Read this article to learn about the two approaches for recording debit and credit of an account, i.e., (i) Traditional Approach and (ii) Modern Approach.

1. Traditional Approach:

Traditional approach of debiting or crediting the account is based on classification. Under traditional approach, all ledger accounts can be classified into personal and impersonal accounts. Before discussing the rules for debit and credit for personal and impersonal accounts, it is necessary for us to understand the meaning of these accounts under the traditional approach.

I. Personal Accounts:

ADVERTISEMENTS:

In this type of category, accounts of natural persons, artificial persons and representative persons are grouped.

(i) Natural Persons:

Natural persons mean human beings. Hence, in this type of category, accounts of human beings are involved. For example, Ram’s Account, Debtors’ Account, Creditors’ Account, Proprietor’s Capital Account, Proprietor’s Drawings Account etc.

(ii) Artificial Persons:

ADVERTISEMENTS:

Artificial persons are those persons who are not human but they can work like humans. In the eyes of law, they are competent to enter into an agreement like any human beings. For example, Mohan & Company, Firm, Corporate Body, Society, Bank and any Government Body like Municipal Corporation etc.

(iii) Representative Persons:

In this type of category, accounts representing persons (natural or artificial) or group of persons are included. Actually, when nominal accounts become outstanding, accrued or prepaid, they are called representative persons. For example, Salary Outstanding Account, Prepaid Rent Account etc.

II. Impersonal Accounts:

In this type of category, all those accounts which do not affect persons are grouped.

ADVERTISEMENTS:

These accounts are further categorized into:

(i) Real Accounts and

(ii) Nominal Accounts.

(a) Real Accounts:

ADVERTISEMENTS:

Accounts of tangible and intangible properties and possession are included in real accounts. The real accounts may be

(a) Tangible Real Accounts and

(b) Intangible Real Accounts.

(i) Tangible Real Accounts:

ADVERTISEMENTS:

Tangible real accounts comprise of those things which can be seen, touched and measured. For example, Furniture, Computer, Building, Stock , Cash etc.

(ii) Intangible Real Accounts:

Intangible real accounts consist of those items that cannot be seen, touched and measured but have monetary values such as Trademark, Copyright, Patent and Goodwill.

(b) Nominal Accounts:

ADVERTISEMENTS:

Accounts which relate to the expenses, losses, incomes and gains of the business concern are known as nominal accounts. For example, Rent Account, Salary Account, Commission Account etc. These accounts are also known as temporary accounts because depending upon their nature (direct or indirect), these accounts are transferred to the Trading or Profit and Loss Account at the end of the financial year.

Rules of Debit and Credit under Traditional Approach:

Under traditional approach, accounts can be classified into personal and impersonal accounts.

ADVERTISEMENTS:

Rules for debit and credit for these accounts are as under:

I. Personal Accounts: ‘Debit The Receiver And Credit The Giver’.

Where the accounts are related to persons, the rule is “debit the person who receives the benefit and credit the person who gives the benefit”.

II. Real Accounts: ‘Debit What Comes In And Credit What Goes Out’.

ADVERTISEMENTS:

In the case of real accounts, the rule is “debit what comes in and credit what goes out”.

III. Nominal Accounts: ‘Debit All Losses and Expenses & Credit All Incomes and gains’.

In the case of nominal accounts, the rule is “debit all losses and expenses & credit all income and gains”

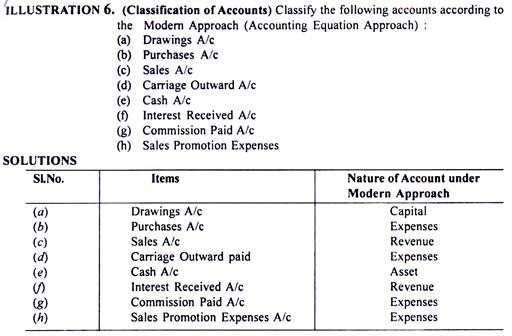

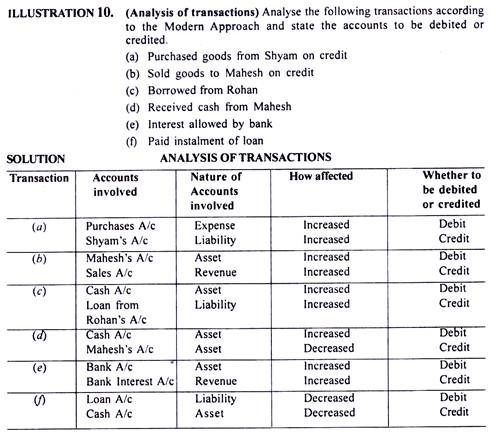

2. Modern Approach (Accounting Equation Approach):

Modern approach of debiting or crediting the account is based on accounting equation. Hence, Modern Approach is also known as Accounting Equation Approach. We know that accounting equation remains balanced all the time.

We have also analyzed that in any accounting equation, there are three main elements viz. Assets, Liabilities and Owner’s Equities. The profit or loss is the net result of revenues and expenses of the business during the year and will change the owner’s equity (Capital).

Therefore, the basic accounting equation can be expanded as under:

Assets = Liabilities + Capital + Revenues – Expenses

Under modern approach, accounts can be classified in five categories viz:

(i) Assets Accounts

(ii) Liabilities Accounts

(iii) Capital Accounts

(iv) Revenue Accounts and

(v) Expenses Accounts.

I. Asset Accounts:

In this type of category, assets are grouped. For example, Land and Building’s Account, Furniture Account, Bank Account, Cash Account, Trade Mark’s Account, Goodwill Account etc.

II. Liabilities Accounts:

In this type of category, accounts related to those financial obligations of an enterprise are grouped which are related to outsiders. For example, Creditor’s Account, Salary’s Outstanding Account etc.

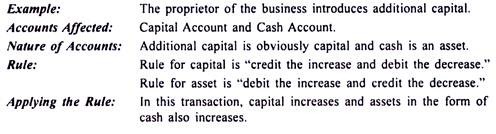

III. Capital Accounts:

In this type of category, accounts related to those financial obligations of an enterprise are grouped which are related to the owner(s). For example, Capital Account and Drawings Account.

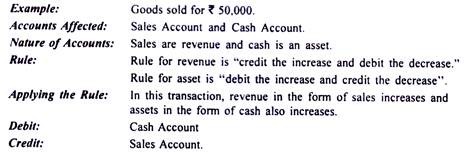

IV. Revenue Account:

In this type of category, accounts related to selling of goods, rendering services and other yields of the enterprise are grouped. For example, Sales Account, Rent Received Account, Interest Received etc.

V. Expenses Account:

In this type of category, accounts related to purchase of goods or services and the amount incurred/lost in the process of earning revenue are grouped. For example, Purchase Account, Discount Allowed Account, Salaries Account, Rent Account etc.

Rules of Debit and Credit under Modern Approach:

Now we shall move to discuss the rules for debit and credit for the main items of accounting equations such as Assets, Liabilities, Capital, Revenues and Expenses.

I. Assets: ‘Debit the Increase and Credit the Decrease’:

When there is an increase in the amount of an asset, the asset should be debited and when there is a decrease in the amount of an asset, it should be credited.

II. Liabilities: ‘Credit the Increase and Debit the Decrease’:

When there is an increase in the amount of a liability, the liability should be credited and when there is a decrease in the amount of a liability, it should be debited.

III. Capital: ‘Credit the Increase and Debit the Decrease’:

When there is an increase in the amount of capital, the capital account is to be credited and when there is a decrease in the amount of capital, it should be debited.

IV. Revenues: ‘Credit the Increase and Debit the Decrease’:

When there is an increase in the amount of revenues, the revenue account is to be credited and when there is a decrease in the amount of revenues, it should be debited.

V. Expenses: ‘Debit the Increase and Credit the Decrease’:

When there is an increase in the amount of an expense, then the expense should be debited and when there is a decrease in the amount of an expense, it should be credited.