Read this essay to learn about: 1. Introduction to Activity Based Costing (ABC) 2. Application of Activity Based Costing in Product Costing 3. Application in Service Industry.

Essay # 1. Introduction to Activity Based Costing (ABC):

Activity based costing (popularly known as ABC) relates to incurrence of costs to activities which are termed as cost driver. In a competitive business environment accountants need to identify the key drivers which influence business performance and they need to advise the management on how to manage them.

ABC is a new approach which swept the age-old concept of linking overhead to products through primary distribution and secondary distribution method. It emphasizes that overheads are driven by certain activities and therefore, they should be charged to products on the basis of suitable cost drivers.

Let us take a small example to understand the ABC approach:

ADVERTISEMENTS:

A company (EEL) is producing two types of telephones: Regular and Cordless. The company has been divided into two departments to provide support services: Purchasing and Stores, and also two production departments: Fabrication and Assembly.

Will you believe that that:

(i) Fabrication,

ADVERTISEMENTS:

(ii) Assembly,

(iii) Purchasing, and

(iv) Stores are activities that drive costs?

The answer is in the negative. These are departments representing collection of similar activities.

ADVERTISEMENTS:

Let me give you some ideas about the activities in the purchase department:

Herein three first level activities are presented and each first level activity is further sub-divided into second level activities. In case the first level activities are not broken down into the second level, accuracy of the analysis will be affected.

ADVERTISEMENTS:

Identification of Activities:

Labour and machine hours can of course be used as allocation basis for appropriate activity.

It can identify the following activities across Fabrication and Assembly:

1. Set up: Machine is set up every time a batch is carried.

ADVERTISEMENTS:

2. Machining: Machining timing for the manufactured components

3. Assembling

4. Testing.

On the other hand, for purchasing we have already identified the following first stage activities:

ADVERTISEMENTS:

1. Process Requisitions

2. Expedite Orders

3. Process Receipts

First stage activities for the Stores are:

ADVERTISEMENTS:

1. Maintaining Stores Record

2. Managing Stores Issues

3. Stores Security

4. Physical Verification

Creation of New Data Base:

EEL should now maintain activity-wise data base rather than department-wise.

ADVERTISEMENTS:

Illustration 1:

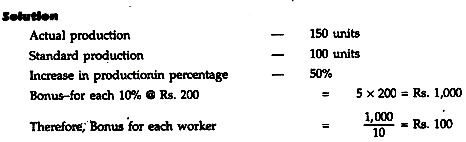

Keep in mind, in the first phase the company is utilizing “first stage” cost drivers only.

Now let us proceed to allocate costs purchase activities.

Purchasing is aggregate of the actions:

(i) Generating Purchase Requisition,

(ii) Expediting Orders, and

(iii) Process Receipts.

If you allocate purchasing costs as such, you are missing the underlying activities which were carried out for a product.

Study the activity-wise product -wise cost allocation as given in the Table 12.1 below:

Similarly, let us create data base for various first stage stores activities:

Applying the same procedure, we may charge costs of stores to activity- wise product-wise:

Finally, let us develop activity data base for production and find out activity-wise product-wise costs:

You would observe that ABC and tedious process. It involves lots of planning and number crushing. Let us find out product costs:

Given three different methods of product cost calculation, management is better comfortable with ABC as it is successful in distinguishing the cost of a specialty products with that of a bulk product.

How could ABC distinguish resource consumption?

Why are departmental rates not useful?

a) The proportion of no unit related overhead costs to total overhead costs is large, i.e. Overhead were not linked to production units.

b) The degree of product diversity is great, i.e. pattern of resource consumption of two products are different.

You may observe resource consumption ratio. Also there is no meaning of routing purchasing and stores costs through Fabrication and Assembly departments as those departments do not manage these costs.

Non-Unit Level Activities:

a) Activities that are not performed each time a unit is produced.

b) Consider setting up activities.

c) Set up costs are incurred each time a batch of products is produced. Batch size may be 1000 or 2000 but the cost of set up is same.

d) No. of set ups not the no. of units produced should be cost driver here.

Product Diversity:

1) Product diversities here mean products consume overhead systematically in different proportion.

2) The proportion of each activity is consumed by a product is defined as the consumption ratio.

Product diversity refers to the quantity or range of distinct products or the variety of product families. Minor product variations should not be confused with product diversity. Differences in complexity of various products should be reflected in the analysis. Products that appear relatively homogenous but that vary greatly in complexity are indicative of high diversity. Examples are 64k memory chips and 1024K memory chips, cordless and regular telephone.

Activity Based Costing to Activity Based Cost Management:

Pricing products properly is no doubt an important issue. But application of ABC is far more greater than what could be envisaged at the time of its application for product costing.

i. Functions of a department lost its traditional meaning and better aggregation of activities becomes possible.

ii. Scrapping a department may be difficult since a company has to oversee certain functions. But outsourcing an activity that proves to be cheaper becomes possible.

iii. There is no meaning of departmental budget as department is aggregate of the activities. To make the budget more realistic, a department has to identify the activities and resource needed to perform those activities. This is the basis for zero based budgeting as all activities can be reviewed as and when a budget is prepared.

iv. Finally, performance of a business is linked to efficient performance of activities. So focus should be on activities not on the departments (which aggregation of activities). Not necessarily the performance of an activity is reflected through departmental activities. Certain activities of a department may be performed efficiently and other may not be.

Ability of an organization to perform a set activities in efficient manner gives it competency. It should give up or outsource the activities in which it is not competent. Also the focus may be to develop competency in the weak areas. Thus activity based cost management becomes a management philosophy.

Reconsider cost of purchasing activities and stores activities once more as worked out in illustration 1.

Smart Purchasing Agency wants to take care follow up activities in purchasing which is coded as “Expedite Orders” at Rs. 10,00,000. G 2 Securities tendered to take care of Stores Security at Rs.5, 00,000 and Lamba & Co, Chartered Accountants, have agreed to carry out physical verification of stores at Rs. 4,00,000 on quarterly basis as is the practice of the company as internal control manual.

ABC helps the company to compare market value of each every activities and its cost of performing. By this weaknesses can be identified and the scope for cost reduction can be pinpointed.

Essay # 2. Application of Activity Based Costing in Product Costing:

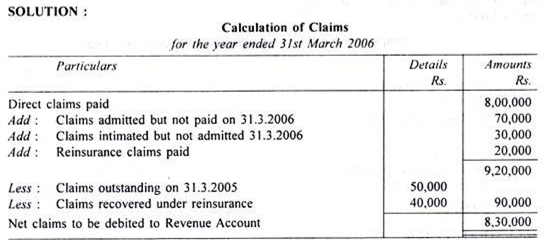

The primary application of ABC was for cost allocation and product costing. Suppose that Cost of purchasing department is Rs.50 lacs. How do you charge this cost to two products regular and cordless? See Figure 12.1. EEL will face a similar problem for allocating cost of Stores department (Say, Rs.70 lacs). Moreover, Regular and Cordless are common products; this means they consume the facilities of Fabrication and Assembly departments together. Let us first assemble the issues involved in the form of an Illustration.

Illustration 2:

EEL produces two products Regular 90000 units and Cordless 10000 units. The company is organized into two production departments – Fabrication and Assembly and two service departments – Purchasing and Stores. Service departments renders support services to the production departments.

Material costs per unit of cordless and regular are Rs.700 and Rs.500 respectively:

The company charges service departments’ costs first to the production departments and then production departments’ costs are charged to the products.

(i) Find out cost per unit of Regular and Cordless applying traditional costing system followed by the company.

(ii) In case the company wants to charge cost of production departments to the products on the basis of Labour Hours, find out cost per unit of Regular and Cordless.

(iii) In case the company wants to charge cost of production departments to the products on the basis of Labour Hours for the Assembly Department and on the basis of Machine Hours for the Fabrication Department, find out cost per unit of Regular and Cordless.

(iv) What are the problems in the traditional system?

(v) What are the symptoms of an outdated functional cost system?

Solution:

(i) In the traditional overheads of service departments are charged to production departments applying suitable bases. In this illustration we may use No. Purchase order as an allocation base for purchase department overhead and No. of Stores Orders as base for allocation of stores.

(ii) The company wants to apply departmental labour rates for overhead absorption, i.e. charging overhead to products. Here assumption is that labour hour drives the cost.

Comment:

Cordless is a specialty product of the company which requires more resource consumption in the manufacturing process. But the traditional system charges less labour and overhead costs to this product.

By this the company started searching a better allocation base. It has been observed that Fabrication is machine driven whereas assembly is labour driven. Therefore, it has tried with dual rates.

(iii) Cost Allocation on the Basis of Labour Hours for Assembly and Machine Hours for Fabrication

Comment:

Using dual rates has improved the rationality of the cost absorption system. In this system at least the specialty product is getting better share of labour and overhead cost per unit.

However, still there remain conflicts:

Accounting Crisis

(iv) Problems in the traditional system:

Inappropriate allocation and apportionment of cost may:

a) Focus on wrong market

b) Servicing wrong customers

c) Encouraging costly product design

d) Encouraging costly process design

e) Increasing cost despite cost cutting programmes

f) Taking incorrect sourcing decisions

(v) Symptoms of an outdated functional cost system:

a) The outcome of the bid is difficult to explain.

b) Competitors’ prices appear unrealistically low.

c) Products that are difficult to produce show high profits.

d) Operational managers want to drop products that appear profitable.

e) Profit margins are difficult to explain.

f) Customers do not complain about price increase.

g) The accounting department spends a lot of time supplying cost data for special projects.

h) Some departments using their own accounting system.

i) Product costs change because of changes in financial reporting regulations.

Essay # 3. Application of Activity Based Costing in Service Industry:

Application of ABC in Service Industry is given below:

Let us take an example of applying ABC to service industry

A bank has issued three types of credit cards –

Classic 5000

Gold 3000

Platinum 2000

How to assign costs to these cards applying ABC?

Step 1: Interview questions for identifying activities

1. How many employees are in your department? (Activities consume labour)

2. What do they do? (Activities are people doing things)

3. Do customers outside your department use any equipment? (Activities also can be equipment doing work for other people)

4. What resources are used by activities? (Activities consume resources – equipment, materials, energy, other than labour)

5. What are the output of each activity? (helps identifying driver)

6. Who or what uses activity output? (Identifies cost object)

7. How much time do workers spend on each activity? By equipment? (Information needed to assign the cost of labour and equipment to activities)

Step 2: Reply to interview questions:

1. There are six employees including supervisor.

2. There are four major activities:

Supervising employees

Processing transactions

Preparing statements

Answering questions

3. Yes. Automatic bank tellers service customers who require cash advances.

4. The Credit card department have our own computers, Printer, desk.

Paper and other supplies are needed to operate the Printers Of course, each of us has a telephone as well.

5. For supervising, the supervisor manage employees’ needs and try to ensure that they carry out their activities efficiently.

Processing transactions produces a posting for each transaction in department’s computer system and serves as a source for preparing monthly statements.

The number of monthly customer statements has to be product for the issuing activity, and what the customers served is the output for answering activity.

Number of cash advances would measure the product of the automatic teller activity, although the teller really generates more transactions for other products such as Savings and Current accounts. So perhaps the number of teller transactions is the real output.

6. The Credit card department three products – classic, gold and platinum.

i) Transactions are processed for these three types of cards.

ii) Statements are to the clients holding these cards.

iii) Answer to questions are all directed to the clients who hold these cards.

iv) As far as supervising, the supervisor spend time ensuring the proper coordination and execution of all activities except the teller.

v) The supervisor has no role in managing that particular activity.

7. How much time do workers spend on each activity? By equipment? (Information needed to assign the cost of labour and equipment to activities). Salaries Supervisor Rs.550000, others Rs.1000000.

Ans. A just completed work survey shows the following result:

Step 3: Identifying resource drivers

a) How much of other resources used to perform an activity?

b) Computer related expenses Rs.7000 per computer

c) Printing expenses Rs.50000

d) Telephone expenses Rs.25000 per telephone except that of supervisor which spends Rs.220000.

e) Expenses for providing teller Rs.200000 (allocated by Teller).

Step 4: Activity Measure:

Required:

i. Compute activity rates

ii. Allocate cost activities.

Find cost of each credit card service.

Solution:

Step 1: Charging expenses to activities:

Step 2: Absorption of activity costs:

Conclusion:

A lot of discussion on the implementation of ABCM revolves around how to modify the existing accounting system and whether or not a separate record should be maintained for activity based data.

Most importantly questions revolve around:

a) How to identify first and second stage activities ;

b) Whether or not to involve into identifying third stage activities;

c) Measuring effectiveness of activities which signifies key business processes;

d) Improving focus on value added activities and discarding non- value added activities (reduce dependence on Cost Volume Profit Analysis in isolation and consider it along with ABC);

e) Cost benefit of maintenance of ABC data base; and

f) Providing managers the information and the framework they need to manage and control business more effectively.