After reading this article you will learn about:- 1. Meaning of Balance of Payments 2. Types of Balance Payment 3. Relationship between Balance of Trade and Balance of Payment 4. Equilibrium 5. Causes of Dis-Equilibrium.

Contents:

- Meaning of Balance of Payments

- Types of Balance Payment

- Relationship between Balance of Trade and Balance of Payment

- Equilibrium of Balance of Payments

- Causes of Dis-Equilibrium of Balance of Payments

1. Meaning of Balance of Payments

:

We also know that in a country’s’ international economic transactions, there is not only visible merchandise only, there are invisible merchandise as well which are commonly known as services e.g., freights and fare of ships and planes, insurance and banking charges, foreign tours and education in foreign countries, payments of interest and dividend on foreigners’ investments etc. — both individual and Governments.

ADVERTISEMENTS:

Needless to mention that if a complete picture is wanted, these invisible transactions are also to be taken into consideration which is called Balance of payments.

In short, the balance of payments is a comprehensive record of economic transactions of the residents of a country with the rest of the world during a given period of time i.e., it is defined as the systematic records of all economic transactions between the residents of foreign countries and the residents of the reporting countries during a given period of time.

2. Types of Balance Payment:

Balance of payments is divided into two following ways:

ADVERTISEMENTS:

(i) Vertically into credit and debit (according to the principals of double entry systems of book-keeping)

(ii) Horizontally into two major categories (according to the nature of transactions).

It is interesting to note that the current account consists of all transactions which relate to the current national income and current expenditure of the home country. It includes imports and exports of goods and services, expenses on travel, transportation, insurance, investment incomes and unilateral transfers.

Similarly, capital account relates to capital transactions i.e., transactions in financial assets which directly affect wealth and debt and as such, it includes only future income and not the current one. It includes borrowings and lending of capital including repayments of capital, purchase and sale of securities and other assets to and from foreigners, individuals as well as governments.

ADVERTISEMENTS:

It is called overall balance of payments when both current and capital account are taken into consideration.

Balance of payments is like the Balance Sheet of a company i.e., the left side of the accounts shows receipts of the country during a particular period and right hand side shows the payments made by the country on various items to other countries for the same period. The balance of payments must always balance.

In short, the left hand side must be equal to right hand sight (at least in principle) although, in reality, the two sides may not be exactly equal and as such, balance of payments may be adverse one or in deficit or it may be favorable or surplus in the opposite case.

We know that an economic transaction relates to a receipt as well as a payment of money in exchange for the economic goods and services or the assets. As such, in each case, an international economic transaction exists and it becomes necessary to make appropriate entry in the balance of payments.

ADVERTISEMENTS:

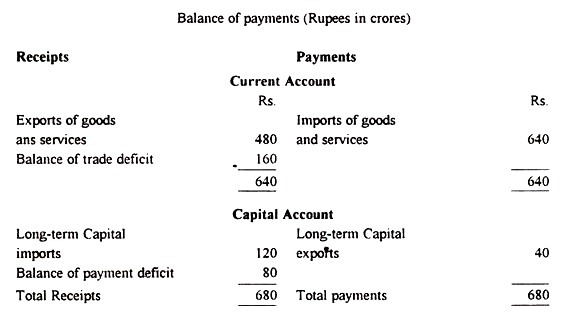

The following table will make the principle clear:

3. Relationship between Balance of Trade and Balance of Payment:

The relationship between the balance of trade and the balance of payment is quite simple, i.e., when exports of goods and services rise more than or fall less than, imports of goods and services, it is said to ‘improve’ and in the opposite care, it is said to ‘deteriorates’.

ADVERTISEMENTS:

Similarly, when the balance of payments deficit gets smaller or the balance of payments surplus gets trigger the balance of payments is said to ‘improve’ and in the opposite case, there is ‘deteriorates’.

It is to be noted in this connection that a balance of trade improvement must be accompanied by the balance of payments improvement unless and until there is a corresponding change in the long-term lending. For example, if our exports rise to Rs. 540 crores in this year in comparison with the last year without changing our imports, our balance of trade, naturally, will improve by Rs. 60 crores.

However, if long-term lending remain constant, the balance of payment will also improve by the like amount which reduces our deficit and comes to Rs. 20 crores. On the contrary, if our long-term lending reduces from Rs. 120 crores to Rs. 40 crores, the balance of payments deficit deteriorates correspondingly.

It is interesting to note that there may be a balance of trade deficit, but still then there is a balance of payments surplus or vice-versa. Thus, if we find any trade deficit, it does not mean that the country is losing its reserves (foreign exchange etc.), the difference so happened due to long-term capital movements.

ADVERTISEMENTS:

In short, the balance of payments account has two parts viz. the current account and the capital account.

Balance of Payments must always Balance:

It has already been stated about that the balance of payments must always balance. It will be balanced only when the total of credit items will exactly be equal to the total of debit items which really happens. As such, there must be either a deficit or a surplus in the current account. The deficit or surplus so created is met by transferring to capital account.

4. Equilibrium of Balance of Payments:

ADVERTISEMENTS:

Equilibrium is that state of the balance of payment over the relevant time period which makes it possible to sustain an open economy without severe unemployment on a continuing basis.

Whether the Balance of Payments is in equilibrium or not, it can be justified with this help of the three following test:

(i) Decrease in Foreign Exchange:

If gold continuously flows from the country, it may be assumed that the balance of payments is in disequilibrium. At present the decrease in foreign exchange reserves of our country indicate such a situation.

(ii) Increase in Foreign Debts and Loans:

If the amount of foreign debts and loans increase, that indicates the balance of payment of the country is in disequilibrium i.e., exports are less than imports,

ADVERTISEMENTS:

(iii) Decrease in Foreign Exchange Rates:

If the foreign exchange rates of a country decrease, it may be said that the country is suffering from the disequilibrium in the balance of payments position.

5. Causes of Dis-Equilibrium of Balance of Payments:

Disequilibrium in the balance of payments in the product of so many factors, e.g. the prices of goods and services, national incomes at home or abroad, the rate of interest, the supply of money, the state of technology, tastes, the distribution of incomes etc.

Now, if any of the above factors change without a corresponding change in other factors there must be a case of disequilibrium in the balance of payment position.

We know that the exports and imports of a country are influenced by a number of factors. It is hardly possible that equilibrium in balance of trade of a country is possible at fixed exchange rate over a long period of time. The balance of payments is quite disturbed by the factors which affect and change imports and exports continuously.

The reasons for the cause of disequilibrium in the balance of payments are noted below:

(a) Domestic Inflation

The greater bulk of balance of payments difficulties are the result of domestic inflation and the same can be corrected by disinflation i.e., eliminating the inflationary gap and reducing demand to the level of full employment. It is possible by increasing exports and reducing imports. Similarly halting of inflation and correction of exchange rate may also help in this regard.

(b) Technological Changes:

No doubt, these are other significant reasons for disequilibrium in balance of payments positions. It is quite known that every change in technology brings some comparative advantages which the other country tries to adjust, but the adjustment process itself brings a deficit in balance of payments.

Thus, the innovation, whatever form it is, invites disequilibrium. So, a new equilibrium requires either to reduce exports or to increase imports.

(c) Short Supply:

Disequilibrium of balance of payment arises due to a fall in supply. For example, due to industrial strike the sugar production of India fall which affect the supply and as a result there is a corresponding shortfall in exports and consequently increases the amount of imports which is the result of disequilibrium.

(d) Fall in Demand or Structural Disequilibrium:

Disequilibrium also arises out of a fall in demand of the export product. For example, if the demand of the Indian jute product decreases in the world due to a change in taste or what so ever, the resources which are engaged in jute production must be shifted to other lines of activity.

In such a situation, we are to restrict our imports and our resources must be diverted into another export line product. If the same is not possible, there must be a structural disequilibrium in balance of payment position.

Of the other causes, the deficit in current account due to the loss of service incomes creates disequilibrium position which may arise through the bankruptcy of direct investment abroad or nationalization etc.

Methods of Correcting Disequilibrium in Balance of Payments:

In order to maintain a country’s sound economic condition, its disequilibrium in balance of payment position (if any) must be corrected. Naturally, the reasons for creating such a situation must be removed. Otherwise if the situation continues for a long, the country will exhaust its foreign exchange reserves.

If such a situation arises the country concerned will have to depreciate its currency below par. We describe hereunder, certain measures to correct or improve the adverse balance of payments position.

These are explained below one by one:

(a) Stimulating exports or to check imports:

If there is a declining trend in exports, various steps must be taken to improve it. In other words, the total cost of the product must be brought down to encourage export which may require cutting down of wages and rate of interest etc. Exports may be also encouraged by granting bounties to exporters and to manufacturers also.

Similarly, imports must be discouraged by:

(i) Imposing import duty,

(ii) Prohibiting the product totally or

(iii) Adopting quota system,

(iv) Manufacturing the equivalent product within the country etc.

(b) Depreciate the External Exchange value:

Another measure to correct the disequilibrium is to depreciate the external (exchange) value of the home currency, which brings domestic goods cheaper to the foreigner. It must be remembered in this respect that the rate of exchange serves as an equilibrating factor between the balance of payments positions.

(c) To deflate the Currency:

It is quite known to us that if our currency contracts, no doubt, prices will fall which will check imports and stimulate exports, although the method of deflation is not even free from snags. Because, if the prices of the product are forced to come down while the cost of the same is rigid, these two do not follow suit. As a result, the country concerned may have to face a serious depression as well as unemployment.

(d) Exchange Control:

Under exchange control, all the exporters are directed to surrender their foreign exchange to the central bank or to sell it at the official rate to the government. Then it is rationed out among the licensed importers i.e., the government will allocate the scarce foreign exchange among the importers on the basis of some non-price criteria.

No importer is allowed to import goods without a license. In this way, the balance of payment is to some extent rectified by reducing the imports.

(e) Devaluation:

The effect of devaluation is almost same like depreciation. In other words, when a currency is devalued its values are decreased in terms of foreign currency. It means, the foreigners can buy more goods than before with the same amount of currency which no doubt, stimulates exports and check imports.

Since the imports are discouraged and exports are encouraged, a time will come when the adverse balance of payment will be corrected and will turn in our favour. From the decision made so far, we can draw a conclusion about the correction of adverse balance of payment position on the basis of the judicious combination of the following:

(i) Adjustment of exchange rate (i.e. appreciation/depreciation of the home currency).

(ii) Movement of Capital (i.e., lending/borrowing abroad).

(iii) Fiscal and Monetary changes that affect prices and incomes.

(iv) Trade restrictions (quotas/tariffs).

Thus, in order to correct the adverse balance of payments no single method is found suitable. We should try to implement all the methods stated above although the application of the factor depends on the nature and type of disequilibrium in balance of payments, (e.g., exchange rate will play a significant role in structural dis-equilibriums).