Here is a compilation of top twenty numerical problems on Cost Audit with their relevant solutions.

Cost Audit: Problem and Solution # 1:

The following information is available from the Financial Accounts of a company for the year ended 30th September, 1996:

The Statutory Cost accounts records reveal:

ADVERTISEMENTS:

Direct material………….. Rs. 5, 60, 000. Factory Overhead recovered @ 20% on Prime Cost. Adman. Overhead @ Rs. 6.00 per unit of production. Selling overhead @ Rs. 8 per unit sold.

Required:

(A) Costing Profit and Loss Account,

(B) Financial Profit and Loss Account, and

ADVERTISEMENTS:

(C) The Statement of Reconciliation between them.

Solution:

(A) Costing Profit and Loss Account:

(i) Work-in-Progress Account

(ii) Finished Goods Control Account

(iii) Cost of Sales Account:

(iv) Costing Profit and Loss Account:

(B) Financial Profit and Loss Account:

(C) Statement of Reconciliation:

Cost Audit: Problem and Solution # 2:

In a Steel Mill having Forging and Casting operations, a considerable quantum of Scrap arises. The Scrap so obtained is fit for own consumption, and the Mill does not dispose it of in the market. They recharge the Scrap arising’s into the production line along with Virgin Raw Materials, after subjecting the Scrap to reclaiming operations.

The cycle of operation is as follows:

As a Cost Auditor, you find that:

(a) The Mill adopts FIFO pricing for valuation of issues of Virgin Raw Materials including Reclaimed Scrap, and computes the values of the Scrap at the rates applicable for Virgin Raw Materials;

(b) The price of Virgin Raw Material fluctuates from period to period (as extracted below);

(c) The ratio of charge of Virgin Raw Materials to reclaimed Scrap in the production process is not constant;

ADVERTISEMENTS:

(d) The identification of Scrap arising from the particular charges is very difficult owing to complex production operations; and

(e) the segregation of stocks of old and new Scrap arising is not practically feasible due to the volume involved.

The cost records maintained by the Mill reveal the following information:

(a) Do you agree with the method of pricing followed for the issues of Scrap to the production? If not, what are your arguments?

(b) Suggest an equitable method and work out the rate for the valuation of Closing Stock of Scrap.

ADVERTISEMENTS:

Solution:

(a) Views:

The method of pricing (i.e., FIFO basis) followed by the Mill for the valuation of issues of Scrap at the rates applicable to the Virgin Raw Materials does not appear to be appropriate, in view of the limitations already noticed by the Cost Auditor.

The entire stock of Scrap at the 4th Quarter end should not be valued at Rs. 22,000 per tonne on the same FIFO method, since the identification and segregation of Scrap arising corresponding to Virgin Raw Materials charged are not possible. Moreover, this method would unnecessary inflate the closing inventory value of Scrap.

(b) Suggestion:

The closing stock of Scrap contains Scrap arising relating to opening stocks and subsequent purchases of raw materials as well as charges of opening Scraps and subsequent Scraps that arose in the course of production and reclamation. In the circumstances, an appropriate method to value the scrap should be ‘Periodical Weighted Average (Quarterly).

*The rate has not been revised since it relates to the period not covered by the cost audit order.

Cost Audit: Problem and Solution # 3:

M/s. Zenith Steel Tube Co. Ltd. manufactured three products, A, B and C during the year 1985-86.

From the cost records of the company, the following information is extracted:

(a) The total of material and labour costs per unit of each product was Rs. 20 only. .

(b) The company (for product costing) used an overhead rate of application of Rs. 2.00 per machine hour, based on the actual works overhead of Rs. 6, 00,000 and actual machine hours of 3, 00,000 as follows:

(c) Each of these products used the following number of machine hours at the process centres:

(d) There was no work-in-progress at the end of the year. There were 2,000, 4,000 and 2,000 Finished Units respectively of product A, B and C on hand.

(e) The company fixed the selling prices by adding 40 per cent to cover profit and selling and administrative expenses.

As a cost auditor of the company, you are required to give your observations and conclusions and illustrate the same with necessary workings.

Solution:

Workings:

1. Element of Overhead in Closing Stocks.

2. Effect on Selling Price: Company’s Overhead Rate Vs. Departmental Overhead Rate.

Observations and Conclusions:

The company has wrongly adopted a blanket rate of overhead absorption to the products irrespective of the fact that each product requires different processing time when it passes through the cost centres—4 Hi Mill, Annealing and ERW Mill. In doing so, there has been an over-valuation of closing inventory of Finished Units.

This resulted in the profit increase of Rs. 1,200. Again, the amount of works overhead having been equally charged to each of the products, the fixation of selling price was incorrect. It was a fact that all the three products, passed through all process centres, but different processing time clearly indicated that the quality or specification variations were definitely achieved in the products.

The selling price fixed by the company did not reflect this important factor. The company should, therefore, adopt the departmental rates of overhead absorption to the products.

Cost Audit: Problem and Solution # 4:

A Paper Mill has generator sets and produces its own power. During the year, the total costs for generating power amounted to Rs. 18,600 of which Rs. 5,000 was fixed cost. The following information is extracted from the cost records.

Production Depts.. Service Depts..

(i) Horse Power Hours P, P2 S, S2 used during the year. 16,000 26,000 14,000 12,000

(ii) Service department S, renders service to P1, P2 and S2 in the ratio of 13: 6: 1, while S, renders services to P, and P, in the ratio of 31: 3.

(iii) Total Power costs (after apportionment and re-apportionment) arrived at by the Mill for its Production Departments are: P1, — Rs. 10,033 and P2 — Rs. 8,567.

On further enquiry, you (as a cost auditor of the company) could know the following information:

Required:

(A) Do you agree with the power costs for P1 and P2 shown at (iii) above? If not, why not?

(B) Prepare a statement showing the revised power costs for P1 and P2.

Solution:

(A) Disagreement:

The power costs arrived at by the Paper Mill for its production departments appear to have been computed by apportioning the total costs of Rs. 18,600 among all the departments based on the ‘House Power Hours used’ at each department and then reapportioning the service departments’ costs to the production departments on the basis of the ratios given.

The power costs computation for the production departments [shown at (iii) above] are wrong as the Mill:

1. Ignored the ‘Power Costs Structure’ which is divided into two portions, Fixed Cost: Rs. 5,000 and Variable Cost: Rs. 13,600;

2. Overlooked the information of ‘annual horse power hours needed at capacity production’ for the departments; and

3. Did not distribute the Fixed Cost of Rs. 5,000 among the departments in proportion to horse power hours needed at capacity production.

(B) Revised Statement of Power Costs distribution:

Cost Audit: Problem and Solution # 5:

An engineering product (under cost audit order) passes through three production shops: Fabrication, Assembly and Finishing. The ‘rejects’, (which did not pass through the Finishing shop) at the end of the Assembly Shop were sold as ‘second’ qualities. The statutory cost accounting records for a typical period reveal the following data:

Quantities produced: Firsts—350 units, Seconds—140 units.

Total material cost: Rs. 7,350 (Fabrication Shop)

The works accounts section of the factory has, from the foregoing data, calculated the unit costs as follows:

Required:

(A) Do you, as a cost auditor, agree with the calculations made by the works accounts section?

(B) If not, explain with reasons and submit your revised calculations.

Solution:

(A) A cost auditor should agree with the following elements of unit cost, namely:

(1) Material Cost Per Unit = Rs. 7,350 + 490 = Rs. 15 for both qualities—Firsts and Seconds.

(2) Unit Labour Cost at Fabrication and Assembly

= (Rs. 14,700 + Rs. 19,600) + 490

= Rs. 34,300 + 490 = Rs. 70 for both qualities—Firsts and Seconds.

He cannot agree with the following elements of Unit Costs, namely:

(1) Unit Labour Cost at Finishing = Rs. 9,800 + 350 = Rs. 28, which is different from the figure by Rs. 20 calculated by the works accounts section.

(2) Overheads per Unit:

Therefore, total overheads for ‘Firsts’ = Rs. (42.50 + 24.50) = Rs. 67, which is different from the figure of Rs. 60 calculated by the Company’s accounts section.

The overheads per unit for ‘Seconds’-quality shown by the Company at Rs. 47 is also incorrect and the correct amount should be Rs. 42.50.

Thus the cost auditor cannot agree with the total unit costs calculated by the company.

(B) Explanatory Notes:

The Works Accounts Section of the Company has committed the following errors:

(a) Apportioned the labour cost of Finishing Shop wrongly over the entire production of 490 units both ‘Firsts’ and ‘Seconds’, though the ‘Seconds’ did not pass through this shop.

(b) Allocated the overheads wrongly @ 66% on labour—which is simply a percentage of total overheads to total labour. The allocation should have been done on the basis of the ‘production units’.

Cost Audit: Problem and Solution # 6:

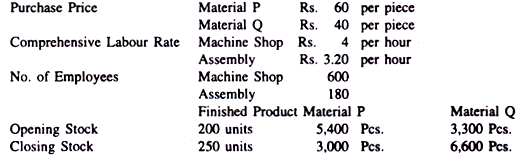

Apollo Pumps Ltd. manufactures and sells a single product. During the year, it earned a sales revenue of Rs. 126 lakhs based on a 20% profit on selling price. The product requires 30 pieces of material P and 15 pieces of material Q for manufacture as well as an operation time of 700 hours in the Machine Shop and 250 hours in the Assembly Section.

Overheads are absorbed at a blanket rate of 33⅓% on Direct Labour. The factory worked 5 days of 8 hours a week in a normal 52 weeks a year. The statutory holidays, leave and absenteeism and idle time amounted to 96 hours, 80 hours and 64 hours respectively, in the year.

The other details available from the Cost Records of the company are as under:

As a Cost auditor of the company, you are required to:

(a) Verify the number of units of the product manufactured (1,450 as per Ledger) and sold (1,400 as per Ledger).

(b) Verify the purchases made of Materials P (Rs. 24, 66,000) and Q (Rs. 10, 02,000) during the year as per Purchases Ledger.

(c) Compute the capacity utilisation of Machine Shop and Assembly Section and offer your comments.

Solution:

Cost Sheet of Apollo Pumps LTD.

(a) Verification of Manufacture and Sales:

(b) Verification of Materials Purchases:

(c) Capacity Utilisation:

Comments:

The Assembly section resorted to overtime work to catch up with the production as the workers are not inter-chargeable between the shops. This has affected the ‘profit’ of the company.

The company is advised to review the labour engagement planning from time to time with a view to reducing the incidence of unnecessary overtime and achieving labour utilisation as much as possible [the maximum attainable utilisation being [(10,15,000 + 3,62,500) + (11,04,000 + 3,31,200)] x 100 = 96%.

Cost Audit: Problem and Solution # 7:

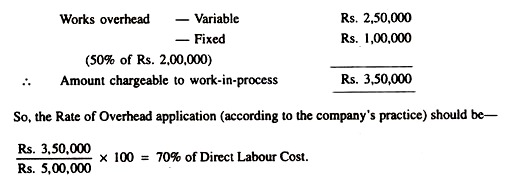

In a factory, the production department has worked at 50% of its normal capacity on account of shortages of skilled labour and raw materials during the year.

The cost records contain the following information among others:

The company charges the works overhead to work-in-process as a percentage of direct labour cost. Accordingly, its Accounts Officer claims that 90% should be charged; whereas you (as a cost auditor) claim that it should be much less than this.

A. Establish your claim with reasons, and

B. Give your opinion, if any.

Solution:

(A) Computations to establish claim:

This percentage should be charged to the work-in-process, the reason being that the department worked only 50% of its normal capacity and that the fixed overhead is to be absorbed on the basis of the capacity level attained.

B. Opinion:

The balance of the fixed works overhead (i.e., 50% of Rs. 2, 00,000 = Rs. 1, 00,000) amounting to Rs. 1, 00,000 represented the idle capacity cost and was therefore not a part of the manufacturing cost. It was a loss on account of non-functioning of the department to its normal capacity.

Cost Audit: Problem and Solution # 8:

The following Annexures with some of the information incorporated therein are placed before you:

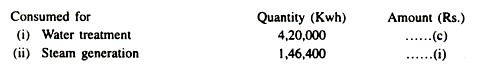

Annexure I: Cost Statement of Water treated and consumed:

In the Annexures above, the data against (a) to (o) are missing. You are required to fill in these blanks with appropriate data to be worked out from the information given.

Solution:

From the information given in the Cost Statements, we can tabulate the following data:

3) Solving the above equations, we get:

W = Rs. 1.20 per Kilo litre; S= Rs. 45 per M.T. and P = Re. 0.40 per Kwh.

... The data against the blanks are:

(a) = W = Rs. 1.20

(b) = P = Rs. 0.40

(c) = 4, 20,000P = 4, 20,000 x Rs. 0.40 = Rs. 1, 68,000.

(d) = Rs. 6, 72,000 + (c) = Rs. 8, 40,000.

(e) = 56.000W = 56,000 x Rs. 1.20 = Rs. 67,200

(f) = 1, 05, 000W = 1, 05,000 x Rs. 1.20 = Rs. 1, 26,000

(g) =S = Rs. 45.

(h) = P = Rs. 0.40

(i) = 1, 46,400P = 1, 46,400 x Rs. 0.40 = Rs. 58,560

(j) = Rs. 6, 84,240 + (e) + (i) = Rs. 8, 10,000

(k) = 10,000 x (g) = 10,000 x Rs. 45 = Rs. 4, 50,000

(1) = 8,000 x (g) = 8,000 x Rs. 45 = Rs. 3, 60,000

(m) = P = Rs. 0.40

(n) = 80,000 x (m) = 80,000 x Rs. 0.40 = Rs. 32,000

(o) = Rs. 5, 92,000 + (0 + (k) + (n) = Rs. 12, 00,000.

Cost Audit: Problem and Solution # 9:

From the information presented above, calculate:

(a) Year-wise labour productivity, and

(b) Labour productivity indices for the years Y2, and Y3 considering the year Y, as base year.

[You may use the following formula:

Labour Productivity = Volume of Output per annum

Average number of men employed

plus man-power equivalent of capital equipment

plus man-power equivalent of services received

plus man-power equivalent of raw materials used.]

Solution:

(a) Year-wise Labour Productivity.

Year Y1:

Man-power Equivalent of Capital Equipment (man years)

Capital Value of Plant/Average annual income per employee 5,000 = 25, 00,000/5,000 = 500 Man Years

Man-power equivalent for plant.

Man Years/Life of Plant (Years) = 500/10 = 50 Men

Man-power Equivalent of Services Received

Year Y2:

Man-power Equivalent for Plant = 50 men.

(From the year Y1)

Men-power Equivalent of Services received

Year Y3:

Man-power Equivalent (Man-years) of New Plant

(b) Year-wise Labour Productivity Indices:

Cost Audit: Problem and Solution # 10:

From the data given below, analyse the Gross Profit Variance by reasons.

Solution:

Calculations:

Cost Audit: Problem and Solution # 11:

Following are the sales and cost data of a manufacturing firm for two years:

Required:

(a) Prepare a Profit Variation Statement and

(b) Account for the cause-wise changes in profit.

Solution:

Profit Variation Statement (Rs. in lakh):

Note:

Net increases in sales and in expenses being equal, there has been no change in ‘net profit’ position.

(b) Statement of Changes in Profit (Cause-wise):

Cost Audit: Problem and Solution # 12:

Give below are the Cost and Sales details in respect of a company for two years:

During the year Y2 average prices or cost rates increased by: Material A—20%, Material B—15%, Labour—10%, Variable ever heads—5% and Fixed overheads—10% over the year Y1. Accordingly, the management increased the selling price of the product by 10% and also the volume of sales. Still then, the profit has declined.

Prepare a Profit Variance Statement, clearly determining the amounts for each of the factors responsible.

Solution:

Workings:

Cost Audit: Problem and Solution # 13:

The following are the cost data for the years X and Y extracted from the cost accounting records of Seamless Steel Tube Factory:

Solution:

Parawise Comments

1, 2 and 3–

No comments (in the absence of requisite data),

4. (Production):

(i) Production of Steel Tubes—1,500 tonnes;

(ii) Percentage of production to installed capacity—50 per cent;

(iii) Addition to production capacity during the year X—500 tonnes.

5. No comments.

6. (Raw Materials):

Cost of Steel Ingots (1,666.67 M.Ts) consumed = Rs. 36,66,674; Transport cost—not available; Consumption per unit of production in year Y—1.1111 tonnes; Standard rate of consumption—not available; Consumption per unit of production in year X—1.0870; Reason for variation—Finishing loss was more in year X; Cost of Steel ingots per tonne of tube = Rs. 2,444.42.

7. Power and Fuel:

Quantity, Rate per unit, Standard consumption per unit of production and of fuels used—details are not available; Total Cost of Power (variable)—Rs. 2,40,000 (in year Y) and Rs. 1,92,000 (in year X); Actual Cost per tonne of tube Rs. 160 and Rs. 200 in the years X and Y respectively.

8. Wages and Salaries:

Total—Rs. 18, 00,000 (in year Y) and Rs. 15, 00,000 (in year X); Separate information in respect of : direct labour costs and indirect employee costs on production, employee costs on administration/ selling/distribution; direct labour man-days (available and actually worked), average number of workmen employed and production incentive schemes are not available, and therefore, direct labour cost per unit of output cannot be computed and commented upon.

9. Stores and Spares:

Cost per unit of output—Rs. 30 (variable) and Rs. 20 (fixed) in year Y as against Rs. 24 and Rs. 16. respectively in year X; The details of closing inventory are not furnished and therefore, cannot be commented upon.

10. Depreciation:

Total amount charged in year Y—Rs. 7, 50,000; The information regarding the rate and method adopted, etc., is not available.

11. Overheads:

The basis of allocation of various overheads to cost centres, and of absorption to products, and the information on; interest, bonus to employees, commission to managerial personnel have not been furnished.

Year-wise amounts of overheads are:

13. No comments in absence of any data.

14. Observation:

(a) Labour costs directly related to the production and services departments have not been segregated. Depreciation chargeable to different departments and to various qualities of products has not been separately determined owing to non-maintenance of Asset records.

The maintenance of cost accounting records was improper as they do not facilitate classification and allocation of various items of costs. Quite a number of Cost Statements (Proformae No. …) could not be properly drawn up by the management as laid down in the Cost Accounting Records (Steel Pipes and Tubes) Rules, 1984.

(b) No. comments.

(c) No. comments

(d) No. comments

(e) The system of budgetary control is being contemplated by the company for the next year onwards—So, no comments. The scope and performance of internal audit department should be extended to the examination of statutory cost records also.

(f) The system of cost control is not satisfactory, as the standards of yield and wastages at various operations of production have not yet been developed apart from cost standards. The company should concentrate its cost reduction efforts specially on the areas of: material productivity, labour productivity inventory classification (fast-slow-non-moving) and capacity utilisation planning.

Cost Audit: Problem and Solution # 14:

From the following information in respect of concern manufacturing cement, offer your comments on the performance and suggestions for improvement:

Utilisation and performance of Grinding Mill of a cement factory (Rated Capacity 80 MT/hr.)

Solution:

(a) Rated Capacity of Grinding Mill = 80 M.T. per hour.

Rated capacity achieved in 1983 = 72/80 x 100 = 90%

(Hourly production rate being 72 M.T.)

Rated capacity achieved in 1984 = 64/80 x 100 = 80%

(Hourly production rate being 64 M.T)

(b) Capacity Utilisation:

It has considerably gone down to 61.84% in 1984 as against 81.99% in the year 1983. The above under-utilisation of capacity to the extent of about 20% can be attributable mainly to the increased total stoppage hours of 4,919 in the year 1984 against 4,205 in the year 1983. The net increase of 714 total stoppage hours is again due to increase of breakdown hours by 1,155 (2,164-1,009) in the year 1984 over 1983.

From the data available it can be concluded that in the year 1984:

and the shortfall on account of lack of orders amounted to 784 hours in the year 1984 which is 114 hours in excess than that in the year 1983.

The management, in view of the above position, is advised to:

(i) Augment its planned maintenance with a view to reducing breakdown,

(ii) Install generator sets in order to compensate the hours lost due to power restriction, and

(iii) Strengthen marketing net-work.

Cost Audit: Problem and Solution # 15:

The escalation clause of a long-term contract stipulates the following quantities and rates of materials of A, B and C and following number of labour hours of X, Y and Z and their rates of pay.

The actual are shown below:

Compute the amount of the final claim so far as rate is concerned.

Solution:

The final claim should be computed:

(i) With reference to the actual rates of materials and labour, and

(ii) With reference to the quantities of materials and hours of labour specified in the long-term contract.

Cost Audit: Problem and Solution # 16:

An Airline Company’s budget and actuals for the Quarter January to March are as under:

The following further details are available:

(a) There was a 9% decrease in air fare resulting in a 5% decrease in the income for the quarter.

(b) Variable Cost like fuel, wages, catering, etc. are increased by 10% over the budget.

Prepare an analysis reconciling the budgeted and actual profits for the quarter.

Solution:

Reconciliation between the budgeted and actual profits for the quarter January to March:

Cost Audit: Problem and Solution # 17:

The Trading Results of Messrs. All found Ltd. for the year 1983 and 1984 were as follows:

Material Prices and wage rates were increased in 1984 by 10% and sale prices were increased by 10%. You are the Management Accountant of the Company. The Managing Director of the Company requests you to prepare a statement showing how much each factor had contributed to the variations of Profit.

Solution:

N. B.: The trading results of 1984 shows an improvement of Net Profit over 1983 = Rs. (17,000 – 8,000) = Rs. 9,000. F = Favourable, A = Adverse.

Cost Audit: Problem and Solution # 18:

A manufacturer of a certain product has been exclusively in the Indian Market up to now. He has just received his first export enquiry and wants to quote as competitively as the circumstances will allow.

His latest Indian cost sheet is:

Management is thinking of quoting a selling price somewhere between Rs. 69 and Rs. 75 per unit for this export order. One of the Directors suggests quoting an even down Price based on the Principles of Marginal Costing.

As the firm’s Management Accountant, you are requested to compute the lowest the management could quote on these Principles. State clearly any assumptions that you may make on the above facts, and also any other costs or facts.

Solution:

(a) Assumptions :

Let us consider the following facts:

(i) Service’ Cost—60% variable and the Fixed portion of cost amounts to Rs. 6,400.

(ii) Works Overhead—60% variable and the Fixed Works Overhead amounts to Rs. 6,400.

(iii) Office Overhead—100% Fixed and amounts to Rs. 3,200 (@ Rs. 2 per unit for a Sales Volume of 1,600 units in the Indian Market). To meet the export order, it is estimated that the manufacturer would incur Rs. 800 additionally on this account.

(iv) The export enquiry is for 300 units.

(v) Existing plant capacities and facilities are sufficient to meet the demands in the Indian Market, including the export order, and no further investments of capital nature are needed.

(vi) The latest Indian Cost Sheet relates to the sales volume of 1,600 units per annum.

(vii) The present manufacturing capacity is limited to 2,500 units annually.

(b) Export Price Fixation based on Marginal Costing Principles:

The Management may quote the export price @ Rs. 59 per unit as the lowest if the circumstances permit to bear the extra office overhead of Rs. 800.

Cost Audit: Problem and Solution # 19:

Machine Tool manufacturers Ltd. have received an enquiry for the supply of 2, 00,000 numbers of special types of machine parts. Capacity exists for the manufacture of the machine parts but a fixed investment of Rs. 80,000 and working capital to the extent of 25% of sales value will be required if the job is undertaken.

The costs are estimated as follows:

Raw material—20,000 Kgs. @ Rs. 2.30 per kg. Labour hours Direct 18,000 of which 2,000 would be overtime hours payable at double the labour rate. Labour rate—Re. 1 per hour. Factory overhead—Re. 1 per Direct Labour hour.

Selling and Distribution expenses Rs. 23,000. Material recovered at the end of the operation is estimated at Rs. 2,000. The company expects a net return of 25% on capital employed. You are the Management Accountant of the Company. The Managing Director requests you to prepare a Cost and Price Statement indicating the price which should be quoted to the customer.

Solution:

The selling price, in the given problem, has to be determined on the basis of cost plus an expected rate of return on capital employed in financing the production and sale.

Therefore, the following formula should be used:

P = (C + Fx)/N (1-Wx) , where P = Selling price per unit.

C = Total cost (Material Cost + Labour Cost + Factory Overhead + Selling and Distribution Cost)

F = Fixed capital invested,

x = Expected rate of return on capital employed.

W = Working capital expressed as a percentage of Sales value.

N = No. of units of Sales.

From the data given and the total costs computed above, we get:

P= (1, 05,000 + 80,000 x 0.25)/2, 00,000(1 – 0.25 x 0.25)

= 0.625/1-0.625 = 0.625/0.9675=0.667

Selling Price per unit works out to Re. 0.667 or Rs. 2 for 3 pieces.

Cost Audit: Problem and Solution # 20:

An ancillary industry has received an order from a large industry for the manufacture of one lakh components (@ Rs. 600 for 1,000 numbers) for which there is a rising demand. The raw materials required are mild steel strips and spring steel strips which will be drawn in press for making components by using tools and dies.

Calculate the estimated cost of production and margin of profit, if any from the following data and submit your recommendations as to whether the order should be accepted or not.

(i) 0.30 M. Tonne and 0.20 M. Tonne of mild steel strip and spring steel strip respectively are required to complete the order. These strips are available in the form of coils.

(ii) Raw material

(a) Mild steel (i) Rs. 2,100 per M. Tonne if purchased in quantities of more than one M. Tonne (ii) Rs. 2,200 per M. Tonne if purchased in quantities of less than one M. Tonne.

(b) Spring Steel (i) Rs. 4,200 per M. Tonne if purchased in quantities of more than one M. Tonne, (ii) 4,500 per M. Tonne if purchased in quantities of less than one M. Tonne.

(iii) Manufacturing period 2 months for one lakh nos. of component.

(iv) Wages—Rs. 4,500 per month.

(v) Capital cost of existing press (capacity exists). (Assume depreciation at 10 per cent per annum)—Rs. 1.20 lakhs.

(vi) Additional special equipment’s required—Rs. 2,000 (Depreciation 10% per annum).

(vii) Estimated cost of manufacture of special tools and dies Rs. 30,000 (life is estimated to cover manufacture of one million components).

(viii) Recurring expenses for grinding of tools and dies to complete the order—Rs. 1,000.

(ix) Cleaning and phosphating cost—5 paise for each component.

(x) Supervision and other overhead expenses of the shop—Rs. 1,000 per month.

(xi) Share of other Service and Administrative Section—Rs. 1,500 per month.

(xii) Selling and Distribution expenses—5 per cent of the total costs.

(xiii) Provision of rejection by customer—10%.

Solution:

Statement showing the Job Order Production Cost and Profit Margin:

Calculations:

Notes:

4. Rs. 2,000 shown against Addl. special equipment’s has been considered as depreciation per annum.

Recommendations:

The order should be accepted in view of the following:

1. The gross margin is good to absorb the fixed burden of cost.

2. The existing capacity of the press permits.

3. There is a possibility of the continuity of orders as there is a rising demand for the components with the customer.

4. Additional special equipment required to execute the order will have spare capacities even after the completion of this order.

5. The life of special tools and dies to be made is estimated to cover manufacture of one million components.

6. Repeat orders will assist the management to take advantage of the reduced purchase prices in respect of raw materials—which will bring down the production cost further, thereby increasing the margin of profit.