After reading this article you will learn about:- 1. Meaning of Public Deposits 2. Advantages of Public Deposits 3. Regulation 4. Effective Rate of Interest.

Meaning of Public Deposits:

Public deposits are those deposits which are taken from the members or directors of the company or from the general public at a specified rate of interest for a specified period. This method of raising fund is becoming popular at present since the bank credit is becoming costlier. According to the existing provisions, a company cannot accept any public deposit for a period of less than 6 months and more than 36 months.

But in order to meet the short-term requirement (i.e., working capital requirements) deposits up to 10% of paid-up capital plus free reserves minus intangible assets, accumulated losses, deferred revenue expenditure, may be accepted for a period of three months.

At the same time, on and from 1st April 1979, no company can accept or renew deposits in excess of 35% of its paid-up capital plus free reserves as against the limit of 40% up to 31st March 1979.

ADVERTISEMENTS:

There are two methods of financing under this method:

(a) Cumulative deposits and

(b) Fixed deposits.

Under cumulative deposits, there is a specified period of time (generally 3 years) at the end of which the depositors would be paid their maturity values which include an interest up to 55% of initial deposits, i.e., 18.5% p a. simple interest or 15% p a. compound interest.

ADVERTISEMENTS:

But under fixed deposit scheme, payment of interest at different rates (generally from 12% to 16% p.a. in our country) is made for the period ranging from 1 to 3 years.

Shareholders or employees of the company are offered an extra amount of interest @ 5% p.a than the amount paid to the general public. However, under both the methods, a minimum amount is laid down and if there is any deposit which is above that minimum level, the same is accepted in multiples of certain amount which are specified.

Advantages of Public Deposits:

This method of financing enjoys certain advantages which are discussed below:

(i) It is very simple form of financing since no complicated formalities are involved in it. A simple advertisement in the newspaper is sufficient to inform the public that the company is interested to accept public deposits.

ADVERTISEMENTS:

(ii) Needless to mention that it is less costly than any other method of financing for raising short-term or medium-term finance.

(iii) Creation of any charge against the assets of the company is not done for raising funds by it, like debentures and others.

(iv) Advantages on trading on equity can be taken by the company since the rate of interest and the period of deposits are fixed.

(v) It enjoys tax exemption, i.e., loan finance enables the company to save the company from taxation.

Disadvantages of Public Deposits:

ADVERTISEMENTS:

The public deposits are not even free from snags. They are:

(i) This form of financing is not a reliable and dependable one and as such, it is difficult to formulate the financial plan on the basis of it.

(ii) It is unreliable since it is fair weather friend, i.e., wholesale withdrawal of this deposit may take place when the company is in recession.

(iii) It is an unsound source of finance, i.e. with the growth and development of banking facilities, it is gradually losing its importance.

ADVERTISEMENTS:

RBI has started to control and regulate the flow of public deposits, i.e., since 1975, no non-banking company may accept deposit more than 15% of its paid-up capital plus free reserves.

It is an inelastic source of finance, i.e., it cannot be regulated according to the needs of company finance.

However, in spite of these shortcomings, public deposits has been a major source of finance for working capital in the field of cotton-textile mills of Bombay and Ahmedabad though it did not obtain in Delhi, Madras and other parts of India.

Further, being essentially an unsecured loan, in the past it was found to arouse temptation for over-trading by borrowers will all grave consequences in its trail Consequently, with the growth of practice of making funds available for working Capital purposes in India by commercial banks, the system of inviting public deposits for financing working capital requirements went into oblivion till the seventies.

Regulation of Public Deposits:

ADVERTISEMENTS:

It has already been stated above that since 1967 RBI has started to regulate and control public deposits accepted by non-banking companies. The regulations and provisions were introduced in January 1967.

These rules and provisions were modified’ revised and made more comprehensive from time to time in order to exercise control over these deposits and. at the same time, offered reasonable protection to the lenders or deposit holders.

Again, during I 967, the companies could accept deposits to the extent of 25% of paid-up capital plus free reserves However, from January, 1072, the deposits (in the form of unsecured loans) guaranteed by the directors and the deposits raised from shareholders were also brought under the deposit control scheme.

In January 1975 the ceiling of 25% of paid up capital plus free reserves had come down to 15% and again, at recent times, it comes further down to 10% of the said paid-up capital plus free reserves It was operated from 1st April 1979 and consequently the companies brought down their public deposits to the limit of 1st April 1980.

ADVERTISEMENTS:

Every company shall invest not less than 10% of the amount of its deposits maturing during the year ending on 31st March next following in a current or other account with a scheduled bank free from any charge of lien, or in approved securities.

It will ensure the liquidity of public deposits and guaranteed repayment of maturing deposits which cannot be renewed The amount so deposited or invested shall be utilised only for the repayment of deposit maturing during the respective year.

If the deposits are accepted in contravention of the limits prescribed by the Central Govt. a mandatory fine which shall not be less than an amount equal to the amount of the defaulting deposit which has already been accepted and at the same time where the contravention is one of inviting deposits in excess of prescribed limits, a fine not less than Rs. 5,000 and not more than Rs 1,00,000 shall be imposed.

Effective Rate of Interest on Public Deposits:

The normal rate of interest on public deposits varies from 12% to 16% p.a. in India It is interesting to note that the actual cost of public deposits is more in comparison with the nominal cost This is due to the fact that in case of other long-term or short-term borrowings the entire amount of interest cost is an admissible charge against the revenue while computing taxable profit.

But in case of public deposit, maximum limit is fixed at 85% of the total interest cost, i.e. 15% of such interest is actually disallowed which, in other words, increases the real cost of funds.

Therefore, the real cost of funds which are supplied by public deposits may be calculated with the help of the following formula:

We have considered so far only one aspect, i.e., taxation effect. But there are other aspects also For instance, a certain amount is to be incurred on account of brokerage/ advertisement, forms, etc. Moreover, like bank finance, current flow of funds does not reduce the block of liability which conforms till repayment.

At the same time, unproductive interest cost on the funds must be set aside and to be held as liquid assets under Rule 3 A of the Companies (Acceptance of Deposits) Rules 1975.

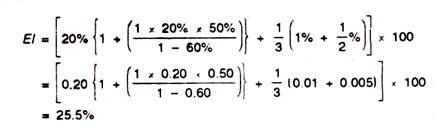

As such, after considering all the related factors, the effective cost of public deposits can be computed with the help of the following:

The above financial can be illustrated with the help of the following illustration:

Illustration:

From the following particulars, compute the effective rate of public deposits:

Rate of Interest on public deposits is @ 20%.

Number of years is 3.

Rate of taxation is 50%.

Brokerage @ 1% and Flotation Cost @ ½ %.

Solution:

Thus, the real cost of public deposits may rise to such an amount which exceeds the cost of other types of bank finance, viz., cash-credit, term-loans or overdraft etc.