where B = issue price of the bond (or present value) RV= Redemption value (or future value) n = Years to maturity k = annualized return to be calculated. For example-

In the case of DDB issued by SSNNL above we have

3600= 110000/ (1+k)5

(1+k)5= 110000/3600

K = (30.6)1/5 – 1

K= 18.6496

Type # 7. Tax Free Bonds:

Another popular type of bonds especially issued by infrastructure companies in India, is tax free bonds. Interest income on tax free bonds is exempt from income tax and hence such bonds become a lucrative investment option for investors in higher tax bracket. Tax free bonds are generally available for a maturity period of 10 years, 15 years and 20 years.

Companies which have recently issued tax free bonds in India include – Rural Electrification Corporation (REC), Power Finance Corporation (PFC) etc. In September 2015, NTPC issued Tax free bonds for a term of 10, 15 and 20 years.

Type # 8. Junk Bonds:

Junk bonds are the bonds which have high default risk. Due to high risk these bonds have high coupon rate and trade at higher yields. Junk bonds are the bonds of the companies having very low credit rating and hence should be avoided by an investor. Due to high risk and high yield these bonds are generally subscribed by speculators.

Type # 9. Treasury Bonds and Corporate Bonds:

Bonds issued by central government of a country are often referred to as sovereign bonds or treasury bonds. Treasury bonds do not have any call or put option. Most of the Treasury bonds are in the form of Zero coupon bonds i.e. they do not have any explicit coupon rate. On the other hand, bonds issued by a company are termed as corporate bonds. They generally have a call option or put option.

Type # 10. Municipal Bonds:

Bonds issued by state and local government are termed as municipal bonds. These bonds are not very popular in India due to high risk. Further, not many local governments issue these bonds in India.

Type # 11. Floating Rate Bonds:

This is a new innovation in bond market. Floating rate bonds do not have a fixed coupon rate. In this case coupon rate is linked to another base interest rate such as Repo rate or MIBOR (Mumbai Inter Bank Offer Rate). A change in Repo rate (or MIBOR) will cause a change in coupon rate hence interest income from this bond will be fluctuating rather than fixed and constant.

For example if a company issues a floating rate bond carrying a coupon rate as Repo rate + 3%, at a time when Repo rate is 7.5%, then the initial coupon rate will be 10.5%. However if Repo rate is increased to 8% in the next monetary policy announcement by RBI then the coupon rate will become 11 % and the bondholder will gain.

On the other hand if Repo rate is reduced to 7% then the bondholder will get a lower coupon rate of 10%. Thus a floating rate bond may not be advisable in times when the interest rates are expected to decline in near future.

Type # 12. Inverse Floaters Bonds:

Inverse floaters bonds are those floating rate bonds, the coupon rate of which move in the opposite direction of the linked base rate.

For example in the above case if the coupon rate is linked to Repo rate as Repo rate +3% -. If at present the Repo rate is 7.5% then the present coupon rate will be 10.5%. If repo rate increases to 8% then coupon rate will become 10% (i.e. decline by 0.5%) and if repo rate declines to 7% then coupon rate will be 11% (i.e. up by 0.5%).

These bonds are good in times when the investor expects a decline in base rate.

Type # 13. International Bonds:

There are two categories of international bonds- Foreign bonds and Euro bonds. Foreign bonds are issued by a borrower from a country other than the one in which bond is sold. These bonds are denominated in the currency of the country in which it is marketed. E.g. if a German firm sells dollar denominated bonds in US, the bond is considered a foreign bond. These bonds are given colourful names based on the countries in which they are marketed. Foreign bonds in US- Yankeebonds, in Japan- Samurai bonds, in UK- Bulldog bonds

Euro bonds, on the other hand are issued in the currency of one country but sold in other national markets.

Example: Eurodollar bonds are dollar denominated bonds sold outside the US, Euro yen bonds are yen denominated bonds selling outside Japan, Euro sterling bonds are Pound sterling denominated bonds sold outside UK.