After reading this article you will learn about the Management of Debtors in India:- 1. Introduction to Management of Debtors 2. Objectives of Management of Debtors 3. Cost of Maintaining Debtors 4. Factors Affecting Size 5. Credit Procedure/Evaluation 6. Benefits of Credit Extension 7. Cash Discount 8. Credit Control System and its Effectiveness.

Contents:

- Introduction to Management of Debtors

- Objectives of Management of Debtors

- Cost of Maintaining Debtors

- Factors Affecting Size of Debtors

- Credit Procedure/Evaluation

- Benefits of Credit Extension

- Cash Discount

- Credit Control System and its Effectiveness

1. Introduction to Management of Debtors:

Management of cash was devoted to an in-depth examination of one of the most important components of current assets, namely, cash. There it was observed that in order to reduce the operating cash requirement collection of debtors/receivable should be accelerated in such a manner so that the average collection period reduces.

ADVERTISEMENTS:

The term ‘debtor’ is used to define as ‘debt owed to the firm by customers arising from sale of goods or services in the ordinary course of business. Debtors/Receivables, as asset, represent amounts owed to the firm by customers from sale of goods or services.

A firm grants trade credit to maintain its sales from the hands of the competitors and at the same time, to attract the potential customers to purchase its products at favourable terms. Trade credit arises only when the firm sells its product to the customers but does not receive immediate cash, i.e., at the time of credit sales. Receivables/Debtors are created out of trade credit and which are collected in the near future.

Debtors have got the three distinct characteristics:

(1) It involves risk which should carefully be studied since cash sales are riskless whereas at the time of credit sales, cash is yet to be received.

ADVERTISEMENTS:

(ii) It is based on present economic value. At the time of sale the economic value of goods passes immediately, whereas, the seller expects an equivalent benefit at a later date.

(iii) It implies futurity. The value of goods or services received by the buyer will be payable by him at a future date.

No doubt, debtors/receivables play a significant role in the total current asset composition since their position is next to inventories. In India, they form about one third of total current asset.

2. Objectives of Management of Debtors:

ADVERTISEMENTS:

Accounts receivable/debtors are generated which is collected at a future date only when the firm grants credit against an ordinary sale of goods or, services without receiving cash. Credit sale is an essential part of the present competitive economic system.

It is granted in order to increase the volume of sales. As such, debtors/receivables which are created out of credit sales, are considered as a marketing tool for increasing sales. It may be mentioned in this respect that credit which is granted to the customer is done in the ordinary course of the business, i.e., on an open account.

In other words, there will be no formal acknowledgement of debt obligation But extension of credit involves cost and risk Therefore, management should weigh the benefits against cost.

As such, the objective of debtors/receivables management is ‘to promote sales and profits until that point is reached (i.e., optimum point) where the return on investment in further funding of receivables is less than the cost of funds raised to finance that additional credit (i.e., cost of capital)’.

ADVERTISEMENTS:

ADVERTISEMENTS:

3. Cost of Maintaining Debtors:

The specific costs arising out of extension of credit which are related to the determination of the objectives of receivable management are:

(a) Collection costs;

(b) Capital costs/Cost of financing;

ADVERTISEMENTS:

(c) Delinquency cost; and

(d) Default cost.

(a) Collection Costs:

These cost are those which are to be incurred by a firm in order to collect the amount on account of credit sales, i.e., these expenses would not be incurred if the firm does not sell goods on credit, e.g., additional expenses incurred for the maintenance of credit and collection department, expenses incurred for obtaining information about credit-worthiness of potential customers.

ADVERTISEMENTS:

(b) Capital Costs/ Cost of Financing:

The amounts which are locked up in debtors on account of credit sales may be financed from one of the following three sources:

(i) Share capital;

(ii) Debt capital (long and short- term); and

ADVERTISEMENTS:

(iii) Retained earnings.

Illustration:

A firm sells its article at a profit of 25% on cost and the average balance of debtors amounts to Rs. 8,00,000 Investment in debtors is being financed by bank borrowings at 15%. Ascertain the cost of financing average debtors.

Solution:

(c) Delinquency Costs When the period of payment becomes due (i.e, after the expiry of the credit period) but is not received from the customers, the same is known as delinquency costs.

ADVERTISEMENTS:

It includes:

(i) Blocking up of funds/cost of financing for an extended period; and

(ii) Cost of extra steps to be taken to collect the over-dues, e.g., reminders, legal charges etc.

(d) Default Costs Sometimes the firms may not collect the over-dues from the customers since they are unable to pay. These debts are treated as bad debts and are to be written off accordingly since the amounts will not be realized in future.

Such costs are termed as ‘Default Costs’. Although, the firms make proper provision against bad debts; the cost will increase if the amount of credit sales is increased in proportion to cash sales.

Volume of Sales:

It is needless to mention that if credit standard changes, there will be a corresponding change in the volume of sales, i.e., if credit standards are tightened, sales are expected to decrease and in the opposite case, that is, if credit standards are relaxed, volume of sales are expected to increase. Thus, volume of sales is affected by the credit standard of a firm.

The following illustration will illustrate the principle clear:

Illustration:

Present selling price Rs. 20 per unit.

Present sales in units, all credit, 60,000 units.

Variable Cost per unit Rs. 12.

Average Cost per unit is Rs. 16 (on a sales volume of 60,000 units).

[Difference between the average cost per unit and the variable cost per unit (i.e., Rs. 16 – Rs 12) = Rs. 4 represents the contribution of each of the 60,000 units towards the fixed cost. Thus, the total fixed cost become Rs. 60,000 x 2 = Rs 1,20,000 ]

Average collection period say, 30 days. The firm desires to relax the credit standard for which sales are expected to increase by 15% and average collection period is increased by 15 days without however, having any bad debt loses. (Increase in collection expenses may be ignored.)

Required rate of return on investment is 15%.

Suggest whether the firm should relax the existing credit standard or not.

Solution:

Whether the credit standard should be relevant or not depends upon:

(i) Additional profit on sales, and

(ii) Cost of incremental investment in accounts recoverable.

In other words, if additional profit on sales exceeds the cost of incremental investment in accounts recoverable, the said proposal may be accepted and the same should be rejected in the opposite case.

(i) Additional Profit on Sale:

It can be ascertained in the following manner:

(a) By longer approach; and

(b) By shorter approach.

(a) Longer Approach:

Under this approach, the costs and profits on existing sales and proposed sales will be determined and the difference in profit will be treated as incremental profit.

The same can be ascertained as under:

(b) Shorter Approach:

Under this method, the profit on sales increase by that amount which equal to the product of the extra unit sold and the additional profit per unit as well Thus, in the above illustration, the cost of additional unit consists of variable cost only as the fixed cost has already been absorbed by the existing level of output.

Since expected increase in sales volume is 15% i.e., 69,000 units, the marginal profit per unit will be the difference between the sale price per unit and the marginal/variable cost per unit which is Rs. 8 (i.e. Rs. 20 – Rs. 12). So the total additional profit will be 9,000 unit x Rs 8 = Rs. 72,000.

(ii) Cost of Incremental Investment in Accounts Receivables:

The second one for relaxing the credit standards in the Cost of incremental Investment in Accounts Receivables which can be ascertained by taking the difference between cost of carrying the account receivables before as well as after the proposed proposal in credit standards is taken into consideration.

The same can be computed in the following manner:

From the above it becomes crystal clear that the additional profit on increased rates (i.e. Rs. 72.000) is more than this cost of such incremental investments is account receivable (i.e., Rs. 6,525) due to relaxing of credit standard. Hence, it is justified.

4. Factors Affecting Size of Debtors:

It has already been pointed out that debtors/receivables are the major component of total current assets. The size or level of debtors is determined by a number of factors.

Three primary factors are:

(1) Level of Sales;

(2) Terms of Trade; and

(3) Credit Policies,

(1) Level of Sales:

The primary factor in determining the volume of debtors/receivables is the level of credit sales. Needles to mention that increase m credit sales means a corresponding increase in debtors and vice- versa.

No doubt, the level of sales can be used to forecast changes in receivables, i.e., if a firm predicts an increase of 50% in its credit sales for the next period, it will experience probably also an increase of 50% in debtors/receivables.

The following illustration will make the principle clear:

Illustration:

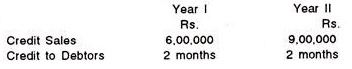

Average Debtors (6,00.000 x 2/12) 1,00,000 (9,00,000 x 2/12 ) 1,50,000 Since there is an increase in credit sale, (50%), there is also a corresponding equal increase (50%) in the amount of Debtors, period of credit remaining constant.

(2) Terms of Trade:

A change in credit policy has a direct impact on debtors. Thus, if credit terms are relaxed, it will lead to increase in the amount of debtors and vice-versa.

The following illustration will help to understand the principle:

Illustration:

From the above, it is quite clear that since there is an increase in credit period by one month, there is a corresponding increase in the amount of debtors by Rs. 25,000 (Rs.75,000 – Rs. 50,000) assuming that the amount of credit sales remains constant.

In reality, of course, if credit period is extended, credit sales increase and at the same time, debtors’ balance also will be increased in comparison with the amounts shown above.

(3) Credit Policies:

The level of debtors/receivables balance is closely related with the collection policy of the firm. Practically, credit policy determines the amount of risk that a firm is to undertake in its sales activities.

5. Credit Procedure/Evaluation:

A firm should follow some clear-cut principles and procedure for granting credit to its individual customers for effective credit management since debtors constitute an investment on the part of the firm.

Generally, the credit-worthies of a customer depends on the three C’s, they are:

(i) Character:

It relates the willingness of the customer to honour his dues which reflects integrity. This should carefully be considered by the credit manager.

(ii) Capacity:

It indicates the ability of the customer to honour his dues in time which depends on the financial position, profitability and the working capital position as well.

(iii) Collateral:

It reveals the security given by the firm as mortgage i.e., hypothecation of various kinds of assets owned by the firm. In short, the reputation or credit-worthiness of the customer should be examined as far as possible before granting credit.

For this purpose, the collection policy of the firm will differ from customer to customer. In case of old customer, past records will tell his story but in other cases, the credit controller should follow a channel of information.

However, the following steps should be involved for the purpose:

(a) Credit information,

(b) Credit investigation,

(c) Credit analysis,

(d) Credit limits, and

(e) Collection procedures,

(a) Credit Information it includes:

(i) Banker’s Enquiry:

Since the customer maintains account in a bank, necessary information can be taken if, of course, the bank so allows. Normally, banks do not provide information directly to the inquirer. The same task can be done with the help of firm’s bank.

In India, practically, this source of information is not very useful because of the indifference of banks in providing information, i.e., bankers may be reluctant to disclose its customer’s position.

(ii) Trade Reference:

The firm may insist on the proposed customers to give the names of such firms as he has current dealings for the purpose of getting information about his credit-worthiness. This is, no doubt, a useful source of credit information without cost.

The firm should take prompt and proper steps to seek information from the references whenever the trade references have been furnished. It may be contacted personally to obtain all relevant information required by the firm.

(iii) Credit Bureau Reports:

In advanced countries, credit bureau organisations are employed in order to get comprehensive and correct information. They are specialized in providing credit information. No doubt, these are valuable sources for assessing the credit-worthiness of proposed customers. There is an urgent need for such organisations in our country.

(iv) Financial Statement:

Scrutinizing the published financial statement (viz., Profit and Loss Account and Balance Sheet) of the proposed customers, the financial condition and the credit-worthiness can be assessed. For example, liquidity and solvency position can be judged with the help of accounting ratios, viz. Current Radio, Liquid Ratio, Debt-Equity Ratio, Return on Equity; EBIT to Total Assets Ratio etc. Creditors’ turnover ratio may also be tested.

(b) Credit Investigation:

Further investigation should be made by the firm after receiving the credit information about the prospective customer.

The following factors may be advocated:

1. The type of customers; whether new or old;

2. The customer’s business line, background and the related trade risks.

3. The nature of the product — perishable or seasonal;

4. Size of customer’s order and expected future volumes of business with him;

5. Company’s credit policies and practices.

It should be remembered that a meaningful investigation can be carried out only with the help of the necessary data supplied about the proposed customers for the last four-five years.

(c) Credit Analysis:

For granting credit, the next step is to conduct the credit analysis of the proposed customer. For this purposes, proper evaluation about the financial position of the customers should be made very carefully with the help of liquidity ratios and other ratios to be computed from the data available in the published financial statement which will indicate the repaying capacity of the customer.

The performance can also be compared with industry average ratios. Besides, ‘the analyst has to be alert to spot instances of imbalance in management of customer’s business, marked by over- centralization of responsibilities and authority, over-trading, shrinking margins and growing liabilities. While business failures can be distributed to a large variety of factors, the central factor is management in competence.

(d) Credit Limit:

Whenever the decision to extend credit is being taken, the amount and duration of the same is to be decided. The decisions in this regard depend on (i) the amount of contemplated sales and (ii) the financial strength of the customers.

A line of credit can be established in case of a frequent buyer which in other words avoid the need to investigate each order from him, i.e., a line of credit is the maximum amount of credit which can be extended by the firm at a given period.

In short, it reveals the maximum risk exposure that the firm will allow itself to undergo for an account. The line of credit can be fixed on the basis of customer’s normal buying trend and depending on the regularity of payment.

(e) Collection Procedure:

The purpose of every collection policy is to speed up the collection of dues. If collections are unnecessarily delayed, alternative sources of finance for sustaining production and sales are to be made and amount of bad debts also will increase.

The collection procedures should always be well-administered and established in clear-cut terms. At the same time, special consideration should be made to some customers who are temporarily in tight financial position due to some external factors, viz., slack economic conditions.

Besides, cash discounts may be allowed to customers for the prompt payment.

However, the terms of credit should be ascertained after assessing the credit-worthiness of the customers. A firm may adopt different credit policies for different customers in order to minimize the risk involved on the basis of credit reputation. ‘Risk-class Approach’ established by Hampton’ may be remembered here.

According to him, a firm establishes a certain number of risk classes ranging from the strongest and most established customers to the weakest firms. A separate credit policy is developed for each class.

When a customer first applies for credit, the customer is investigated and placed into one of the classes. This eliminates the need to make a separate decision on extending credit each time when the customer wants to make purchase.

The following table will make the principle clear:

6. Benefits of Credit Extension:

If the period of credit is extended, there will be a corresponding increase in the amount of sales. Before extending credit, one has to compare additional profits with costs related with the decisions which may arise out of increased sales due to extension of credit terms.

If the period of credit is extended, that will, no doubt, increase average debtors. Additional investment in debtors should be determined first. Thereafter, the cost of additional investment in debtors is to be ascertained. For the computation of cost for additional investment in debtors, two methods are generally adopted.

The first one is the appropriate required rate of return for the level of risk involved in the investment of debtors. The second one is the cost of debt capital as against the cost of financing investment in debtors.

This is based on the assumption that as soon as the firm expands its debtors, the same is possible usually by taking the help of long- term debt capital. However, the first one is ‘superior to using the financing cost of debt.

Thus, the decision rule is that the cost of additional investment in debtors must not exceed the expected additional profit or contribution whenever there is a change in credit policy. There are two assumptions which are to be considered before taking any decision for the extension of credit.

Firstly, increase in sales can be made with available capacity and secondly, there must not be an adverse effect on the price of articles due to increase in the volume of sales.

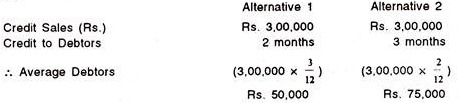

Illustration:

Present annual sale of Company X, amounts to Rs. 40,00,000 at Rs. 10 per unit

Variable cost Rs. 6 per unit.

Fixed cost Rs. 3,00,000 annually.

The present credit period is 1 month which is proposed to be extended to 2 and 3 months, whichever appears to be more profitable.

Due to extension of credit period sales will increase by 10% and 25% respectively.

The company requires a pre-tax return on investment of at least 20% for the level of risk involved Evaluate the profitability.

Solution:

Illustration:

In order to Increase sales from its present level of Rs. 2.4 lakhs p a. your marketing manager submits proposal for liberalizing the credit policy as shown below:

Solution:

Illustration:

Best Manufacturers Ltd. sells their product in cash. Now they desire to sell their products on credit in order to increase the volume of sales. It wants to grant credit to its customers in the following two alternative forms from which you are asked to find out the better one.

Solution:

7. Cash Discount:

Many firms offer cash discounts to their customers in order to speed up the payment of debts at a certain specified rate. The cash discount terms reveal the rate of discount and the period for which discount has been offered. As such, if a customer does not avail this opportunity, he is to make payment by the net date.

Practically, credit terms include both cash discount and credit period.

It indicates:

(i) The rate of cash discount,

(ii) The period of discount, and

(iii) The period of credit.

For example, credit terms are expressed as “5/15, net 30”. It expresses that a 5% discount will be granted if payment is made by the 15th day and if the offer is not availed, the payment is to be made by the 30th days.

However, the decision about the cash discount depends on the comparative study between costs and benefits. Here, costs represent the amount of discounts on credit sales which the debtors will avail of and opportunity saving will be the benefits. In short, the average balance of debtors will come down if the cash discount is being introduced.

As a result, reduction in investment in average debtors can easily be ascertained. Consequently, opportunity savings will arise by the application of required rate of return to the reduction in the investment in debtors. Therefore, if opportunity savings is higher than the cost of cash discount, cash discount scheme will, not doubt, prove worth.

Illustration:

Company X furnished the following particulars:

Credit sales Rs 50,00,000

Variable cost to sales ratio 50%.

Fixed Cost Rs. 11,00,000

Present credit policy is 2 months.

Cash discount scheme of “2/10, net 60”. is to be introduced.

It is estimated that 50% of the debtors will enjoy the discount scheme. As a result, the average age of debtors would be reduced to 1 month.

Required rate of return on investment in debtors may be taken at 20% before tax Evaluate the proposal.

Solution:

Since opportunity savings exceed cost of cash discount by Rs. 10.000 (Rs 60,000 Rs. 50,000), hence the discount policy will be profitable.

However, profit or loss in cash discount decision depends on the following:

(1) The terms relating to discount and period offered

(2) The rate of opportunity investment.

(3) The age of debtors who do not take the benefit of cash discount

8. Credit Control System and its Effectiveness:

Different aspect in relation to the policy decision on credit management has already been focused earlier. Now, we would like to discuss the efficiency of debt collection system. The primary purpose is to express the collection of debt according to credit terms and reducing the incidence of bad debt losses, which, in other words, include the following.

(a) Efficient Billing System, and

(b) Adherence to a given Credit Policy.

(a) Efficient Billing System:

Efficient billing system, no doubt, improves the cash inflow. And, as such, if collections from debtors are delayed as a result of wrong billing, delayed billing etc., that system must be improved. In that case, there should be a thorough watch at the existing billings system within the firm on the following questions:

— Is the Billing Mechanism efficient?

If the billing is to be done at monthly intervals in the firm, do the bills reach all the customers within at least 5 days after the close of the month?

— Are there frequent complains on the rates and quantities mentioned in the bills?

If so, there is something inherently wrong with the present system and it is imperative to streamline the system in this regard:

— How does the existing system compare with the competitors and/or similar firms?

However, in a recent study of 8 public sector undertakings in India, it has been found that the average time taken for preparing and sending the bills to customers lies between 7 and 30 days. Although, in most of the undertakings, the range actually varies from 7 to 15 days and some other firms extend to 30 days or more.

(b) Adherence to a given Credit Policy:

The credit terms, including the introduction of cash discount which have been highlighted so far, should be honoured. In order to perform it properly, it requires an organized follow-up system. At the same time, it becomes necessary to know the average age of outstanding debtors’ balance just to follow-up the collection of debts.

The average age of debtors so calculated should be compared with the normal credit period which will indicate either the weakness or otherwise of the collection system. Besides the management should know the age of delinquent customers which needs a classification of debtors according to age groups.

Again the debtors who are enjoying the benefits of introducing cash discount should also be analyzed and ascertained. Actual bad debt losses, if any, are to be compared with the anticipated amount which helps to revise the credit policy of the firm in the near future.

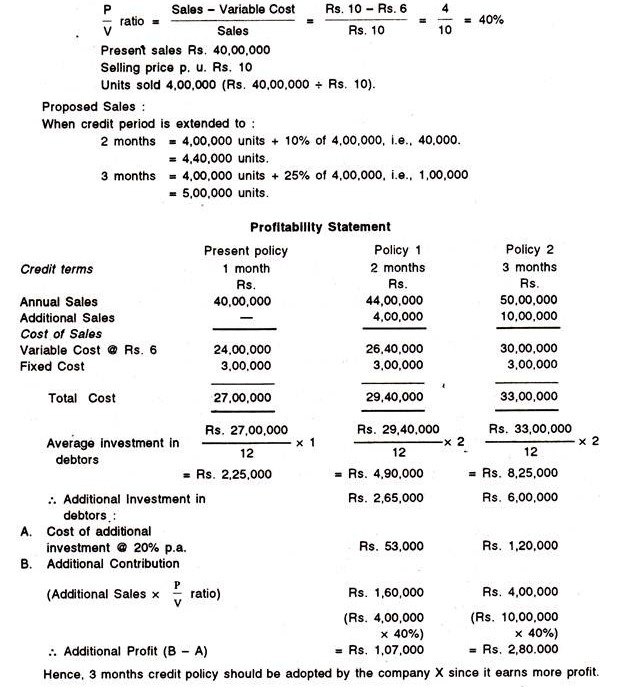

Average Age of Debtors:

It is also known as Debtors Turnover Ratio. It indicates the speed at which the debtors are converted into cash.

The same is calculated as under:

From the above illustration, it is quite clear that the trend of credit collection period is increasing in comparison with the normal credit period of 30 days and as such, the position is very alarming. If this position is continued the liquidity position of the firm will deteriorate and naturally additional funds would be required in order to continue the operation.

Besides, for the purpose of better comparison between the months, percentage increase or decrease in sales is to be compared with the percentage increase or decrease in average age of debtors. Consequently, special attention must be given when percentage of average age of debtors increase than the corresponding increase in the percentage of sales.

It is better to classify the debts according to their respective ages instead of the method of calculating the average age of debtors (so calculated above) which express an overall picture only be approximation.

From the statement presented above information like date of sales, payment received from debtors from time to time etc., can easily be known which helps the management to consult the debtors ledger for further decision. Actually, the main purpose of the age group of classification is to ensure a stricter control on the collection of debts from individual customers.

Besides, it indicates an additional information about the average age of debtors by expressing a trend for old accounts to accumulate For example, from the above table, it is found that out of the total debts, about 50% belongs to the age group of over 30 days.

Again, out of the total debts Rs 90,000 becomes outstanding for more than the period of 120 days which may be proved bad if the management does not take any immediate step.

Problem:

(a) A company sells a product at Rs. 30 per unit with a variable cost of Rs. 20 per unit. The fixed costs amount to Rs. 6,25,000 p a. and the total annual sales to Rs. 75 lakhs. It is estimated that if the present credit facility of one month were doubled, sales could be increased by Rs. 6,00,000 p a. The company expects a return on investment at least 20% prior to taxation. Justify by calculation that this course can be adopted.

(b) There is the possibility of an additional overseas order being procured which would not affect the home market, 10,000 extra units could be sold, but additional costs on the order would amount to Rs 300 while the risk of a bad debt is estimated at 0.25. Also credit would have to be extended to the customer to 90 days. Should the order be accepted?

Solution:

Problem:

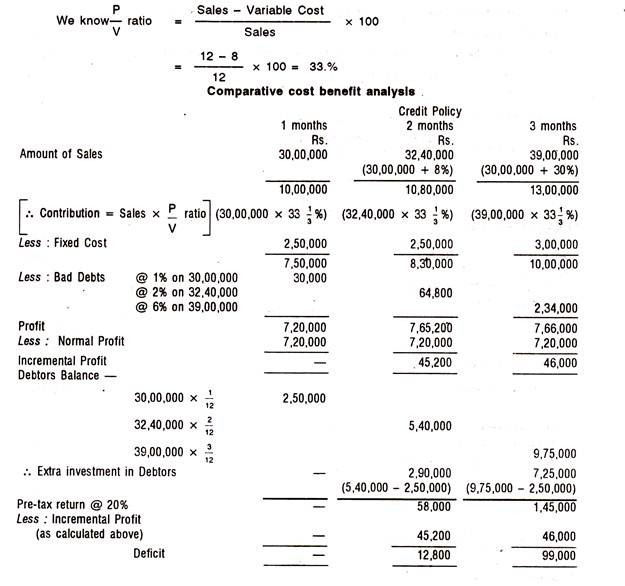

ABC company’s present annual sales amount to Rs. 30 lakhs at Rs. 12 p.u. Variable costs are Rs. 8 p.u. and fixed costs amount to Rs. 2.50 lakhs p a. Its present credit period of one month is proposed to be extended to either 2 or 3 months, whichever appears to be more profitable.

The following estimates are made for the purpose:

Fixed cost will increase by Rs. 50,000 annually after any increase in sales above 25% over the present level.

The Company requires a pre-tax return on investment of at least 20% for the level of risk involved.

What will be the most rewarding credit policy in case of ABC Company under the above circumstances? Present your answer in a tabular form.

Solution:

Hence, most rewarding credit policy is 1 month since 2 months and 3 months credit policies are not at all rewarding. They are less than required pre-tax return calculated on the basis of extra debtors balance.

Problem:

A company is now extending one month’s credit to its selected customers. It sells product at Rs. 100 each and has an annual sales volume of 60,000 units. A current level of production, which matches with sales, the product has total cost of Rs. 90 per unit and a variable cost of Rs. 80 per unit.

The company is considering a plan to grant more liberal terms by extending the duration of credit from one month to two months and expects the sales to the customer group to go up by 25%. In the background of a normal expectation of a 20% return on investment, will this relaxation in credit standard justify itself?

Solution:

Since, additional profit amounting to Rs. 3,00,000 may be earned, relaxation of credit from one month to two months may be granted.

Problem:

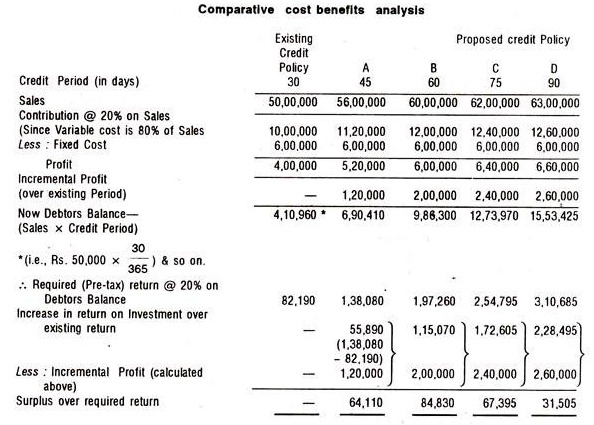

Super Sports Co., dealing in sports goods, have an annual sale of Rs, 50 lakhs and are currently extending 30 days, credit to the dealers. It is felt that sales can pick up considerably if the dealers are willing to carry increased stocks, but the dealers have difficulty in financing their inventory. Super Sports Co., is, therefore, considering shifts in credit policy.

The following information is available:

Solution:

It is evident from the above statement that Proposed Credit Policy’ of B, i.e.. 60 days credit should be adopted since it gives the highest return over the existing policy.

Problem:

You have recently taken over as credit manager of a large Co and you have collected the following data for the last year Prepare a note on credit collection and also indicate a basis for a differentiated credit policy.

Solution:

Comment:

It is quite clear from the above statement that the average credit period allowed to customers IH respect of Govt.— Others, is the highest i.e., 94 days sales and even in case of consumers, there is 80 days which is also higher in relation to normal credit period But in case of Govt. — DGS & D, the same is almost normal whereas in case of Stockiest, it is the lowest i.e., only 2 days.