The following points highlight the top six methods of providing depreciation. The methods are: 1. Depreciation Based on Time Factor 2. Depreciation Based on Usage 3. Depreciation Based on Both Usage and Time Factors Joint Rate Method 4. Depreciation Based on Maintenance Factor 5. Considering the Revenue Earning Factor of the Asset 6. Revaluation Method.

Methods of Providing Depreciation:

- Depreciation Based on Time Factor

- Depreciation Based on Usage

- Depreciation Based on Both Usage and Time Factors Joint Rate Method

- Depreciation Based on Maintenance Factor

- Considering the Revenue Earning Factor of the Asset

- Revaluation Method

Method # 1.

Depreciation Based on Time Factor:

Under methods based on time factor, depreciation is a fixed overhead expenditure as the time factor is taken into consideration. If there is no production from an asset, depreciation will be charged to cost of production on time basis.

ADVERTISEMENTS:

(i) Straight Line Method:

Under this method, a fixed percentage of the original value of the asset is written off every year so as to reduce the asset account to nil or to its scrap value at the end of the estimated life of the asset. To ascertain the annual charge under this method all that is necessary is to divide the original value of the asset (minus its residual value, if any) by the number of years of its estimated life i.e.

If, for example, a machine costing Rs.11,000 is estimated to have a life of ten years and the scrap value is estimated at T 1,000 at the end of life, the amount of depreciation would be

The main advantage of this method is that it makes calculation of depreciation simple and can write down an asset to zero at the end of its working life, if so desired. As the charge to cost is uniform every year so it is easy to have comparable costs. This method is suitable for establishing standards and budgets as it is possible to estimate depreciation charge in advance.

The limitations of this method are:

(a) That while the charge for depreciation remains constant year after year, the expenses of repairs and maintenance a: e increasing as the asset grows older and the charge to cost of production increases progressively,

ADVERTISEMENTS:

(b) It becomes difficult to calculate the depreciation on subsequent additions due to tedious calculations,

(c) The incidence of depreciation on unit cost, due to wide fluctuations in production activity, cannot be calculated correctly.

(ii) Reducing or Diminishing Balance Method:

Under this method, depreciation will be calculated at a certain percentage each year on the balance of the asset which is brought forward from the previous year. Every year the installment of depreciation will reduce as the beginning balance of the asset in each year will reduce. It is usually adopted for plant and machinery.

ADVERTISEMENTS:

The advantages of this method are:

(a) It tends to give a fairly even charge of depreciation to cost of production each year. Depreciation is generally heavy during the first few years and is counter-balanced by the repairs being light and in the later years when repairs are heavy this is counter-balanced by the decreasing charge for depreciation,

(b) As and when additions are made to the asset, fresh calculations of depreciation are not necessary,

(c) This method is recognised by the income-tax authorities in India.

ADVERTISEMENTS:

Its main drawback is that in subsequent years, original cost of the asset is altogether lost sight of and the asset can never be reduced to zero under this method. Further this method does not take into consideration the asset as an investment and interest is not taken up-to consideration.

(iii) Sum of the Digits Method:

This is variant of the reducing installment or diminishing balance method. Under this method depreciation is calculated by the following formula:

Suppose machinery was purchased for Rs.6,000 on 1st January, 2006 and depreciation was charged following the sums of the digits method assuming useful life to be 3 years.

ADVERTISEMENTS:

Depreciation for three years will be calculated as under:

Depreciation for the

First year = 3/(3+2+1) x Rs.6,000 = Rs.3,000

ADVERTISEMENTS:

Second year = (2/6) x Rs.6,000 = Rs.2,000

Third year = (1/6) x Rs.6,000 = Rs.1,000

Method # 2. Depreciation Based on Usage:

Under methods based on usage, depreciation is a variable overhead expenditure as the time factor (i.e. the lapse of time) is completely ignored. If there is no production from an asset, no depreciation can be charged to cost of production on usage basis.

(i) Production Unit Method:

A fixed rate of depreciation per unit of production is calculated by the following formula:

ADVERTISEMENTS:

Rate of depreciation per unit of production = (V – S)/P

where V = Value of the asset

S = Scrap value

P = Physical units of production.

Thus, if an asset has a value of Rs.11,000 and its scrap value is Rs.1,000, physical units of product are 10,000. The rate of depreciation will be RS.1 per unit i.e.

This method is applicable in case of plant and machinery directly engaged on production and for wasting assets like quarries, mines, oil extraction from the ground etc. known as depletion. No depreciation is charged when an asset remains idle but with the increase in the units of production, the depreciation charge also increases. It recognises the fact that depreciation varies according to the volume of output.

The cost of an asset is spread evenly over the work done by it as per costing requirements. The incidence of depreciation arises only when the asset is employed in production and not when it remains idle.

It recognises the usage factor and not the time factor. Thus, the use of this method for charging depreciation on output will overcome the problems created by wide fluctuations in production activity and charging depreciation on time basis.

It cannot be applied when various outputs from an asset are not identical or uniform or cannot be measured in terms of homogeneous units. It will increase clerical cost as a separate record is kept for each type of asset.

(ii) Production Hour Method:

A fixed rate of depreciation per hour of production is calculated as under:

Rate of depreciation per hour = V- s/t where t is the estimated life of the asset in number of hours

Rs.1,00,500 – Rs.500 = 20,000 hours = Rs.5 per hour.

This method can be used in cases where the production is not in identical or uniform physical units.

Method # 3. Depreciation Based on Both Usage and Time Factors Joint Rate Method:

Under this method, depreciation is composite amount consisting of two elements one for the passage of time and the other for the usage of the asset. The proportion of the elements is estimated and calculated separately in accordance with the methods already discussed. The amount of depreciation will be calculated by combining the two parts.

Assume:

Total cost of an asset = Rs.35,000

[Rs.30,000 to be depreciated on time basis and the rest Rs.5,000 on usage basis].

Life = 15 years

Residual value = Rs.1,500

Total hours worked during the year = 1,000

Total hours estimated for the whole life = 20,000

Annual depreciation on time basis (straight line method)

Annual depreciation on usage basis (Production hour method)

Total depreciation = Rs.1,900 + Rs.250 = Rs.2,150.

This method is used where an asset works intermittently and there are periods of idleness followed by periods of normal and sometimes overtime work. Total charge is a semi-variable factor i.e. partly fixed and partly variable. But this method involves considerable work.

Method # 4. Depreciation Based on Maintenance Factor:

Repairs Provision Method:

This method provides for the aggregate of depreciation and maintenance cost by means of periodic charges each of which is a constant proportion of the aggregate of the cost of the asset depreciated and the expected maintenance cost during its life. The rate of depreciation is calculated as under:

Assume the same data except the cost of the asset Rs.40,000 as in previous method and an assessed maintenance cost (m) of Rs.3,500. In the life period of the asset, the depreciation will be as under:

In assessing the maintenance cost of the asset over its life for a number of years, uncertainty is involved and that becomes a limitation of this method.

Method # 5. Considering the Revenue Earning Factor of the Asset:

(i) Annuity Method:

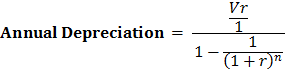

The method provides for depreciation by means of periodic charges, each of which is a constant proportion of the aggregate of the cost of the asset depreciated and interest at a given rate per period on the written down value of the asset at the beginning of each period. Depreciation per year will be calculated as under:

The amount of depreciation under this method is heavy and is intended to cover the cost of opportunity lost by not investing the capital elsewhere. It is mostly used for depreciating leasehold buildings where no subsequent additions are made to the asset and the scrap value is nil.

(ii) Sinking Fund Method:

(Also known as Redemption or Amortisation Method). This method provides for depreciation by means of fixed periodic charges which, aggregated with compound interest over the life of the asset, would equal the cost of that asset.

Simultaneously with each periodic charge an investment of the same amount would be made in fixed interest securities which would accumulate at compound interest to provide at the end of the life of the asset a sum equal to its cost. Depreciation per year is calculated as under:

The main objective of this method is to provide ready liquid funds at the time of replacement. The money can be diverted for an urgent and more useful purpose if it is not to be invested in outside securities.

(iii) Endowment Policy Method:

This method provides for depreciation by means of fixed periodic charges equivalent to the premiums on an endowment policy for the amount required to provide at the end of the life of the asset a sum equal to its cost. Depreciation equals premium charged by insurance company. The amount of premium is determined by the insurance companies.

Method # 6. Revaluation Method:

This method provides for depreciation by means of periodic charges, each of which is equivalent to the difference between the values assigned to the asset at the beginning and at the end of the period. This method is used in case of bottles, corks, crates, loose tools, packages, patterns, trade-marks, live-stock, plant in a contract etc.