In this article we will discuss about the International Accounting Standards Committee (IASC) Foundation:- 1. History of IASC Foundation 2. Organization of the IASC Foundation 3. Relation with IOSCO.

History of IASC Foundation:

The IASC Foundation is an independent body, not controlled by any particular Government or professional organization. Its main purpose is to oversee the IASB in setting the accounting principles which are used by business and other organizations around the world concerned with financial reporting.

The IASC was formed in 1973 through an agreement made by professional accountancy bodies from Australia, Canada, France, Germany, Ireland, Japan, Mexico, the Netherlands, the UK and the USA.

In November 1999, the IASC board itself approved the constitutional changes necessary for its own restructuring. In May 2000, the IFAC unanimously approved the restructuring. The constitution of the old IASC was revised to reflect the new structure.

ADVERTISEMENTS:

A new IASC Foundation was incorporated (under the laws of the US state of Delaware), and its trustee were appointed. By early 2001, the members of the IASB and the SAC were appointed, and the new structure became operational. Later that year, the IASB moved into new quarters in London. The technical staff of the IASB comprises over 20 accounting professionals—roughly quadruple the former IASC’s professional staff.

In this testimony before the US Senate Committee on Banking, Housing and Urban Affairs on 14 February, 2002 in Washington, Sir David Tweedie, Chairman of the International Accounting Standards Board, stated that an international standard setter was needed for four reasons:

1. There is a recognised and growing need for international accounting standards.

2. No individual standard setter has a monopoly on the best solutions to accounting problems.

ADVERTISEMENTS:

3. No national standard setter is in a position to set accounting standards that can gain acceptance around the world.

4. There are many areas of financial reporting in which national standard setter finds it difficult to act alone.

The objectives of the IASB stated in its Constitution (2000) are:

(a) To develop in the public interest, a single set of high-quality, understandable and enforceable global accounting standards that require high quality, transparent and comparable information in financial statements and other financial reporting to help participants in the world’s capital markets and other users make economic decisions;

ADVERTISEMENTS:

(b) To promote the use and rigorous application of those standards; and

(c) To bring about convergence of national accounting standards and International Accounting Standards to high-quality solutions.

The IASC saw these objectives as giving a more precise focus to the objectives originally written in 1973 which were:

i. To formulate and publish in the public interest accounting standards to be observed in the presentation of financial statements and to promote their worldwide acceptance and observance; and

ADVERTISEMENTS:

ii. To work generally for the improvement and harmonization of regulations, accounting standards and procedures relating to the presentation of financial statements.

In the words of Burggraaff a former Chairman of the International Accounting Standards Committee:

“IASC is a private sector professional exercise. It is meant to remain that way. Not because we feel that others should not be allowed to have a say in standard-setting; on the contrary, we feel that they too should be involved. But it is our experience that only in the profession is there a sufficient body of common knowledge, expertise, independence and mutual understanding—all essential ingredients to achieve our goal; unbiased, workable standards that contribute to improved reliability and understandability of financial statements, world-wide”.

Organization of the IASC Foundation:

(1) Membership:

From 1983 the membership of IASC included all the professional accountancy bodies that were members of IFAC. Although IASC is older than IF AC by four years, the creation of IFAC brought into being a global structure from which IASC could obtain wider authority.

ADVERTISEMENTS:

IASC retains its independence by having its own constitution that, from 2000, can be altered only by a meeting of the Trustees. Under the 2000 Constitution, the members cease to have a formal role in the decisions of the IASC Foundation.

(2) The Trustees:

From 2000, the governance of the IASC foundation rests with the Trustees. There are 19 trustees, initially appointed by a Nominating Committee but thereafter taking responsibility themselves for filling vacancies as these arise.

Trustees are required to show a firm commitment to the IASC as a high-quality global standard-setter, to be financially knowledgeable, and to have the ability to meet the time commitment expected.

Each Trustee must have an under-standing of, and be sensitive to, international issues relevant to the success of an international organization responsible for the development of high-quality global accounting standards for use in the world’s capital markets and by other users.

ADVERTISEMENTS:

To ensure an adequate geographic representation it is required that six Trustees be appointed from North America, six from Europe, four from the Asia/Pacific region and three from any area, subject to overall geographic balance.

The appointment is for a term of three years, renewable once. They appoint the members of the IASB, the members of the Standing Interpretations Committee and the members of the Standards Advisory Council.

(3) The International Accounting Standards Boards (IASB):

From 2000, the IASB comprises 14 members, appointed by the Trustees. The foremost qualification for membership of the Board is technical expertise. The people chosen represent the best available combination of technical skills and background experience of relevant international business and market conditions.

ADVERTISEMENTS:

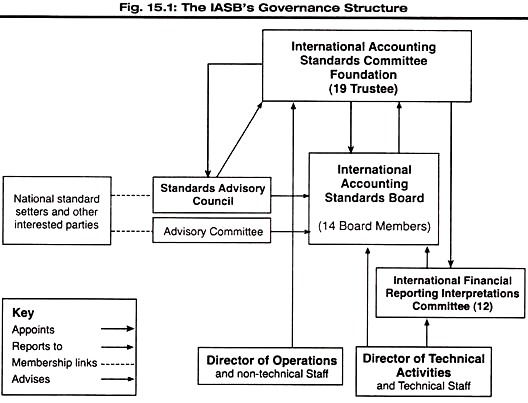

The selection is not based on geographical representation. The idea of balance requires at least five to have a background as practising auditors, at least three to have a background in the preparation of financial statements, at least three a background as users of financial statements, and at least one an academic background. The IASB’s Governance structure is given in Fig. 15.1.

Publication of an exposure draft, standard or interpretation requires approval by eight of the fourteen members of the Board. Other matters require a simple majority of those present, subject to 60% attendance either in person or by telecommunications link. Up to the end of 2000, the IASC Board issued International Accounting Standards (IASs). From 2001, the IASB issues International Financial Reporting Standards (IFRSs).

(4) Standing Interpretation Committee (SIC):

For many years, the publication of the IAS was the final stage of the process. In 1995, it was agreed that it would be desirable to have interpretations giving additional rulings on particular aspects of the standards. This would be an important aspect of ensuring the acceptance of IASs by the regulators of securities exchanges. The work of preparing these interpretations is in the hands of the Standing Interpretations Committee (SIC).

Interpretations issued by the SIC are approved by the IASB and arc part of the IASC’s authoritative literature. The objective of the SIC is to enhance the rigorous application and worldwide comparability of financial statements that are prepared using IAS by interpreting potentially contentions accounting issues.

The SIC has been reconstituted in December 2001 and renamed as the International Financial Reporting Interpretations Committee (IFRIC). It reviews on a timely basis within the context of existing International Accounting Standards and the IASB Framework, accounting issues that are likely to receive divergent or unacceptable treatment in the absence of authoritative guidance, with a view to reaching consensus as to the appropriate accounting treatment.

In developing interpretations, the IFRIC works closely with similar national committees. The IFRIC meets about every two months. All technical decisions are taken at sessions that are open to public observations.

(5) Enforcement of IASs:

ADVERTISEMENTS:

The power of enforcement has diminished over time. When the IASC was founded its members agreed to use their best endeavors and persuasive influence to ensure compliance with the standards.

It was intended that each professional accounting association within the IASC would ensure that the external auditors would satisfy themselves as to observance of the standards and would disclose cases of non-compliance; appropriate action was to be taken against any auditor who did not follow these recommendations.

Later, revised wording of the agreement among members acknowledged that LASC pronouncements would not override the standards followed by individual countries. By 1982, the agreement no longer contained the requirement that the auditors should disclose the extent of non-compliance.

The failure of the agreement to make any mention of obligations placed on auditors continues; the route to enforcement has now moved in the direction of applying the powers of national stock exchanges which subscribe to the IOSCO agreement on the acceptance of core standards.

(6) Intergovernmental Organizations:

IASB works closely with a number of intergovernmental bodies.

These bodies co-operate with each other and with IASB. Such bodies are:

Intergovernmental Organizations, 2001:

EU – European Union:

European Commission issues Directives which form a basis for national law within each member country. Accounting Directives (Fourth and Seventh) are largely concerned with harmonisation of presentation in financial statements.

OECD:

Organization for Economic Cooperation and Development:

Established by 24 of the world’s ‘developed’ countries to promote world trade and global economic growth. Is concerned with financial reporting by multinational companies. OECD has a Working Group on Accounting Standards.

Issues guidelines for multinational companies, carries out surveys and publishes reports. Work extends to Central and Eastern Europe, e.g., the Coordinating Council on Accounting Methodology in the CIS (Former Soviet Union).

ISAR:

Intergovernmental Working Group of Experts on International Standards of Accounting and Reporting:

Operates within the United Nations, with a particular interest in accounting and reporting issues of the developing countries. Carries out surveys and publishes reports. Makes recommendations with regard to transnational companies.

(7) Acceptance of IASs by International Organisation of Securities Commission (IOSCO):

The core standards programme.

Relations of IASC with IOSCO:

In this present form IOSCO dates from the mid-1980s. Its objectives include:

i. The establishment of standards and effective surveillance of international securities transactions

ii. Provision of mutual assistance to ensure the integrity of the markets by a rigorous application of standards and by effective enforcement against offenders.

A working party was established to co-operate with the IASC with a view to identifying accounting standards which security regulators might be ready to accept in the case of multinational offerings. In 1995, the IASC made a significant agreement with IOSCO.

The agreement stated that the goal of both IASC and IOSCO was that financial statements prepared in accordance with IASs can be used in cross-border offerings and listings as an alternative to national accounting standards.

In May 2000, IOSCO announced completion of its assessment of the accounting standards issued by the IASC. The Presidents Committee of IOSCO referred to the 30 standards and related interpretations evaluated by them (described as ‘the IASC 2000 standards’).

It recommended that IOSCO members permit incoming multinational issuers to use the IASC 2000 standards to prepare their financial statements for cross-border offerings and listings, as supplemented where necessary by one or more of three supplemental treatments of reconciliation, disclosure and interpretation.

i. Reconciliation means requiring reconciliation of certain items to show the effect of applying a different accounting method, in contrast with the method applied under IASC standards.

ii. Disclosure means requiring additional disclosures, either in the presentation of the financial statements or in the footnotes.

iii. Interpretation means specifying the use of a particular alternative provided in an IASC standard, or a particular interpretation in cases where the IASC standard is unclear or silent.

This resolution confirmed the good working relationship between IASC and IOSCO but left considerable discretion with the separate market regulators who are the members of IOSCO. It is for each securities commission or regulator to decide whether to accept the IOSCO recommendation and whether to apply supplemental treatments.

In particularly, if the SEC in the USA were to continue requiring reconciliations to US GAAP there is a risk that foreign registrants on US stock exchanges would regard this as too costly and troublesome and would apply US GAAP in preference to IASB Standards.