This article will guide you to learn about how to record journal entries in accounting.

Journals are the books of primary entry in which the transactions and events are recorded at the first instance. Entry means record of a transaction or an event in the journal. Journalisation is the first phase of the accounting process by which transactions and events are recorded in the Journal.

Two Steps in Journalisation:

Two steps in journalisation are: Transaction Analysis and Presentation.

The first step consists of:

ADVERTISEMENTS:

Understanding transactions and events

Observing dual effects

Identification of debit and credit

The second step consists of:

ADVERTISEMENTS:

Recording date

Recording accounts involved with indication of debit-credit

Giving reference to evidence of occurrence of transaction or event

Mentioning account of the transaction or event

ADVERTISEMENTS:

Narrating the transaction or event

Presentation in the Journal:

Usually six columns are maintained in a journal:

(i) Date,

(ii) Particulars,

ADVERTISEMENTS:

(iii) Voucher Number,

(iv) Ledger folio,

(v) Debit Amount, and

(vi) Credit Amount.

ADVERTISEMENTS:

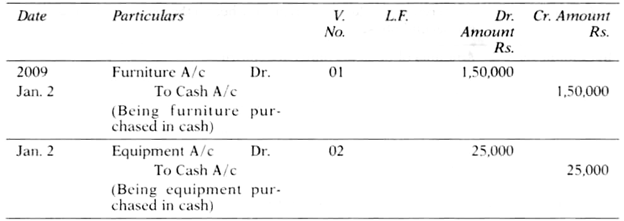

Design of a journal is given in Exhibit 5.1.

Example 1:

Given below are three transactions:

ADVERTISEMENTS:

2009

Jan. 1 Ms. Khalida invested Rs.2,60,000 in business of general stores.

Jan. 2 She purchased furniture for Rs.1,50,000 and refrigerator for Rs.25,000.

Jan. 3 She purchased grocery items, cold drinks and ice-creams for Rs.2,00,000 from M/s Maersk Trading and paid Rs.85,000 in cash.

ADVERTISEMENTS:

Journalise the above transactions.

Solution:

Narration should be very brief but clear. When either debit entry or credit entry or both of any transaction or event involve more than one accounts that is called a composite entry. A composite entry is arrived at by merging two or more entries.

For example, transactions occurred on Jan. 2 (in Example 5.1) give two independent journal entries:

Summing up these two independent entries, we got the composite entry:

Voucher is supportive evidence of the occurrence of transaction or event. Bills, cash memos, etc. provide such evidence. A business entity maintains duplicate of the bills and cash memos given to other parties as well as original of the bills and cash memos received from the others.

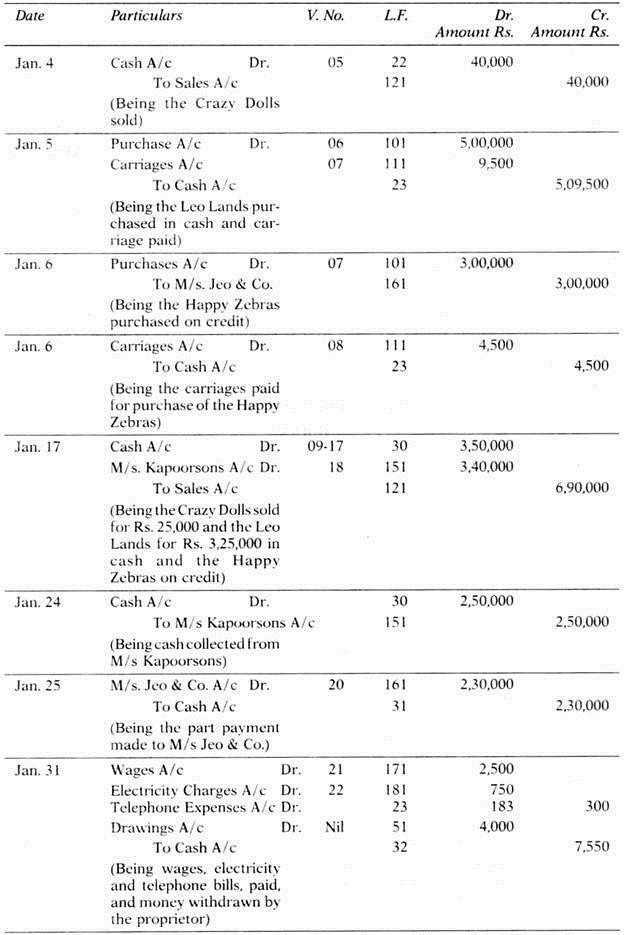

Example 2:

Mr. Deembale started an exclusive toy shoppe ‘Kiddies Kingdom’ on and from 1st January, 2009.

The following transactions occurred during the month of January:

Jan. 1 Deembale invested Rs.14,00,000: he paid Rs.5,00,000 to the landlord for 20 years’ lease of the shop.

Jan. 2 He spent Rs.3,00,000 for show-case.

Jan. 3 Purchased ‘Crazy Dolls’ for Rs.50,000, spent Rs.2,000 for carriage.

Jan. 4 Sold ‘Crazy Dolls’ for Rs.40,000.

Jan. 5 Purchased ‘Leo Land’ for Rs.5,00,000, paid carriage Rs.9,500.

Jan. 6 Purchased ‘Happy Zebra’ for Rs.3,00,000 on credit from M/s Jeo & Co. paid Rs.4,500 for carriage.

Jan. 17 Sold ‘Crazy Dolls’ for Rs.25,000, sold ‘Leo Land’ for Rs.3,25,000, in cash; and sold ‘Happy Zebra’ for Rs.3,40,000 to M/s Kapoorsons on credit.

Jan. 24 Received Rs.2,50,000 from M/s Kapoorsons.

Jan. 25 Paid Rs.2,30,000 to M/s Jeo & Co.

Jan. 31 Paid wages to assistant Rs.2,500, paid electricity bill of Rs.750, paid telephone bill of Rs.300, met personal expenses of Rs.4,000.

Journalise the above transactions.

Solution:

A separate Drawings A/c is generally kept to record all withdrawals by the proprietor. By this, Capital A/c will remain unchanged for day-to-day withdrawals.

Different Types of Journals:

The following are the some widely used journals in a trading entity:

1. Purchases Day Book:

Only credit purchases are recorded in this journal.

2. Sales Day Book:

Only credit sales are recorded in this journal.

3. Purchases Return Book:

Purchase returns are recorded in this journal. (This is also called Return Outward Book.)

4. Sales Return Book:

Sales returns are recorded in this journal. (This is also called Return Inward Book.)

5. Cash Book:

All cash, bank and discount transactions are recorded in this journal; (It also serves the purpose of ledger for cash account and bank account).

6. Journal Proper:

All other transactions are recorded in this journal. There may be many other journals depending upon the circumstances.

Journal Proper:

Transactions and events not recorded in any other journal are recorded primarily in the Journal Proper.

In the Journal Proper, the following transactions and events are recorded:

1. Credit sale of old assets and credit purchase of assets.

2. Opening entries: At the beginning of the accounting period balances of assets, liabilities and capital are brought forward from the preceding accounting period.

3. Closing entries: At the end of accounting period ledger accounts relating to income and expenses are transferred to Profit and Loss Account (ledger accounts relating to assets, liabilities and capital are carried forward).

4. Other end of accounting period adjustments:

I. Adjustment for closing stock;

II. Depreciation;

III. Outstanding expenses and expenses paid in advance;

IV. Accrued income and income received in advance;

V. End of accounting period sale and purchase;

VI. Goods on approval; VII. Provision for liability and loss;

5. Rectification of errors.

6. Transfer entries. Sometimes transfer becomes necessary from one account to the other.

7. Miscellaneous non-cash transactions. They include abnormal loss, allowance of trade discount other than adjustment to voucher, etc.