This article throws light upon the six types of cost of capital. The types are: 1. Explicit Cost and Implicit Cost 2. Future Cost and Historical Cost 3. Specific Cost 4. Average Cost 5. Marginal Cost 6. Overall Cost of Capital.

Type # 1. Explicit Cost and Implicit Cost:

The explicit cost of any sources of capital may be defined as the discount rate that equates the present value of the cash inflows that are incremental to the taking of the financing opportunity with the present value of its incremental cash outflows. When a firm raises funds from different sources, it involves a series of cash flows.

At its first stage, there is only a cash inflow by the amount raised which is followed by a series of cash outflows in the form of interest payments, repayments of principal or repayment of dividends.

Therefore, if a firm issues, 1,000 8% debenture of Rs. 100 each; redeemable after 10 years at par, there will be an inflow of cash to the extent of Rs. 1,00,000 (1,000 x Rs. 100) at the beginning, but the annual cash outflow will be Rs. 8,000 (Rs. 1,00,000 x( 8/100)) in the form of interest and there also will be an outflow of Rs. 1,00,000 at the end of 10th year when the debentures will be redeemed.

ADVERTISEMENTS:

We know that a firm can raise its funds by issuing equity or preference shares, or debentures or by selling assets etc., which are known as sources of funds. The cash outlays for this purpose may be in the form of interest/ dividends, repayments of principal.

The following equation may be used in general in order to calculate the explicit cost of capital:

It is evident from the above equation that it is the internal rate of return of the cash-flow of financing opportunity. Therefore, if a firm takes any non-interest bearing loan, there will be no explicit cost since there is no outflow of cash by way of interest payment although the principal must be repaid.

ADVERTISEMENTS:

From the above, it becomes clear that the explicit cost will arise when capital is raised and which is also the IRR of the financial opportunity. Implicit cost of capital, on the other hand, arises when a firm considers alternative uses of the funds raised. That is, it is the opportunity cost.

In other words, it is the rate of return which is available on other investment in addition to what is being considered at present. To sum up, the implicit cost may be defined as the rate of return associated with the best investment opportunity for the firm and its shareholders that will be foregone if the project presently under Consideration by the firm were accepted.

In this respect it may be mentioned that the earnings are retained by a firm, the implicit cost is the income which the shareholders could have earned if such earnings would have been distributed and invested by them. Therefore, explicit cost will arise only when funds are raised whereas implicit cost will arise when they are used.

Type # 2. Future Cost and Historical Cost:

Future Costs are the expected costs of funds for financing a particular project. They are very significant while making financial decisions. For instance, at the time of taking financial decisions about the capital expenditure, a comparison is to be made between the expected IRR and the expected cost of funds for financing the same, i.e., the relevant costs here are future costs.

ADVERTISEMENTS:

Historical costs are those costs which have already been incurred in order to finance a particular project. They are useful while projecting future costs. In short, historical costs are very important by the amount they keep in predicting the future costs. Because, they supply an evaluation of performance in comparison with standard and/or predetermined costs.

Type # 3. Specific Cost:

The cost of each component of capital, viz., equity shares, preference shares, debentures, loans etc., is termed as specific or component cost of capital which is the most appealing concept. While determining the average cost of capital, it requires consideration about the cost of specific methods for financing the projects.

This is particularly useful where the profitability of the project is evaluated on the basis of the specific source of funds taken for financing the said project. For instance, if the estimated cost of equity capital of a firm becomes 12%, that project which are financed by the equity shareholders’ fund, will be accepted provided the same will yield at least a return of 12%.

Type # 4. Average Cost:

The average cost of capital is the weighted average cost of each component of funds invested by the firm for a particular project, i.e., percentage or proportionate cost of each element in total investment. The weights are in proportion of the shares of each component of capital in the total capital structure or investment.

ADVERTISEMENTS:

But the average cost has the following three computational problems:

(i) It refers to the measurement of costs of each specific sources of capital;

(ii) It also requires the assignment of proper weights to each component of capital;

(iii) Is the overall cost of capital (discussed subsequently) affected by the changes in the composition of the capital?

Type # 5. Marginal Cost:

ADVERTISEMENTS:

According to the Terminology of Cost Accountancy, Marginal Cost is the amount at any given volume of output by which aggregate costs are .hanged if the volume of output is increased or decreased by one unit. Same principle is being followed in cost of capital.

That is, marginal cost of capital may be defined as the cost of obtaining another rupee of new capital. Generally, a firm raises a certain amount of fund for fixed capital investment. But marginal cost of capital revels the cost of additional amount of capital which is raised by a firm for current and/ or fixed capital investment.

When the firm procures additional capital from one particular source only, i.e., not from the different sources, in given proportions, the marginal cost in that case, is known as specific or explicit cost of capital. In other words, marginal cost of capital may be more or may be less than the average cost of capital of a firm.

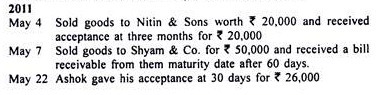

Illustration:

ADVERTISEMENTS:

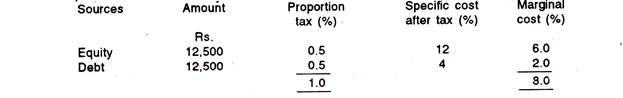

A firm presents the following information relating to cost of capital:

The firm wants to raise a fund for Rs 25.000 for the purpose of an investment proposal. It also decides to take it the same from a financial institution at a cost of 10%. Compute the marginal cost of capital and compare the same with the average cost of capital before and after additional financing assuming that the corporate rate of tax is 50%

Solution:

ADVERTISEMENTS:

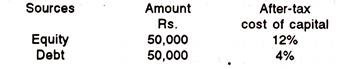

It becomes clear from the above problem that the marginal cost is Rs. 25,000 which is 10% before tax and 5% after tax (i.e., 10% – (50% of 10%)]. The same is also known as specific or explicit cost of financing Rs. 25,000 since the source is only one i.e. financial institution. But the same also differs from the average cost which is calculated as under:

Thus, it is evident from the above that the weighted average cost comes down from 8% to 7.4%. The cost of new debt is higher than the cost of old debt. Again, the cost of new debt is lower than the cost of equity capital. Therefore, average cost of capital reduces since there is an increase in the proportion of debt capital to total capital invested.

While raising additional capital, a firm must have to concentrate on the optimum capital structure and should use the different sources of financing proportionately for the purpose of maintaining the optimum capital structure.

In the circumstance, the present book value may be considered as weight in order to compute the average cost of capital. If the capital is raised from different sources at a given proportion, it needs a computation of average cost of capital to know the cost of the total additional amount raised.

So, in this case, marginal cost of capital may also be known as weighted average cost for the same. There will be no difference between the two provided there is no change in specific cost.

ADVERTISEMENTS:

Consider the following illustration:

Illustration:

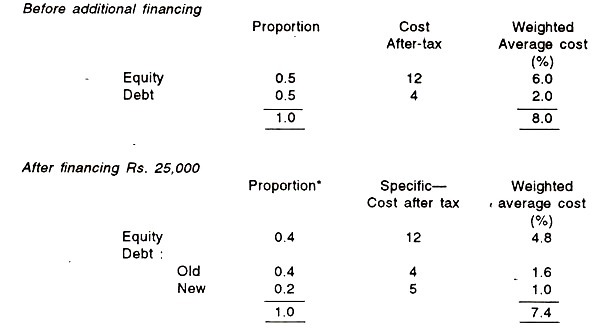

In illustration 1, if it is considered that the additional amount of Rs. 25,000 will be raised by the firm from equity and debt at the existing specific cost, there will be no difference between the weighted average cost and the marginal cost of capital as both of them will be one or the same which is presented below:

Therefore, the cost of raising Rs 25,000 is only 8% which is the marginal cost. The same should be measured with the help of weighted average cost for raising the additional funds of Rs. 25,000. It has already been highlighted above that if the specific cost changes, there will be a difference between the marginal cost of capital and the average cost of capital of a firm even if additional capital is procured at a given proportion.

It should be remembered that the marginal cost of capital will continue to be the weighted average cost of new capital for a firm. The following illustration will, however, make the principle clear:

Illustration:

If it is assumed that cost of debt is 10% (before tax) and rate of tax is 50% and the firm prefers to raise Rs. 25,000 proportionately, compute the marginal cost of capital and the average cost of capital.

Solution:

It becomes clear from the above that overall cost of capital is raised upward as there is an increase in the cost of new debt capital. The same actually differs from the marginal cost of 8.5% for rasing additional capital of Rs. 25,000 to 8.1%.

The relationship between marginal cost and average cost of capital may be presented with the help of a graph given by Brigham.

From the above graph, it becomes clear that if additional capital is raised up to the amount X, the marginal cost of capital (MCC) and also the average cost of capital (ACC) are the identical one. Therefore, both of them are rising although the ACC rises at a lesser rate than the MCC.

Type # 6. Overall Cost of Capital:

It may be recalled that the term ‘cost of capital’ has been used to denote the overall composite cost of capital or weighted average of the cost of each specific type of funds, i.e., weighted average cost. In other words, when specific costs are combined in order to find out the overall cost of capital, it may be defined as the composite or weighted average cost of capital.

Thus, the weighted average is used on the ground that the proportion of various sources of funds are different in the total capital structure of a firm. That is why, overall cost of capital recognises the relative proportions of different sources and as such, the weighted average and not the simple average.

Overall cost of capital is used for the following justifications:

(i) The firm can increase the market price per share after accepting projects which yields more than the average cost.

(ii) It recognises the fact that it is better to use different sources of finance instead of a single one.

(iii) It also provides a basis for comparison among projects as a standard or a cut-off rate. One point in this respect is to be noted, that is, if specific costs are taken as the cost of financing, proper comparison is not possible. In that case, specific costs will reveal shifting standard at certain intervals.

This particular attention has been depicted in the graph (Fig. 6.2) which expresses the relationship between the specific cost and the average cost of capital.

Computation of Overall Cost of Capital:

The computation of overall cost of capital involves the following steps:

(i) Compute specific cost for each individual projects;

(ii) Assign proper weights to specific costs;

(iii) Multiply the cost of each of the sources by the appropriate weight;

(iv) Divide the total weighted cost by the total weights in order to get the overall cost of capital.

Needless to mention that the weighted cost of capital may be changed due to:

(i) Change in the cost of each component or,

(ii) Change in weight, or

(iii) Both.

We have explained the overall cost of capital or weighted average cost of capital after applying appropriate weights. Now, the crucial part, i.e., selection of weights with its related aspects should be highlighted. We would like to illustrate the relevant aspects of the selection of the weights.

Selection / Assignment of Weights:

The following three possible weights may be used for the purpose:

(i) Using ‘Book-Value Weights’;

(ii) Using ‘Market-Value Weights’;

(iii) Using ‘Marginal-Value Weights’.

The first one is used for actual or historical weights, the second one for ‘current weights’ and the third one for ‘proposed future’ financing. The critical assumption in any weighting system is that the firm will, in fact, raise capital for investment in the proportions specified.

(i) Book-Value Weights:

Under this method, weights are the relative proportions of various sources of capital to the total capital structure of a firm. The advantages of these weights are operational in nature since book-values are easily available from the published annual report of a firm.

Moreover, every firm sets their capital structure targets in terms of values rather than market value. At the same time, the analysis of capital structure in terms of debt-equity ratio depends also on book value. The following illustration will help to explain the principle clearly.

Illustration:

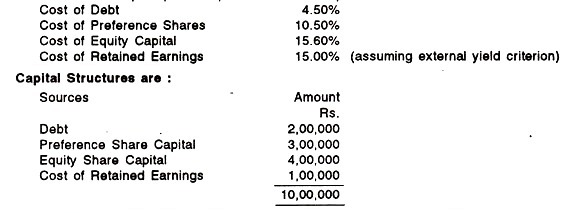

The cost of capital (after tax) of a firm of the specific sources is as under:

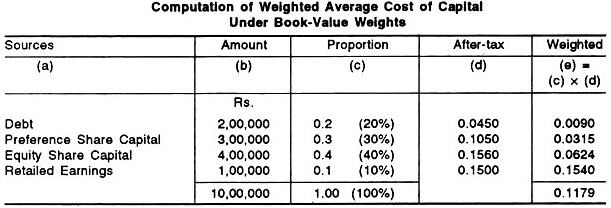

Calculate the weighted average cost of capital using ‘Book-Value Weights’:

Solution:

... weighted average Cost of Capital 11.79 %.

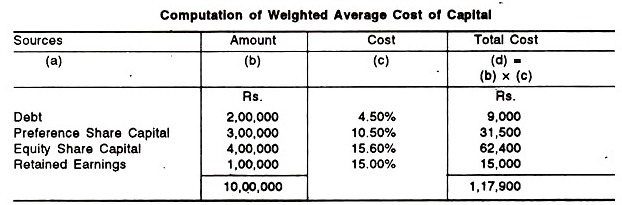

Alternative approach

An alternative method is to compute the total cost of capital and then figure by the total capital which actually avoids fractional calculation as calculated above.

... weighted Average Cost of Capital = Rs. 1,17,900/Rs. 10,00,000 = 11.79 %.

(ii) Market-Value Weights:

Theoretically, the use of market value weights for calculating the cost of capital is more appealing due to the following reasons:

(a) The market value of the securities is closely approximate to the actual amount to be received from the proceeds of such securities.

(b) The cost of each specific source of finance which constitutes the capital structure is calculated according to the prevailing market price.

But, there are some practical difficulties for using market value weights which are:

(a) The market value of securities may frequently fluctuate.

(b) Market value of securities is not readily available like book value since the latter can be taken from the published annual report of the company.

(c) The analysis of capital structure in terms of debt-equity ratio is based on book value and not on the market value.

Therefore, although market value weights are operationally inconvenient in comparison with book-value weights, particularly the market value of retained earnings, the former is theoretically consistent and sound and as such, may be used as a better indicator about the cost of capital of a firm.

Illustration:

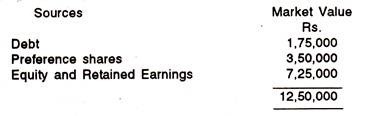

From the data contained in Illustration4, calculate the weighted average cost of capital bearing in mind that the market value of different sources of funds are as under:

Sources Market Value:

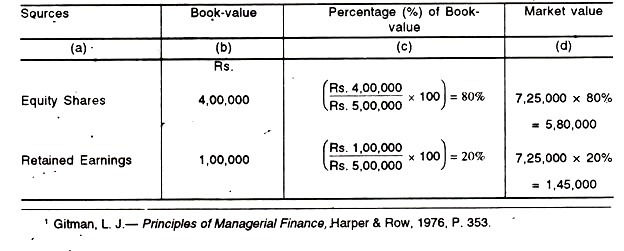

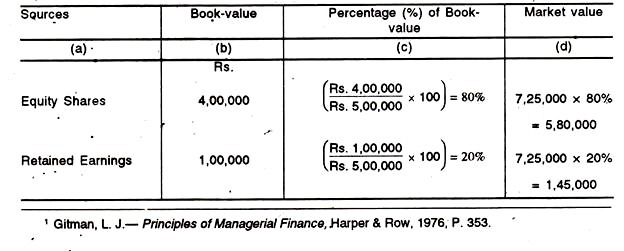

It has been stated above that market value weights are operationally inconvenient, particularly market value of retained earnings. But market value of retained earnings can indirectly be estimated which actually is suggested by Gitman.

According to him, as retained earnings are treated as equity capital for calculating cost of specific sources of funds, the market value of equity shares may be considered as the combined market value of both equity shares and retained earnings.

Individual market value (Equity Share and retained earnings) may also be determined by allocating each of the percentage share of the total market value equal to their respective percentage share of the total values.

Thus, according to Gitman, the sum of Rs. 7,25,000 may be allocated between equity share capital and retained earnings as under:

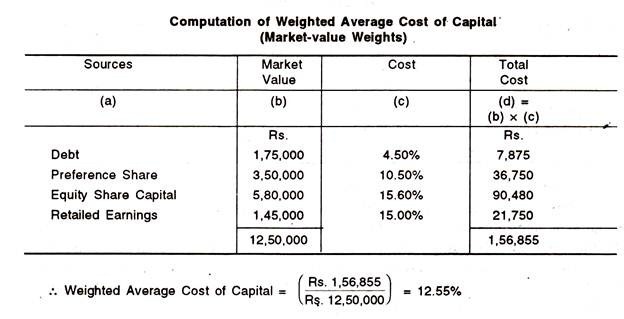

Therefore, after determining the market value, weighted average cost of capital is calculated as under:

Thus, one significant point can be noticed from the above table. That is, average cost of capital under market value weight is higher than the average cost of capital under book value weight since the former has considerably increased due to the fact that market value of equity and preference shares are greater than their respective book values.

In the present case, the overall cost is increased as these sources of finance have higher specific cost.

(iii) Marginal Weights:

When weights are assigned to the specific costs by the proportion of each type of fund to the total funds that are raised, it is known as marginal weights. In short, weights corresponds to the proportions of financing inputs a firm intends to employ to finance a proposed investment proposal.

In this context, it may be mentioned that here new or incremental capital is considered rather than capital raised in the part of current market values.

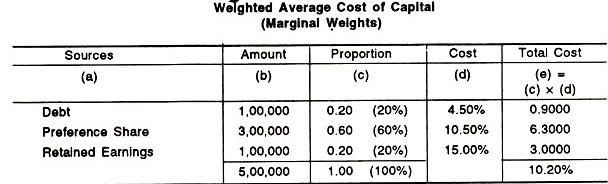

Illustration:

Data are taken from the illustration 4. The firm desires to raise Rs. 5, 00,000 for the purpose of extending its plant capacity. It also estimates that Rs. 1, 00,000 may be utilised from retained earnings and the balance Rs 4, 00,000 may be raised as under:

Compute the weighted average cost of capital after applying marginal weights.

Solution:

Weighted average Cost of Capital 10.20%

Needless to mention that this weighted average cost of capital (i.e., under marginal weights) is substantially lower than the above two methods, viz., book value and market value. This is simply due to the fact that preference shares have been used by large amount.

It is interesting to note that the above computed average cost of capital would have even been lower than the present one if ‘debt’ is being used at a large amount since it’s interest rate is very low.

However, marginal weight system does not recognise the long-term implications on the current financing of a firm as capital expenditure decisions are long-term investments, long-term implications of financing strategy should be implemented, i.e., it does not take into consideration the fact that to-day’s financing affects tomorrow’s cost.

If only a single source is being employed instead of a number of sources, application of marginal weights for the purpose of computation of weighted average cost will be of no use.