Absorption costing refers to the ascertainment of costs after they have been incurred. Here, fixed costs as well as variable costs are allotted to cost units and total overheads are absorbed by actual or normal activity level.

Absorption costing is called total, or historical, or traditional, or cost plus costing. It is not suitable for exercising cost control as there is substantial time-gap between occurrence of expenditure and reporting of information.

Absorption costing is also referred to as full costing. It is a costing technique in which all manufacturing cost (fixed and variable) are considered as cost of production and are used in determining the cost of goods manufactured and inventories.

The fixed production costs are treated as part of the actual production costs. Stock and cost of goods manufactured are valued on a full production cost basis. The fixed overhead is viewed as product cost and is charged to product.

ADVERTISEMENTS:

Contents

- Introduction to Absorption Costing

- Meaning of Absorption Costing

- Definitions of Absorption Costing

- Objectives of Absorption Costing

- Features of Absorption Costing

- Steps Involved in Absorption Costing

- Difference between Marginal Costing and Absorption Costing

- Differences between Absorption Costing and Variable Costing

- Income Statement Under Absorption Costing and Marginal Costing

- Arguments in Support of Absorption Costing

- Advantages of Absorption Costing

- Disadvantages of Absorption Costing

- Limitations of Absorption Costing

Absorption Costing: Meaning, What is, Definitions, Objectives, Features, Steps, Difference Between, Income Statement, Advantages, Disadvantages and More…

Absorption Costing – Introduction

Absorption costing refers to the ascertainment of costs after they have been incurred. Here, fixed costs as well as variable costs are allotted to cost units and total overheads are absorbed by actual or normal activity level. Absorption costing is called total, or historical, or traditional, or cost plus costing. It is not suitable for exercising cost control as there is substantial time-gap between occurrence of expenditure and reporting of information.

In this system all costs are identified with the manufactured products. Here, the management is interested to know whether a product can generate sufficient return on investment after absorbing its share of costs. Despite considerable problems, absorption costing is sometimes used in business decisions.

Under absorption costing fixed expenses form the part of total cost. Valuation of stock includes elements of fixed expenses. Under this system, if there is no sale the entire stock is carried forward, and there will be no trading profit/loss. Absorption costing is well situated for determination of long term cost and long term pricing policy. It lays importance on production or output.

ADVERTISEMENTS:

Absorption costing is also referred to as full costing. It is a costing technique in which all manufacturing cost (fixed and variable) are considered as cost of production and are used in determining the cost of goods manufactured and inventories.

The fixed production costs are treated as part of the actual production costs. Stock and cost of goods manufactured are valued on a full production cost basis. The fixed overhead is viewed as product cost and is charged to product.

The inventory valuation under the absorption costing method is different when compared with variable costing because of fixed factory overhead being considered as product cost under absorption costing. Similarly there is a difference in the net income figures and the product cost in the two costing techniques.

Absorption Costing – Meaning

Absorption costing is a managerial accounting cost method of expensing all costs associated with manufacturing a particular product and is required for Generally Accepted Accounting Principles (GAAP) external reporting. Some of the direct costs associated with manufacturing a product include wages for workers physically manufacturing a product, the raw materials used in producing a product, and all of the overhead costs, such as all utility costs, used in producing a good.

ADVERTISEMENTS:

Absorption costing includes anything that is a direct cost in producing a good as the good as the cost base. Absorption costing is also called full costing as all costs including fixed overhead charges are included as product costs. As opposed to the other alternative costing method called variable costing, every expense is allocated to products manufactured within or not they are sold.

Absorption costing is- “a principle whereby fixed as well as variable costs are allotted to cost units”. (CIMA-Definition). As per this system, fixed as well as variable costs are allotted to cost units and total overheads are absorbed by actual and normal activity level.

Since costs are ascertained after they have been incurred. Absorption Costing is also called Historical Costing. Hence, there will be some time gap between occurrence of expenditure and reporting of cost information to the management.

In the long run, all costs are to be recovered, whether it may be fixed or variable direct or indirect. After meeting all costs, there will be profit for which Return on Investment may be calculated and intimated to the management.

ADVERTISEMENTS:

CIMA holds absorption costing as, “the process of absorbing all overhead costs allocated or apportioned over a particular cost centre or production department by the units produced.”

The term may be applied in the cases the following are allotted:

1. Production costs or

2. Costs of all functions

Absorption Costing – Definitions

CIMA (Chartered Institute of Management Accountants) defines the ‘Absorption Costing’ “as the process of charging all costs, both variable and fixed to operations, process or products.” Under absorption costing system, all production related costs (direct or indirect, fixed or variable) are included in the unit costs.

ADVERTISEMENTS:

The CIMA Official Terminology defines absorption costing as “a method of costing that, in addition to direct costs, assigns all, or a proportion of, production overhead costs to cost units by means of one or a number of overhead absorption rates.”

According to this definition, absorption costing is a method or technique by which all manufacturing costs are assigned to cost units either directly or indirectly by allocation and apportionment.

Accordingly, the cost per unit of a product comprises the cost of direct materials, cost of direct labour, direct or chargeable expenses and a share of other manufacturing costs which are collectively referred to as ‘manufacturing or production overhead’.

ADVERTISEMENTS:

These other manufacturing costs are charged to products by computing predetermined absorption rate or rates, depending upon whether a blanket rate is used or departmental rates are applied.

There are also costs other than production or manufacturing costs which every firm has to incur. These other costs, known as ‘non-manufacturing costs’, are not assigned to products but charged direct to profit and loss account as period costs. They are also excluded from the purview of stock valuation.

Manufacturing costs, other than material cost, labour and chargeable expenses, do not reflect the same characteristic feature, but differ widely from one another.

Some of them, such as foreman’s salary, factory rent, maintenance of plant, municipal taxes, depreciation, insurance of plant, etc., remain fixed over wide ranges of output. They are not affected by either an increase or decrease in the output.

ADVERTISEMENTS:

On the other hand, certain other items of manufacturing overhead such as power, fuel, royalty, sundry supplies, etc., increase or decrease as output increases or decreases. The same is true of depreciation if it is calculated on the basis of number of units produced or machine hours worked.

These other manufacturing expenses, which are collectively known as manufacturing overhead, are not distinguished as such for purposes of product costing under the technique of absorption costing. Regardless of their differences, they are also charged to the cost unit. That is the reason why absorption costing is also known as ‘full’ or ‘total’ costing.

Absorption Costing – 5 Main Objectives

The main objectives of absorption costing are:

(a) To know direct and indirect cost separately.

(b) To know department wise participation in cost.

(c) To know the overall cost of the product.

ADVERTISEMENTS:

(d) To analyse the data related to production and to confirm that the resources are properly used or not.

(e) To find out and fixing the sale price to be quoted in the market.

Absorption Costing – Main Features

Main features of absorption costing are as under:

1. Period Costs –

All administration, selling and distribution overheads are treated as period costs. Therefore, these are written off against the profits in the period in which they arise.

2. Classification on Functional Basis –

All costs are classified on functional basis as production costs, administration costs, selling costs, distribution costs.

3. Treatment As Product costs –

All variable manufacturing costs and fixed production overheads are treated as product costs and hence are charged to operation, process is or products.

Some of the features of absorption costing given in points:

(a) All manufacturing costs, whether direct or indirect, are absorbed by the product produced.

(b) Each unit of the product should bear its share of total cost.

(c) No distinction is drawn between fixed manufacturing cost and variable manufacturing cost. Both are charged or assigned to the cost unit.

(d) Manufacturing costs that cannot be identified with any product is apportioned by computing predetermined absorption rate. Such a rate may either be the blanket rate for the entire factory or departmental rates of recovery.

(e) Stocks are valued at full cost since both fixed and variable costs are regarded as product cost.

(f) Portion of the fixed cost relating to unsold stock is carried forward to the next accounting period.

(g) This technique of cost finding gives rise to under or over-absorption of manufacturing overhead.

(h) Under this technique, profit is the excess of sales revenue over cost of goods sold.

Top 2 Steps Involved in Absorption Costing (with Formula for calculating Overhead Absorption Rate)

The steps involved in absorption costing are as follows:

Step # 1. Computation of Overhead Absorption Rate:

First of all, Absorption rates are computed for absorption of overheads in costs of the cost units. There are many methods to determine absorption rates. In all these methods, the overhead rate is computed by dividing the total amount of overheads of department or cost centre by the number of units in the base, such as number of cost units, machine hours, labor hours, direct labor cost, price cost etc.

This is given as under-

It is to be kept in view that only one rate is computed for any single group of overheads.

Step # 2. Application of Rates to Cost Units:

To arrive at the overhead cost of each cost unit, the overhead rate is multiplied by the number of units of base in the cost unit. In this way

Overhead Absorbed = No. of units of base in the cost unit x Overhead rate

To illustrate machine hour rate is Rs.25 and a cost unit has used 12 hours of the machine, overhead absorbed will be = 12 hours x Rs.25 = Rs.300.

Difference between Marginal Costing and Absorption Costing

Both marginal costing and absorption costing are the alternative techniques of cost ascertainment. As such, product costs may be ascertained by the adoption of either absorption costing or marginal costing.

In the case of absorption costing, the cost of a cost unit comprises direct costs plus production overheads, both fixed and variable. Operating statements do not distinguish between fixed and variable costs and all manufacturing costs are allocated to cost units. Non-manufacturing costs, however, are charged to profit and loss account. They are also excluded from valuation of stocks.

Absorption costing is favoured by the Accounting Standards Committee of the United Kingdom, for external reporting. It’s published Statement of Standard Accounting Practice on Stocks and Work-in-progress (SSAP 9) favours absorption costing not merely for external reporting but also permits a proportion of fixed costs of one accounting period to be carried to the next accounting period as part of inventory value.

In the case of marginal costing technique, only variable costs are charged to cost units. Fixed costs are treated not as product costs but as period costs. These costs are, in their entirety, charged to contribution generated by cost units. The effect of this kind of treatment is that finished goods and work-in- progress are valued at marginal cost, i.e., prime cost plus variable production overheads.

Besides the above basic point of difference between the two techniques, the following other points of difference may also be noted:

(a) Classification of Expenses:

In the case of absorption costing, costs or expenses are classified on the basis of functions, such as production costs, administration, selling and distribution costs. In the case of marginal costing, however, costs are classified on the basis of nature or variability, i.e., fixed and variable costs.

(b) Presentation of Cost Data:

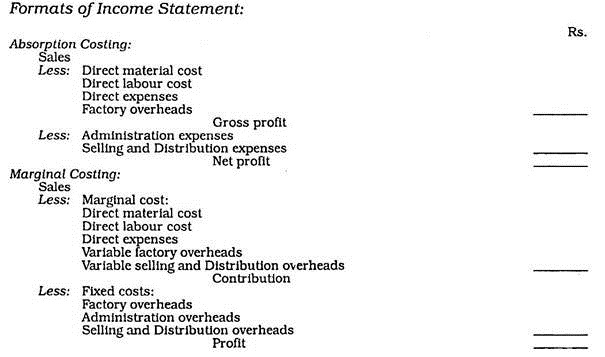

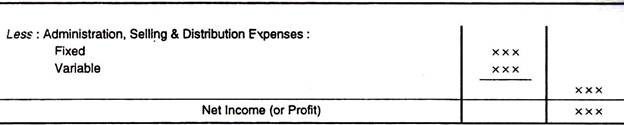

Under the absorption costing technique cost data are presented in the conventional form. Starting from the sales value of each product line, direct costs are deducted therefrom in order to get the gross profit.

From this profit are deducted administration, selling and distribution costs to get the net profit. In the case of marginal costing technique, however, variable production costs are deducted from the sales value to get the amount of contribution. From this amount, fixed overheads are deducted to get the amount of profit or loss.

(c) Ascertainment of Profitability:

In the case of absorption costing, the profitability or otherwise of a product is influenced by the amount of fixed costs apportioned to it. Since fixed costs are treated as product cost, each product is made to bear a reasonable proportion of fixed cost for the purpose of ascertaining its profitability.

In the case of marginal costing, however, fixed costs are treated as period costs. As such, profitability of a product is determined by the amount of contribution generated by it and its profit/volume ratio.

(d) Inventory Valuation:

Stocks of finished goods and work-in-progress are valued under absorption costing at full cost. As such, for the purpose of inventory valuation, not merely direct costs but also indirect manufacturing costs are taken into consideration. Indirect manufacturing costs comprise both variable and fixed costs.

This method of valuing stocks has the effect of carrying over fixed costs from one period to another. Such a carry-over distorts the trading results besides vitiating cost results.

Under the marginal costing technique, inventories are valued at marginal cost. Since no part of fixed manufacturing costs are included in the value of closing inventories, there is no problem of carrying over fixed costs from one period to another and the consequent distortion in the trading results.

(e) Magnitude of Opening and Closing Stocks:

Difference in the size or magnitude of opening and closing stocks not only affects the unit cost of production but profit also in the case of absorption costing due to the impact of fixed cost. In the case of marginal costing, however, there is no such problem with regard to the size of opening and closing stocks.

Neither the unit cost is affected nor the amounts of profit by the impact of fixed costs since fixed costs are not considered at all for inventory valuation.

(f) Under or Over-Absorption of Overheads:

In the case of absorption costing fixed costs are also treated as product cost by charging the same to cost units on the basis of predetermined absorption rates.

The inclusion of fixed costs and their arbitrary apportionment over the cost units gives rise to the problem of under or over absorption of overheads. In the case of marginal costing, however, fixed costs are not included in product cost. Hence, there is no problem of under or over-absorption of overheads.

(g) Decision-Making:

The basis of decision-making under the absorption costing technique is the amount of profit which is the excess of sales revenue over total cost. In most cases, however, fixed costs are not relevant for managerial decisions.

Therefore, the inclusion of fixed costs may, sometimes, lead to improper decisions. As such, absorption costing is of limited significance from the point of view of decision-making.

In the case of absorption costing, however, contribution is the basis of decision-making. Since fixed costs are not considered while computing the amount of contribution, marginal costing technique is the most suited for managerial decisions.

In fact, even the Official Terminology of the CIMA has, while defining the term ‘marginal costing’ observed that “its special value is in recognising cost behaviour, and hence assisting in decision-making.”

Differences between Absorption Costing and Variable Costing

The main points of differences between Absorption Costing and Variable Costing may be summarized as follows:

Difference # 1. Product costing –

Under absorption costing all costs, whether fixed or variable, are treated as product costs. The cost units are made to bear the burden of full costs even though fixed costs are period costs and have no relevance to current operations. Under variable (or marginal) costing, however, only variable costs are treated as product costs.

Difference # 2. Under/over-absorption of overheads –

In absorption costing, fixed manufacturing overheads are charged to the production on the basis of estimated overhead rate and therefore, some over/under-absorption of overheads is normally found. In variable costing, the fixed overheads are charged on actual basis and hence no under/over-absorption arise.

Difference # 3. Inventory valuation –

In absorption costing, inventory is valued at full manufacturing cost (including both fixed and variable). This has the effect of carrying over fixed costs from one period to another along with the closing stock. This distorts the trading results and vitiates the cost comparison.

Difference # 4. Profit concept –

Under absorption costing, the profit is computed and decisions are taken on that basis while under variable costing, contribution is the key to decision-making.

Income Statement Under Absorption Costing and Marginal Costing (With Formats)

As shown in the above formats, net income under absorption costing is the balance of sales revenue after deducting full or total costs, both fixed and variable. In the case of marginal costing however, excess of sales revenue over variable costs is the amount of contribution which for all practical purposes is the profit.

However, fixed costs are deducted in full from the amount of contribution, as period costs, without carrying forward any portion of the same as inventory value.

Impact of the Technique on Profit:

The formats in respect of absorption costing and marginal costing being different, the operating statements under these two techniques also differ. However, net profit under both the techniques will be the same when there is no opening or closing stock.

(a) Production Equals Sales:

When production equals sales, there will be no closing stock and hence, opening stock also. In such a case, net profit under both the techniques will be the same. The situation will be the same even if stocks exist, but the volume of these stocks is equal.

However, for net profit to be same in a situation such as this, it is necessary that unit cost of current production, opening stock and closing stock should be the same for both variable and fixed elements.

(b) Production Exceeds Sales:

Net profit reported under both the techniques differ from one another when sales for the year are more or less than production, i.e., sales and production are out of balance. In the case of absorption costing, the fixed production cost is carried forward from year to year as a part of inventory cost.

As such, in case a concern produces more than it sells, i.e., when production exceeds sales, the whole of the fixed production cost relating to the current period will not be matched against revenue. A part of it will be held in the form of inventory, and will be released as part of the cost of goods sold in a later year.

In a situation when production exceeds sales, closing stock will be more than the opening stock. Assuming that cost per unit remains unchanged, profit reported will be higher under absorption costing than that under marginal costing.

The reason why closing stock will be more than the opening stock is that the fixed cost brought forward as a part of opening stock will be much lower than the fixed cost carried forward as a part of closing stock.

(c) Sales Exceed Production:

When sales exceed production, opening stock will be more than the closing stock because of the fact that a greater amount of fixed overhead will have been brought forward in the opening stock than the amount of fixed cost carried forward to the next period as a part of closing stock. Consequently, the profit reported under the technique of absorption costing will be less than that reported under marginal costing, cost of goods sold being higher under absorption costing.

(d) Fluctuating Sales:

When sales fluctuate but production remains constant, profit increases or decreases with the level of sales whether it is absorption costing or marginal costing, assuming that costs and prices remain constant. However, profit may not be the same under both the techniques due to the existence of stocks and variations in cost per unit during different periods.

(e) Fluctuating Production:

When production fluctuates and sales remain constant, stocks fluctuate resulting in fluctuations in profit under the absorption costing technique due to the carry-over of fixed cost as part of stocks and under or over absorption of overheads. Under the technique of marginal costing, however, profit remains more or less constant since the same is not affected by variations in stocks.

Arguments in Support of Absorption Costing

As against the variable costing, some people may argue for the absorption costing which considers all costs to be inventoried.

The arguments in support of the absorption costing may be placed as follows:

a. The variable costing concentrates only on the sales revenue and the variable costs and ignores the fixed cost which is also to be recovered in the long run. The use of absorption costing, on the other hand, ensured that the fixed costs will be covered, by allocating fixed costs to a product.

However, this argument may not be correct. The absorption costing will not ensure the recovery of fixed cost if the actual sales volume is less than the estimated sales used to calculate the fixed overhead rate.

b. In case, the business shows seasonal sales pattern, the production may be built up during the slack season. If so, the operations will show losses during the period of production in the variable costing, and large profits will be shown in the periods when goods are sold.

On the other hand, in the absorption costing, the fixed overheads will be deferred by including in the closing stock valuation. Losses are therefore, unlikely to be reported in the period when stocks are being built up. In such a situation, the absorption costing appears to provide the more logical profit calculation.

Absorption Costing – Advantages

The main advantages of absorption costing are as under:

1. Separation of costs into fixed and variable components is not needed.

2. Analysis of over/under absorbed overheads reveals any inefficient use of production resources.

3. It conforms to the accrual concept by matching revenue with costs for a certain accounting period.

4. Valuation of stock complies with the accounting standards and fixed manufacturing costs are absorbed into stocks.

5. The apportionment and allocation of fixed manufacturing overheads to cost centres make executives more conscious about costs and services rendered.

6. Sales are equal to or more than the budgeted level of activity. It ensures that all costs are covered.

Some of the other advantages of absorption costing explained:

1. Based on Accrual Concepts –

It conforms to the accrual concept by matching revenue with costs for a certain accounting period.

2. More Consciousness about Costs and Services –

The apportionment and allocation of fixed manufacturing overheads to cost centres make executives more conscious about costs and services rendered.

3. Revelation of Inefficient Use of Production Resources –

Analysis of over/under absorbed overheads reveals any inefficient use of production resources.

4. Covering All Costs –

Sales are equal to or more than the budgeted level of activity. It ensures that all costs are covered.

5. No requirement of Separation of Costs –

Separation of costs into fixed and variable components is not needed.

6. Compliance With Accounting Standards –

Valuation of stock complies with the accounting standards and fixed manufacturing costs are absorbed into stocks.

Absorption Costing – Disadvantages

Following are the disadvantages of absorption costing:

1. Of little Use for Decision-making

Under absorption costing collection and presentation of cost data is not of much use for decision-making, the reason is the process of assigning product cost a reasonable share of fixed overhead obscures cost-volume-profit relationship.

2. Reduction in Practical Utility

This method employs highly arbitrary method of apportionment of overhead. This tends to bring reduction in the practical utility of cost data for control purposes.

3. Unsound Practice

Under absorption costing, fixed cost relating to closing stock is carried forward to the next year. In the same way, fixed cost relating to opening stock is charged to current year instead of previous year. Thus, under this method, all the fixed cost is not charged against the revenue of the year in which they are incurred. It is an unsound practice.

4. Costs not highlighted

Under absorption costing, behavioral pattern of costs is not highlighted. As such many situations, which can be utilized under marginal costing, are likely to unnoticed in absorption costing.

Absorption Costing – Limitations

1. Under absorption costing, a portion of the fixed cost relating to closing stock is carried forward to the subsequent period. This is an unsound practice as costs relating to a period should not be allowed to be vitiated by the inclusion of costs relating to the previous period, and vice versa.

2. Absorption costing is not generally suitable for decision making as conclusions made on its basis are often misleading.

3. Absorption costing depends on levels of output which vary from period to period. Hence, costs are vitiated due to fixed overhead. Fixed overhead rate must be based on normal capacity; otherwise such vitiated costs will not be helpful for purposes of control and comparison.

Some of the other limitations are as follows:

In spite of the fact that absorption costing is a widely used technique of product costing, and it has its own advantages, it suffers from the following limitations:

(i) Fixed costs accrue on a time basis. They are independent of production. While the volume of output may vary from period to period, fixed costs remain constant in total. As such, relating fixed costs with production will distort trading results and vitiate cost comparison.

(ii) Inclusion of fixed costs makes cost comparison difficult because of the fact that average fixed cost goes on decreasing with increase in the volume of production. At higher levels of output, when total fixed cost gets spread over the actual number of units produced, the resultant lower cost per unit makes cost comparison difficult.

(iii) Where fixed costs are indivisible, the apportionment of the same over cost units results in arbitrary allocation. The result is inaccurate product costs. Decision-making cannot be accomplished relying on inaccurate costs.

(iv) Absorption of fixed costs in inventories results not only in over-valuation of inventories but also in over-statement of profit.

(v) There is no justification for carrying over fixed cost of one period to a subsequent period as part of inventories. If carried over, there cannot be a proper matching of costs and revenue.

(vi) Since absorption costing does not distinguish between fixed and variable costs, it is not an aid to forecasting and preparing a flexible budget.

(vii) Absorption costing does not help fixation of price during a period of depression when prices of goods and services go on falling.

(viii) Profit under absorption costing is not a good measure of a concern’s profitability. As such, profitability comparison amongst different product lines cannot be made on a realistic basis.

Absorption Costing: Meaning, Ascertainment of Profit, Advantages and Disadvantages

In this article we will discuss about Absorption Costing:- 1. Meaning of Absorption Costing 2. Ascertainment of Profit under Absorption Costing 3. Advantages 4. Disadvantages.

Meaning of Absorption Costing:

Absorption costing also known as ‘full costing’ is a conventional technique of ascertaining cost. It is the practice of charging all costs both variable and fixed to operations, processes and products. It is the oldest and widely used technique of ascertaining cost. Under this technique of costing, cost is made up of direct costs plus overhead costs absorbed on some suitable basis.

Under this technique, cost per unit remains same only when the level of output remains same. But when the level of output changes the cost per unit also changes because of the presence of fixed cost which remains constant.

The change in cost per unit with a change in the level of output in absorption costing technique poses a problem to the management in taking managerial decisions. Absorption costing is useful if there is only one product, there is no inventory and overhead recovery rate is based on normal capacity instead of actual level of activity.

Two distinguishing features of absorption costing are that fixed factory expenses are included in:

(i) Unit cost and

(ii) Inventory value.

Ascertainment of Profit under Absorption Costing:

Under this technique of costing the following proforma is used for the ascertainment of profit:

Illustration 1:

Following data relate to XYZ Company:

Normal capacity 40,000 units per month

Variable cost per unit Rs.6

Actual production 44, 000 units.

Sales 40,000 units @ Rs.15 per unit.

Fixed manufacturing overheads Rs.1,00,000 per month or Rs.2.50 per unit at normal capacity.

Other fixed expenses Rs.2,40,000 per month. Prepare Income Statement under absorption costing.

Solution:

Advantages of Absorption Costing:

Following are the main advantages of absorption costing:

1. It suitably recognises the importance of including fixed manufacturing costs in product cost determination and framing a suitable pricing policy. In fact all costs (fixed and variable) related to production should be charged to units manufactured. Price based on absorption costing ensures that all costs are covered. Prices are well regulated where full cost is the basis.

2. It will show correct profit calculation in case where production is done to have sales in future (e.g., seasonal sales) as compared to variable costing.

3. It helps to conform with accrual and matching concepts which require matching cost with revenue for a particular period.

4. It has been recognised by various bodies as FASB (USA), ASG (UK), ASB (India) for the purpose of preparing external reports and for valuation of inventory.

5. It avoids the separation of costs into fixed and variable elements which cannot be done easily and accurately.

6. It discloses inefficient or efficient utilisation of production resources by indicating under-absorption or over-absorption of factory overheads.

7. It helps to make the managers more responsible for the costs and services provided to their centres/departments due to correct allocation and apportionment of fixed factory overheads.

8. It helps to calculate gross profit and net profit separately in income statement.

Disadvantages of Absorption Costing:

Following are the main limitations of absorption costing:

1. Difficulty in Comparison and Control of Cost:

Absorption costing is dependent on level of output; so different unit costs are obtained for different levels of output. An increase in the volume of output normally results in reduced unit cost and a reduction in output results in an increased cost per unit due to the existence of fixed expenses. This makes comparison and control of cost difficult.

2. Not Helpful in Managerial Decisions:

Absorption costing is not very helpful in taking managerial decisions such as selection of suitable product mix, whether to buy or manufacture, whether to accept the export order or not, choice of alternatives, the minimum price to be fixed during the depression, number of units to be sold to earn a desired profit etc.

3. Cost Vitiated because of Fixed Cost included in Inventory Valuation:

In absorption costing, a portion of fixed cost is carried forward to the next period because closing stock is valued at cost of production which is inclusive of fixed cost.

4. Fixed Cost Inclusion in Cost not Justified:

Many accountants argue that fixed manufacturing, administration and selling and distribution overheads are period costs and do not produce future benefits and, therefore, should not be included in the cost of product.

5. Apportionment of Fixed Overheads by Arbitrary Methods:

The validity of product costs under this technique depends on correct apportionment of overhead costs. But in practice many overhead costs are apportioned by using arbitrary methods which ultimately make the product costs inaccurate and unreliable.

6. Not Helpful for Preparation of Flexible Budget:

In absorption costing no distinction is made between fixed and variable costs. It is not possible to prepare a flexible budget without making this distinction.