How to Prepare a Cash Flow Statement: With Methods, Examples and Entries!

Cash flow statement is prepared on the same lines as the funds flow statement, but strictly restricted to sources and uses of cash. Preparation of the statement is based on the opening and closing balance sheets, profit and loss account and other relevant information.

Cash flow statement starts with the cash and bank balances at the commencement of the period. If there is bank overdraft and cash balance, the net cash balance or net bank overdraft becomes the starting point.

The different ‘sources’ of cash are added to the opening balance and the ‘applications’ of cash are subtracted. The balance represents cash and bank balances at the end of the accounting period. If a negative balance is obtained, it represents the bank overdraft at the end of the period. The closing balance or overdraft thus arrived at should be the same as shown in the closing balance sheet for the accounting period.

Cash Flow Statement: Methods, Examples and Entries!

Sources and Applications of Cash:

ADVERTISEMENTS:

The various sources and uses of cash are to be ascertained or computed from the accounting statements and other information.

Sources of Cash:

A business can have two kinds of sources of cash:

ADVERTISEMENTS:

(A) Cash from operations; and

(B) External sources of cash

(A) Cash from Operations:

A business generates cash inflows through its normal business operations which is usually the most important and routine source of cash. It is the internal source for cash.

ADVERTISEMENTS:

Computation of Cash from Operations:

(i) When all Transactions are Cash Transactions:

It is a hypothetical situation where all expenses incomes and revenues are paid or received in cash. In such a case, the net profit revealed by profit and loss accounts represents ‘cash from operations’. Net loss represents ‘cash out flow on account of operations’.

(ii) When all Transactions are not Cash Transactions:

ADVERTISEMENTS:

In practice income statements are prepared on accrual basis; several non-cash items are shown in the income statement; credit transactions result in debtors and creditors. Opening and closing inventories are to be accounted for.

In such situations, cash from operations is ascertained in two stages:

1. Computation of funds from operations (just as in the case of a funds flow statement).

2. Computation of cash from operations by adjusting the current assets and liabilities except cash and bank balance in the funds from operations.

ADVERTISEMENTS:

1. Computation of Funds from Operations:

This is done in the same way as was explained in the funds flow analysis. An adjusted profit and loss account may be prepared or a statement of funds from operations can be prepared, with the net profit revealed by the profit and loss account as the starting point.

The following items are added back to the profit shown by the profit and loss account:

(a) Depreciation on fixed assets because it decreases profit without any cash outflow.

ADVERTISEMENTS:

(b) Loss on sale of fixed assets since the loss is not a cash loss. The same applies to loss on sale of investments.

(c) Capital losses, fictitious assets and intangible assets written off. They do not result in any cash out flow. Examples are goodwill written off, discount on debentures written off.

(d) Transfer to reserves- any transfer to reserves are only book entries and do not affect cash.

The following items are reduced from the net profit:

ADVERTISEMENTS:

1. Profit on sale of fixed assets and investments Cash received from sale of investments and fixed assets including the profit is shown separately, as a source. So it should not be a part of cash from operations.

2. Transfers from reserves or profit and loss account which does not result in cash inflow.

3. Income tax refund, income from investment, etc., which are non-operating incomes.

2. Calculation of Cash from Operations:

The net profit shown by an income statement is on ‘Accrual’ basis. It is essential to convert the various items affecting the profit into ‘cash’ basis. Ascertaining funds from operations has accomplished this task to some extent by adding back to the net profit all ‘non cash’ expenses shown in profit and loss account and subtracting the non-cash incomes.

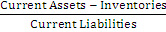

The funds from operations need further adjustment to be converted fully to cash basis. For this purpose all the current assets and current liabilities except cash and bank balances are to be analysed from the point of view of their impact on cash.

ADVERTISEMENTS:

The following explanations should clarify the effect of the changes in the current assets and current liabilities on the cash flows:

(a) Effect of Credit Sales and Debtors on Cash Flows:

Both cash sales and credit sales increase the revenues of a business and the funds from operations and net profit are proportionately more. But cash inflow is not improved by the credit sales immediately. Thus both cash sales and credit sales can increase funds by increasing the cash and debtors balances. But cash balance goes up to the extent of cash sales only. However when debtors are collected later on, cash inflows go up without any increase in the funds because the working capital is not affected.

The debtors created through credit sales, thus, affect funds and cash at different times. Cash from operations through credit sale transactions can be presented as follows:

(b) Effect of Credit Purchases and Creditors on Cash Flows:

Cash paid for purchases reduces cash balance and results in immediate cash out flow. Credit purchases create trade creditors, thus decreasing the working capital or the funds. But cash is not immediately affected. When the creditors are paid later on, the cash out flow takes place.

(c) Effect of Unsold Goods in Stock on Cash Flows:

The opening stock shown on the debit side of income statement reduces the net profit without affecting the cash flows. Similarly the closing stock credited to the income statement increases the net profit without actually increasing cash inflows.

Effect of changes in stock on cash from operations can be summarised as under:

(d) Effect of Out Standing Expenses and Incomes Received in Advance:

Outstanding expenses are debited to the income statement though they are not yet paid. Thus net profit reduces, without actually resulting in cash outflow. Similarly incomes received in advance are subtracted from the income heads concerned, thus reducing the net profit. But the income received in advance has already resulted in cash inflow, though not reflected in the profit.

Effect of changes in outstanding expenses and incomes received in advance on the cash from operations can be presented as follows:

Cash from operations = Net profit + Closing outstanding expense’s and incomes received in advance – Opening outstanding expenses and incomes received in advance.

(or)

Cash from operations = Net profit + Increase in outstanding expenses and incomes received in advance (or) – Decrease in outstanding expenses and incomes received in advance.

(e) Effect of Prepaid Expenses and Accrued Incomes:

Prepaid expenses are reduced from the expenses concerned in the income statement. So, they are not charged to profit and the profit is more to that extent, though cash for them is already paid. Similarly, accrued incomes are shown as incomes in the income statement, thereby increasing the net profit. But no cash is received for them and cash inflow has not gone up.

Effect of changes in the prepaid expenses and accrued incomes on the cash from operations can be presented as follows:

Cash from operations = Net profit + Opening accrued incomes and prepaid expenses – Closing prepaid expenses and accrued incomes.

(or)

Cash from operations = Net profit + Decrease in accrued incomes and prepaid expenses (or) – increase in accrued incomes and prepaid expenses.

The above discussion may be summarised as follows:

(1) Total sales, whether for cash or credit, increase funds and net profits but only cash sales increase the cash balance. So, change in debtors due to credit sales has to be adjusted in the funds from operations.

(2) Total purchases, whether for cash or on credit decrease the funds and the profits. But cash purchases alone reduce cash. Change in creditors due to credit purchases has to be adjusted in the funds from operations.

(3) All expenses incurred, whether paid for or not, decrease funds. But expenses actually paid alone decrease cash. Change in outstanding and prepaid expenses has to be adjusted in the funds from operations.

(4) All incomes earned increase funds, whether cash is received or not. But, incomes received in cash alone can increase cash balance. Accrued incomes and incomes received in advance have to be adjusted in the funds from operations.

In other words the effect of credit sales, credit purchases, stocks of goods, outstanding and prepaid expenses, accrued incomes and incomes received in advance should be removed from the ‘funds from operations’. The balance will be ‘cash from operations’.

The changes during the accounting period in current assets and current liabilities other than cash and bank balances have to be noted. Then the amount of such changes should be added to or subtracted from the funds from operations on the basis of the following principle.

While using the above, principle, current assets received in exchange for shares or debentures issued must be omitted from the respective closing balances of the assets.

The balance obtained after the above additions and deductions can be termed as ‘cash from operations,’ if the balance obtained is positive. If the balance obtained is negative, it is called “cash outflow on account of operations”.

(B) External Sources of Cash:

Apart from cash from operations, a firm can have several other sources of cash outside the organisation.

1. Fresh Issue of Shares:

Issue of shares to the public or rights shares to the existing shareholders brings in additional cash. If the issue is at premium, the cash received from the issue increases to that extent. However issue of shares for non-cash consideration is not a source of cash.

2. Issue of Debentures or Bonds:

Cash is received by issue of debentures either at par or at premium or even at discount. The actual amount received is a source of cash.

3. Long Term Borrowings:

Borrowings on long term basis from banks or other sources are a source of cash. Recently public deposits have been an important source of this type.

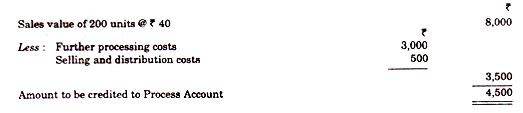

4. Sale of Fixed Assets and Investments:

The cash received from the sale of fixed assets like machinery or buildings is a source of cash. Similarly non trading investments sold are also a source of cash.

Applications of Cash:

Cash outflows or uses of cash or applications of cash are usually in the following forms:

1. Redemption of Debentures and Preference Shares:

The amount paid for repayment of debentures or preference share capital is a cash outflow. The actual cash paid alone should be taken either including premium or excluding discount.

2. Repayment of Bank Loans or Other Long Term Borrowings:

Repayment of loans results in cash outflow.

3. Cash Outflow on Account of Operations:

It is also to be shown as an application of cash.

4. Purchase of Fixed Assets and Long Term Investments:

Amounts paid to acquire fixed assets like buildings, furniture, and equipment and machinery ire to be shown as uses of cash. Similarly amount paid to purchase non trading investments is also an application of cash.

5. Payment of Tax and Dividend:

If they are treated as non-current items, amount paid for tax or dividends have to be shown as uses of cash. If they are treated as current liabilities, they are shown as a part of computation of cash from operations.

Form of Statement of Cash from Operations:

(a) Forms showing funds from operations and cash from operations separately.

Form of Cash Flow Statement:

(A) Form excluding computation of cash from operation.

(1) Report Form:

(2) Account From:

Cash Flow Statement may also be presented in the account form as shown below:

(B) Form of Cash Flow Statement which combines the computation of cash from operations also. If this form is used, there is no need to ascertain separately the funds and cash from operations.