Here is a compilation of top nine problems on holding companies with its relevant solutions.

Problem 1 (Wholly Owned Subsidiary):

ADVERTISEMENTS:

Note:

Investment which is made by the Holding Company in the form of shares of subsidiary company is replaced by the subsidiary company’s assets and liabilities.

Problem 2 (Goodwill):

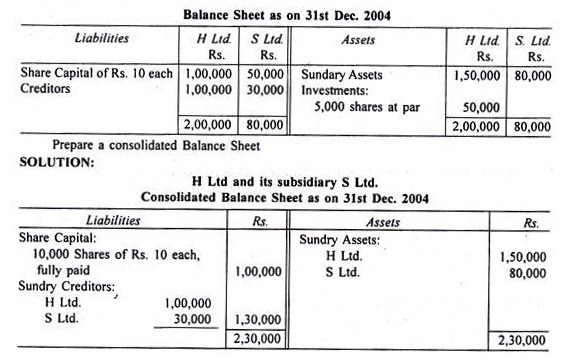

The following are the Balance Sheet of H and S as at 31st December on which date H acquires all the shares of S:

Problem 3 (Capital Reserve):

Balance Sheet as on 31st March

Note:

ADVERTISEMENTS:

The Reserve and Profit and Loss Account balances of the Subsidiary Company do not figure in the consolidated Balance Sheet as they are considered together with share capital in the calculation of Capital Reserve.

Problem 4 (Inter-Company Owings):

ADVERTISEMENTS:

From the balance sheets and information given below, prepare a Consolidated Balance Sheet:

(a) All the profits of S Ltd. have been earned since the shares were acquired by H Ltd. but there was already the Reserve of Rs. 6, 00,000 on that date.

(b) The bills accepted by S Ltd. are all in favour of H Ltd. which has discounted Rs. 2,000 of them.

ADVERTISEMENTS:

(c) Sundry assets of S Ltd. are undervalued by Rs. 2,000.

{d) The stock H Ltd. includes Rs. 5,000 bought from S Ltd. at a profit to the latter of 25% on cost.

ADVERTISEMENTS:

Problem 5 (Inter-Company Owings):

The following are the Balance Sheets of H Ltd. and its subsidiary S Ltd. as on 31st December 2004.

Debtors of H Ltd. include Rs 2,000 due from S Ltd. and Bills payable of H Ltd. included a bill of Rs 500 accepted in favour of S Ltd. A Load of Rs 1,000 given by H Ltd. to S Ltd. was also included in the items of debtors and creditors respectively. Rs 500 was transferred by S Ltd. from Profit and Loss Account to Reserve out of current year’s profit. Shares were purchased on 30th June 2004 at par.

ADVERTISEMENTS:

Prepare consolidated Balance Sheet.

Problem 6 (Cash-in-Transit & Mutual Obligation):

X Ltd. purchased 750 shares in Y Ltd. on 1.7.2006. The following were their Balance Sheets on 31.12.2006.

ADVERTISEMENTS:

Further:

1. Bills Receivable of X Ltd. include Rs. 10,000 accepted by Y Ltd.

2. Debtors of X Ltd. include Rs. 20,000 payable by Y Ltd.

3. A cheque of Rs. 5,000 sent by Y Ltd. on 20th December was not yet received by X Ltd. till 31st December 2006.

4. Profit and Loss Account of Y Ltd. showed a balance of Rs. 20,000 on 1st January 2006.

You are required to prepare a consolidated Balance sheet of X Ltd. and Y Ltd. as on 31st December 2006.

Problem 7 (Cost of Control):

The summarised Balance Sheet of H Ltd. and its S Ltd. on 31st December 2004 are as follows:

S Ltd. had the credit balance of Rs 30,000 in the Reserves when H Ltd. acquired shares in S Ltd. decided to make a bonus issue out of post-acquisition profits of two shares of Rs 10 each fully paid for every five shares held. Calculate the cost of control before the issue of bonus shares and after the issue of bonus shares. Also make the consolidated Balance Sheet after the issue of bonus shares.

Problem 8:

Following are the Balance Sheets of A Ltd. and B Ltd. on 31st March, 2006.

On 1.4.2005 the date of purchase of shares of B Ltd. by A Ltd., there was debit balance of Rs. 1,000 in the P & L. A/c of B Ltd. and reserves of B Ltd. were nil. Prepare Consolidated Balance Sheet.

Problem 9 (Bonus Shares):

The Sun Co. Ltd. acquired 6,000 shares in the Moon Co. Ltd. on 31.12.2006.

The summarised Balance Sheets of the two companies on that date were:

On 31st December, 2002 the Sun Co. Ltd. remitted cash Rs. 1,000 on current account to Moon Co. Ltd. On 1st January, 2007, Moon Co. Ltd., utilised a part of its capital reserve to make a bonus issue of one share for every four shares held. There is a contingent liability for bills discounted Rs. 1,200.