Here we detail about the steps for posting of transactions from different subsidiary books to ledger accounts.

Posting from Cash Book to Ledger Accounts:

On the receipts side of cash book, all receipts through cash and bank are recorded. Similarly, on the payments side of cash book, all payments through cash and bank are recorded. We have already discussed that cash book serves the purpose of cash account also. Hence, by recording cash transactions in the cash book, posting of one aspect is completed. Now, the posting transactions into the respective ledger accounts are to be done.

For posting of transactions recorded in the cash book, the following steps are to be taken:

Step 1:

For posting from the debit (receipt) side of the cash book, the respective accounts are to be credited with cash and/or bank account by writing the words ‘By Cash/Bank A/c’.

ADVERTISEMENTS:

However, in case of personal accounts, the personal account is credited with cash and/or bank account along with the discount allowed account.

Step 2:

For posting from the credit (payment) side of the cash book, the respective accounts are to be debited with cash and/or bank account by writing the words ‘To Cash/Bank A/c’.

However, in case of personal accounts, the personal account is debited with cash and/or bank account along with the discount received account or bad debt account, if any.

Illustration. (Posting from Cash Book)

ADVERTISEMENTS:

From the following Cash Book, post the transaction into relevant ledger accounts:

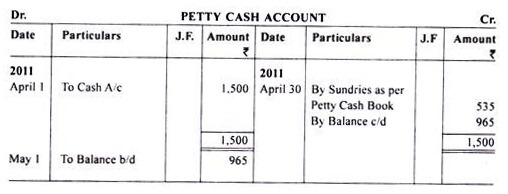

Posting the from Petty Cash Book to Ledger:

Step 1:

For posting of items of petty cash book, all heads of petty cash book are totaled periodically, say monthly.

Step 2:

Then, total of individual heads of the petty cash book are posted to the debit side of respective ledger account by writing the words ‘To Petty Cash A/c’.

Step 3:

Next, the petty cash account is to be credited with the amount of expenditure, incurred till date, by writing the words ‘By Sundries as per Petty Cash Book’.

ADVERTISEMENTS:

Illustration. (Posting from Petty Cash Book)

From the following Petty Cash Book, post the transactions into Ledger:

Posting from Purchases Book to Ledger:

Step 1: Posting to Purchases Account:

Usually, the purchase book is totaled at the end of every month. The monthly total shows the credit purchases during the month and should be debited in the purchases account by writing the words ‘To Sundries as per the purchase book’.

Under traditional approach of debit and credit, purchase is an expense and falls under the category of nominal accounts, so it should be debited. Also, under modern approach (accounting equation approach), purchase is an expense and ‘increase in expense is to be debited’.

Step 2: Posting to Personal Accounts:

The accounts of the various parties (natural or artificial) recorded in the purchase book are to be credited with their respective amount shown in the purchase book by writing the words ‘By Purchases A/c’. The posting to personal accounts is done daily with the relevant amount on their credit side.

Under traditional approach, these are persons and rule for personal accounts is ‘credit the giver’. Also, under the modern approach (accounting equation approach), these parties fall under the category of liabilities and ‘increase in liabilities is to be credited’.

ADVERTISEMENTS:

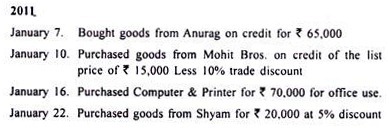

Illustration: (Posting Purchase Book)

Enter the following transactions in Purchase Book and post them into Ledger:

Posting from Sales Book to Ledger:

Sales book records only credit sales of goods and show the names of parties (the debtors) to whom the sales have been made.

Step 1: Posting to sales account:

ADVERTISEMENTS:

Total credit sales shown by the sales book should be credited in the sales account. Under traditional approach of debit and credit, sales is a revenue item and falls, under the category of nominal accounts, so it should be credited. Also, under modern approach (accounting equation approach), sales is revenue and increase in revenue is to be credited.

Step 2: Posting to personal accounts:

The accounts of the various parties (natural or artificial) recorded in the sales book are to be debited with their respective amounts shown in the sales book. The posting to personal accounts is done daily with the relevant amount on their debit side. Under traditional approach, these are persons and rule for personal accounts is ‘debit the receiver’. Also, under the modern approach (accounting equation approach), these parties are the debtors and fall under the category of assets and, ‘increase in assets is to be debited’.

Illustration. (Posting from Sales Book) Enter the following transactions in Sales Book and post them into Ledger:

Posting from Purchases Return Book to Ledger:

Purchases Return Book records purchases returned to the parties.

Step 1: Posting to Purchases Return Account:

Usually, the purchases return book is totaled at the end of every month. The monthly total shows the purchases returned during the month and should be credited in the purchases return account by writing the words ‘By Sundries as per the Purchases Return Book’.

Under traditional approach of debit and credit, purchases return falls under the category of nominal accounts, so it should be credited. Also, under modern approach (accounting equation approach), purchases return falls under the category of an expense and ‘decrease in expense is to be credited’.

Step 2: Posting to Personal Accounts:

The accounts of the various parties (natural or artificial) recorded in the purchases return book are to be debited with their respective amounts shown in the purchases return book by writing the words ‘To Purchases Return A/c’.

Under traditional approach, these are persons and rule for personal accounts is ‘debit the receiver’. Also, under the modern approach (accounting equation approach) these parties fall under the category of liabilities and ‘decrease in liabilities is to be debited’.

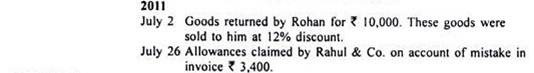

Illustration. (Posting from Purchase Return Book)

Enter the following transactions in Purchase Return Book and post them into Ledger:

Posting from Sales Return Book to Ledger:

Sales Return Book records the sales returned by the customers.

Step 1: Posting to Sates Return Account:

Usually, the sales return book is totaled at the end of every month. The monthly total shows the sales return during the month and should be debited in the sales return account by writing the words ‘To Sundries as per the Sales Return Book’.

Under traditional approach of debit and credit, sales return falls under the category of nominal accounts, so it should be debited. Also, under modern approach (accounting equation approach), sales return fall under the category of revenue and ‘decrease in revenue is to be debited’.

Step 2: Posting to Personal Accounts:

The accounts of the various parties (natural or artificial) recorded in the sales return book are to be credited with their respective amounts shown in the sales return book by writing the words ‘By Sales Return A/c’. Because under traditional approach, these are the persons and rule for personal accounts is ‘credit the giver’. Also, under the modern approach (accounting equation approach), these parties fall under the category of assets and ‘decrease in assets is to be credited’.

Illustration. (Posting from Sales Return Book) Enter the following transactions in Sales Return Book and post them into Ledger:

Posting from Bills Receivable Book to Ledger:

Bills Receivable Book records the names of the parties from whom the bills were received the business enterprise.

Step 1: Posting to Bills Receivable Account:

Usually, the bills receivable book is totaled at the end of every month. The monthly total shows the bills received by the business enterprise during the month and should be debited in the ‘Bills Receivable A/c’ by writing the words ‘To Sundries as per the Bills Receivable Book’.

Under traditional approach of debit and credit, bills receivable fall under the category of real accounts, so ‘debit comes in’. Also, under the modern approach (accounting equation approach), bills receivable fall under the category of assets so, ‘increase in asset is to be debited’.

Step 2: Posting to Personal Accounts:

The accounts of the various parties (natural or artificial) recorded in the bills receivable book are to be credited with their respective amount shown in the bills receivable book by writing the words ‘By Bills Receivable A/c’.. Under traditional approach, these are persons and rule for personal accounts is ‘credit the giver’.Also, under the modern approach (accounting equation approach), these parties are debtors and hence fall under the category of assets so, ‘decrease in assets is to be credited’.

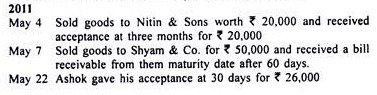

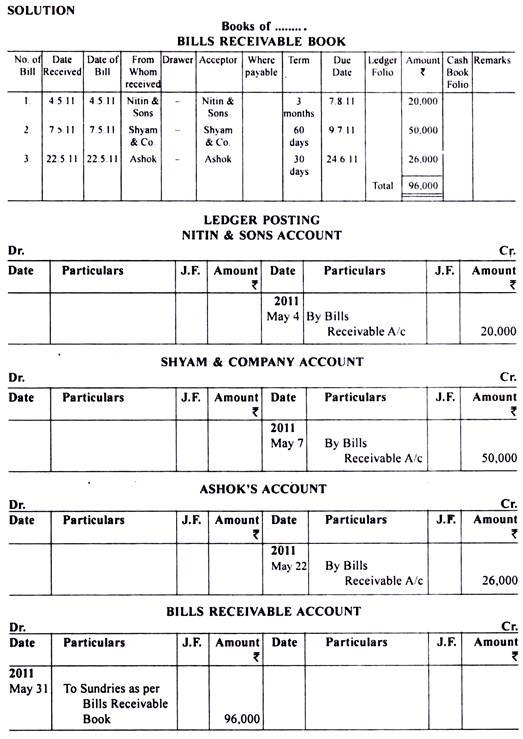

Illustration. (Posting from Bills Receivable Book) Enter the following transactions in Bills Receivable Book and post them into Ledger:

Posting from Bills Payable Book to Ledger:

Bills Payable Book records the name of parties to whom the bills were given by the business enterprise.

Step 1: Posting to Bills Payable Account:

Usually, the bills payable book is totaled at the end of every month. The monthly total shows the bills given by the business enterprise during the month and should be credited in the ‘Bills Payable A/c’ by writing the words ‘By Sundries as per the Bills Payable Book’.

Under traditional approach of debit and credit, bills payable fall under the category of real accounts, so ‘credit what goes out’. Also, under the modern approach (accounting equation approach), bills payable fall under the category of liabilities so ‘increase in liabilities is to be credited’.

Step 2: Posting to Personal Accounts:

The accounts of the various parties (natural or artificial) recorded in the bills payable book are to be debited with their respective amounts shown in the bills payable book by writing the words ‘To Bills Payable A/c’. Under traditional approach these are persons and rule for personal accounts is ‘debit the receiver’. Also, under the modern approach (accounting equation approach) these parties are creditors and hence fall under the category of liabilities, so that ‘decrease in liabilities is to be debited’.

Illustration. (Posting from Bills Payable Book)

Enter the following transactions in Bills Payable Book and post them into Ledger: