In this article we will discuss about the classification of balance sheet ratios. They are:- 1. Current Ratio 2. Net Working Capital Ratio 3. Quick Ratio 4. Cash Position Ratio 5. Proprietary Ratio 6. Capital Gearing Ratio 7. Debt Equity Ratio 8. Reserves to Equity Share Capital Ratio 9. Solvency Ratio 10. Security Ratio.

1. Current Ratio:

Current Ratio is the most common ratio for measuring liquidity. Being related to working capital analysis, it is also called the working capital ratio. Current ratio expresses relationship between current assets and current liabilities. The current ratio is the ratio of total current assets to total current liabilities. It is calculated by dividing current assets by current liabilities, or

Current Ratio = Current Assets/Current Liabilities

Current assets are those, the amount of which can be realised within a period of one year. That is, the current assets of a firm represent those assets which can be in the ordinary course of business converted into cash within a period not exceeding one year.

ADVERTISEMENTS:

Following are normally treated as current assets:

1. Cash in Hand

2. Cash at Bank

3. Debtors

ADVERTISEMENTS:

4. Bills Receivable

5. Prepaid Expenses

6. Money at call and short notice

7. Stock

ADVERTISEMENTS:

8. Sundry Supplies

9. Other amounts receivable within a year

Current liabilities are those amounts which are payable within a period of one year.

ADVERTISEMENTS:

Following are normally treated as current liabilities:

1. Creditors

2. Bills Payable

ADVERTISEMENTS:

3. Bank Overdraft

4. Expenses Outstanding

5. Interest Due or Payable

6. Reserve for unbilled Expenses

ADVERTISEMENTS:

7. Installment payable on long term-loans

8. Any other amount which is payable in short period. (One year)

The current ratio of a firm measures its short-term solvency i.e., its ability to meet short- term obligations. As a measure of short-term current financial liquidity, it indicates the rupees of current assets available for each rupee of current liability/obligation.

The higher the current ratio, the larger the amount of rupees available per rupee of current liability, the more the firm’s ability to meet current obligations and the greater the safety of funds of short-term creditors.

ADVERTISEMENTS:

Significance of Current Ratio:

Current ratio provides a margin of safety to the creditors. In a sound business, a current ratio of 2:1 is considered an ideal one. If current assets are equal to current liabilities, position is not good even though it appears that after realising all the amount of current assets, current liabilities can be paid off. This means the firm has no working capital.

Working capital is excess of current assets over current liabilities. The current ratio must not only be equal to current liabilities but should leave a comfortable margin of working capital after paying of the current debts. The reason in favour of prescribing current ratio as 2:1 or 2 for 1 is that all the current assets do not have the same liquidity, or in short, all current assets cannot be immediately converted into cash for a number of reasons.

For instance, debts may not be realised in full, credit sales may be higher than the cash sales etc. If goods are always sold for cash, a small margin will suffice. But in case of credit sales, margin will have to be increased. Therefore, the demand for a 100% margin of current assets over current liabilities, as a precautionary measure, is preferred. Secondly, prescribing the current ratio as 2:1 or 200% facilitates to keep the surplus as working capital even if all current liabilities are paid off:

Current ratio is an index of the firm’s financial stability i.e., an index of technical solvency and an index of the strength of working capital, which means excess of current assets over current liabilities. A high current ratio is an assurance that the firm will have adequate funds to pay current liabilities and other current payments.

Significance of Current Ratio, in brief:

ADVERTISEMENTS:

1. Current ratio indicates the firm’s ability to pay its current liabilities i.e., day-to-day financial obligations.

2. It shows short-term financial strength.

3. It is a test of credit strength and solvency of a firm.

4. It indicates the strength of the working capital.

5. It indicates the capacity to carry on effective operations.

6. It discloses the over-trading or under-capitalisation.

7. It shows the tendency of over-investment in inventory.

8. Higher ratio i.e., more than 2:1 indicates sound solvency position.

9. Lower ratio i.e., less than 2:1 indicates inadequate working capital.

10. It discloses the quantity of working capital position.

Precautions:

While calculating the Current Ratio, the following guidelines may be noted:

1. Reasonable valuation should be made in case of current assets and current liabilities. The amount of bad debts and doubtful debts should be deducted from the amount of debtors. The amount of obsolete stock, if any, should also be deducted from the stock. The reserves and other accounts related to the valuation of currents are deducted from the total current assets.

2. Loose tools though called current asset are not included.

3. Investments which are easily marketable and are meant to be sold for cash should be treated as current assets.

4. Fictitious assets such as, preliminary expenses, Discount on Issue of Shares, advances made for purchase of fixed assets etc. are to be excluded.

5. Long-term liabilities, if they are repayable within a year, should be treated as a current liabilities.

6. Bank overdraft, unless specially stated as a permanent arrangement, should be treated as a current liability.

7. All Bills Receivable, whether discounted or not, should be treated as current assets and at the same time, discounted bills should be treated as current liability.

Problems of Window Dressing:

Window-dressing as used here refers to the practice of manipulating the current assets and current liabilities in a manner so as to present a more favourable current ratio than the actual one. This may be done by manipulating the value of inventory, recording in advance cash receipts of next year, treating a short-term obligation as long term debt etc. In such cases, the current ratio will not be representative of the actual position.

Limitations of Current Ratio:

Current ratio suffers from the following weaknesses:

1. While current liabilities are fixed in the sense that they have to be paid in full in all circumstances the current assets are subject to shrinkage in value, possibility of bad debts, unsalability of inventory and so on.

Moreover, some of the current assets are more liquid than others: cash is the most liquid of all, receivables are more liquid than inventories etc. Different components of current assets have not the same degree of liquidity. The limitation of current ratio arises from the fact that it is a quantitative rather than a qualitative index of liquidity.

A qualitative measure takes into account the proportion of various types of current assets to the total current assets. All current assets are treated alike but they are not equally or readily realisable in cash.

2. Ratios are computed from the figures taken from Balance Sheet. The current assets and current liabilities might be manipulated to show a better liquidity and solvency position of a firm, through a high current ratio, by the name of window-dressing. A high current ratio, therefore, will be of no significance, if the same is the product of window dressing.

3. Even if the ratio is favourable, the firm may be in financial trouble because of more stocks, work-in-progress etc. which are not easily convertible into cash. Therefore, the current ratio, is not a conclusive index of the real liquidity of a firm.

4. It is a crude measure of financial liquidity as it does not take into account the liquidity of the individual components of current assets.

5. Ratio analysis gives only a good basis for quantitative analysis of financial problems. But at the same time, it suffers from qualitative aspects.

2. Net Working Capital Ratio:

Net working capital is not a ratio. The difference between current assets and current liabilities is called net working capital. The term current assets refers to assets which in the normal course of business get converted into cash over a short period, usually not exceeding one year.

Current liabilities are those liabilities which are required to be paid in short period, normally a year. It is a measure of company’s liquidity position. Generally it is understood that between two firms, the one having a larger net working capital has the greater ability to meet its current obligations.

But this is not necessarily so. The measure of liquidity is a relationship, rather than the difference between current assets and current liabilities. At the same time, it measures the firm’s potential reservoir of funds.

3. Quick Ratio:

Quick ratio is also known as liquid ratio or acid test ratio or near money ratio. It is the ratio between quick or liquid assets and quick liabilities. As pointed out, the current ratio in the study of solvency may be sometimes misleading due to high ratio of stock to current assets. This ratio is calculated by dividing the quick assets by the current liabilities.

It indicates the relation between strictly liquid assets whose value is almost certain on the one hand, and strictly liquid liabilities on the other. The term quick assets refers to current assets which can be converted into cash immediately or at a short notice without diminution of value. Liquid assets comprise all current assets minus stock and prepaid expenses.

Liquid liabilities comprise all current liabilities minus bank overdraft. Stock is excluded from liquid assets on the ground that it is not converted into cash in the immediate future; prepaid expenses by their very nature are not available to pay off current debts: and at the same time bank overdraft is excluded on the ground that it is not required to be paid off in the immediate future.

A comparison of current ratio with liquid ratio would give an indication regarding inventory position.

Both the companies show satisfactory working capital position as the current assets are two times the current liabilities. However, the liquidity ratio of Y Ltd. has gone far below than that of X Ltd. It can be concluded that Y Ltd. is over stocking. Thus, less the quick ratio, higher the incidence of inventory in inflating the current ratio. The higher the quick ratio, lower the incidence of inventory in inflating the current ratio.

As pointed out earlier, current ratio may be misleading, in spite of a favourable current ratio, a firm may not be able to pay off its creditors in time due to larger proportion of stock in current assets. In such a case liquid ratio will be more reliable and a safer guide.

Generally speaking, an acid test ratio of 1:1 is considered satisfactory as a firm can easily meet all current claims. If the ratio is less than 1:1, that is, liquid assets are less than current liabilities, the financial position of the concern shall be deemed to be unsound.

On the other hand, if the ratio is more than 1:1, the financial position of the concern is sound and good. The acid test ratio provides, in a sense, a check on the liquidity of a firm as shown by its current ratio. The quick ratio is a more rigorous and penetrating test of the liquidity position of a firm.

The interpretation that can be placed on the current ratio (2:1) and acid test ratio (0.7:1) is that a large part of the current assets of the firm is tied up in slow-moving and unsaleable inventories and slow-paying debts. Both the current ratio and quick ratio should be considered in relation to the industry average to infer whether the firm’s short-term financial position is satisfactory or not.

Significance of Quick Ratio, in brief:

1. It is the true test of business solvency.

2. Higher ratio i.e., more than 1:1 indicates sound financial position.

3. Lower ratio i.e., less than 1:1 indicates financial difficulty.

4. This is an important ratio of financial institutions.

5. It is a stringent test of liquidity.

6. It gives better picture of firm’s ability to meet its short-term debts out of short-term assets.

7. If the current ratio is more than 2:1 but liquid ratio is less than 1:1 it indicates excessive inventory.

8. It is more of a qualitative nature of test.

4. Cash Position Ratio:

(Absolute Liquidity Ratio)

It is a variation of quick ratio. When liquidity is highly restricted in terms of cash and cash equivalents, this ratio should be calculated. Liquidity ratio measures the relationship between cash and near cash items on the one hand, and immediately maturing obligations on the other. The inventory and the debtors are excluded from current assets, to calculate this ratio.

Generally, 0.75:1 ratio is recommended to ensure liquidity. This test is more rigorous measure of a firm’s liquidity position. If the ratio is 1:1, then the firm has enough cash on hand to meet all current liabilities. This type of ratio is not widely used in practice.

5. Proprietary Ratio:

Proprietary Ratio relates the shareholders funds to total assets. It is a variant of the debt equity ratio. This ratio shows the long term or future solvency of the business. It is calculated by dividing shareholders funds by the total assets.

Preference share capital and equity share capital plus all reserves and surplus items are called shareholders’ fund. Total assets include all assets including goodwill. The acceptable norm of the ratio is 1: 3. The ratio shows the general strength of the company. It is very important to creditors as it helps them to find out the proportion of shareholders’ funds in the total assets used in the business.

Higher ratio indicates a secured position to creditors and a low ratio indicates greater risk to creditors. A ratio below 50% may be alarming for the creditors since they may have to lose heavily in the event of company’s liquidation on account of heavy losses.

Proprietary Ratios are also further analysed into the following manner:

(i) Ratio of Fixed Assets to Proprietors’ Funds.

(ii) Ratio of Current Assets to Proprietors’ Funds.

(i) Fixed Assets to Proprietors’ Fund Ratio:

This shows the relationship between fixed assets and shareholders’ funds. The purpose of this ratio is to calculate the percentage of the owners funds invested in fixed assets.

Fixed Assets to Shareholders Fund = Fixed Assets/Proprietors’ Funds

The fixed assets are valued at their depreciated book value. Internal equities in Debt Equity ratio are the proprietors’ funds. If the ratio is greater than one, it means that creditors obligation have been used to acquire a part of the fixed assets.

(ii) Current Assets to Proprietors Fund Ratio:

It shows the relationship between current assets and shareholders’ funds. The purpose of this ratio is to calculate the percentage of shareholders’ funds invested in Current Assets.

Current Assets to Proprietors Fund = Current Assets/Proprietors’ Funds

This ratio can be expressed in percentage or as a proportion. Different industries have different norms and hence the ratio should be carefully studied. Fixed assets to proprietors ratio and this ratio should be studied for a meaningful analysis.

Significance of Proprietary Ratio:

1. It indicates long term solvency of the firm.

2. It shows the proportion of assets financed by the proprietors.

3. It is a test of long-term credit strength.

4. Higher ratio, say more than 75% shows lesser dependence on external sources, (i.e., sound financial position)

5. Lower ratio, say less than 60% shows more dependence on external sources (i.e., unsound financial position)

6. It shows the general financial strength of the firm.

7. It determines the extent of trading on equity.

8. It measures the extent of protection available to creditors.

6. Capital Gearing Ratio:

Capital Gearing Ratio is also known as Capitalisation Ratio or Leverage Ratio. Closely related to solvency ratios is the capital gearing ratio which is mainly used to analyse the capital structure of a company.

The term Capital Gearing or Leverage normally refers to the proportion between the fixed interest or dividend bearing funds and non-fixed interest or dividend bearing funds. The former includes funds supplied by debenture-holders and preference shareholders and the latter includes equity shareholders’ fund, including reserves and surplus.

Capital Gearing = Fixed Interest Bearing Funds/Equity Share Holders’ Funds

The capital gearing ratio shows the mix of finance employed in the business. It indicates the proportion between owners’ funds and non-owners funds (Preference shares plus long-term debt). This proportion is by definition known as leverage. If the ratio is high, the capital gearing is said to be high and if the ratio is low, the gearing is said to be low.

The extent to which capital is geared shows the speed with which the enterprise is accelerating towards the corporate goal. High gearing means more speed and low gearing means less speed. Further, high gearing means trading on thin equity and low gearing is known as trading on thick equity.

Highly geared capital structure may be indicative of under-capitalisation which means that the amount of capital is disproportionate to the needs measured by the volume of activity. A capital gearing ratio of low order indicates trading on thick equity and it indicate over-capitalisation. This ratio is important to the company and the prospective investors.

It must be carefully planned as it affects the company’s capacity to maintain a uniform dividend policy during difficult trading periods.

The capital gearing also reveals the suitability or otherwise of the company’s capitalisation, that is:

Equity Capital = Loan Capital = Even Gear

Equity Capital > Loan Capital = Low Gear

= Over Capitalisation

Equity Capital < Loan Capital = High Gear

= Under Capitalisation

Company’s financial strength can also be known from the following ratios:

(i) Total Investments to Long-Term Liabilities

(ii) Current Liabilities to Proprietors Fund

(iii) Reserve to Equity Capital Ratios.

Significance of Capital Gearing Ratio:

1. It aids in regulating a balanced capital structure in a company.

2. It analyses the capital structure of a company.

3. Low gearing indicates trading on equity.

4. It is useful to ascertain whether a company is practising “trading on equity” and if so, to what extent is done.

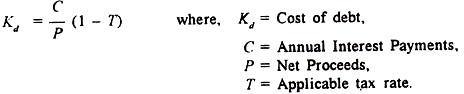

7. Debt Equity Ratio:

The financing of total assets of a business concern is done by owners’ equity (also known as internal equity) as well as outside debts (known as external equity). How much fund has been provided by the owners and how much by outsiders in the acquisition of total assets is a very significant factor affecting the long-term solvency position of a concern.

In other words, the relationship between borrowed funds and owners’ capital is a popular measure of the long-term financial solvency of a firm. This relationship is shown by the debt-equity ratio. This ratio indicates the relative proportions of debts and equity in financing the assets of a firm. This ratio is calculated in various ways.

It is also known as External-Internal Equity Ratio. Debt-Equity Ratio is determined to ascertain soundness of the long-term financial policies of the company. This ratio relates all external liabilities to owners’ recorded claims.

Debt-Equity Ratio is calculated as follows:

The term external equities refer to the total outside liabilities. The term internal equities refer to all claims of preference shareholders and equity shareholders such as share capital and reserves and surplus. Outside fund refers to all short-term debts like mortgage, bills etc. When long-term financial ratio is calculated, term debts like debentures are to be considered.

Shareholders’ funds refer to preference share capital, equity share capital, capital reserve, revenue reserve, reserves for contingencies, sinking fund for renewal of a fixed asset or redemption of debentures etc. less fictitious assets.

As acceptable norm for this ratio is considered to be 2:1. A higher debt-equity ratio is allowed in the case of capital-intensive industries, a norm of 4:1 is used for fertiliser and cement units and a norm of 6:1 is used for shipping units.

Whatever way the debt-equity ratio is calculated, it shows the extent to which debt financing has been used in the business. A high ratio shows that the claims of creditors are greater than those of owners. A very high ratio is unfavourable from the firm’s point of view. This introduces inflexibility in the firm’s operations due to the increasing interference and pressures from creditors.

A High debt company, also known as highly leveraged or geared, is able to borrow funds on very restrictive terms and conditions. A low debt-equity ratio implies a greater claim of owners than creditors. From the point of view of creditors, it represents a satisfactory capital structure of the business since a high proportion of equity provides a larger margin of safety for them.

8. Reserves to Equity Share Capital Ratio:

It reveals the policy pursued by the company with regard to growth Shares. A very high ratio indicates a conservative dividend policy and increased ploughing back of profit. Higher the ratio, better will be the position.

Reserve to Equity Capital Ratio = Revenue Reserves/Equity Capital

9. Solvency Ratio:

It is also known as Debt ratio. It is a difference of 100 and proprietary ratio. This ratio is found out between total assets and external liabilities of the company. External liabilities mean all long period and short period liabilities.

Solvency Ratio = Total Liabilities/Total Assets

Solvency generally refers to the capacity or ability of the business to meet its short-term and long-term obligations. If a company is in a position to pay its long-term liabilities easily, it is said to possess long term solvency. If a company’s financial position is strong to pay current liabilities, it is regarded as short term solvency. There are circumstances arising to find out solvency of the company for very short period for immediate solvency, for example, Liquidity Ratio and Absolute Liquid Ratio.

It measures the proportion of total assets provided by the firm’s creditors. If total assets are far more than external liabilities, the company is treated as solvent. A company is solvent if it can meet its outside liabilities out of its total assets. Higher the ratio, the greater amount of firm’s creditors’ money that is being used to generate profits for the firm’s owners.

10. Security Ratio:

Fixed liabilities usually take the form of debentures, preferably, secured on fixed assets of the company. The market value or depreciated book value of the fixed assets, should be taken into account at the date of calculation of this ratio. A ratio of 1.5:1 is considered good.