Generally speaking, the Fund Flow analysis requires the preparation of two statements:- 1. Statement of Changes in Working Capital 2. Fund Flow Statement.

1. Statement of Changes in Working Capital:

The working capital does change due to various transactions. The working capital position at the beginning of a period is changed to a different position at the end of that period. A Statement of working capital is prepared to depict the changes in working capital. Working capital represents the excess of Current Assets over Current Liabilities.

Since, several items i.e. all current assets and current liabilities are the component of working capital, it is necessary to measure the increase or decrease therein, by preparing a Statement or Schedule of changes in Working Capital. This Statement is prepared with current assets and current liabilities as appearing in the Balance Sheets under consideration.

The Statement shows the changes in individual items of current assets and current liabilities and their effect of working capital. The total increase and the total decrease in the end is compared and the difference of total increase and total decrease shows the net increase or net decrease in the working capital.

ADVERTISEMENTS:

A form of the Statement is given below:

How to Prepare the Above Schedule?

ADVERTISEMENTS:

Remember that:

i. The Schedule is prepared with the help of only Current Assets and Current Liabilities.

ii. The Schedule considers only the Accounts appearing in the Balance Sheets.

iii. There is no effect of additional information given at the end of problem.

ADVERTISEMENTS:

Steps:

1. The amount of every item of Current Asset of the current year is compared with its amount of previous year. If the amount of current asset of the current year is more than its amount of previous year, the excess is recorded in debit column.

2. If the amount of current asset of the current year is less than its amount of the previous year, the deficiency is recorded in credit column.

3. Make sure that all the accounts relating to current assets appearing in the two Balance Sheets are gone through and differences are properly recorded.

ADVERTISEMENTS:

4. If the amount of each current liability of current year is more than its amount of previous year, the excess is recorded in the credit column.

5. If the amount of current liability of current year is less than its amount of previous year, the deficit is recorded in debit column.

6. Find out totals of all debit amounts and all credit amounts.

7. The above total are compared in the end and the difference shows decrease or increase in the Working Capital.

ADVERTISEMENTS:

8. (The difference of total Current Assets and the total Current Liabilities of a year is its Working Capital.) If the Working Capital at the end of the current year is more than the Working Capital at the previous year the excess is called “Increase in Working Capital”. If previous year’s Working Capital is more than the current year’s Working Capital, the excess is called “Decrease in Working Capital”.

We can first prepare the “Schedule of changes in Working Capital”. It is easy as there is no complications. This facilitate us to know in advance the answer to be disclosed by the Statement of Sources and Applications.

The following rules may be noted:

(a) Increase in a current asset item increases working capital.

ADVERTISEMENTS:

(b) Decrease in current asset item decreases working capital.

(c) Increase in current liability item decreases working capital.

(d) Decrease in current liability item increases working capital.

The increase or decrease in the Working Capital should be equal to that shown in the Statement of Sources and Applications of Funds.

ADVERTISEMENTS:

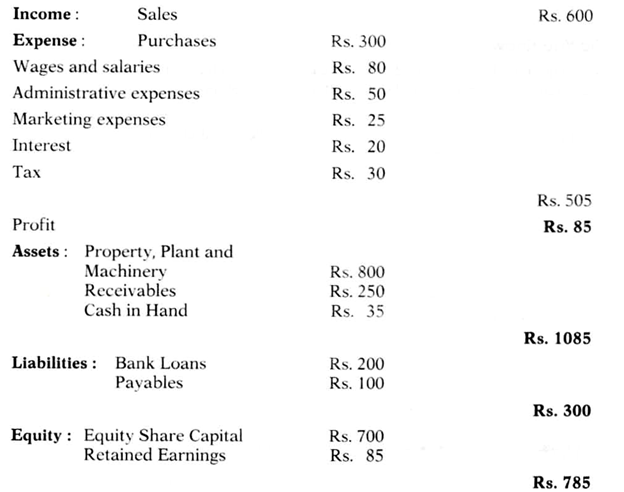

Illustration 1:

You are given the following Balance Sheets of a Company:

Alternative Methods to the Above:

Here we make use of both current assets and current liabilities and non-current assets and non-current liabilities. The schedule is similar to the above but with only one difference of two more columns to record increase or decrease in non-current assets and non-current liabilities.

The specimen form is given below:

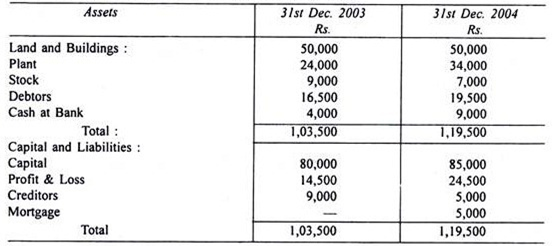

Illustration 2:

The following are the summarised Balance Sheets of Ram Ltd. as at 31st December 2003 and 2004:

Non-Current Assets:

All assets other than current assets come within the category of non- current assets. For examples, Goodwill, Land, Buildings, Plant, Machinery, Patents, Debit balance of P & L A/c. Preliminary Expenses, Discount on Issue of shares or Debentures etc.

Non-Current Liabilities:

All liabilities other than current liabilities come within the category of non-current liabilities. For example, Share Capital, Debentures, Long Term Loans, Security Premium, Credit Balance of P & L A/c, Capital Reserve etc.

2. Fund Flow Statement:

This is second but most important part of Fund Flow Statement. After preparing the Statement of Working Capital, the Statement of Sources and Application of Fund is prepared. This Statement is prepared with the help of remaining items in the Balance Sheet of the two periods all non-current assets and non-current liabilities and other information given in the problem.

That is, it is prepared on the basis of the changes in Fixed Assets, Long-term Liabilities and Share Capital ascertained on the basis of values of these items shown in the Balance Sheets. Of course, additional information, if given, must also be considered.

Thus the preparation of this Statement involves the ascertainment of increase or decrease in the various items of fixed assets, long-term liabilities and share capital. Those business transactions, which cause an increase in the working capital, are considered as Source of Fund and on the same footing business transactions causing a decrease in working capital are known as Uses of Funds.

The probable items of sources and uses of fund are tabulated below:

There is no legally prescribed or generally accepted form of Fund Flow Statement. The example of Fund Flow Statement is given below:

Fund Flow Statement is a statement which indicates various sources from which funds (Working Capital) have been obtained during a certain period and the uses or applications to which these funds have been put during that period.

Generally, this statement is prepared in two formats:

(1) T form or an Account form

(2) Report form

Illustration 3:

From the following Balance Sheets of X Ltd., you are required to prepare a Schedule of Changes in Working Capital and Statement of Flow of Fund:

Some Practical Hints:

Given below are some matters which require special attention while preparing a Statement of Sources and Application of Funds i.e., Fund Flow Statement.

(1) Trading Profit/Fund from Operations:

Sales are the major source of cash-inflow and at the same time cost of goods sold and expenses are the main outflow of cash. The difference of these two i.e. Sales—(Cost of Goods sold + Expenses) is net profit i.e. net income from operations. However, the profit so calculated is seldom equal to the Funds from Operations because there are many items which are debited or credited in the profit and loss account but which do not affect working capital.

Hence, to calculate funds from operations, the following adjustments are to be done:

(a) Items to be Added Back to the Net Profit

(i) Non-Fund Items:

Items which do not increase the current liability or decrease the current asset are non-fund items.

They are in brief:

(a) Depreciation and Depletion:

Depreciation and depletion do not affect the working at all. It is usual practice in every business to write off depreciation on fixed assets which is debited to Profit and Loss Account and a corresponding credit is made in the respective asset account. In this way, it is only an accounting entry, having the effect of reducing the book value of fixed asset as well as the profit by the same amount. Thus it affects only the fixed assets. Therefore, to nullify the effect, the amounts of depreciation and depletion already debited to Profit and Loss Account are added back to the profits in order to calculate the amount of funds.

(b) Amortisation of Fictitious and Intangible Assets:

Amortisation of certain fictitious assets in the nature of Deferred Revenue Expenditure like, Preliminary Expenses, Advertising Suspense Account, Discount on Issue of Shares and Debentures, Premium on Redemption of Redeemable Preference Shares or Debentures etc. and write off of certain intangible assets like Goodwill, Trade Marks and Patents are also items which are only accounting entries and do not affect the current assets or current liabilities at all. They are, therefore, added back to the net profit.

(c) Provision for Taxation:

Provision for taxation made out of current year’s profit also does not affect the flow of funds. So it must be added back to profit.

(ii) Non-Trading Charges or Losses:

Items which are not trading charges or losses are called non- trading charges or losses.

They are:

(a) Appropriation of Retained Earnings:

Transfer of profits to certain reserves, such as, General Reserve, Dividend Equalisation Fund, Sinking Fund, Reserve for Contingencies or any other reserves do not affect the current assets or current liabilities. So, they will be added back to the net profits.

(b) Proposed Dividend on Shares:

It is also an appropriation of profits and not a charge and in no way involves a change in Current Assets or Current Liabilities. So, it is added back to profits.

(c) Loss on Sale of Non-Current Assets:

Loss on sale of fixed assets such as Building, Machinery, Furniture or Investment which has already been debited to Profit and Loss Account, is not a business loss and does not affect the flow of funds. It is therefore, added back to net profit.

(iii) Items to Be Deducted from Net Profit:

The non-fund and non-trading revenue receipts or incomes must be deducted from the net profit in order to compute funds from operations.

Such items may be as follows:

(a) Dividend Received or Receivable:

Although this transaction increases current assets of the firm but as it is not a trading income, it should be deducted from the net profit.

(b) Retransfer of Excess Provisions:

Where provisions made for Taxation, Depreciation, Doubtful Debts etc. exceed the genuine requirements, the excess amount is transferred back i.e. credited back to Profit and Loss Account. But it is simply an accounting entry. It does not create any inflow of fund. Hence it will be deducted from net profit.

(c) Profits on Sale of Non-Current Assets:

Any profits arising out of sale of fixed assets which have already been credited to Profit and Loss Account, must be deducted from the net profit.

(d) Appreciation of Fixed Assets:

The amount of appreciation on revaluation of fixed assets, if credited to Profit and Loss Account, must be deducted from the profit to compute funds from operations.

Calculation of Funds from Operation:

There are two methods to find out the amount of Funds from Operation:

1. Statement form and

2. Account form.

Statement Form:

It can be prepared as under:

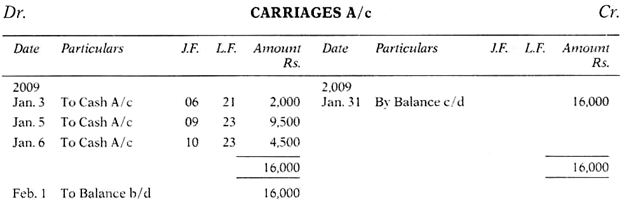

Account Form:

Alternatively, an adjusted Profit and Loss account may be written up as follows and the balancing figure thus represents Trading Profit or Fund from Operation:

Illustration 4:

A Company’s reported current profit is Rs. 70,000 after incorporating the following:

Derive the net inflow of funds from the operations:

(2) Analysis of Transactions:

The accounts of an undertaking reflect the effect of many different kinds of transactions but for the purpose of funds statement preparation are grouped into three categories:

(a) Transactions Affecting Current Account only:

If both the aspects of a transaction are affecting current account only, no Flow of Fund takes place. Flow of Fund Statement is related with Working Capital and Working Capital is the result of excess of Current Assets over Current Liabilities.

(i) Decrease in both C.A. and C.L. by the same amount.

(ii) Increase and decrease in C.A. only by the same amount.

(iii) Increase in both C.A. and C.L. by the same amount.

(iv) Increase and decrease in C.L. only by the same amount.

In order to understand the rules, we take the following examples:

(b) Transactions Affecting Current and Non-Current Accounts:

If a transaction is such that one aspect of it affects current account and its other aspect affects non-current account, there will be effect on Working Capital and Fund will flow.

(i) Increase in C.A. and non-current liability.

(ii) Decrease in non-current liability and C.A.

(iii) Increase in non-current asset and decrease in C.A.

(iv) Decrease in non-current asset and increase in C.A.

(c) Transactions Affecting Non-Current Account Only:

If there is a transaction which affects non-current accounts only, it is not considered for Flow of Fund. That is, when both aspects of a transaction are non-current, no flow of fund takes place.

Example: Machinery purchased by issuing shares.

Journal: Machinery A/c Dr.

To Share Capital A/c

Here Machinery and Share Capital Accounts are non-current accounts, therefore, they do not affect Flow of Fund, which is based on Current Assets and Current Liabilities.

The following chart illustrates:

1. Investments:

Investments may be held by a trading concern either as a current asset or as fixed asset. If the investments represent surplus funds temporarily invested in marketable securities, they are to be treated as current assets. If on the other hand, investments are of a permanent nature i.e. trade investments or long term investments, they should be treated as fixed assets. The actual sale proceeds, without considering profit or loss on sale should be taken to the Fund Statement as a Source of Fund and the figure of purchase as Application of Fund.

2. Provision for Tax:

It may be treated either as current liability or non-current liability. If it is treated as current liability tax payment is not regarded as an item of application of Fund and provision for tax is not adjusted to Profit or loss for finding out income from operation. If provision for tax is treated as non-current, payment of tax is treated as application of Fund and it is treated for adjustment of profit or loss.

3. Proposed Dividend:

It can be treated as an item of current liability of non-current liability. As current liability, actual payment of this dividend is not treated as application of Fund. If it is treated as non- current, its actual payment is treated as application of fund.

4. Interim Dividend Paid:

It will appear as an application in the Funds Statement and on the debit side of Adjusted Profit and Loss Account. No adjustment is necessary for interim dividend paid if Funds from operation are being determined on the basis of ‘net profit for the current year before debit for interim dividend.’

Hidden Information:

Sometimes the information required for Fund Flow Statement is not directly given in the problem. Often student is faced with a situation where he is not able to locate easily transactions taking place in the business. In such circumstances, it is suggested to prepare Accounts.

Follow the steps given below:

1. Find out the amount of Working Capital for the two consecutive years from the respective Balance Sheets and determine the schedule of changes in Working Capital which will result in either a decrease or an increase in Working Capital.

2. Open for all other non-current assets and non-current liabilities accounts by taking their respective opening and closing balances.

3. Consider the adjustment given in the problem one by one.

4. Close the accounts one by one which result either as an item of Source of Funds or an item of Application of Funds or close remaining accounts by transferring to Adjusted Profit and Loss Account.

To make the above discussions clear, the following illustrations are much helpful. They are self-explanatory.

Illustration 5:

From the following Balance Sheets of Prem & Company for the year ended on 31st Dec. 2003 and 2004, prepare a statement showing sources and application of funds and schedule of changes in Working Capital.