The below mentioned article provides an overview on the Entries in the Books of Purchasing Company.

Purchase of Business:

A company may start an entirely new business or it may start with buying an existing business, either that of a partnership or of a limited company. Frequently, later in its life a company buys businesses. The purchase price or purchase considerate may be discharged in the form of shares debentures or cash. The price paid for the business will naturally depend on the valuation of its assets including goodwill.

In case the business is purchased for a lump sum, goodwill will be the difference between the price paid and the value of net tangible assets. A company pays Rs 10 lakh for a business which has tangible assets amounting to Rs 11 lakh and which owes Rs 2 lakh to sundry creditors.

ADVERTISEMENTS:

The net tangible assets are Rs 9 lakh and goodwill will be Rs 1 lakh i.e., Rs 10 lakh less 1 lakh. It may happen that a company pays less than the value of net assets. The company then makes a profit. Such a profit is treated as capital profit and is to be credited to Capital Reserve. In other words, if net tangible assets exceed the ‘purchase consideration’, the difference will be treated as Capital Reserve.

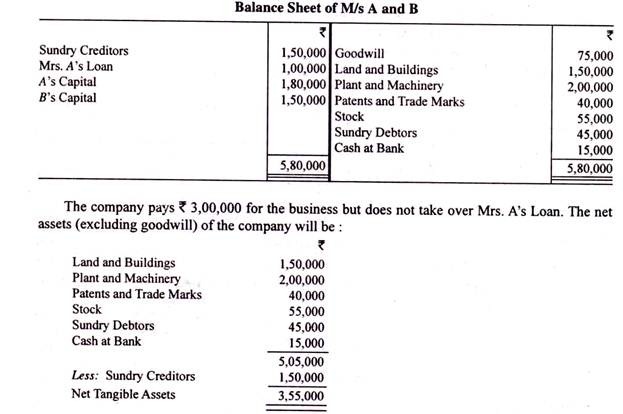

Following is the balance sheet of A and B on the basis of which their business will be taken over by AB Ltd.:—

The company pays Rs 3,00,000 for the business but does not take over Mrs. A’s Loan The net assets (excluding goodwill) of the company will be:

ADVERTISEMENTS:

Since the company pays only Rs 3,00,000 for net tangible assets worth Rs 3,55,000, the Capital Reserve is Rs 55,000.

In case a lump sum amount is not settled as purchase consideration, it will be equal to the net assets, including goodwill, acquired. In the example given above, if the company takes over all the assets and no liabilities, the company will pay Rs 5,80,000. If the company also agrees to pay the trade creditors, it will deduct Rs 1,50,000 and pay only Rs 4,30,000. If the company takes over Mrs. A’s Loan also, it will further deduct Rs 1,00,000 and pay only Rs 3,30,000.

Entries in the Books of the Purchasing Company:

The following entries are necessary to record the purchase of business:—

ADVERTISEMENTS:

1. Debit Business Purchase Account ] with the purchase price agreed upon.

Credit Vendor

2. Debit various assets taken over at the value at which the company wants to record them in its books.

Credit various liabilities taken over at the values agreed upon.

ADVERTISEMENTS:

Credit Business Purchase Account with the purchase consideration.

If the credits exceed the debits, the difference is Goodwill and should be debited as such

If the debits exceed the credits, the difference is capital profit and should be credited to

Capital Reserve.

ADVERTISEMENTS:

(Note The student should remember to calculate goodwill or capital reserve not by taking the balance sheet figures of the vendor but the figures at which the company wants to record, in its books, the assets and liabilities taken over.)

3. On payment to the Vendor:

Debit the Vendor

Credit: Bank (if cash is paid)

ADVERTISEMENTS:

Securities Capital (if shares are issued, paid up value)

Securities Premium (if any)

Debentures (nominal value of debentures that may be issued)

Premium on Issue of Debentures Account (if any)

ADVERTISEMENTS:

Entries in the books of the vendor will be such as to close the books. In the case of partnership, such entries have already been noted.

Illustration 1:

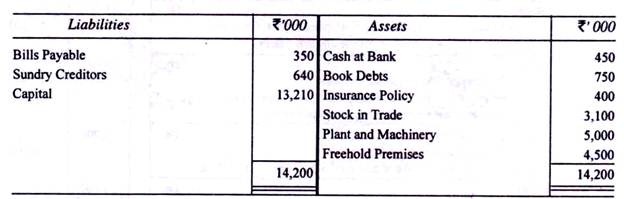

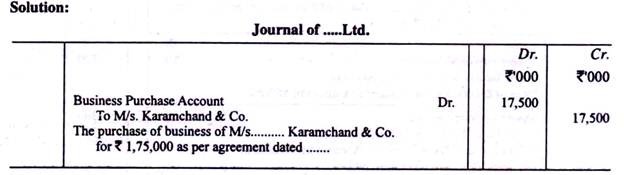

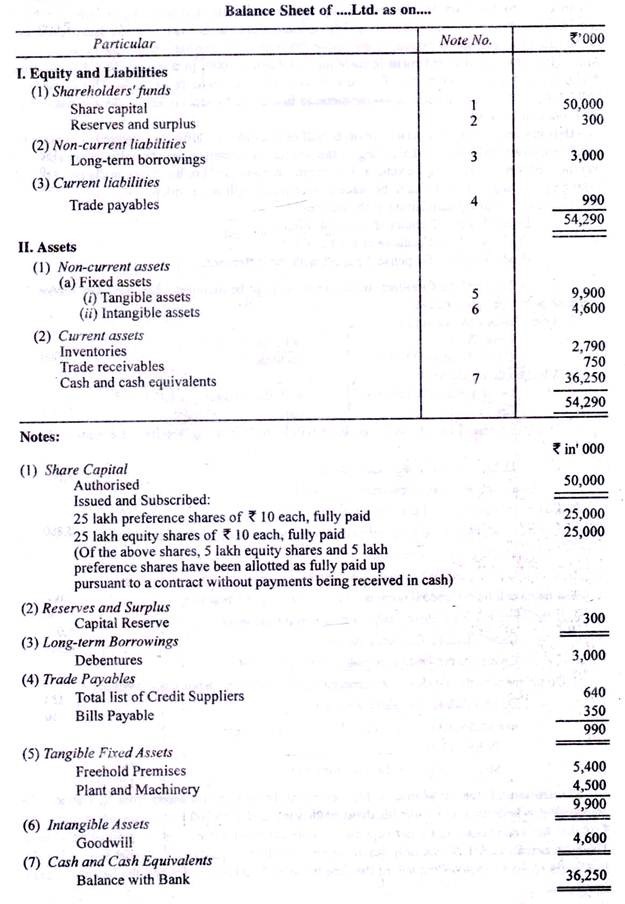

A company was formed with an authorised capital of Rs 5 crore divided into 25 lakh equity shares of Rs 10 each and 25 lakh preference shares of Rs 10 each to acquire the going concern of M/s. Karamchand & Co. whose balance sheet stood as follows :—

The purchase price was agreed upon at Rs 1 crore, 75 lakh to be paid, Rs 50 lakh in fully paid equity shares, Rs 50 lakh in fully paid preference shares, Rs 30 lakh in redeemable debentures and the balance in cash.

The company does not take over the insurance policy, values the stock and plant and machine at 10 per cent less than the book value and the freehold premises at 20% more than the book value. The liabilities will be discharged by the company.

ADVERTISEMENTS:

The balance of both kinds of shares was issued to and paid up by the public with the exception of 60 000 equity shares held by Jamnadas on which he did not pay the last call of Rs 3 per share, and which were subsequently forfeited and reissued at a discount of 20 per cent.

Give journal entries to record the above and prepare the balance sheet of the company.

(Adapted from R.A. First)

Interest to Vendors:

If there is a delay in the settlement and discharge of the purchase consideration, the vendors are generally entitled to interest at an agreed rate from the date of purchase to the date of settlement.

Suppose, in the above illustration, the business is purchased as from 1st April, 2009, and that the settlement is made on 31st August, 2009. In that case. M/s. Karamchand & Co. will be entitled to interest on Rs 1 crore 75 lakh at 12% (say) for five months. This amounts to Rs 8,75,000 and should be debited, on payment, to Interest to Vendors Account. This is charged to the Profit and Loss Account.

Debtors and Creditors Taken Over on Behalf of the Debtors:

Often, a company does not take over the debtors and creditors belonging to the vendor but merely agrees to collect the debts and pay the creditors on behalf of the vendor. This means that any profit or loss made in the process will belong to the vendor.

The entries to be made in such a case will be as follows:

1. At the time of the acquisition of the business:

Debit Vendors’ Debtors at the book value.

Credit Vendors’ Creditors at the book value.

Credit Vendors’ Suspense Account with the difference.

Note. The Debtors and Creditors, in this case, will not be included when the main entries for purchase of business are passed.

2. When debtors are realised:

Debit Bank

Credit Vendors’ Debtors > with the amount realised.

3. When creditors are paid:

Debit Vendors’ Creditors

Credit Bank > with the amount paid.

4. Any loss suffered on realisation of debts will be transferred to Vendors’ Suspense Account, thus:

Debit Vendors’ Suspense Account.

Credit Vendors’ Debtors.

The entry will be reversed if there is a profit.

5. Any gain on payment to creditors will be credited to Vendor’s Suspense Account, thus:-

Debit Vendors’ Creditors

Credit Vendors’ Suspense Account

The entry will be reversed if there is a loss on payment to creditors.

6. If the company is entitled to any commission for the work done:

Debit Vendors’ Suspense Account

Credit Commission Account

7. On payment to the Vendor of the amount due in respect of debtors and creditors:

Debit Vendors’ Suspense Account

Credit Bank or

Debentures or

Share Capital (as the case may be).

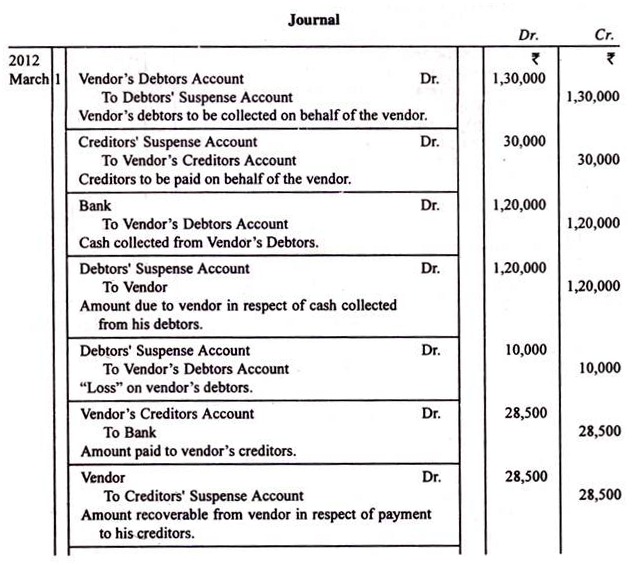

Illustration 2:

On 1st March, 2012, a company bought certain assets from R. Hardas. The company also undertook to collect his debts amounting to Rs 1,30,000 and to pay his creditors for Rs 30,000 for a commission of 3 per cent on amounts collected and one per cent on amounts paid.

The debtors realised Rs 1,20,000 only out of which Rs 28,500 was paid to creditors in full settlement. R. Hardas received 14% debentures of the face value of Rs 50,000 at 95% and the balance in cash.

The above mentioned entries will ensure that the balance in the Vendor’s Debtors Account will equal that in the Debtors’ Suspense Account; so also in the case of vendor’s creditors.

The vendor is credited with actual cash collected from the vendor’s debtors and debited with actual payment made to the vendor’s creditors and also with the commission that may be chargeable to them. The illustration given above will be worked out as follows under this method.

Illustration 3:

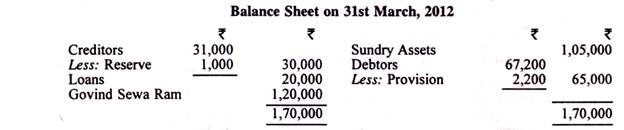

The Balance Sheet of Gobind Sewa Ram was as follows:-

On 15th July, 2012, G.S. Ltd. was incorporated, taking over all the assets (except Debtors) and the liability for loans; interest at 12 per cent per annum on the purchase price to be allowed to the vendors from 1st April, 2012, to the date of completion. The credit balance of Gobind Sewa Ram’s capital to be satisfied by the issue of equity shares in G.S. Ltd.

The loan-holders accept 14% per cent preference shares in discharge of their debts. The company, as agent for the vendor, agrees to collect the debts, which realise ultimately Rs 63,000 out of which it pays, as agent for the vendor, the creditors at the net figure shown in the balance sheet.

Of the balance, it pays on account to Gobind Sewa Ram the sum of Rs 10,000; the amount remaining undrawn by Govind Sewa Ram, including interest, to be discharged in the form of Rs 25,000 debentures at 96 and balance in cash. The new company is entitled k all intervening profit (i.e., between 1st April, 2012, and 15th July, 2012)

Show the opening entries of G.S. Ltd. and the closing entries of Govind Sewa Ram in respect of the above, assuming that the date of completion is 31st August, 2012. Ignore income tax.

Entries, when the same account books are continued:

The treatment detailed above applies when the purchasing company starts new books of account. However, often a company decides to continue the same books of account as were being maintained by the seller.

In such a case, the following steps will be necessary:

1. If assets and liabilities, which are to be taken over by the purchasing company; are to be revalued, a profit and loss adjustment account should be prepared and the balance transferred to the capital accounts of partners (or shareholders’ account if the vendor is a company).

2. If certain assets or liabilities are not taken over by the purchasing company, these should be transferred to the capital accounts of the partners in the ratio of their capitals. If the asset is worthless, it should be transferred in the profit-sharing ratio.

In case the vendor is a company, the assets not taken over by the purchasing company will be realised and the liabilities that are not taken over by the purchasing company will be paid. Usually, a separate Bank account is opened for this purpose.

3. The capital accounts of partners (or Shareholders’ Account) will be debited and Share Capital Account (for shares issued) or Debentures Account (for debentures issued) and Bank (for cash paid) should be credited.

It will be noted no entries will be required to close the books of the vendor and no special entries will be required to open the books of the purchasing company.

An alternative to the steps Nos. 2 and 3 is to: (1) debit Purchase of Business Account with the amount agreed as purchase price and credit Share Capital (for shares issued), Debentures (for debentures issued) and Bank (for cash paid); and (2) transfer to Purchase of Business Account, the Capital Accounts of partners (or Shareholders’ Account) and the assets and liabilities not taken over by the purchasing company.

Illustration 4:

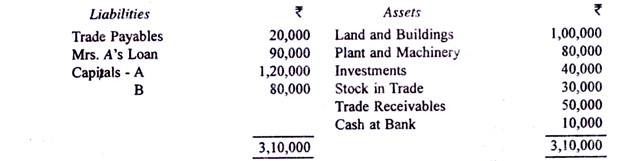

The following is the Balance Sheet of M/s. A and B as on March 31, 2012:-

Profits were shared as 2/3 to A and 1/3 to B. On 1st April, 2012, AB Ltd. purchased the business of M/s. A and B for a payment of Rs 3,00,000 to be made in the form of equity shares of Rs 100 each credited as Rs 80 paid.

The company does not take over the investments and Mrs. A’s Loan. The company also decides to revalue land and buildings at Rs 1,35,000, plant and machinery at Rs 70,000 and to create a provision for doubtful debts on trade receivables @ 5%.

There was a claim by a worker for Rs 3,000 for injuries in an accident. The company decided to admit the claim. Out of the investments, Rs 6,000 worth are worthless. Mrs. A agrees to receive the remaining investments and 700 shares of A B Ltd. in settlement of her loan.

The company decides to retain the books of account of the firm. Journalise.