In this article we will discuss about ‘Over-Absorption and Under-Absorption of Overheads’:- 1. Definition of Over-Absorption and Under-Absorption of Overheads 2. Treatment of Over-absorption or Under-absorption in Cost Accounts.

Definition of Over-Absorption and Under-Absorption of Overheads:

Usually overheads are absorbed on the basis of predetermined rates. Since predetermined overhead rates are based on budgeted overheads and budgeted production, invariably the overheads absorbed by this process do not agree with the actual overheads incurred for the period.

If the absorbed overheads at predetermined rates are greater than actual overheads, this is known as OVER-ABSORPTION. Conversely, if absorbed overheads ae less than the actual overheads, this is known as UNDER-ABSORPTION.

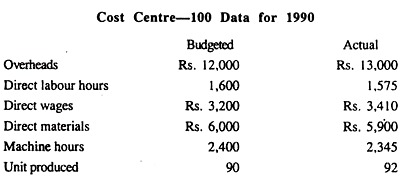

The predetermined overhead absorption rate for direct labour hours was Rs.7.5 per hour.

ADVERTISEMENTS:

Solution:

Total overheads absorbed by actual activity of 1,575 labour hours

= 1,575 x 7.50 = Rs.11,812.50 absorbed into production but actual overheads were Rs.13,000.

ADVERTISEMENTS:

Under-absorbed Overheads = Rs.13,000 – 11,812.50 = Rs.1,1857.50

It is to be noted that under or over-absorption may arise from either actual overheads differing from budget or a difference between the actual and budgeted amount of the absorption base or a combination of these two factors.

Treatment of Over-Absorption or Under-Absorption:

There are many factors that are responsible for the difference between absorbed overheads and actual overheads. But it is actual overhead that is to be absorbed to ascertain the actual cost which finally determines the profit.

The total of actual costs must appear in the final income statement and not merely those calculated product costs which include actual prime cost plus overheads based on predetermined overhead rates.

ADVERTISEMENTS:

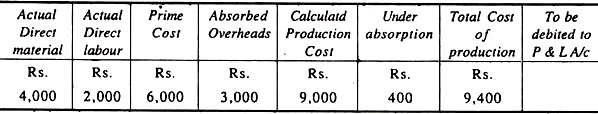

Accordingly, the amount of under-absorbed overheads should be added to total costs before the profit is calculated and, conversely, the amount of over-absorbed overheads should be subtracted from the total cost.

The following illustration will make the concept clear:

This treatment can be made when under or over-absorption of overheads is caused by abnormal factors. In a seasonal business firm, the balance (being the difference between predetermined absorbed overheads and actuals) may be carried forward to a subsequent period expected to be counter balanced at the end of the accounting period.

ADVERTISEMENTS:

A supplementary rate can be used to adjust the amount of under or over-absorption.

The supplementary rate is determined as follows:

Under-absorption is adjusted by using a plus supplementary rate while a minus supplementary rate is used to correct over absorption.

ADVERTISEMENTS:

Problem 1:

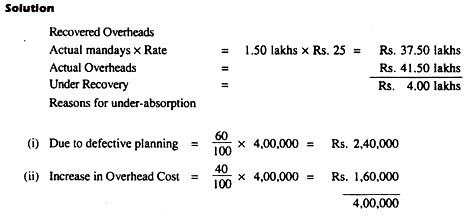

In a manufacturing company overhead was recovered at a predetermined rate of Rs.25 per man-day. The total factory overhead expenses incurred and the man-days actually worked were Rs.41.50 lakhs and Rs.1.50 lakhs days, respectively.

Out of the 40,000 units produced during a period, 30,000 were sold.

On analysing the reasons, it was found that 60% of the unabsorbed overheads were due to defective planning and the rest were attributable to increase in overhead costs.

ADVERTISEMENTS:

How would under-absorbed overheads be treated in cost accounts?

Treatment of Over-absorption or Under-absorption in Cost Accounts:

(i) Rs.2,40,000 should be transferred to Costing Profit & Loss Account as under- absorption has been caused by abnormal factors.

(ii) Rs.1,60,000 should be charged to units produced.

ADVERTISEMENTS:

So, the distribution should be as follows:

Problem 2:

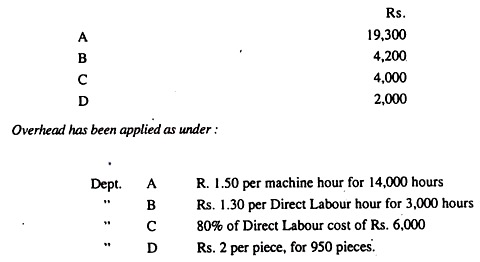

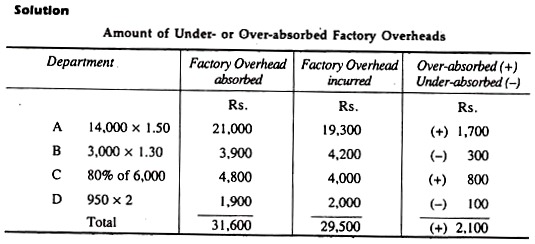

The factory overhead costs of four production departments of a company engaged in executing job orders, for a accounting year, are as follows:

Find out the amount of department-wise under or over-absorbed factory overheads.

ADVERTISEMENTS:

What are the methods that could be considered for disposal of the resultant under or over-absorbed factory overheads?

Methods for disposal of under- or over-absorption of factory overheads:

1. Apportionment through supplementary rates.

2. Transfer to Costing Profit and Loss Account

3. Carry over to next year’s Accounts.