List of top five problems on financial ratios with its relevant solution.

Problem # 1:

The working capital of ABC Ltd. has deteriorated in recent years and now stands as under:

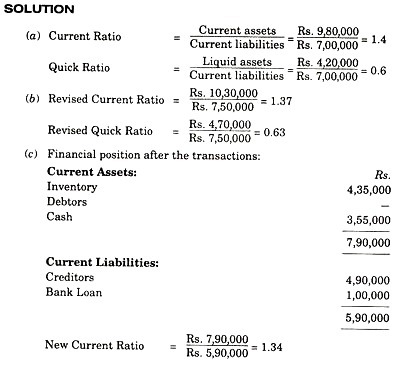

(a) Compute the current and quick ratios.

ADVERTISEMENTS:

(b) A further bank loan of Rs. 50,000 against debtors is under negotiation. Assuming the loan is received, calculate the revised current and quick ratios.

(c) There is also a negotiation going on for discounting the debtors of Rs. 350,000 for Rs. 3,15,000 to a collection agency for immediate cash. Also obsolete stocks worth Rs. 1,25,000 are being sold for Rs. 80,000. Of the cash to be realised by the two transactions, the bank loan is proposed to be reduced to Rs. 1,00,000. Calculate the current ratio after the transactions are put through.

Problem # 2:

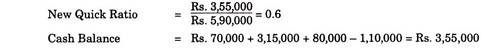

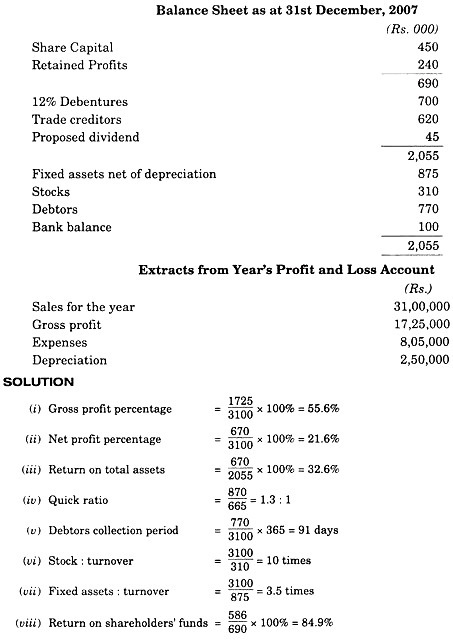

From the following annual accounts of New Horizontal Limited you are required to calculate the following ratios and comment on the results, indicating what other information you require:

ADVERTISEMENTS:

(i) Gross profit percentage,

(ii) Net profit percentage,

(iii) Return on total assets,

ADVERTISEMENTS:

(iv) Quick asset ratio,

(v) Debtors collection period,

(vi) Stock turnover,

(vii) Fixed assets turnover,

ADVERTISEMENTS:

(viii) Return on shareholders’ funds,

(ix) Current ratio, and

(x) Debt ratio.

Very few ratios have an absolute value but they are used in a relative way in intra-and inter- firm comparisons. Both gross and net margins are calculated using the profit before tax and interest to identify the trading profit, irrespective of the capital structure in force.

Both these figures seem satisfactory but knowledge of the industry is necessary. Also the returns on shareholders’ funds and on total assets both appear quite satisfactory.

The quick ratio exceeds the 1: 1 norm and the current ratio is near the 2: 1 norm, but this requirement varies widely. On the other hand the debt ratio seems high, as two-thirds of all assets are financed by debt. Asset turnover rates also need comparisons to make any judgement but the debtors collection period of 91 days would seem too long for most industries, especially if credit is granted on a net monthly basis.

Problem # 3:

XYZ Company’s financial statements contain the following information:

On the basis of the above ratios, it can be said that the firm’s positions is sound from the point of view of liquidity, solvency and profitability. However, its activity ratios do not represent a satisfactory position. Better position will be reflected only if the ratios are compared with the performance of other firms in the same industry.

Problem # 4:

The balance sheet of XYZ Company is given below:

Problem # 5:

ABC Distributors has the following Balance Sheet and Income Statement:

You are required to:

ADVERTISEMENTS:

(а) Determine ABC distributor’s liquidity position by calculating the Current ratio, Working Capital, the ratio of Current Assets to Total Assets, the ratio of Current Liabilities to Total Assets and the Cash Conversion cycle.

(b) Calculate the current market price per share of ABC’s Stock if its P/E ratio is eight.

Solution:

Various Ratios of ABC Distributors may be found as follows: