The following points highlight the top six methods used for apportionment of joint costs. The methods are: 1. Average Unit Cost Method 2. Physical Unit Method 3. Survey Method 4. Contribution Method 5. Standard Cost Method 6. Market Value Method.

1. Average Unit Cost Method:

Under this method the total joint costs up-to the point of separation are assessed and divided by the total units produced of all the products yielding an average unit cost with one net profit for the total operation. This method can be applied where processes are common and inseparable for the joint products and where the resultant products can be expressed in some common unit.

This means that all joint products have the same unit cost and therefore, if price fixing is based on cost of various products which may be of different grades or quality, they will be sold at the same unit price, resulting in a customer’s price advantage in high grades. Moreover, where the end products cannot be expressed in some common unit, this method breaks down.

Merits:

ADVERTISEMENTS:

(i) It is very simple and can be easily used.

(ii) Under this method, all joint products will have uniform cost.

(iii) It is logical to use this method as all products are produced out of the same materials and process of operations.

Demerits:

ADVERTISEMENTS:

(i) It cannot be used till the end products are expressed in the same units.

(ii) It cannot be used for setting prices of the products especially in highly competitive market.

(iii) It is not useful in decision making.

(iv) It also results in identical cost being assigned to different grades or quantities of products.

ADVERTISEMENTS:

Illustration 1.

The Rama Corporation produces four products in a manufacturing process. The Corporation produced 10,000 units of A, 20,000 units of B, 15,000 units of C and 25,000 units of D. The cost before split off point for the four products was Rs.1,40,000. Using the average unit cost method (a) calculate the unit cost, and (b) show how the joint cost would be apportioned among the products.

Solution:

(a) Average Unit Cost = Joint Cost/ Total Number of Units Produced = Rs.1,40,000 /70,000 = RS 2 per unit

ADVERTISEMENTS:

(b) Cost apportioned among different products:

Product A = 10,000 x Rs.2 = R.20,000 ;

Product B = 20,000 x Rs.2 = Rs.40,000 ;

Product C = 15,000 x Rs.2 = Rs.30,000 ;

ADVERTISEMENTS:

Product D = 25,000 x Rs.2 = Rs.50,000.

2. Physical Unit Method:

A physical base such as raw materials weight, linear measure volume etc. is applied in apportioning pre-separation point costs to joint products. For example, if there is 40% beef in product X and 60% beef in product Y, 4/10 of the cost up-to separation point will be charged to X and 6/10 to Y.

This method is not suitable where, for example, one product is a gas and another is a liquid. This method pre-supposes that each joint product is equally valuable, which is probably not the case in practice. Process loss is borne by the joint products in the ratio of their output weight.

Merits:

ADVERTISEMENTS:

(i) This method is technically sound.

(ii) It is simple and easy to use.

Demerits:

(i) This method is not suitable where output cannot be expressed in terms of the same physical unit i.e., liquid or solid etc.

ADVERTISEMENTS:

(ii) It is illogical to presume that production of all products is equally desirable and valuable.

(iii) It assumes the same unit cost to low quality joint products or high quality joint products.

Illustration 2.

One ton of raw material put into a common process yields joint products P, Q, R and S; their weights being 63 kgs, 117 kgs, 180 kgs and 540 kgs respectively. The balance weight is normal wastage.

Based on the total processing cost of Rs.20,000 per ton of raw material input, you are required to apportion the joint costs to products P, Q, R and S.

Solution:

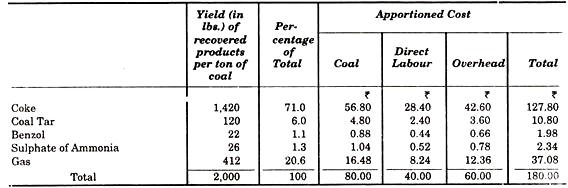

Illustration 3.

Following data have been extracted from the books of M/s. East India Coke Co. Ltd.:

The price of coal is Rs.80 per tonne. Direct labour and overhead cost to split off joint are Rs.40 and Rs.60 respectively per tonne of coal. Calculate the material, labour, overhead and total cost of each product on the basis of weight.

Solution:

3. Survey Method:

Under this method all the important factors such as volume, selling price, technical side, marketing process etc. affecting costs are ascertained by means of extensive survey. Points values or percentages are given to individual products according to their relative importance and costs are apportioned on the basis of total points.

These ratios should be revised from time to time depending upon the factors affecting production and sales.

Merits:

(i) Under this method, allocation is accurate.

(ii) It is considered more equitable than other methods, due to consideration by each of combination of related factors.

(iii) By use of weight factor, joint cost is allocated according to the benefits received by each of the products.

Demerits:

(i) The weight used may be inappropriate in the first place or may become so with the passage of time.

(ii) Since the weight factors are arbitrary assigned, the resultant cost of individual joint products will also be arbitrary.

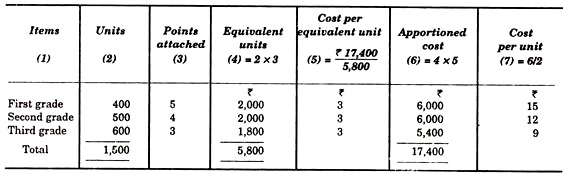

Illustration 4.

In the timber industry, the milling operations to the split off point during a period amounted to 7 17,400 with the following production:

You are required to apportion the joint cost on technical evaluation with points 5, 4 and 3 for first, second and third grade respectively.

Solution:

4. Contribution Method:

Under this method the marginal cost of the joint cost is apportioned on the basis of weight or quantity of each product. If the products are further processed, then all variable cost incurred be added to the variable cost determined earlier.

Then contribution is calculated by deducting variable cost from their respective sales value. The fixed cost is apportioned on the basis of marginal contribution made by each of the products. This method provides useful information for taking decision on maximization of profit by rearrangement of products and sales mix.

Merits:

(i) It is very simple and easy to use.

(ii) Joint costs are allocated appropriately under this method.

(iii) It is appropriate for pricing of products.

(iv) It is considered as best method as contribution is only reliable measure of profitability.

Demerits:

(i) Segregation of variable and fixed cost for all products is a difficult task.

(ii) It is applicable only where marginal cost technique is applied.

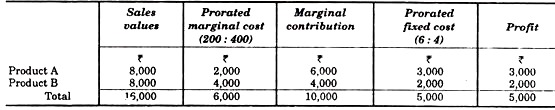

Illustration 5.

From the following information apportion marginal cost and fixed cost on suitable basis and obtain profit/loss under each of the joint products:

Sales: A 200 kgs. @ Rs.40 per kg. and B 400 kgs. @ Rs.20 per kg. Total cost: Marginal cost Rs.6,000 and Fixed cost Rs.5,000.

Solution:

5. Standard Cost Method:

Under this method, the joint cost is apportioned on the basis of standard cost set for the respective joint products.

Merits:

(i) It is simple and easy to use.

(ii) It has the advantage of measuring efficiency.

Demerits:

(i) This method cannot be used without setting standard cost of each of the joint products.

(ii) It is inappropriate if standard cost for the products is not correctly set.

6. Market Value Method:

This method of apportioning joint costs to products on the basis of relative value is the most popular and convenient method. The joint costs are split in the ratio of selling price of individual products.

This method has two important characteristics viz:

(i) All joint products tend to have uniform profit margin,

(ii) Cost of each of the joint products being based on selling price, should there be any change in the selling price of individual joint products, allocation of total costs between the joint products will have to be made.

Market value may mean any of the following:

(i) Market Value at Separation Point:

The market value of the joint products at the separation point is ascertained and total cost is ascertained in the ratio of these values. Suppose product X and Y are jointly produced in a factory, and the values at separation point are known to be Rs.100 and Rs.120 respectively.

The cost will then be appointed 5/11 to X and 6/11 to Y. This is abject to giving weights to the quantities produced. This method is useful where further processing of products incurs disproportionate costs. When it is difficult to ascertain the market value at this stage, then joint cost may be apportioned in the ratio of sales values of different joint products.

Illustration 6.

The joint cost of making 40 units of product A, 120 units of product B and 140 units of product C is Rs.2,250. The selling prices of products A, B and C are Rs.2, Rs.3 and Rs.4 respectively. The products did not require any further processing cost after split off point.

You are required to apportion the joint cost (a) on sales price basis and (b) on sales value basis.

Solution:

(ii) Market Value after further Processing:

This method is easy to operate because selling price of the various joint products will be readily available. Further processing cost is deducted from the sales value in order to calculate the ratio in which the joint costs (up-to the point of separation) are to be apportioned.

The use of this method is unfair where further processing costs after the point of separation are disproportionate or when all the joint products are not subjected to further processing.

This will be more clear from the following illustration:

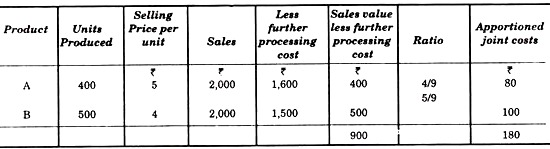

Illustration 7.

X Co. Ltd. manufactures two joint products, A and B and sells them at Rs.5 and Rs.4 per unit respectively. During a particular period, 400 units of A and 500 units of B were produced and sold. The joint cost incurred was Rs.180 and further processing costs for products A and B are 11,600 and Rs.1,500 respectively. Apportion the joint cost.

Solution:

(iii) Net Realisable Value or Reverse Cost Method:

From the selling prices of the finished products are deducted estimated net profit, direct selling and distribution expenses and the cost of further processing after the separation point. A ratio is established on the basis of which the total costs before separation point is apportioned. Subsequent costs are added to arrive at product costs. This method is extensively used in many industries such as oil refineries, lumber mills etc.

Illustration 8.

A factory produces three products A, B and C of equal value from the same manufacturing process. Their joint cost before split off point is Rs.19,600. Subsequent costs are given as under:

Solution:

Show how you would propose to apportion the joint costs of manufacture.

Merits of Market Value Method:

(i) This method is quite popular as the market value of any product is a manifestation of cost incurred in its production.

(ii) All joint products tend to have uniform profit margin.

(iii) Cost of joint products is based on selling price. Therefore, if there is any change in the selling price of individual joint products, that will be a reallocation of total costs between joint products.

(iv) It is only a logical way to prorate joint cost on the basis of respective market value of the joint products.

Demerits:

(i) This method is appropriate only for external financial reporting purposes.

(ii) It is difficult and time consuming exercise to determine the relative selling price.

(iii) It cannot be called a fair method by any norm.

(iv) It is difficult to determine the market value at the split off point.

(v) It is not an accurate indicator of cost incurred in their manufacture up to the point of separation.

(vi) It is not equitable as it does not take into consideration the utilisation of productive factors.

(vii) It will distort cost allocation due to fluctuations in market prices.