Let us make in-depth study of the meaning, utility and preparation of suspense account.

Meaning of Suspense Account:

Suspense Account is a temporary ledger account, opened for putting the difference on shorter side of the trial balance. Sometimes, it is not possible to locate someone sided errors in-spite of taking all efforts for their detection. As trial balance is the basic input for preparation of final accounts, it is not possible to retain open trial balance till those errors were detected.

The only option available with the accountant is to temporarily put the difference on the shorter side of the trial balance as ‘Suspense Account’. Thus we can say that Suspense Account is a temporary ledger account in which entries are made when the exact profile of one sided errors cannot be identified.

Utility of Suspense Account:

Suspense Account serves the following purposes:

(i) Helps in Preparation of Trial Balance:

ADVERTISEMENTS:

When trial balance does not agree, in that case the amount of difference can be put on the shorter side of the trial balance as ‘Suspense Account’ and thus, the trial balance stands closed.

(ii) Helps in Locating the Errors:

The amount of Suspense Account helps to locate the errors because with the amount of Suspense Account, the accountant can find the errors committed in the past.

(iii) Helps in Judging the Nature of Errors:

The balance of Suspense Account helps the accountant to locate the errors because the balance (debit or credit) helps the accountant to determine the possible head of account in which error might have been committed.

For example, debit balance of Suspense Account may be due to errors committed in accounts related to some assets or expenses and similarly credit balance of Suspense Account may be due to errors committed in accounts related to some liabilities or revenues.

(iv) Helps in Rectifying One-Sided Errors Entirely:

ADVERTISEMENTS:

When the errors are detected, the amount is transferred from Suspense Account to the respective account. Suspense Account stands automatically closed when the entire one sided errors are rectified. Thus, nil balance in Suspense Accounts is the conclusive proof of absence of one-sided errors in the books of accounts.

(v) Helps in Preparation of Final Accounts:

Trial balance is the basic input for preparation of final accounts. In case of disagreement of total of trial balance, the accountant puts the difference on the shorter side of the trial balance as ‘Suspense Account’ and proceeds for preparation of final accounts. In this sense, disagreement of total of trial balance does not hamper the preparation of final accounts.

Preparation of Suspense Account:

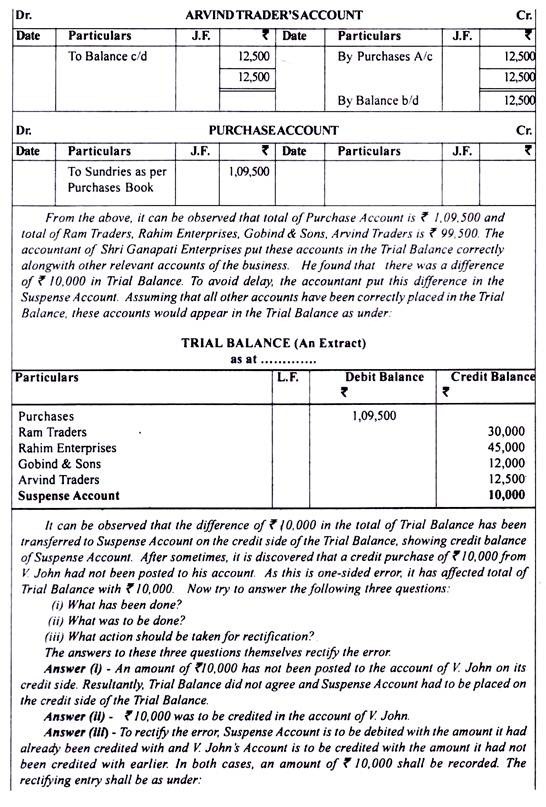

In the aforesaid paragraphs, we have discussed that ‘Suspense Account’ is a temporary account opened with the amount of difference in both sides of the trial balance. By putting the amount on the shorter side of the trial balance, trial balance can be totaled up and balanced. It is worth mentioning that thereafter, as and when the errors get detected, the amount is transferred from Suspense Account to the respective account.

In this process, after detection of every error, the balance of Suspense Account reduces gradually and when all errors are rectified, there will be nil balance in the Suspense Account. In other words, we can say that Suspense Account stands automatically closed when all one sided errors are rectified. Let us now look at a few case studies and learn the opening and disposal of Suspense Account.