The fundamental accounting equation is:

This is basis of double entry book keeping as well.

Income – Expense = Profit; when income is more than expenses the difference is termed as profit.

ADVERTISEMENTS:

Expense – Income = Loss; when income is less than expenses the difference is termed as loss.

Both profit and loss are equity – profit is increase to equity and loss is decrease in equity.

Example:

ADVERTISEMENTS:

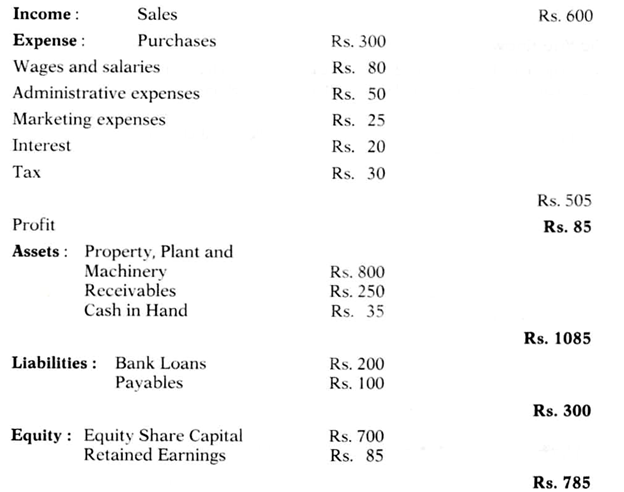

Classify the following items into various accounting elements and verify accounting equation: (Figures are in Rs. million)

Purchases Rs.300, sales Rs.600, wages and salaries Rs.80, administrative expenses Rs.50, marketing expenses Rs.25, corporate tax Rs.30, property, plant and machinery Rs.800, bank loans Rs.200, interest Rs.20, equity share capital Rs.700, cash in hand Rs.35, receivables Rs. 250, payables Rs.100

Solution: (Figure in Rs. Million)

Assets Rs.1085 = Liabilities Rs.300 + Equity Rs.785