In this article we will discuss about the break even chart:- 1. Meaning of Break Even Chart 2. Angle of Incidence at Break Even Point 3. Relationship between Angle of Incidence, Break-even Sales and Margin of Safety 4. Assumptions 5. Advantages 6. Limitations 7. Cash Break Even Chart.

Contents:

- Meaning of Break Even Chart

- Angle of Incidence at Break Even Point

- Relationship between Angle of Incidence, Break-even Sales and Margin of Safety

- Assumptions Underlying Break Even Chart

- Advantages of Break Even Charts

- Limitations of Break Even Chart

- Cash Break Even Chart

1. Meaning of Break Even Chart:

A break-even chart is a graphical representation of marginal costing. It is considered to be one of the most useful graphic presentations of accounting data. It is a readable reporting device that would otherwise require voluminous reports and tables to make the accounting data meaningful to the management.

ADVERTISEMENTS:

This chart shows the inter-relationship between cost, volume and profit. It shows the break-even point and also indicates the estimated cost and estimated profit or loss at various volumes of activity. There are three methods of drawing a break-even chart.

Illustration 1:

From the following data, calculate the breakeven point and profit if output is 50, 000 units by drawing a break even chart.

These have been explained with the help of the following illustration:

Solution:

First Method:

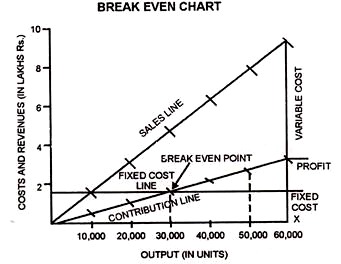

On the X-axis of the graph is plotted the number of units produced, sold and on the Y-axis are shown costs and sales revenues. The fixed cost line is drawn parallel to X-axis. This line indicates that fixed expenses remain the same with any volume of production. The variable costs for different levels of activity are plotted over the fixed cost line. The variable cost line is joined to fixed cost line at zero volume of production.

This line can also be regarded as the total cost line because it starts from the point where fixed cost has been incurred and variable cost is zero. Sales values at various levels of output are plotted joined and the resultant line is the sales lire.

ADVERTISEMENTS:

The sales line will cut the total cost line at a point where the total costs are equal to total revenues and this point of intersection ox’ two lines is known as breakeven point—the point of no profit no loss.

The number of units to be produced at the breakeven point is determined by drawing a perpendicular to the X-axis from the point of intersection and measuring the horizontal distance from the zero point to the point at which the perpendicular is drawn.

The sales value at breakeven point is determined by drawing a perpendicular to the Y-axis from the point of intersection and measuring the vertical distance from the zero point to the point at which the perpendicular is drawn.

Loss and profit are as have been shown in the charts which show that if production is less than the breakeven point, the business shall be running at a loss and if the production is more than the breakeven level, profit shall result.

Second Method:

A variation of the first method is that variable cost line is plotted first and then fixed cost line over the variable cost line. The latter line is the total cost line because it is drawn over the variable Cost line and represents the total cost (variable and fixed) at various levels of output.

This method is more helpful to the management for decision making because it shows the recovery of fixed costs at various levels of production before profits are realized. Contributions at various levels of production are automatically disclosed in the chart.

ADVERTISEMENTS:

Third Method:

Under this method, the fixed cost line is drawn parallel to the X-axis. The contribution line is drawn from the origin and this line goes up with the increase in output. The sales line is plotted as usual. The question of interaction of sales line with cost line does not arise because the total cost line is not drawn in this method.

In this method, breakeven point is that point where the contribution line cuts the fixed cost line. At this point, contribution is equal to fixed expenses and there is no profit no loss.

If the contribution is more than the fixed expenses, profit shall arise and if the contribution is loss than the fixed expenses, loss shall arise. In this example there is a profit of Rs.1, 00,000 when the output is 50,000 units. At this level of output, contribution is Rs.2,50,000 (i.e., 50,000 units @ Rs.5), and fixed cost is Rs.1,50,000, resulting in a profit of Rs.1,00,000, i.e., contribution minus fixed cost.

Arithmetical Verification:

2. Angle of Incidence at Break Even Point:

ADVERTISEMENTS:

This is the angle formed at the break-even point at which the sales line cuts the total cost line. This angle indicates rate at which profits are being made. Large angle of incidence is an indication that profits are being made at a high rate.

On the other hand, a small angle indicates a low rate of profit and suggests that variable costs from the major part of cost of production. A large angle of incidence with a high margin of safety indicates the most favourable position of a business and even the existence of monopoly conditions.

3. Relationship between Angle of Incidence, Break-even Sales and Margin of Safety:

When the break even sales are very low, with large angle of incidence, it indicates that the firm is enjoying business stability and in that case margin of safety sales will also be high.

When the break even sales are low, but not very low with moderate angle of incidence, in that case, though the business is stable, the profit earning rate is not very high as in earlier case.

ADVERTISEMENTS:

Contrary to above, when the break even sales are high, the angle of incidence will be narrow with much low margin of safety sales.

4. Assumptions Underlying Break Even Chart:

a. All costs can be separated into fixed and variable costs.

b. Fixed costs will remain constant and will not change with the change in level of output.

c. Variable costs will fluctuate in the same proportion in which the volume of output varies. In other words, prices of variable cost factors i.e., wage rates; price of material etc. will remain unchanged.

d. Selling price will remain constant even though there may be competition or change in volume of production.

e. The number of units produced and sold will be the same so that there is no opening or closing stock.

f. There will be no change in operating efficiency.

g. There is only one product or in the case of many products, product mix will remain unchanged.

h. Product specifications and methods of manufacturing and selling will not change.

5. Advantages of Break Even Charts:

a. Information provided by the break even chart can be understood by the management more easily than contained in the Profit and Loss Account and the Cost Statements because a break even chart is the simple presentation of cost, volume and profit structure of the company. It summarizes a great mass of detailed information in a graph in such a way that its significance may be grasped even with a cursory glance.

b. A break even chart is useful for studying the relationship of cost, volume and profit. The chart is very useful for taking managerial decisions because it shows the effect on profits of changes in fixed costs, variable costs, selling price and volume of sales.

c. The chart is very useful for forecasting costs and profits at various volumes of sales.

d. A break even chart is a tool for cost control because it shows the relative importance of the fixed costs and the variable costs.

e. Profitability of various products can be studied with the help of these charts and a most profitable product mix can be adopted. Profits at different levels of activity can also be ascertained.

f. The profit potentialities can be best judged from a study of the position of the break-even point and the angle of incidence in the break even chart. Low break-even point and large angle of incidence in the break even chart indicate that fixed costs are low and margin of safety is high. It is a sign of financial stability.

In such a case, some monopolistic conditions prevail and high profits are earned over a large range of production activity. Low break-even point and small angle of incidence show that fixed costs are low and margin of safety is high, but rate of profit is not high because of absence of monopolistic conditions. High break-even point and large angle of incidence show that fixed costs are high and margin of safety is low.

A small fall in volume may put the business into losses and a small increase in volume may give a high profit because of large angle of incidence. Last, high break-even point and small angle of incidence is the worst position because it indicates a low margin of safety and a low rate of profit.

g. It is helpful in the determination of sale price which would give desired profits or a B.E.P.

h. It is helpful in knowing the effect of increase or reduction in selling price.

6. Limitations of Break Even Chart:

a. A break even chart is based on a number of assumptions (discussed earlier) which may not hold good. Fixed costs vary beyond a certain level of output. Variable costs do not vary proportionately if the law of diminishing or increasing returns is applicable in the business.

Sales revenues do not vary proportionately with changes in volume of sales due to reduction in selling price as a result of competition or increased production.

In the break even chart, we have seen that the total cost line and the sales line look straight lines. This is possible only with a number of assumptions. But, in practice, the total cost line and the sales line are not straight lines because the assumptions do not hold good. Thus, there might be several break even points at different levels of activity.

b. A limited amount of information can be shown, in s break even chart. A number of charts will have to be drawn up to study the effects of changes in fixed costs, variable costs and selling prices.

c. The effect of various Product mixes on profits cannot be studied from a single break even chart.

d. A break-even chart does not take into consideration capital employed which is a very important factor in taking managerial decisions. Therefore, managerial decisions on the basis of break even chart may not be reliable.

In spite of the above limitations, the break even chart is a useful management device for analysing the problems, if it is constructed and used by those who fully understand its limitations.

Profit-Volume Graph:

Profit-volume graph is a simplified form of break even chart and is an improvement over the break even chart as it clearly shows the relationship of profit to volume or sales. This graph suffers from the same limitations with which break even chart suffer It is possible to construct a P/V graph for any data relating to a business from which a break even chart can be drawn.

Construction of this graph is relatively simple and the procedure of construction is as follows:

(1) A scale for sales on horizontal axis is selected and other scale for profits and fixed cost or loss on the vertical axis is selected. The area below the horizontal axis is the ‘loss area’ and that above it is the ‘profit area’.

(b) Points of profits of corresponding sales are plotted and joined. The resultant line is the profit/loss line.

Uses of P/V Graph:

(i) To determine break-even point.

(ii) To show impact on profits of selling profit at different prices for a product.

(iii) To forecast costs and profits resulting from changes in sales volume.

(iv) To show the deviations of actual profit from anticipated profit relative profitability under conditions of high or low demand.

Limitations of P/V Graph:

(i) It assumes that cost can be predicted at any level of activity and can be categorized into fixed and variable and their written behaviour at all levels, i.e., fixed costs always remain fixed and variable cost strictly vary with production.

(ii) Assume constant selling price and the same pattern of sales amount of different products.

(iii) Changes in inventory levels at the beginning and end will be insignificant.

(iv) It assumes the same level of technology and the same level of efficiency. All these mean our simplification of actual state of affairs and to that extent the conclusions drawn are affected.

7. Cash Break Even Chart:

While preparing cash break-even chart, only cash fixed costs are taken. Non-cash items like depreciation etc., are excluded from the fixed costs for computation of break-even point. Cash break-even chart depicts the level of output or sales at which the sales revenue will be equal to total cash outflow.

It is computed as under:

Hence for example suppose insurance has been paid on 1st January, 2007 till 31st December, 2009, then this fixed cost will not be considered as a cash fixed cost for the period 1st January, 2008 to 31st December, 2009.

Illustration 2:

Prepare a P/V graph from the following data:

Units produced 60,000; Selling price per unit Rs.15; Variable cost per unit Rs.10; Fixed costs Rs.1, 50,000.

Show the expected sales on the graph when the profit to be earned is Rs.87,500.

Solution:

Illustration 3:

Following figures relate to one year’s working at 100 per cent capacity level in a manufacturing business:—

Illustration 4:

Following figures have been taken from a manufacturing company:

It is proposed to increase the capacity by the acquisition of 30% additional space and plant. One result will be to increase fixed overheads by Rs 1, 00,000 per annum.

Plot the foregoing on a single break-even chart, and determine from the chart at what capacity utilization the same profit as before will be produced after the extensions have been made.

Solution:

Before we draw the break even chart, it is better to determine the costs and sales at various capacity levels as follows:

Arithmetical Verification:

Contribution = Sales – Variable Costs = Rs.12, 00,000 – Rs.6, 00,000 = Rs.6, 00,000. Therefore, contribution at 100% effective capacity (before extension) is Rs.6, 00,000. After extension, the fixed overheads increase by Rs.1,00,000 and amount to Rs.5,00,000 (Rs.4,00,000 + Rs.1,00,000).

To have the same profit of Rs.2,00,000, contribution should be : Rs.5,00,000 + Rs.2,00,000 (Fixed Expenses + Profit) = Rs.7,00,000. A Contribution of Rs.6, 00,000 is obtained from a capacity utilisation of 100%.

A contribution of Rs. 7,00,000 is obtained from a capacity utilisation of Rs.7,00,000 = 116⅔%.

Illustration 5:

You are given the following data for the year 2010 for a factory:

Draw a break even chart showing the break-even point.

How many units must be produced and sold if the selling price is reduced by 10% in order to give the same profit? Show by break even chart what will be the new break-even point?

Solution: