An overview of four basic financial statements will be helpful to illustrate how certain events are reported. These examples are not complete but can be used to demonstrate the presentation of various transactions and accounts.

Government-Wide Financial Statements:

Only two financial statements make up the government-wide financial statements- the statement of net assets and the statement of activities. These statements separate the reporting into governmental activities (all governmental funds and most internal service funds) and business- type activities (all enterprise funds and any remaining internal service funds). Government-wide financial statements do not report the transactions and balances of any fiduciary funds, which are shown only in separate fund-based financial statements.

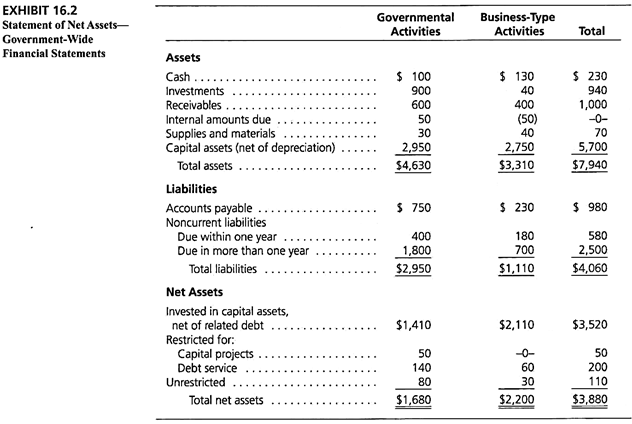

Exhibit 16.2 shows the basic outline of a statement of net assets. Under the economic resources measurement focus used in the government-wide financial statements, all assets and liabilities are reported. The final section of this statement, the net assets category, indicates- (1) the amount of capital assets being reported less related debt, (2) restrictions on any net assets, and (3) the total amount of unrestricted net assets. For example, in Exhibit 16.2, Governmental Activities has $80 of completely unrestricted net assets to use and Business-Type Activities has $30 of unrestricted net assets.

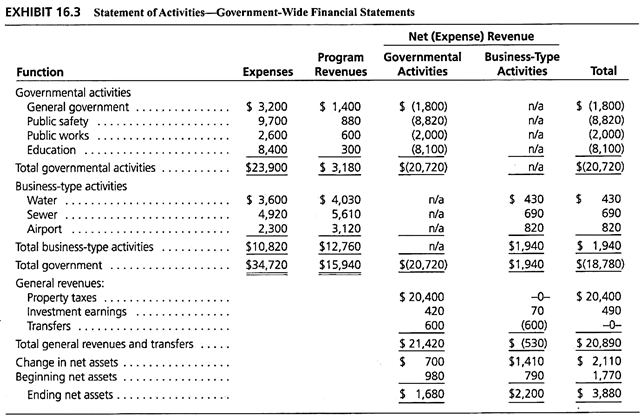

The statement of activities in Exhibit 16.3 provides details about revenues and expenses, once again separated into governmental activities and business-type activities.

This is a statement that is usually read horizontally first and then vertically. The statement shows direct expenses and program revenues for each government function. Program revenues are fines, fees, grants, and the like that the specific activity generates. Thus, a single net revenue or net expense is determined horizontally for each function as a way of indicating its financial burden or financial benefit to the government.

Here, for example, the public safety category has a net cost to the government of $8,820, expenses of $9,700 that are partially offset by program revenues of $880. The total of these amounts is summed vertically to show the total cost of operating the government, an amount that is offset by general revenues such as property taxes and sales taxes. For example, here the governmental activities cost $20,720 whereas the business-type activities generated $1,940.

Fund-Based Financial Statements:

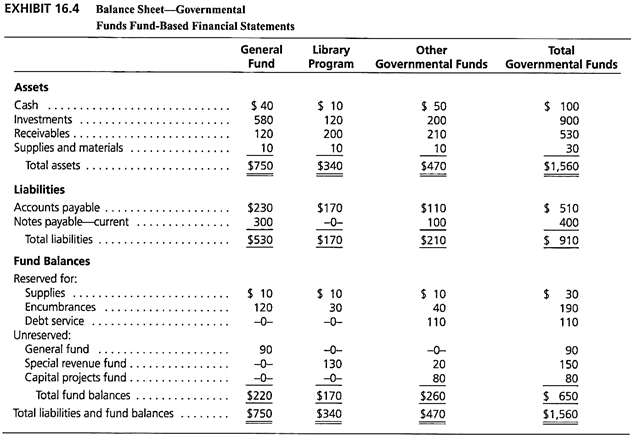

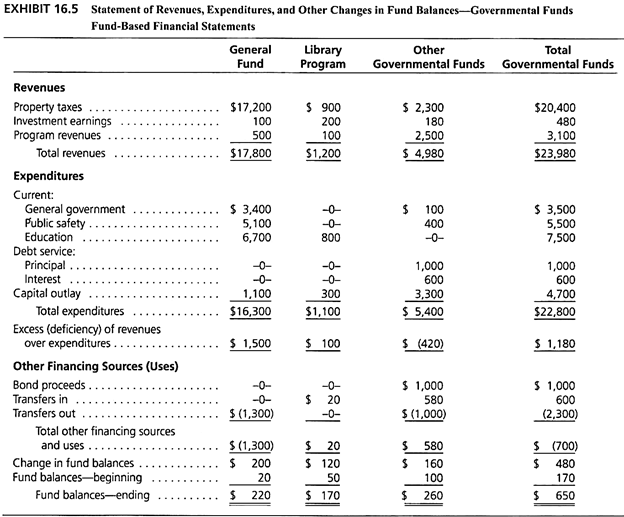

A state or local government produces a number of fund-based financial statements. However, at this introductory stage, only the two fundamental statements that parallel the two government- wide statements are included. First, Exhibit 16.4 shows a balance sheet for the governmental funds and then Exhibit 16.5 presents a statement of revenues, expenditures, and changes in fund balances produced for the same governmental funds.

Note that the figures here will not be the same as those presented for the governmental activities in the government-wide statement of net assets (Exhibit 16.2) and statement of activities (Exhibit 16.3), primarily for three reasons:

1. Government-wide statements report most internal service funds within the governmental activities. However, fund-based statements report all internal service funds as proprietary funds, not as governmental funds. Thus, totals will vary because funds are grouped differently.

2. Governmental activities use the economic resources measurement focus whereas the governmental funds, in the fund-based statements, use the current financial resources measurement focus. Therefore, different assets and liabilities are being reported.

ADVERTISEMENTS:

3. Governmental activities use accrual accounting in government-wide statements; governmental funds use modified accrual accounting in creating fund-based financial statements. The timing of recognition is different.

Because of these differences, reconciliations between the totals presented in Exhibits 16.2 and 16.4 and between Exhibits 16.3 and 16.5 should be reported.

In looking at both of the fund-based financial statements being presented (Exhibits 16.4 and 16.5), note that the General Fund and every other individual fund that qualifies as major requires a separate column. The assumption here is that the Library Program (probably one of this government’s special revenue funds) is the only individual fund outside the General Fund that is considered to be major. Information for all other funds is then grouped together. Consequently, identification of a “major” fund becomes quite important for disclosure purposes.

It is defined as follows:

ADVERTISEMENTS:

The reporting government’s main operating fund (the general fund or its equivalent) should always be reported as a major fund.

Other individual governmental and enterprise funds should be reported in separate columns as major funds based on these criteria:

a. Total assets, liabilities, revenues, or expenditures/expenses of that individual governmental or enterprise fund are at least 10 percent of the corresponding total (assets, liabilities, and so forth) for all funds of that category or type (that is, total governmental or total enterprise funds), and

b. Total assets, liabilities, revenues, or expenditures/expenses of the individual governmental fund or enterprise fund are at least 5 percent of the corresponding total for all governmental and enterprise funds combined.

ADVERTISEMENTS:

In addition to funds that meet the major fund criteria, any other governmental or enterprise fund that the government’s officials believe is particularly important to financial statement users (for example, because of public interest or consistency) may be reported as a major fund.

Recognition of Expenditures for Operations and Capital Additions:

Although budgetary and encumbrance entries are unique, their impact on the accounting process is somewhat limited because they do not directly affect a fund’s financial results for the period. Conversely, the method by which a state or locality records the receipt and disbursement of assets can significantly alter the reported data. For example, because a primary emphasis in the governmental funds is on measuring changes in current financial resources, neither expenses nor capital assets are recorded in the fund-based financial statements. Probably no more significant distinction exists between the fund-based statements and the government-wide statements.

Governmental funds report an Expenditures account in the fund- based statements. This term reflects outflows or other reductions in current financial resources caused by the acquisition of a good or service (or some other utility). The actual reduction of resources is recorded as an expenditure whether it is for rent, a fire truck, salaries, or a computer. In each case, a good or service is acquired. The statement of revenues, expenditures, and other changes in fund balances allows the reader to see the utilization of an activity’s current financial resources.

Spending $1,000 for electricity for the past three months is an expenditure of a fund’s current financial resources in exactly the same way that buying a $70,000 ambulance is:

Within the governmental funds, the timing of the recognition of expenditures (and revenues) follows the modified accrual basis of accounting. For expenditures, modified accrual accounting requires recognizing a claim against current financial resources when it is created. If a claim is established in one period to be settled in the subsequent period using year-end current financial resources, the expenditure and liability are recorded in the initial year.

However, the maximum length of time for payment to occur—often 60 days into the subsequent period—should be disclosed. Thus, if equipment is received 15 days before the end of the year but payment will not be made until 75 days later, the recording is still likely to be made in the first year, depending on the period being utilized.

The recording of expenditures rather than expenses and capital assets is one of the most distinctive characteristics of traditional governmental accounting. In fund-based statements, a governmental fund records both cash expenses and the entire cost of all buildings, machines, and other capital assets as expenditures. No net income figure is calculated for these funds; thus, computing and recording subsequent depreciation is not relevant to the reporting process and is omitted entirely.

For the government-wide financial statement, all economic resources are being measured.

ADVERTISEMENTS:

Consequently, the previous two transactions would be recorded as follows:

Capital Assets and Fund-Based Financial Statements:

One interesting result of measuring and reporting only expenditures within the fund-based statements of the governmental funds is that virtually no assets other than current financial resources such as cash, receivables, and investments are reported. All capital assets are recorded as expenditures at the time of purchase with that balance closed out at the end of the fiscal period. Note that the statement in Exhibit 16.4 shows no buildings, schools, computers, trucks, or other equipment as assets.

With the creation of government-wide financial statements, a record of all capital assets is available in the statement of net assets (see Exhibit 16.2). Thus, recording only expenditures in the fund-based financial statements does not leave a gap in the information being presented.

In the initial production of government-wide financial statements, officials simply took the cost of fixed assets (or fair value for donated items) that had been listed for monitoring purposes in a General Fixed Assets account group as the opening asset balances to be reported. One problem, though, was the initial reporting of “infrastructure” assets including roads, sidewalks, bridges, and the like that are normally stationary and can be preserved for a significant period of time.

ADVERTISEMENTS:

A bridge, for example, might last for more than 100 years. Traditionally, the listing of such infrastructure assets within the General Fixed Assets account group was optional. To save time and energy, many governments simply did not maintain a record of these assets after the initial expenditure. Thus, in creating the first set of government-wide financial statements, records were often unavailable for some or all of the infrastructure assets that have been bought or constructed over the years.

Because of the potential problem of establishing balances for all infrastructure assets, GASB made an exception in reporting for government-wide financial statements. A government must capitalize all new infrastructure assets bought or built. However, the book value of previous infrastructure assets only had to be approximated.

The GASB suggested methods by which costs such as highways, curbing, and sidewalks could be estimated for reporting purposes. For example, current costs for such projects could be determined and then adjusted for both inflation and usage since the assets were originally obtained.

However, an important limitation was placed on the need for such complex calculations. This type of historical estimation and reporting is required only for major general infrastructure assets acquired or significantly improved since June 30, 1980. Thus, a city is probably not required to determine a cost approximation for a sidewalk built in 1928.

Fund-based financial statements do not recognize depreciation expense in connection with governmental funds for two reasons:

1. These funds reflect expenditures rather than expenses, and the entire cost of the asset was reported as an expenditure at the time of the original claim against current financial resources. The acquisition was recorded when obtained so that reporting subsequent depreciation expense would reflect the impact twice: once when acquired and once when depreciated.

2. These funds traditionally do not record expenses. Reporting depreciation expense (rather than an expenditure) is not consistent with measuring the change in current financial resources.

However, the government-wide financial statements (as well as fund-based statements for proprietary and fiduciary funds) list assets rather than expenditures for such costs, and therefore depreciation is appropriate. Consequently, on these statements, depreciation on all long-lived assets with finite lives should be calculated and reported each period.

Supplies and Prepaid Items:

In gathering information for government-wide financial statements, the acquisition of supplies and prepaid costs such as rent or insurance is not particularly complicated. An asset is recorded at the time of acquisition and subsequently reclassified to an expense account as the asset’s utility is consumed by use or time.

However, reporting prepaid costs and supplies (by the governmental funds) within the fund-based financial statements is not so straightforward. These assets have a relatively short life. Should the cost incurred be reported as an asset until consumed or recorded directly as an expenditure at the time of acquisition?

Traditionally, governments have used the purchases method, which simply records these costs as expenditures at the point that a claim to current financial resources is created. For disclosure purposes, though, remaining supplies or prepaid items (such as insurance or rent) have then been entered into the accounting records as assets just prior to production of financial statements.

Mechanically, the asset is recorded at year end along with an offsetting balance such as Fund Balance Reserved for Inventory of Supplies (or Prepaid Items). This balance informs the reader that the fund is reporting assets which are not current financial resources available for spending in the future.

The purchases method reflects modified accrual accounting because the entire cost is recognized as an expenditure when current financial resources are initially reduced. However, many government units have chosen to have governmental funds report such supplies and prepaid items using an accepted alternative known as the consumption method.

The consumption method parallels the process utilized in creating government-wide financial statements. Supplies or prepayments are recorded as assets when acquired. Subsequently, as the items are consumed by usage or over time, the cost is reclassified into an expenditures account. Under this approach, the expenditure is matched with the period of specific usage.

Because these assets cannot be spent for government programs or other needs, a portion of the Fund Balance account should be reclassified as Reserved for Inventory of Supplies (or Prepaid Items) as is shown in the balance sheet in Exhibit 16.4.

To illustrate, assume that a municipality purchased $20,000 in supplies for various General Fund activities. During the remainder of the fiscal period, $18,000 of this amount is consumed so that only $2,000 remains at year-end.

These events could be recorded through either of the following sets of entries:

Recognition of Revenues—Overview:

The recognition of some revenues has always posed theoretical issues for state and local government units. For most revenues, such as property taxes, income taxes, and grants, no earning process exists as in a for-profit business. These revenues are referred to as non-exchange transactions. Taxes, fines, and the like are assessed or imposed on the citizens to support the government’s operations rather than giving the payors a specific good or service in return for their payments.

GASB Statement Number 33, “Accounting and Financial Reporting for Non-exchange Transactions,” provided a comprehensive system for recognizing many of the revenues specifically applicable to state and local government units. This statement does not apply to true revenues such as interest or rents for which an earning process exist. Instead, the pronouncement concentrates on “non-exchange transactions,” including most taxes, fines, grants, and the like for which the government does not have to provide a direct and equal benefit for the amount received.

For organizational purposes, all such non-exchange transactions are separated into four distinct classifications, each with its own rules as to proper recognition:

i. Derived Tax Revenues:

Income taxes and sales taxes are the best example of this type of revenue; a tax assessment is imposed when an underlying exchange takes place. A sale occurs, for example, and a sales tax is imposed, or income is earned and an income tax is assessed.

ii. Imposed Non-Exchange Revenues:

Property taxes and fines and penalties are viewed as imposed non-exchange revenues because the government mandates an assessment, but no underlying transaction occurs. As an example, real estate or other property is owned and a property tax is levied each period. The government is taxing ownership here, not a specific transaction.

iii. Government-Mandated Non-Exchange Transactions:

This category includes monies such as grants conveyed from one government to another to help cover the costs of required programs. If a state specifies that a city must create a homeless shelter and then provides a grant of $400,000 to help defray the cost, the city records that money using these prescribed rules. The state has mandated the utilization of the money to meet the law. City officials have no choice; the state government has required the shelter to be constructed and is providing part or all of the funding.

iv. Voluntary Non-Exchange Transactions:

In this final classification, money has been conveyed willingly to the state or local government by an individual, another government, or an organization usually for a particular purpose. For example, a state might grant a city $900,000 to help improve reading programs in its schools.

Unless the state has mandated an enhancement in these reading programs, this grant is accounted for as a voluntary non-exchange transaction. The decision has been made that the money will provide an important benefit, but no separate government requirement led the state to the conveyance.

Derived Tax Revenues such as Income Taxes and Sales Taxes:

Accounting for derived tax revenues is relatively straightforward. These revenues are normally recognized in government-wide financial statements when the underlying transaction occurs. Thus, when a taxpayer earns income, the government should record the resulting income tax revenue. Likewise, when a sale is made, the government should recognize the sales tax revenue that is created.

Assume, for example, that sales by businesses that operate within a locality amount to $10 million for the current year and a sales tax of 4 percent is assessed. In the period in which the sales are made, the following entry is required of the government. The amounts should be reported net of any estimated refunds or uncollectible balances.

Government-Wide Financial Statements:

For fund-based financial statements, the preceding rules also apply except for one additional requirement. In connection with governmental funds, the resources must be available before the revenue can be recognized. That is, the amounts must be received during the year or soon enough thereafter to satisfy claims to current financial resources.

In that way, the essence of modified accrual accounting is still being utilized at the fund level of reporting. Except in connection with the reporting of property taxes, the government selects (and must disclose) the length of time that serves as the boundary for financial resources to be viewed as available.

A separate issue is raised if government officials have specified that the derived tax revenue must be used in a certain way. For example, in the preceding entry, assume that the city government has stated that 25 percent of this tax must be used for park beautification. Thus, $100,000 must be spent in this designated fashion. Such restrictions are disclosed in the financial statements by reclassifying an appropriate amount of the fund balance or net assets to indicate the intended usage.

Consequently, in the statement of net assets for the government-wide financial statements (as shown in Exhibit 16.2), a $100,000 amount should be reclassified in the net assets section as restricted for park beautification. A similar treatment is proper for the balance sheet created according to the fund-based financial statements (as shown in Exhibit 16.4) except that the amount is shown as a separate fund balance restricted for park beautification.

Imposed Non-Exchange Revenues such as Property Taxes and Fines:

Accounting for imposed non-exchange revenues is a bit more complicated than for derived tax revenues because no underlying transaction exists to guide the timing of the revenue recognition. Interestingly, the GASB set up separate rules for recognizing the asset and the related revenue.

A receivable is to be recorded when the government first has an enforceable legal claim as defined in that particular jurisdiction (or when cash is received if a prepayment is made). For the revenue side of the transaction, recognition should be made in the time period when the resulting resources are required to be used or in the first period in which use is permitted.

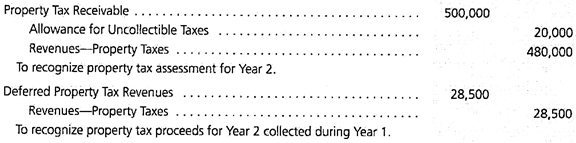

To illustrate, assume that officials of the City of Alban need to generate property tax revenues of at least $500,000 to finance budgeted government spending for Year 2. On October 1, Year 1, property tax assessments for a total of $530,000 are mailed to the citizens. Assume that according to applicable state law, the city has no enforceable claim until January 1, Year 2 (often called the lien date). However, to encourage early payment, the city allows a 5 percent discount on any payment received by December 31, Year 1.

No entry is recorded on October 1, Year 1. Although the assessments have been delivered, no enforceable legal claim yet exists, and the proceeds from the tax cannot be used until Year 2. However, assume that $30,000 of the assessments is collected from citizens during the final three months of Year 1. After reduction for the 5 percent discount, the collection is $28,500.

Government-Wide Financial Statements:

Assume that city officials expect to collect 96 percent of the remaining $500,000 in assessments, or $480,000. At the beginning of Year 2, both this receivable and the related revenue can be recognized. The receivable is reported at that time because there is an enforceable claim.

The revenue is reported at that time since Year 2 is the year in which the money can first be used. In the following journal entry, note that the revenue is reduced directly by the estimate of taxes deemed uncollectible. In addition, the collected amount should be recognized in Year 2 as revenue because this is the period for which use is allowed.

Government Wide Financial Statement, January 1, Year 2:

The preceding recording would be the same for the fund-based financial statements unless some portion of the future cash collection was viewed as not being available. Because property taxes are such a significant source of revenue for many governments, a specific 60-day period for recognition has been standardized here rather than allowing the government to choose the period.

To illustrate the recording of this receivable assume that historical records indicate that $400,000 of this $480.000 amount will be collected during Year 2, another $50.000 in the first 60 days of Year 3, and the final $30.000 beyond 60 days into Year 3. This last $30,000 is not viewed as being available to pay for expenditures in Year 2 so that revenue recognition is not appropriate until Year 3. Only $450.000 of the financial resources are expected to be available for Year 2 expenditures. For the fund-based statements, this entry must conform to modified accrual accounting. Again, revenues are recorded net of estimated uncollectible taxes.

Fund-Based Financial Statements, January 1, Year 2:

Government-Mandated Non-Exchange Transactions and Voluntary Non-Exchange Transactions:

Although these two sources of revenues are identified separately, the timing of accounting recognition is the same so they are logically discussed together. The government recognizes these types of revenue (often a grant) when all eligibility requirements have been met. Until eligibility has been established the existence of some degree of uncertainty precludes recognition. Thus, revenue reporting occurs at the time of eligibility even if the money was actually received earlier.

All eligibility requirements are divided into four general classifications. The applicable requirements must all be met before revenues can be recorded for either government-mandated non-exchange transactions or voluntary non-exchange transactions.

1. Required Characteristics of the Recipients:

In many programs, the government unit scheduled to receive funds is given standards that must be met in advance. For example, assume that a state grant has been awarded to a city to help teach all kindergarten children in its school system to read. However, as part of this program, state law has been changed to mandate that all kindergarten teachers must hold proper certification. Consequently, the state will not convey the grant to the city until all kindergarten teachers have met this standard. The city must conform to state law first. Because of this eligibility requirement, revenue recognition is delayed until all teachers have become certified.

2. Time Requirements:

Programs can specify when money is to be used. To illustrate, assume that in April, a state provides a grant to a city to buy milk for each child during the subsequent school year starting in September. The grant should be recognized as revenue in the period of use or in the period when the use of the funds is first permitted.

3. Reimbursement:

Many grants and other forms of similar support are designed to reimburse a government for amounts spent appropriately. These arrangements are often called expenditure-driven programs. Assume that a state informs a locality that it will reimburse the city government for money paid to provide milk to schoolchildren who could not otherwise afford it. In such cases, proper spending is the eligibility requirement; the city recognizes no revenue until the money is spent for milk.

4. Contingencies:

In voluntary non-exchange transactions (but not in government-mandated non-exchange transactions), revenue may be withheld until a specified action has been taken. A grant might be given to buy park equipment, for example, but only after an appropriate piece of land has been acquired on which to build the park. Until a lot is obtained, a contingency exists, and the revenue should not be recognized.

Issuance of Bonds:

Although not a revenue, the issuance of bonds serves as a major source of funding for many state and local governments. At the end of 2006, the total of all long-term debt outstanding for state and local governments amounted to the almost unbelievable balance of $2.01 trillion. Proceeds from these debt issuances are used for many purposes, including general financing and a wide variety of construction projects.

As of December 31, 2005, the City of Seattle, Washington, had approximately $3.8 billion of long-term debts outstanding. Of that amount, more than $1.1 billion had been issued by governmental activities and nearly $2.7 billion by business-type activities.

Because the proceeds of a bond issuance must be repaid, the government recognizes no revenues under either method of financial reporting. The reporting in the government-wide financial statements is hardly controversial- Both the cash and the debt are increased to reflect the issuance.

Conversely, in the fund-based financial statements, recording is not so simple because cash is received but the debt is not a claim on current financial resources. Thus, from that perspective, the inflow of current financial resources does not create a revenue or a liability that can be reported.

Assume, for example, that the Town of Ruark sells $5 million in general obligation bonds to finance the construction of a new school building. Because of the intended use of this money, the town designated a Capital Projects Fund to receive the cash. To emphasize that this inflow of money is not derived from a revenue, Ruark utilizes a special designation. Other Financing Sources.

Note in Exhibit 16.5 the placement of Other Financing Sources (Uses) at the bottom of the statement of revenues, expenditures, and other changes in fund balance to identify changes in the amount of current financial resources created through transactions other than revenues and expenditures.

Thus, the following journal entry is needed to reflect the sale of these bonds in the fund- based statement if issued by one of the governmental funds:

Fund-Based Financial Statements:

Although an inflow of cash into this fund has taken place, no revenue has been generated. However, in the same manner as a revenue, the Other Financing Sources is a measurement account that is closed out at year-end. The actual $5 million liability is completely omitted from the Capital Projects Funds. Because the governmental funds stress accountability for the inflows and outflows of current financial resources, recognition of long-term debts in fund-based accounting has traditionally been considered inappropriate.

For example, the balance sheet in Exhibit 16.4 shows no long-term liabilities at all for the governmental funds but only claims to current financial resources. Any user of the financial statements who wants to see the amount of the government’s long-term debts can simply examine the statement of net assets in the government-wide financial statements.

Payment of Long-Term Liabilities:

The payment of long-term liabilities again demonstrates the huge differences between the government-wide financial statements and the fund-based financial statements. For the government-wide statements, recording the payment of principal and interest is the same as the accounting by a for-profit organization. For the fund-based statements, an expenditure account is recognized for settlement of the debt and also for the related interest (often paid for and recorded in a Debt Service Fund).

Assume as an illustration that a government has a $500,000 bond payment coming due along with three months of interest that amounts to $10,000. This example assumes that cash had been set aside previously in the Debt Service Fund to satisfy this obligation.

The needed entries follow:

Government-Wide Financial Statements:

Fund-Based Financial Statements:

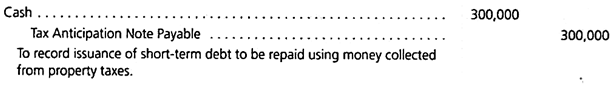

Tax Anticipation Notes:

One type of formal debt is recorded in the same manner for government-wide and fund-based financial statements. State and local governments often issue short-term debts to provide financing until revenue sources have been collected. For example, if property tax payments are expected at a particular point in time, the government might need to borrow money for operations until that date. These short-term liabilities are often referred to as tax anticipation notes because they are being issued until a sufficient amount of taxes can be collected. As short-term liabilities, these debts are a claim on current financial resources.

Thus, for the fund-based financial statements, the issuance is not recorded as another financing source but as a liability in the same manner as in the government-wide financial statements. Amounts paid for interest, though, would still be recorded as an expenditure in producing fund-based statements and as an expense on the government-wide financial statements.

Assume that a city borrows $300,000 on a 60-day note on January 1 and agrees to pay back $305,000 on March 1. The city will repay the debt with receipts from property taxes.

For both sets of financial statements, the following entry is made on January 1:

At repayment, however, two different entries are required because the fund-based statements measure current financial resources while the government-wide statements measure all economic resources:

Fund-Based Financial Statements:

Government-Wide Financial Statements:

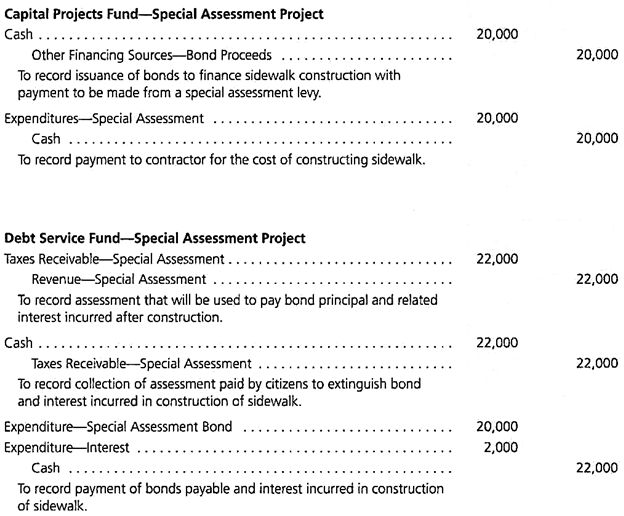

Special Assessments:

Governments occasionally provide improvements or services that directly benefit a particular property and assess the costs (in whole or part) to the owner. In many cases, the owners actually petition the government to initiate such projects to enhance property values. Paving streets, installing water and sewage lines, and constructing curbs and sidewalks are typical examples. To finance the work, the government usually issues debt and places a lien on the property being improved to ensure reimbursement.

Government-wide financial statements handle the debt and subsequent construction in the manner of a for-profit enterprise. The asset is recorded at cost and taxes are assessed and collected. These receipts are then used to settle the debt. For example, assume that a sidewalk is to be added to a neighborhood at a cost of $20,000.

The city is to sell a bond of this amount to finance the construction with repayment eventually to be made using funds collected from the owners of the property benefited. Total interest to be paid is $2,000. The assessment to the owners is set at $22,000 to cover all costs.

Government- Wide Financial Statements:

In the fund-based financial statements, this same series of transactions has a completely different appearance. Neither the infrastructure nor the long-term debt would be recorded because the current financial resources measurement basis is being used.

Fund-Based Financial Statements:

One other aspect of special assessment projects should be mentioned. In some cases, the government may facilitate a project but accept no legal obligation for it. The government’s role is limited to conveying funds from one party to another so that the government assumes no liability (either primary or secondary) for the debt.

Normally in such cases, the money goes from citizens to the government and then directly to the contractors. If the government has no liability for defaults, overruns, or other related problems, recording the special assessment assets, liabilities, revenues, expenses, other financing sources, and expenditures is not really relevant to the government’s resources. In that situation, all transactions are recorded in an agency fund as increases and decreases in cash, amount due from citizens, and amount due to contractors. As a fiduciary fund, no reportable impact appears within the government-wide statements.

Consequently, the city of Saint Paul, Minnesota, in explaining the debts of its governmental activities in the government-wide statements, includes special assessment debt with governmental commitment having a principal of more than $23 million. The “governmental commitment” is key to this reporting. Because of the obligation, extensive reporting outside the agency fund is required.

Interfund Transactions:

Interfund transactions are commonly used within government units as a way to direct sufficient resources to all activities and functions. Monetary transfers made from the General Fund are especially prevalent because general tax revenues are initially accumulated in this fund. For example, the General Fund for Houston, Texas, indicated in the fund-based financial statements for the year ending June 30, 2005, that approximately $197 million had been transferred out to other funds while only $1 million had been transferred in from other funds.

However, the government-wide financial statements do not report many such transfers because they frequently occur solely within the governmental activities or solely within the business-type activities. For example, a transfer from the General Fund to the Debt Service Fund would be reported in both funds on fund-based financial statements but would create no net impact in the government-wide financial statements because they are both classified as governmental activities.

Thus, for government-wide financial reporting, the following distinctions for transfers are drawn:

i. Intra-activity transactions are those that occur between two governmental funds (so that net totals reported for governmental activities are not affected) or between two enterprise funds (so that totals reported for business-type activities are not affected). Transfers between governmental funds and most Internal Service Funds are also included in this classification because, Internal Service Funds are usually reported as governmental activities in government-wide statements.

Government-wide financial statements do not report intra-activity transactions because they create no overall change in either the governmental activities or the business-type activities.

ii. Interactivity transactions occur between governmental funds and enterprise funds. They impact the totals reported for both governmental activities and business-type activities. Government-wide financial statements do report interactivity transactions. In Exhibit 16.2, for example, internal amounts due are reported within the asset section of the statement of net assets and then are eliminated to arrive at overall government totals.

Likewise, in Exhibit 16.3, transfers between the two activity classifications appear at the very bottom of the general revenues section. Again, individual totals are shown and then are offset so that no total amount is reported. Although most transfers are intra-activity, interactivity transactions are also common. In its June 30, 2006, financial statements, the City of St. Louis reported internal balances of $86 million and interactivity transfers of $7.4 million.

Consequently, in discussing interfund transactions, the reporting for government-wide statements is appropriate only when an interactivity transaction is involved.

The most common interfund transactions are transfers within the governmental funds to ensure adequate financing of budgeted expenditures. A city council could vote to transfer $800,000 from the General Fund to the Capital Projects Funds to cover a portion of the cost of a new school building.

This scenario involves recording the following entries:

Fund-Based Financial Statements:

The Other Financing Uses/Sources designations are appropriate here; financial resources are being moved into and out of these funds although neither revenues nor expenditures have been earned or incurred. As Exhibit 16.5 shows, these balances are reported by each fund in the statement of revenues, expenditures, and other changes in fund balances.

Each figure is shown but is not offset in any way. Both accounts are then closed out at the end of the current year. The Due to/Due from accounts are the equivalent of interfund payable and receivable balances, and each account is reported within the proper fund on its balance sheet. Again no elimination is made in arriving at total figures for the governmental funds.

Because this is an intra-activity transaction, none of the above entries is made in creating the government-wide financial statements. Financial resources are simply being shifted around within the governmental activities.

Not all monetary transfers are for normal operating purposes; nonrecurring or non-routine transfers may also take place. For example, money might be transferred from the General Fund to create or expand an enterprise fund such as a bus or subway system. Assume that a city sets aside $1 million of unrestricted money to help permanently finance a new subway system that will be open to the public.

For convenience here, the transaction is recorded as if the cash is transferred immediately so that no receivable or payable is necessary:

Fund-Based Financial Statements:

Because this transfer is an interactivity transaction (between governmental activities and business-type activities), a similar entry is made for the government-wide financial statements.

This transfer reduces the assets of the governmental activities but increases the assets in the business-type activities:

Government-Wide Financial Statements:

Internal Exchange Transactions:

Some transfers made within a government are actually the same as revenues and expenditures. For example, a city’s payment to its own print shop (or any other Internal Service Fund or Enterprise Fund) for services or materials is the equivalent of a transaction with an outside party. To avoid confusion in reporting, such transfers are recorded as revenues and expenditures or expenses as if the transaction had occurred with an unrelated party. No differentiation is made; these payments are not treated as transfers which are designed to shift resources.

The fund-based financial statements record all such internal exchange transactions. However, because Internal Service Funds are usually reported as governmental activities in the government- wide statements, any such exchanges between a governmental fund and one of these internal service funds has no net impact on overall figures being reported and should be omitted.

To illustrate, assume that a government pays its print shop (an internal service fund) $8,000 for work done for the fire department. In addition, the government pays another $1,000 to a toll road operated as an enterprise fund to allow government vehicles to ride on the highway without having to make individual payments.

Both of these internal exchange payments are made for services being rendered:

Fund-Based Financial Statements:

The $8,000 transaction with the print shop would not be reflected on government-wide financial statements if this internal service fund is classified within the governmental activities. If classified in this way, the transfer is the equivalent of an intra-activity transaction. However, the $1,000 payment made for the fire department (a governmental activity) to the enterprise fund (a business-type activity) is the same as an interactivity transfer and is reported in the following entries.