The labour remuneration plans are broadly classified into three categories. They are: 1. Time Rate Plans 2. Piece Rate Plans 3. Group Bonus Plans

1. Time Rate Plans:

In time based wage payment plans, standard time is predetermined and the efficiency of each individual worker is assessed to compensate them for higher efficiency in work as compared to standard time set.

These plans can be suitably applied in the following circumstances:

(1) Where the output of an individual worker cannot be measured reasonably.

ADVERTISEMENTS:

(2) Where the work is required to be closely supervised.

(3) Where the quality of work is more important.

(4) Where output of an individual worker is not in his control.

(5) Where increase in output is negligible compares to the incentive.

ADVERTISEMENTS:

Advantages:

The advantages of time rate remuneration plans are as follows:

(a) It is commonly recognized by all trade unions as well as workers.

(b) It is a guaranteed income assured to the workers.

ADVERTISEMENTS:

(c) It is very easy to understand and simple to calculate the earnings of workers.

(d) It involves less clerical work and detailed records are not necessary.

(e) Since the production is not the criteria for calculation of wages, tools and materials are handled carefully. Wastage is also minimized.

Disadvantages:

ADVERTISEMENTS:

The time rate remuneration plans suffer from the following drawbacks:

(a) Labour cost may rise due to decrease in productivity, thereby decreasing profit.

(b) Production may decrease thus upsetting production schedules, create production bottlenecks and increase cost of production per unit.

(c) It may lead to create idle time.

ADVERTISEMENTS:

(d) The payment is not linked to production, this system encourages inefficiency.

(e) It does not encourage initiative.

(f) Standards for labour are difficult to set.

(g) It requires close supervision resulting in increase in supervision costs.

ADVERTISEMENTS:

(h) Labour cost cannot be accurately estimated for the purpose of cost estimations and quotations.

Flat Time Rate Plan:

Under this plan, the worker is paid on hourly, daily or weekly wage rate and his remuneration is based on the time spent for production and wages are calculated as follows:

Wages = Hours worked x Hourly wage rate

ADVERTISEMENTS:

For example, if the hourly rate is Rs. 12 and a worker has worked 42 hours in a week, his weekly wages are:

Wages = 42 hours x Rs. 12 per hour = Rs. 504

In an organization where quality is given priority or if it is difficult to measure the production on time basis, this plan is more appropriate. But this will not give consideration to hard, sincere and skillful work.

High Day Rate Plan:

Under this plan, employees are paid a high hourly wage rate than the rate paid at different organizations in the industry or region expecting that the workers will work more efficiently. To implement this plan, the efficient, skilled and experienced workers are selected expecting an efficient and hard work from them in expectation of that the organization will pay wages at higher rates than prevailing in the industry.

Wages = Hours worked x High day rate

ADVERTISEMENTS:

For example, the normal wage rate prevailing in the other similar companies is Rs. 12 per hour, x Ltd. has adopted high day rate of Rs. 15 per hour.

A worker who worked for 42 hours in a week will be paid as under:

Wages = 42 hours x Rs. 15 = Rs. 630

The supervision cost will reduce under this method and there will be reduction in overall labour cost per unit. The main drawback is that there is no guarantee that high day rate system will act as an incentive. The high wages may become the accepted level of pay for normal working and supervision may be necessary to ensure increased productivity and units cost would rise.

Another disadvantage is that the workers will get only fixed hourly rate for their effort and it will not act as an individual incentive for extracting efficient and more output from him. Sometimes, this wage plan is used as an incentive to achieve present targets and problem arises if the anticipated production targets are not achieved.

Plan with Different Time Rates:

Under this plan, different time rates are fixed for different efficiencies and skills. Normal wages are paid upto the level of standard efficiency and increase in efficiency, will be paid at graduated scale of payment.

For example, wages are paid according to skills of the workers as given below:

This plan of wage payment is also not popular due to its complication in computation of earnings.

Halsey Premium Bonus Plan:

F.A. Halsey, an American engineer has suggested this wage incentive plan in the year 1891.

The basic features of Halsey premium bonus plan are as follows:

(a) For each unit or job, a standard time is determined.

(b) Time rate is guaranteed for the worker.

(c) When the worker completes the job or operation in less time than allowed time (standard time), he is paid 50% of time saved as bonus.

(d) The employer will gain for remaining 50% of time saved by the worker.

(e) If the job is completed in more than the standard time, wages for standard time are guaranteed.

The major drawback of the system is that employer is not protected against over-speeding jobs by workers resulting in waste.

Total wages = (Time taken x Hourly rate) + [50/100 x Time saved x hourly rate]

Illustration 1:

A worker is allowed 60 hours time for completion of the job and the hourly rate is Rs. 4. The actual time taken by the worker is 40 hours.

Calculate the wages of worker under Halsey plan.

Solution:

Time saved = Time allowed – Time taken = 60 hrs. – 40 hrs. = 20 hours

Total wages = (40 hrs. x Rs. 4) + [50/100 (20 hrs. x Rs.4] = Rs. 160 + Rs. 40 = Rs. 200

Rowan Premium Bonus Plan:

James Rowan in Glasgow introduced this wage incentive scheme in the year 1898. This scheme is a modification of Halsey plan as regards payment of premium.

The basic features of Rowan plan are as follows:

(a) For each unit or job, a standard time is ascertained.

(b) Time rate is guaranteed for the worker.

(c) Bonus is paid upon the time saved calculated as a proportion of time taken to the time allowed (standard time).

(d) The employer shares the benefit of increased output. It protects the employer against loose rate setting.

Illustration 2:

In continuation of the illustration given under Halsey plan, calculate the total wages of worker under Rowan plan.

Comparison of Halsey and Rowan Plans:

From the view point of worker:

The Halsey scheme is better than Rowan scheme for the following reasons

(a) Where the worker completes his work just half the time allowed; the bonus under both the plans will be same.

(b) If time saved is less than 50% of time allowed, the Rowan plan is beneficial for the worker.

(c) If time saved is more than 50% of the standard time, the Halsey plan is advantageous to the worker.

From the view point of Employer:

The Rowan scheme is better than Halsey scheme for the following reasons:

(a) The bonus is set at 50% of time saved in Halsey scheme. It will not serve as a strong incentive. If workers over-speed, the quality of the products deteriorates.

(b) There is an automatic check on the earning and thus over-speeding is arrested under Rowan scheme. In Halsey scheme if two thirds of time is saved, the worker can double his earnings per hour. But in Rowan scheme, it is not possible.

(c) The earnings per hour is higher up to 50% of time saved and falls thereafter under Rowan scheme. But in Halsey scheme the earnings per hour increases at a slow speed and can be doubled.

Halsey-Wair Plan:

This is a modified plan of Halsey premium bonus plan. This plan is also called as 33⅓% – 66⅔% sharing plan. According to this plan, 33⅓% of the time saved will be paid to the worker as bonus and the remaining 66 ⅔ % is shared by the employer.

Illustration 3:

A worker is allowed to complete a job in 80 hours with an hourly rate of Rs. 6. The time spent by the worker is 60 hours.

Calculate the earnings of a worker under Halsey-Wair plan.

Solution:

Standard time 80 hours; Time taken 60 hours; Time saved 20 hours; Hourly rate Rs. 6

Accelerated Premium Bonus Plan:

Under accelerated premium plan, the rate of bonus payable to the workers will increase along with increase in efficiency. The skilled workers are highly encouraged under this plan.

Emerson’s Efficiency Bonus Plan:

This plan is also called as ‘Emerson’s Empirical Plan. It provides for guaranteed time wages to the worker and the bonus is paid according to the efficiency of the worker.

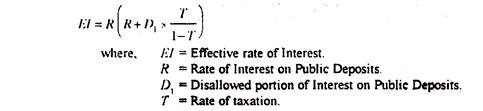

The formula for calculation of earnings of a worker is given below:

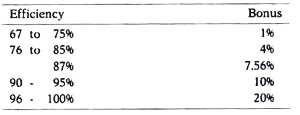

Emerson used 32 different steps. The step bonus rates are as follows:

Under Emerson’s plan, 100% efficiency is considered as standard. The efficiency percentage is calculated as follows:

(i) If time is considered

Efficiency (%) =-Standard time/Time taken x 100

(ii) If output is considered

Efficiency (%) = Actual output/Standard output x 100

This plan is not popular due to complications in calculation of bonus and it is not easily understandable to workers.

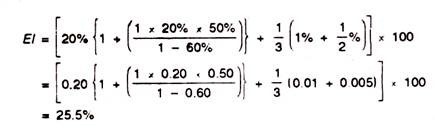

Illustration 4:

A worker was given a job for completion in 100 hours on an hourly rate of Rs. 8. The actual time taken for completion of the job is 80 hours.

Calculate the earnings of a worker under Emerson’s efficiency plan.

Solution:

Standard time = 100 hours Time taken = 80 hours Hourly rate = Rs. 8

Illustration 5:

From the following information, calculate the earnings of a worker under Emerson efficiency bonus plan: Standard output in 8 hours is 150 units, Actual output in 8 hours is 135 units, Hourly rate is Rs. 6.

Solution:

Since the efficiency of the worker is falling between 66V3 to 100% efficiency, hence the worker is entitled to 10% bonus over basic wages under Emerson’s efficiency bonus plan. (Rs ).

Barth Variable Bonus Plan:

This plan is also called as ‘variable sharing plan’. Under this plan the earnings of a worker is calculated by multiplying the hourly rate of pay with square root of the product of standard time and time taken.

This plan is difficult to understand by the workers and hence it is not popular. This plan may specially be used for trainees, beginners, apprentices and unskilled workers. The main disadvantage of this plan is that total wages is higher for less efficient people. As the efficiency increases, the earnings of a worker decrease. This plan discourages the efficient workers.

Illustration 6:

The standard time set for completion of job is 12 hours and the time taken by three workers are as follows: A – 15 hours, B – 12 hours, C – 8 hours. The hourly rate of wage Rs. 5. Compute the earnings of a worker under Barth variable bonus plan.

Solution:

Calculation of Effective Earnings per hour

A = Rs. 67.08/15 hrs. = Rs. 4.47 p.h.

B = Rs. 60.00/12 hrs. = Rs. 5.00 p.h.

C = Rs. 48.99/8 hrs. = Rs. 6.12 p.h.

Bedaux Points Plan:

Under this plan, the standard time is fixed for completion of the job and each minute of time is called ‘bedaux point’. Time wages are paid up to 100% efficiency and bonus is paid on the basis of number of bedaux points saved. A worker gets a bonus which is equal to 75% of bedaux points saved and 25% is either retained by the employer or paid to foremen and indirect workers. Under this plan, time wages are guaranteed.

The formula is given below:

Wages = Time taken x Hourly rate

Bonus = 75/100 x Bedaux points saved x Point rate

Illustration 7:

A worker is given job for completion in 10 hours and actual time taken for completion of it is 8 hours. The hourly rate fixed is Rs. 6. Each minute of time is considered as a Bedaux point.

Calculate the earnings of a worker under Bedaux plan.

Solution:

Gnatt’s Task Bonus Plan:

This plan is a combination of both time and piece wage systems. Day wages are guaranteed under this plan. Standard time is set for a job or task and the worker’s efficiency is ascertained by comparing the actual performance with the standard set.

The formula is given below:

2. Piece Rate Remuneration Plans:

Under piece rate plans of wage payment, the worker’s efficiency is measured in terms of production against standards set. A worker who produces more units than standard set for him is eligible for bonus in piece rate wage payment plans.

Merits:

(a) Employee morale is more due to higher earnings.

(b) Increased production result in decrease in cost of production per unit.

(c) It is possible to set accurate labour standards.

(d) A task is done in the most economical manner which reduces labour cost.

(e) Less supervision is required resulting less cost of supervision.

(f) Productivity of the organization will increase.

(g) Labour cost can be accurately estimated.

(h) Optimum utilization of resources is possible.

Demerits:

(a) Quality may deteriorate in order to increase the production quantity to earn more.

(b) Safety conditions may be violated by the workers in order to increase production which may lead to accidents at work place.

(c) There may be apprehensions regarding rate cutting.

(d) Unskilled workers sometimes earn more than skilled workers if the latter have to work on time basis.

(e) If rates are not uniform for same type of jobs, it causes discontent among workers.

(f) It involves more calculations and detailed production records are to be maintained.

(g) The worker’s health may be affected due to overstrain taken by the workers to earn more wages.

(h) Inefficient workers may envy the efficient ones which may cause unrest.

Straight Piece Rate Plan:

Under this plan, a fixed wages rate is paid for each unit of production, job completed or number of operations completed irrespective of the time spent on it.

The wages are calculated as follows:

Wages = No. of pieces produced x Rate per piece

This plan is used where the production is repetitive in nature and it cannot be applied to the work which require skill and artistic work. The workers’ pay depends upon his output and not upon the time he spends in the factory. The supervision cost is reduced as workers are paid depending on their actual units produced.

This plan will act as an incentive to efficient workers and act as disincentive to inefficient workers. The main disadvantage is that the production may need to be thoroughly inspected for its quality.

The stoppage of work due to abnormal causes like machine breakdown, power failure, shortage of power etc. may cause the workers to loose their wages, and they feel insecure under this method of wage payment. The spoilage, defective and wastage of materials is more, if this wage plan is adopted, due to reckless use to achieve higher output.

Piece Rate with Guaranteed Time Rate Plan:

Under this plan, the employee is assured of agreed level of wages for the specified level of performance. The wage rate consists of two components.

The first component is of fixed nature depending on the time spent the wages are paid and the other part is variable in nature linked to merit rating and cost of living. The main disadvantage in this method is that it is more complicated in computation of wages and it is not popular.

Differential Piece Rate Plan:

Under this plan, an incentive is offered to workers to increase their output by paying higher rates for increased levels of production. Under the straight piece rate system, the time factor is not taken into consideration but under differential piece rate plan, a series of production targets will be established and as each target is reached a new piece work rate will apply.

In this plan the fast doing skilled workers can able to reach higher levels of targets and will be compensated at higher piece rates. The extra rates of pay can act as an inducement to the employee to aim for higher productivity to increase their earnings by putting more efforts. Differential piece work plan is normally accompanied by the guaranteed day rates.

Illustration 8:

ABC Ltd. is following the differential piece rate plan, under which the following piece rates are determined at various output levels:

The production details of three workers are under:

A = 38 units

B = 65 units

C = 85 units

Calculate the earnings of workers.

Solution:

Calculation of Earnings

A = 38 units x Rs. 3.00 p.u.= Rs. 114.00

B = 65 units x Rs. 4.00 p.u.= Rs. 260.00

C = 85 units x Rs. 4.50 p.u.= Rs. 382.50

Taylor’s Differential Piece Rate Plan:

In this plan, the inefficient workers are penalized by paying him low piece rate and rewarding the efficient worker by paying him a high piece rate for his higher production. Minimum wages are not guaranteed under this plan.

Formula:

(i) 80% of Normal piece rate when below standard (low piece rate).

(ii) 120% of Normal piece rate when at or above standard (high piece rate).

This plan penalizes not only those workers that are not only below the standard but even those whose output is just below the standard output.

Illustration 9:

With the help of the following information, you are required to ascertain the wages paid to workers X and Y under the Taylor’s plan:

Standard time allowed = 10 units per hour

Normal wage rate = Re. 1 per hour

Differential rates to be applied:

(a) 75% of piece rate when below standard

(b) 125% of piece rate when at or above standard

The workers have produced in a day of 8 hours as follows: X – 60 units, Y – 100 units.

Solution:

Merrick’s Differential Piece Rate Plan:

It is also called as ‘Merrick’s multiple piece rate plan’. Under this plan three piece rates are used unlike the Taylor’s differential piece rate plan which consist of only two piece rates. This plan is an improvement of the Taylor’s plan by eliminating its disadvantages.

3. Group Bonus Plans:

In time rate plans and piece rate plans, the efficiency of each individual worker is considered for wages and bonus calculations. But under group bonus plans, different groups of workers are identified and the task is given to the group and the efficiency of the whole group, instead of each individual worker, is determined for computation of bonus and earnings. The bonus is distributed among the workers belonging to the particular group on predetermined basis.

Applicability of Group Bonus Plans:

The group incentive plans can be successfully implemented where:

(1) Output depends on team work and joint efforts of group of workers.

(2) It is difficult to measure the individual result rather than the group’s result.

(3) It is necessary to work as a member of a team rather than on individual basis, for example in chemical process industry, an individual worker cannot influence the production of the plant.

(4) Both direct and indirect workers need to be compensated equally.

(5) It is possible to create small work units/groups to set the standards to production and costs.

(6) Skill of the workers in the group does not vary widely. Advantages and Disadvantages

Advantages:

(a) Increase in production and saving in cost of production can be achieved.

(b) Supervision costs will be reduced substantially.

(c) The quality of work is improved.

(d) Absenteeism is reduced to minimum and creates interest in work among the workers.

(e) Routing and scheduling problems are eliminated.

(f) It creates team spirit and collective interest in the work.

(g) Minimizes waste and reduces cost per unit.

(h) Clerical work in calculation of bonus is reduced.

Disadvantages:

(a) Individual skills and efficiency are not considered in these systems.

(b) Difficulty may arise in calculation of bonus and method of its distribution to all the workers in the group.

(c) The bonus is paid on group efforts, an individual worker may not put his maximum effort in view of equal sharing of bonus by inefficient workers.

(d) An inefficient group leader may cause the entire group to suffer.

Some of the group bonus plans are given below:

Priestman’s Production Bonus Plan:

Under this plan, the standard output and standard time for each department is predetermined in consultation with the workers. Bonus is payable to the department when the actual production exceeds the standard production. The bonus is calculated as a percentage on such excess production and distributed to all employees in that particular department by increasing their normal wages by the same percentage the actual production increased over the standard.

For example, the standard set for a particular division is 10,000 units and actual production achieved is 12,000 units. There is excess production of 20% over the standard output. The employees in that particular division are eligible for 20% increase in their normal salaries as bonus. In this system the time wages are guaranteed if actual production of the particular division, department, group is less than the standard output.

This method not only applicable for excess of actual production over the standard but also saving in material and labour costs is also considered for payment of bonus. The main drawback in this system is the efficiency of individual worker is not considered and inefficient workers can also claim for bonus in this system.

Cost Efficiency Bonus Plan:

In this plan, the standard cost for a particular period is determined and an agreed portion of saving in actual cost over the standard is distributed among the workers as bonus. This plan is used for improvement in efficiency of workers, increase in production and to reduce costs.

Rucker’s Plan:

It is also called as share of production plan. Under this plan, the workers will get a fixed percentage of ‘value added’. Value added is defined as “the increase in market value resulting from an alteration in the form, location or availability of a product or service excluded the cost of goods and services purchased from outside.” This plan suggests the payment of bonus on the basis of reduction in the ratio between labour earnings and added value.

Nunn-Bush Plan:

Under this plan, the direct labour cost is fixed and expressed as a percentage of the sales value and any saving in labour cost is credited to a fund account and is distributed among the workers on a method suitable to the work environment.

Towne Gain Sharing Plan:

In this plan, the standard cost of production is determined and saving in cost is calculated as difference between the standard cost and actual cost. In addition to the normal wages, 50% of the saving in cost is paid as bonus to workers and supervisors in proportion to their normal earnings.

Profit Sharing Plan:

It refers to the payment of bonus to employees based on profits of the company. Generally, the companies have profit sharing schemes in which employees will receive a bonus related to the profits of the firm. The main objective of this scheme is to provide an incentive for the workforce as a whole to work collectively to improve the overall results of the organization.

The advantages of profit sharing plan are as follows:

(a) Every worker in the organization contributes towards profit irrespective of their skills and efficiency.

(b) Better employer-employee relationship is established under this plan.

(c) A share of profit, capital and control of the management given to employees creates a sense of belonging to the company and the workers contribute to the welfare of the company and wastage is minimized.

(d) Direct relationship between profits and bonus, will increase bonus by increasing efficiency and production.

(e) Skilled workers are attracted to the industry.

(f) Labour and management relations will improve, since labour take interest in management.

(g) Labour morale is improved which will result in industrial peace and harmony.

(h) Annual bonus payable will reduce labour turnover.

(i) Cooperation and team spirit is more.

The disadvantages of the scheme are as follows:

(a) The reward is not linked to immediate effort and workers have to wait long period for getting their share of bonus.

(b) The bonus is declared only when the profits are available. But in bad years, even though workers might have worked hardly may not get bonus.

(c) In profit sharing plan, number of employees is participating in a single scheme and it is doubtful whether it motivates the employees in their work.

(d) Profits are more influenced by external factors than by the employees in spite of their efficient and hard work.

Co-Partnership Plan:

Co-partnership plan is also known as ‘co-ownership’ involve the issue of shares to employees so that they may feel identified with the business. The employees, being shareholders also, will take more care of machines and materials as it will increase the sense of belonging and will work towards the progress of the organization along with that their share value also increases. The improved productivity means low cost of production and higher profits, and improved standard of living of the workers.

The advantages of co-partnership plan are as follows:

(a) It helps to reduces labour turnover.

(b) Contribution of employees to the profitability of the concern is recognized.

(c) The morale of the employees is high.

(d) The employees will have a greater sense of belonging since they also hold share capital in the organization.

The disadvantages of co-partnership plan are as follows:

(a) The lack of production oriented incentive system will not create any interest in work.

(b) Political interference may also possible due to employees association in management.

(c) Efforts and rewards are not properly related.

(d) It does not differentiate between efficient and inefficient workers.

(e) Even though employees are admitted into partnership they will not have any voice in management decision making.

Requisites of Good Wage Incentive Plan:

For design and introduction of good wage incentive plan the following points are considered:-

(1) It should be simple to understand by the workers and should enable themselves to calculate their earnings.

(2) It should be simple to administer and reduce clerical work.

(3) It should be capable of using computers for increase in speed of calculations.

(4) It should be introduced only after full consultation and agreement with the workers and unions.

(5) It should act as a motivational scheme.

(6) It should guarantee the minimum day wages.

(7) It should be ensured to operate for a long period.

(8) It should cover as many employees as possible.

(9) The incentive should be paid as quickly as possible after the completion of the work.

(10) The cost of administration of the scheme should be minimum.

(11) The incentives should relate to the efforts and efficiency of the workers.

(12) The abnormal factors should not affect the earnings of the workers.

(13) The incentives should be paid only on good production units and discouragement for defective work.

(14) The standards of work should be set after scientific study of work and the performance levels should be fair to reach.

(15) It should conform to labour laws and regulations of the land.

(16) It should minimize labour turnover and absenteeism.

(17) No limits should be placed on additional earnings under the scheme.

(18) It should be at least equivalent to the incentive schemes prevailing in other units or industries in the region.

(19) Due consideration should be given for the saving in cost of production due to the incentive plan and the incentive that will pass to the workers.