Here we detail about the twenty special business transactions which needs special treatment in Double Column Cash Book!

(i) Contra Transactions:

When a single transaction affects both cash and a bank column with the same amount then it is known as contra transaction. These transactions should be indicated by the contra sign ‘C’ in the ‘Ledger Folio’ column against both sides of the cash book.

It should be noted that ‘Contra’ is a Latin word which means ‘against’. By indicating ‘C’ against both sides of the cash book under the ‘L.F.’ column, double entry aspect in respect of that transaction is completed and no further posting to ledger is required.

Examples of contra transactions are:

ADVERTISEMENTS:

(a) Amount deposited in the bank and

(b) Amount withdrawn from bank for office use.

(c) Cheque deposited in the bank, received previously.

Amount deposited in bank is recorded on the debit (receipt) side of bank column showing increase in bank and credit (payment) side under the cash column showing decrease in cash.

ADVERTISEMENTS:

When cash is withdrawn from the bank for business purpose, the transaction is recorded on the debit (receipts) side under the cash column showing increase in cash and credit (payment) side under the bank column showing decrease in bank. From the above, it can be concluded that under the contra transactions both sides of the cash book are affected but under different columns.

Example:

On 17-01-2008, a business enterprise pays Rs. 5,000 into bank.

This transaction shall be recorded in the cash book as under:

Example:

On 18-01-2008, a business enterprise draws a cheque of Rs. 2,000 for office use.

This transaction shall be recorded in the cash book as under:

(ii) Cheque Received and Deposited on Same Day:

A cheque received may be deposited into bank on the same day or on another day. The amount is recorded in the bank column of cash book on the receipts side in case the cheque is deposited on the same day.

ADVERTISEMENTS:

Example:

On 21-01-2008, a business enterprise receives a cheque of Rs. 2,500 from Rahim and deposits the same into bank on the same day.

This transaction shall be recorded in the cash book as under:

(iii) Cheque Received and Deposited on Another Day:

It is treated as cash received on the date of receipt and recorded in the cash column on receipts side. When the cheque is deposited the entry for deposit will be passed on the day of depositing the cheque into bank. The amount will be recorded on the receipts side in bank column and on the payments side in the cash column. This will become contra entry and should be indicated by ‘C’ in the L.F columns of the cash book.

Example:

On 23-01-2008, a business enterprise receives a cheque of Rs. 1,000from Satish and deposits the same into bank on 25-01-2008.

This transaction shall be recorded in the cash book as under:

(iv) Dishonour of Cheque:

Dishonour of cheque means return of the cheque as unpaid by the bank due to various reasons such as insufficient funds in the party’s( who has given the cheque) account with bank, signature of the party does not match with the bank record, wrong account number quoted on the cheque etc.

In case of dishonour of cheque the bank will debit the account of the business enterprise and return the cheque. On intimation and receipt of such cheque back from the bank, the enterprise should make an entry in such a way that the position prevailing before the receipt of the cheque from the party and its deposit in the bank can be restored.

For this purpose, entry on the credit side of the cash book is made by entering the amount of dishonoured cheque in the bank column and name of the party in the particular column of the cash book.

Example:

ADVERTISEMENTS:

On 28-01-2008, an intimation was received from the bank that a cheque received from Rahim had been dishonoured.

This transaction shall be recorded in the cash book as under:

(v) Payment by Cheque:

All payments made through cheques are recorded on the credit side and under the bank column of the cash book, because cheques once issued will ultimately reduce the bank amount.

Example.

ADVERTISEMENTS:

On 29-01-2008, Electricity bill of Rs. 3,550 was paid by cheque.

This transaction shall be recorded in the cash book as under:

(vi) Endorsement of Cheque:

A bearer cheque received from a party and not deposited in the bank, can be given to any third party for making the similar payment to the latter. This is known as endorsement. On endorsement of cheque to the third party the cash column must be reduced so that it gets recorded in the cash column on the credit side of the cash book. It should be noted that when the cheque was received, it must have been recorded in the cash column on the debit (receipt) side of the cash book.

Example:

On 29-01-2008, the business enterprise endorsed a cheque of Rs. 1,500 in favour of Satvinder. The cheque was earlier received from Smith on 12-01-2008 but due to paucity of time cheque was not deposited in the bank till date.

This transaction shall be recorded in the cash book as under:

(vii) Amount Withdrawn from the Bank for Personal Use:

Amount withdrawn from the bank for personal use is regarded as drawings of the proprietor and therefore, this will not become contra entry. This entry will reduce the bank balance, hence, it should be shown in the bank column on the credit (payment) side of the cash book.

Example:

On 29-1-2008, a business enterprise draws a cheque worth Rs. 3,000 for personal use.

This transaction shall be recorded in the cash book as under:

(viii) Interest and Dividend Received by the Bank:

Sometimes bank credits the customers’ account for collection of interest or dividend or any receipt on behalf of the customers. In that case, entry shall be made in the bank column on the debit (receipt) side of the cash book.

Example:

On 30 -1-2008 bank credits the account of business enterprise with Rs. 250 in respect of interest on deposits.

This transaction shall be recorded in the cash book as under:

(ix) Interest, Commission or Other Charges by the Bank:

The entry will be made in the bank column on the credit (payment) side of the cash book when the bank debits the account of business enterprise on account of interest, commission or other charges for the services rendered by the bank.

Example:

On 30-1-2008, bank debits the account of business enterprise with Rs. 500 in respect of bank charges.

This transaction shall be recorded in the cash book as under:

(x) Amount Directly Deposited into the Bank by Customers:

Upon receiving the information that the customers have deposited any payment into the bank of the business enterprise, the entry shall be recorded in the bank column on the debit (receipt) side of the cash book.

Example:

On 30-01-2008 goods were sold to Hari for Rs. 3,900. On the same day, Hari deposited the full amount directly into the bank of the business enterprise.

This transaction shall be recorded in the cash book as under:

(xi) Discounting Bills Receivable from the Bank:

Bill receivable received from the debtors can be discounted from the bank before its maturity. In that case, bank, after deducting some amount, credits the net amount in the account of the customer. Thus, entry shall be made in the bank column on the debit (receipt) side of the cash book with the net amount (i.e., after deducting the discount amount).

It should be noted that entry for recording discount shall be made in the journal proper as under:

Discount on Bills A/c Dr. (With the amount of discount)

To Bills Receivable A/c

Example:

On 30-1-2008, goods were sold to Vijay for Rs. 4,500. On the same day, a bill for the same amount was drawn upon Vijay for two months. Instead of waiting for the two months the business enterprise got it discounted from the bank on 30.1.2008. Bank deducted Rs. 250 for discount.

This transaction shall be recorded in the cash book and journal proper as under:

The entry for recording discount shall be made in the journal proper as under:

(xii) Bills Sent for Collection Collected by the Bank:

Bank may facilitate its customers to collect on behalf of them, the amount due on various bills from the drawee of the bills in time. The entry shall be made in the bank column on the debit (receipt) side of the cash book with the amount of bill.

Example:

On 30-1-2008, bank intimates that the bill for Rs. 5,000 which were sent for collection has been collected.

This transaction shall be recorded in the cash book as under:

(xiii) Cash Discount Received:

When a business enterprise receives cash discount, only net amount (i.e., the amount after deducting the discount) paid shall be recorded on the credit side under the cash column, if the payment is made in cash. However, if the payment is made through cheque, then net amount paid shall be recorded in the bank column on the credit side of the cash book.

It should be noted that entry for recording discount shall be made in the journal proper as under:

Creditors’ A/c Dr.

To Discount Received A/c (with the amount of discount)

Example:

On 30-1-2008, a creditor worth f 40,000 allowed 10% discount on the total payment due to him, if paid immediately. To avail that facility, the business enterprise paid the full amount through cheque on the same day.

This transaction shall be recorded in the cash book and journal proper as under:

The entry for recording discount shall be made in the journal proper as under:

(xiv) Cash Discount Allowed:

When a business enterprise allows cash discount then only net amount received (i.e., the amount after deducting the discount) shall be recorded on the debit (receipts) side under the cash column, if the payment is received in cash. However, if the payment is received through cheque then the net amount received shall be recorded in the bank column on the debit (receipts) side of the cash book.

It should be noted that entry for recording discount shall be made in the journal proper as under:

Discount Allowed A/c Dr. (with the amount of discount)

To Debtors’ A/c

Example:

On 30-1-2008, a business enterprise allowed 10% discount to Kabir (one of the debtors) who owes Rs. 5,000 to the business enterprise. Kabir paid the entire sum on the same day through cheque. The cheque was deposited into the bank on the same day.

This transaction shall be recorded in the cash book and journal proper as under:

The entry for recording discount shall be made in the journal proper as under:

(xv) Discount Received Earlier, Disallowed Later on by the Creditors:

Sometimes, discount is received by a business enterprise for making payment to the creditors before time. If payment is made through cheque and cheque is dishonoured, the entry on the debit side of the cash book is made by entering the amount of dishonoured cheque in the bank column and name of the party in the particular column of the cash book.

Entry for discount received earlier should be nullified by way of the following entry in the journal proper:

Discount Received A/c Dr. (with the amount of discount received earlier)

To Creditors’ A/c

Example:

On 31-01-2008, an intimation was received from the bank that a cheque for Rs. 3,600, given to Payal on 12-01-2008 for making the payment settling her account of Rs. 4,000, had been dishonoured due to insufficient funds in the bank.

This transaction shall be recorded in the cash book and the journal proper as under:

The entry for discount received earlier should be nullified by way of the following entry in the journal proper:

(xvi) Discount Allowed Earlier, Disallowed Later on:

Sometimes, discount is allowed by a business enterprise to the debtors if the debtors make payment within specified time. If payment is received through cheque and cheque is dishonoured, the entry on the credit side of the cash book is made by entering the amount of dishonoured cheque in the bank column and name of the party in the particular column of the cash book.

Entry for discount allowed earlier should be nullified by way of the following entry in the journal proper:

Debtors’ A/c Dr.

To Discount Allowed A/c (with the amount of discount allowed earlier)

Example:

On 31-1-2008, an intimation was received from the bank that a cheque for Rs. 4,500, received from Kabir on 30.1.2008, had been dishonoured.

This transaction shall be recorded in the cash book and the journal proper as under:

The entry for recording discount shall be made in the journal proper as under:

(xvii) Insolvency of Debtors:

When any debtor of a business enterprise becomes insolvent, the actual cash received from his estate shall be recorded on the debit side of the cash book under cash column if payment is received in cash or under bank column if payment is received through cheque and the cheque is deposited on the same day.

It should be noted that entry for recording bad debts shall be made in the journal proper as under:

Bad Debts A/c Dr. (with the amount not received from debtors)

To Debtors’ A/c

Example:

On 31-1-2008, a business enterprise received Rs. 4,500 from Ramesh (one of the debtors) as 50% of the amount due from him as Ramesh had become insolvent. The cheque was deposited into bank on the same day.

This transaction shall be recorded in the cash book and journal proper as under:

The entry for recording bad debts shall be made in the journal proper as under:

(xviii) Loan Taken:

Loan taken from the bank or any financial institutions should be recorded on the debit side of the cash book under the bank column.

Example:

On 31-01-2008 a sum of Rs. 45,000 was taken from the IDBI.

This transaction shall be recorded in the cash book as under:

(xix) Bank Overdraft:

Bank overdraft is an arrangement made with the bank under which a business enterprise can withdraw beyond its bank balance but upto an agreed limit. This limit is decided by the bank authorities and depends upon the reputation and need of the business enterprise. The bank overdraft shall appear on the credit side of the cash book under the bank balance. This, credit balance of bank is known as bank overdraft.

Example:

On 31-01-2008, a business enterprise issued a cheque of Rs. 50,000 to Babu, bank intimated that the business enterprise had exercised the overdraft facility and drawn Rs. 20,000 from the bank in excess of its savings.

This transaction shall appear in the cash book as under:

(xx) Sale through Credit/Debit Cards:

Credit/Debit Cards are now being issued by almost every Bank in India. Banks issue such cards directly or with collaboration of some other agencies. Some of the popular cards are HSBC, SBI Cards, BOB Card, ICICI Bank Card, HDFC Cards and Andhra Bank Card etc.

Procedure for issuing (Credit/Debit Cards is as under:

(i) After verifying the credibility and income sources, the bank issues credit card to the customers. The credit card is in the form of a small plastic card. Only a person who has an account with the bank, can have a Debit card issued by the bank maintaining a minimum balance. These days banks are issuing ATM cards which are being used as Debit cards. ATM card bears the name of the card holder and an embossed 16 digit number.

(ii) Annual subscription fees is charged by the bank only from the credit card holders. However, some banks charge a nominal fees on Debit card also, otherwise no fees is charged in case of Debit Card.

(iii) Some rules are to be followed for using Credit or Debit Cards. The use is in the form of buying some goods or having services. The seller is required to fill a form, generally in triplicate. The details of the goods with the amount of sales is to be mentioned on those forms.

The data is printed on that form with the help of credit card machine using the ambossed card. The customer is required to counter sign the form and he gets one carbon copy of the form for the record.

(iv) The seller submits all the forms received by him on goods sold/services rendered on credit basis to his bank, generally daily.

(vi) The card holder gets a monthly statement from the bank. The amount is debited to card holder’s account immediately in case of Debit card whereas in case of credit card, the card holder has to pay the amount in full or part. The interest is charged in case the amount is not paid in full.

Sale through credit/Debit Card is equivalent to cash sale, hence amount of sale shall be recorded on debit (receipt) side of the cash book under bank column. Similarly, commission charged by the bank is treated as selling expenses and recorded on the credit (payment) side of the cash book under the bank column.

Example:

On 31-01-2008, a business enterprise sold goods at Rs. 10,000 through Debit Card. Bank charged 1% commission on sales through Debit/Credit Cards.

These transactions shall appear in the cash book as under:

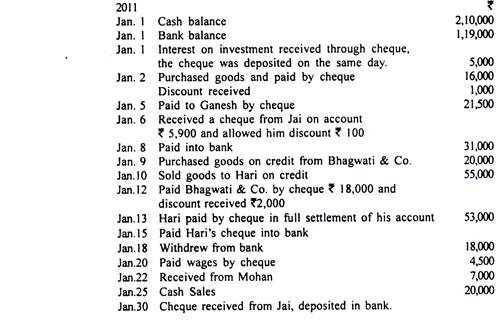

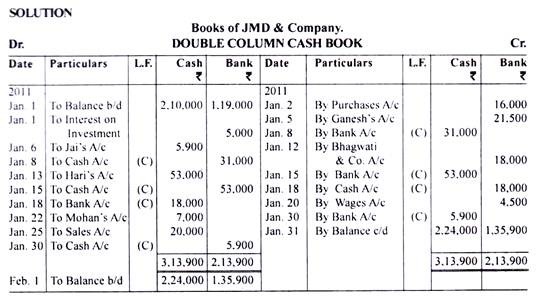

Illustration: (Double Column Cash Book)

Record the following transaction in cash book in the books of JMD & Company: