Here is a term paper on ‘Balance Sheet’ for class 11 and 12. Find paragraphs, long and short term papers on ‘Balance Sheet’ especially written for school and college students.

Term Paper on Balance Sheet

Term Paper Contents:

- Term Paper on the Meaning and Definitions of Balance Sheet

- Term Paper on the Titles Used in Respect of Balance Sheet

- Term Paper on the Classification of Assets and Liabilities

- Term Paper on the Performa of Balance Sheet

- Term Paper on the Adjustments Required for Preparing Balance Sheet

Term Paper # 1. Meaning and Definitions of Balance Sheet:

ADVERTISEMENTS:

A balance sheet is a statement of assets and liabilities of a business enterprise at a given date. It is prepared at the end of the accounting period after the trading account and profit and loss account have been prepared. It shows the financial position of the business at the end of accounting period. It is called a balance sheet because it is a sheet of balances of ledger accounts, which are still open after the preparation of trading, and profit and loss account.

According to Freeman, “A balance sheet is an item wise list of assets, liabilities and proprietorship of a business at a certain date.”

According to American Institute of Certified Public Accountants, “Balance sheet is a list of balances in the assets and liability accounts. This list depicts the position of assets and liabilities of a specific business at a specific point of time”

“Balance sheet is a ‘Classified summary’ of the ledger balances remaining after closing all revenue items into the profit and loss account.” – Cropper.

ADVERTISEMENTS:

“Balance sheet is a screen picture of the financial position of a going business concern at a certain moment” – Francis.

The Balance sheet comprises of lists of assets, liabilities and capital fund on a given date. It presents the financial position of a concern as revealed by the accounting records. It reflects the assets owned by the concern and the sources of funds used in the acquisition of those assets.

In simple language it is prepared in such a way that true financial position is revealed in a form easily readable and more rapidly understood than would be possible from a view of the detailed information contained in the accounting records prepared during the currency of the accounting period. Balance sheet may be called a ‘statement of equality’ in which equality is established by representing values of assets on one side and values of liabilities and owners’ funds on the other side.

Term Paper # 2. Titles Used in Respect of Balance Sheet:

ADVERTISEMENTS:

A Balance sheet is called by different names probably due to lack of uniformity in accounting systems.

Generally, the following titles are used in respect of balance sheet:

(i) Balance sheet or General Balance sheet;

(ii) Statement of Financial position or condition;

ADVERTISEMENTS:

(iii) Statement of assets and liabilities;

(iv) Statement of assets and liabilities and owners’ fund etc. Of the above, the title ‘Balance sheet’ is mostly used. The use of this title implies that data presented in it have been taken from the balances of accounts.

Term Paper # 3. Classification of Assets and Liabilities:

A clear and correct understanding of the basic divisions of the assets and liabilities and the meanings which they signify and the amounts which they represent is very essential for a proper perspective of financial position of a business concern.

ADVERTISEMENTS:

Assets and liabilities are classified under the following major headings:

1. Assets:

Assets are properties of business. They are classified on the basis of their nature.

Different types of assets are as under:

ADVERTISEMENTS:

(i) Fixed Assets:

Fixed assets are the assets which are acquired and held permanently and used in the business with the objective of making profits. Land and building, Plant and machinery, Furniture and Fixtures are examples of fixed assets.

(ii) Current Assets:

The assets of the business in the form of cash, debtors bank balances, bill receivable and stock are called current assets as they can be realised within an operating cycle of one year to discharge liabilities.

ADVERTISEMENTS:

(iii) Tangible Assets:

Tangible assets have definite physical shape or identity and existence; they can be seen, felt and have volume such as land, cash, stock etc. Thus tangible assets can be both fixed assets and current assets.

(iv) Intangible Assets:

The assets which have no physical shape which cannot be seen or felt but have value are called intangible assets. Goodwill, patents, trade-marks and licenses are examples of intangible assets. They are usually classified under fixed assets.

(v) Fictitious Assets:

Fictitious assets are not real assets. Past accumulated losses or expenses which are capitalised for the time being, expenses for promotion of organisations (preliminary expenses), discount on issue of shares, debit balance of profit and loss account etc. are the examples of fictitious assets.

ADVERTISEMENTS:

(vi) Wasting Assets:

These assets are also called depleting assets. Assets such as mines, Timber forests, quarries etc. which become exhausted in value by way of excavation of the minerals, cutting of wood etc. are known as wasting assets. Such assets are usually natural resources with physical limitations.

(vii) Contingent Assets:

Contingent assets are assets, the existence, value possession of which is based on happening or otherwise of specific events. For example, if a business firm has filed a suit for a particular property now in possession of other persons, the firm will get the property if the suit is decided in its favour. Till the suit is decided, it is a contingent asset.

2. Liabilities:

A liability is an amount which a business firm is ‘liable to pay’ legally. All the amounts which are claims by outsiders on the assets of the business are known as liabilities. They are credit balances in the ledger.

Liabilities are classified into four categories as given below:

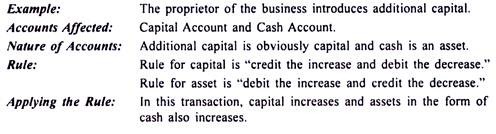

1. Owner’s Capital:

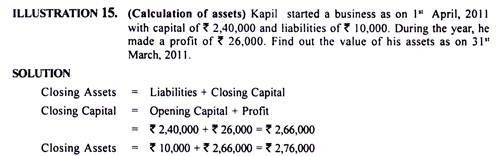

Capital is the amount contributed by the owners of the business. In addition to initial capital introduced, proprietors may introduce additional capital and withdraw some amounts from business over a period of time. Owner’s capital is also called ‘net worth’. Net worth is the total fund of proprietors on a particulars date.

It consists of capital, profits and interest on capital subject to reduction of drawings and interest on drawings. In case of limited companies, capital refers to capital subscribed by shareholders. Net worth refers to paid up equity capital plus reserves and profits, minus losses.

2. Long Term Liabilities:

Liabilities repayable after specific- duration of long period of time are called long term liabilities. They do not become due for payment in the ordinary ‘operating cycle’ of business or within a short period of lime. Examples are long term loans and debentures. Long term liabilities may be secured or unsecured, though usually they are secured.

3. Current Liabilities:

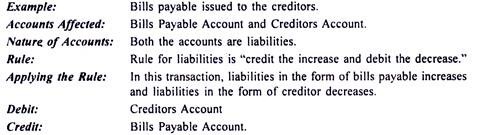

Liabilities which are repayable during the operating cycle of business, usually within a year, are called short term liabilities or current liabilities. They are paid out of current assets or by the creation of other current liabilities. Examples of current liabilities are trade creditors, bills payable, outstanding expenses, bank overdraft, taxes payable and dividends payable.

4. Contingent Liabilities:

Contingent liabilities will result into liabilities only if certain events happen. Examples are Bills discounted and endorsed which may be dishonoured, unpaid calls on investments.

Term Paper # 4. Performa of Balance Sheet:

Term Paper # 5. Adjustments Required for Preparing Balance Sheet:

On preparing, Trading and profit and Loss Account, adjustments are necessary when accrual basis of accounting is followed.

The following are the items for which adjustments are usually required:

1. Closing Stock:

This is the stock which remained unsold in the preceding accounting period.

2. Outstanding Expenses:

Outstanding expenses refer to those expenses which have become due during the accounting period for which the final accounts have been prepared, but have not yet been paid.

3. Prepaid Expenses:

Prepaid expenses are the expenses the benefit of which has not been fully enjoyed before the end of the accounting year. They are expenses paid in advance or unexpired expenses.

4. Income Earned but not Received (Outstanding or Accrued Income):

It may often happen that certain items of income such s interest on investments, commission etc. are earned during the current accounting year, but have not been actually received by the end of the same year. Such incomes are known as outstanding or accrued incomes.

5. Income Received in Advance:

Sometimes a portion of income received during the current year relate to the future period. Such portion of the income which belongs to the next accounting period is income received in advance and is known as unexpired income.

6. Depreciation:

Depreciation is the decreased in the value of an asset due to wear and tear, passage of time, obsolescence etc. It is a business expenses, though it is not paid in cash every year. It is to be debited to profit and loss account and the amount be deducted from the relevant asset in the Balance Sheet.

If depreciation is given in the Trial Balance, it is taken only on the debit side of Profit and Loss Account as its adjustment is over.

7. Bad Debts:

Any irrecoverable portion of sundry debtors is termed as bad debt. Bad debt is a loss to the business. If is given in the Trial Balance, it should be shown on the debit side of Profit and Loss Account. Bad debts given in the adjustment is to be deducted from sundry debtors in the Balance Sheet and the same is debited to the Profit and Loss Account.

8. Provision for Doubtful Debts:

It is a provision created to meet any loss, if the debtors fail to pay the whole or part of the debt owed by them. The amount required for doubtful debt is kept by changing the amount to the profit and loss account.

9. Provision for Discount on Debtors:

Sometimes the goods are sold on credit to customers in one accounting period whereas the payment of the same is received in the next accounting period and discount is to be allowed.

10. Reserve for Discount on Creditors:

Prompt payment, if made, enables a business man to receive discount. So on last day of accounting period if some amount is still payable to creditors, a provision should be created for such probable income and the amount should be credited to the profit and loss account of that year in which purchases are made.

11. Interest on Capital:

Sometimes interest is paid on the proprietor’s capital. Such interest is an expense to the business and is debited to profit and Loss Account.

12. Interest on Drawings:

Often, interest is charged on drawings made by the proprietor. It is a gain to the business.

13. Transfer to Reserve:

Reserves save a business from future losses and meet the losses without reduction in capital. The reserves are appropriation of profits and are created only in the year when there are profits.

14. Commission on Profit:

The Commission as a percentage of the net profit may be ‘before’ or ‘after’ charging such commission. In the absence of any special instruction, it is assumed that commission is allowed as a percentage of the net profit before charging such commission.

(a) If the commission is on the net profit before charging such commission, the formula is:

For example, if profit is Rs. 22,000 and rate of commission is 10% on the profit before charging such commission, the calculation is as follow:

(b) If the commission is on the net profit after charging such commission, the amount is calculated as follows:

Commission as per above example:

15. Loss of Goods by Fire or Accidents:

(a) Such losses are abnormal losses. Stock destroyed by fire or accidents is credited to the Trading Account.

The loss of stock is closed by transferring the amount to Profit and Loss Account.

(b) If the loss is fully covered by insurance, no portion of the loss is debiting to the Profit and Loss Account. The amount due by Insurance Company is shown as an asset in the Balance Sheet.

(c) If the Insurance Company agrees to pay only a part of the loss, the position of loss not covered by insurance is debited to Profit and Loss Account and the amount due by the Insurance Company is shown as an asset in the Balance Sheet.

16. Goods Drawn for Personal Use:

If goods are drawn by the proprietor for the personal use or domestic purpose, the cost of such goods drawn is deducted from purchase account and the same is added to his drawings.

The amount of such drawings cannot be treated as sales, as the goods are not drawn at selling price.

17. Goods Used in Office from Purchases:

In certain trading concern, good bought for trading purpose are used in the office. The cost of such goods used is to be deducted from purchases and added to printing and stationery or office expense.

18. Goods Sent on Sale or Return Basis:

The sales value of such goods if included in the total sales should be deducted from sales and debtors.

The entry for the same is:

19. Goods Distributed as Free Samples:

It may be debited in the goods sent as free samples or Advertisement account and credited to Purchases Account.