After reading this article you will learn about Over-Capitalisation:- 1. Meaning of Over-Capitalisation 2. Causes of Over-Capitalisation 3. Effects 4. Remedies.

Meaning of Over-Capitalisation:

Over-capitalisation refers to that state of affairs where earnings of a company do not justify the amount of capital invested in its business.

According to Gerstenberg, “A company is over-capitalised when its earnings are not large enough to yield a fair return on the amount of stock and bonds that have been issued, or when the amount of securities outstanding exceeds the current value of the assets”.

In the words of Bonneville, Deway and Kelly, “When a business is unable to earn fair rate on its outstanding securities, it is over-capitalised.”

ADVERTISEMENTS:

Simply stated, over-capitalisation means more capital than actually required, and therefore, in a over capitalised concern, the invested funds are not properly used. It is, therefore, quite clear that over-capitalisation may be explained in terms of earnings as well as cost of assets.

In terms of earnings, over-capitalisation arises when the earnings of the company are not sufficient to give a normal return on capital employed by it. Let us take an example.

Suppose, a company earns Rs,5,00,000 and the normal rate of return expected is 10% then capitalisation at Rs. 50,00,000 would be (5,00,000 × 100/10) = (Rs. 50,00,000) a fairly capitalised situation. But suppose, the capital employed by this company is Rs. 60,00,000.

Then we will say that the company is over-capitalised to the extent of Rs. 10,00,000. The new rate of earnings in this company now would be (5,00,000/60,00,000 × 100) = Rs. 8⅓%

ADVERTISEMENTS:

Thus, we see that as a result of over-capitalisation, the rate of earnings has dropped from 10% to 8⅓%. Therefore, we can say that the test of over—capitalisation is the lower rate of return on capital over a long-term.

On the other hand, over-capitalisation may occur when the amount of shares debentures, public deposits and loans exceed the current value of the assets.

This may be due to:

(1) Acquiring of fictitious assets like goodwill at high prices.

ADVERTISEMENTS:

(2) Acquiring assets during inflationary period.

(3) Showing assets at increased value due to lack of proper depreciation policy.

Thus, we can summarise the entire concept of over-capitalisation in the words of Harold Gillbert as: “When a company has consistently been unable to earn the prevailing rate of return on its outstanding securities (considering the earnings of similar companies in the same industry and the degree of risk involved) it is said to be over-capitalised.”

Illustration 2:

ADVERTISEMENTS:

A firm earns Rs. 4,80,000 annually after paying all expenses and interest. The total amount of capital employed by the firm is Rs. 60,00,000 and the fair rate of return expected by investors is 12%. Is the firm over-capitalised and, if so, by how much?

Solution:

Over-Capitalisation and Excess of Capital:

ADVERTISEMENTS:

It may be noted that over-capitalisation is not exactly the same as excess of capital. Abundance of capital may be one of the reasons of over-capitalisation but it is not the only reason. In fact, in actual practice, many over-capitalised companies have been found to be short of funds.

Over-capitalisation arises when the existing capital of a firm is not effectively utilised with the result that there is a fall in the earning capacity of the company. Thus, the main sign of over-capitalisation is fall in the rate of dividend and market value of shares of the company in the long-run.

Causes of Over-Capitalisation:

There are many factors which account for the situation of over-capitalisation of a company.

Following are some of the important causes of over-capitalisation:

ADVERTISEMENTS:

1. Over-issue of capital. Sometimes, while floating a new company, the promoters over-estimate the financial requirements, and as a result, they raise more capital than what is actually needed, resulting in over-capitalisation.

2. Promotion, formation or development during inflation. If a company is to be floated during an inflationary period, or any development activity is carried out in such a period, it will be a victim of over-capitalisation because it has to spend huge amounts.

3. Buying assets of lower value at higher prices. It promoters buy assets of lower values at higher prices, they are led to a situation of over-capitalisation because assets of lower value will be shown at higher value in the Balance sheet.

4. High Promotion expenses. Incurring high promotional expenses, excessive preliminary expenses etc. may lead to over-capitalisation.

ADVERTISEMENTS:

5. Inadequate depreciation. Providing inadequate depreciation results in over-capitalisation as it leaves insufficient provision for replacement of assets.

6. Liberal dividend policy. Many companies prefer to declare a higher rate of dividend instead of retaining a part of the profits and ploughing them back or reinvesting them. Such a practice should be discouraged as it leads to over-capitalisation, because liberal dividends are paid at the cost of inadequate provision for depreciation.

7. Taxation Policy. High rates of taxation may leave little in the hands of the management to provide for depreciation, replacements and dividends. This will adversely affect earnings capacity and thus leads to over-capitalisation.

8. Inadequate demand for products. If a company’s products register a constant decline, it will bring down the profitability of the concern and as a result, returns on capital employed will be reduced which represents over-capitalisation.

9. Payment of high rate of interest. Procurement of funds at high rate of interest will adversely affect the company resulting in over-capitalisation.

ADVERTISEMENTS:

10. Under-estimation of the capitalisation rate. If the rate of capitalisation is under-estimated, it will lead to a situation of over-capitalisation.

Effects of Over-Capitalisation:

Over-capitalisation affects not only the company and its owners (shareholders) but also the society as a whole. The evil effects of over-capitalisation are discussed below:

1. Effects on the Company:

The effects of over-capitalisation on the company itself are disastrous in many ways:

(i) Loss of goodwill. In an over-capitalised company, there is a reduced earning capacity resulting in the fall of market price of its shares and thereby shaking up the investor’s confidence. A company whose shares sell below the face value may find it difficult to improve its goodwill in the market.

(ii) Poor creditworthiness. Reduced earnings of an over-capitalised concern affect its creditworthiness and as a result, it becomes difficult for it to get loans or credit at cheaper rates of interest.

(iii) Difficulties in obtaining capital. For a company faced with a situation of over-capitalisation, it is very difficult to obtain further capital for its growth and expansion programmes. It is so because the investors have already lost confidence in the company.

(iv) Decline in efficiency of the company. To cover for one loss, other losses are incurred by the company and in the process overall efficiency of the company declines. Such a company usually does not make adequate provisions for depreciation, repairs and renewals, etc., leading to further decline in its efficiency.

(v) Loss of market. Over-Capitalised companies fail to produce goods at competitive costs and, hence, often lose their market to competitors.

(vi) Inflated profits. In order to regain the confidence of its investors, over-capitalised companies generally resort to manipulation of accounts and over-statement of their profits. These inflated profits lead to payments of dividends out of capital.

(vii) Liquidation of company. An over-capitalised company goes into liquidation unless drastic steps are taken to re-organise the whole capital structure, and re-organisation would itself lead to a lot of problems.

2. Effects on Shareholders:

As, shareholders are the real owners of a company, they suffer most on account of over-capitalisation.

Some of the major effects of over-capitalisation on shareholders are:

(i) Reduced dividends. An over-capitalised company will not be able to pay a fair rate of dividend to its shareholders because it is earning a low rate of return (earnings) on its capital. More so, the payment of dividend becomes uncertain and irregular.

(ii) Fall in the value of shares. Low rate of earnings and reduced dividends cause fall in the market value of shares of the over-capitalised company. Thus, shareholders have to suffer a loss in capital due to depreciation of their investments.

(iii) Unacceptable as collateral security. The shares of an over-capitalised company have small value as collateral security. Banks and other financial institutions are reluctant to lend money against such securities. Hence, it is very difficult for the shareholders to borrow money against the security of their shares.

(iv) Loss on speculation, the prices of the shares of an over-capitalised company remain unstable because of speculative dealings in such shares. This malpractice further adds to the losses of the shareholders.

(v) Loss on re-organisation. An over-capitalised company has to often resort to reorganisation and reduction of its capital in order to write off the accumulated losses. This results in the reduction of face value of shares and loss to its owners.

3. Effects on Society:

Over-capitalisation affects not only the company and its owners but also the society as a whole.

(i) Loss to Consumers:

In order to prevent declining trend of income, an over-capitalised concern resorts to increased prices and reduction in quality of its products.. Hence, consumers have to suffer by paying more for the poorer quality.

(ii) Loss to Workers:

An over-capitalised company tends to reduce wages and welfare facilities of the workers to reduce losses of the earnings. No consideration is given to the demands of the workers and some of them even lose their jobs because of lay offs and retrenchment and closure of such units.

(iii) Under or Misutilisation of Resources:

An over-capitalised concern either misutilises or under utilises its resources. Hence, the scarce resources of society are not properly utilised.

(iv) Gambling in Shares:

Another social evil of over-capitalisation is promotion of gambling habits by providing scope for gambling in shares of such a company.

(v) Recession:

Over-capitalisation leads to increased losses, poor quality of products, retrenchment or unemployment of workers, decline in wage rates and purchasing power of labour. This tendency gradually affects the entire industry and the society, and may lead to recession of economy.

Remedies for Over-Capitalisation:

The evil effects of over-capitalisation are so grave that the management must take remedial measures to rectify the situation as soon as the first symptoms of over-capitalisation are observed by the firm. An over-capitalised company has been rightly compared with a very fat person who is likely to suffer from various diseases unless he takes steps to immediately reduce his weight.

Likewise, an over-capitalised company must cut its dead weight before it becomes deep rooted and almost impossible to get rid of. In this regard, various remedial measures such as increasing the efficiency of management, reduction of high interest bearing funded debt, redemption of preference shares, reduction in face value and number of shares, etc., have been suggested.

1. To have Efficient Management:

Management should try to become more efficient and try to curb excess expenditure. Earning capacity should be improved and care must be taken to spend every single rupee in the most profitable and economic manner.

2. Redemption of Preference Shares:

Preference shares carrying high rate of dividend should be redeemed out of retained earnings in order to raise the share of equity shareholders.

3. Reduction of Funded Debts:

Debentures, public deposits and loans taken at higher rates of interest should be prepaid out of accumulated profits or out of fresh borrowings at lower rates of interest, if there are no accumulated profits.

4. Reorganisation of Equity Share Capital:

The face value or the number of equity shares may be reduced in order to rectify over-capitalisation. Sometimes, shareholders may oppose to this proposal but actually their proportionate interest in the equity is not reduced. The amount available due to reorganisation of share capital is utilised for writing off the fictitious assets and other over-valued assets.

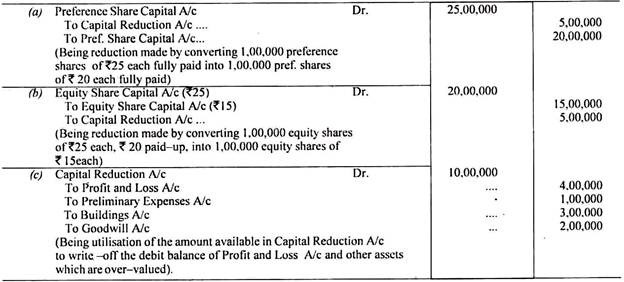

The following -entries are passed: