Read this essay to learn about:- 1. Meaning of Cost 2. Cost Elements 3. Direct Costs and Indirect Costs 3. Classification.

Essay # 1. Meaning of Cost:

Cost is the sacrifice of resource to achieve an objective. In relation to production, cost is sacrifice of resource to produce goods. Cost is measured in monetary term.

In the production of goods, what are the resources required?

Resources are:

ADVERTISEMENTS:

a) Raw materials

b) Labour

c) Machine hours

d) Management/Administration

ADVERTISEMENTS:

e) Marketing.

In cost management terms these resources are identified by elements, by functions or by variability.

Essay # 2. Cost Elements:

List of Cost Elements:

1. Salary of research staff

ADVERTISEMENTS:

2. Expenses of research lab

3. Expenses of design engineering department

4. Raw materials

5. Wages

ADVERTISEMENTS:

6. Power and fuel

7. Factory building

8. Factory machinery

9. Administrative building

ADVERTISEMENTS:

10. Administrative equipment

11. Delivery van

12. Purchasing expenses

13. Material handling

ADVERTISEMENTS:

14. Labour welfare

15. Expenses of accounting department

16. Stationery, postage

17. Watch and ward

ADVERTISEMENTS:

18. Factory superintendent’s salary

19. Managing director’s salary

20. Legal charges

21. Audit fees

22. Salesmen’s commission

23. Delivery expenses

ADVERTISEMENTS:

24. Advertisement

25. Depreciation of factory building

26. Software and hardware expenses

27. Output royalty (paid per unit of production)

28. Warranty expenses

29. Items mentioned above are cost elements of a manufacturing company.

Understanding Value Chain:

Value chain is defined as a sequence of business functions in which utility is added to the products or services.

Understand the value chain of a manufacturing business:

Each step in the value chain can be sub-classified.

Study the value chain of three different farms: Crop farming, Dairy farming and Beef Cattle Farming:

Observe these steps reflects:

(i) Sourcing raw materials,

(ii) Shipping to process centres,

(iii) Processing, and

(iv) Distribution.

Costs are incurred for each steps in the value chain. We have so far identified such costs by elements. Should we now re-classify these costs by functions?

Then what functions do you learn from the value chain?

Business Functions:

Research & Development:

Dr. Reddy’s Lab carries out research for new pharmaceutical products. Tata Motors carries out research for passenger cars.

Designing:

A division of Tata Motors designs various types of passenger cars.

Production:

This division manufactures car.

Marketing & Distribution:

This division markets the product and distributes cars.

Administration:

Engaged in overall management.

After Sale Service:

This may be carried out through franchise shops.

Functional Classification of Costs:

Example:

Common costs should be apportioned to various functions as per some suitable usage ratio.

Each functional head is responsible for managing costs of his/her functional departments.

Essay # 3. Direct Costs and Indirect Costs:

Certain costs are directly related to units produced or service generated. These costs are direct costs. Examples are material, wages of the staff engaged in production, other expenses directly related to production. These are also termed as prime cost.

Certain costs although not directly related to production of goods or generation of service, these costs are incurred for support services. Examples are purchasing, warehousing, material handling, repairs and maintenance, administration, marketing and distribution. These costs are indirect costs. Indirect costs are termed as overhead.

Essay # 4. Classification of Costs:

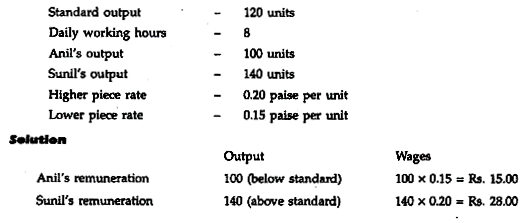

Costs are classified as per variability into three categories – variable, fixed and semi-variable. Variable Cost varies with the unit of production.

Prime cost is variable cost. It comprises of direct labour, direct material and direct expenses. The word “direct” implies that costs are directly related to cost object, which may be units produced. Apart from prime cost, a portion of overheads may also vary with production.

a. Fixed Costs:

Fixed costs are basically overheads.

They may be manufacturing overheads, administrative overheads, selling and distribution overheads etc. Monthly rent of factory building is fixed manufacturing overhead. Maintenance and up keep of factory premise is also fixed manufacturing overhead. Administrative overheads like salaries of office staff, maintenance and depreciation of office premise and equipment are mostly fixed in nature.

Salesman’s fixed salary is fixed selling overheads whereas sale-linked commission is variable overhead. However, fixed overheads are fixed for a given range of activity. You cannot expect that fixed cost will remain fixed although production is increased continuously. Ability of the support facilities created for production will not be sufficient to support increased level of production.

For the purpose of classification of overheads into fixed and variable it is necessary to study the nature of each and every cost element. If a salesman is given a salary which is partly fixed and partly variable, it is termed as semi-variable. Overheads are segregated into fixed and variable elements for proper classification.

b. Variable Costs:

Variable cost varies with cost object. A cost object may be production units, machine hours, labour hours. For example, raw material required per unit varies directly with the No. of units produced. Power and fuel to consumed in the production process varies with No. of machine hours. In turn machine hours required to manufacture one unit are directly related. So per unit variable cost remain same if there is no price change. Total variable cost rises with the increase in cost object.

c. Semi-Variable Costs:

A salesman gets fixed salary plus incentive bonus on No. of units sold. Delivery van incurs monthly maintenance as well as running cost per mile.

Tracing semi-variable cost item by item is quite difficult and cumbersome as well. An important method of studying cost variability is regression analysis.

See Illustration 1.

Illustration 1:

On the basis of past 12 month cost data classify each of the four costs, namely, factory overhead, administrative overhead and prime costs into fixed and variable categories.

Solution:

Let us apply two variable linear regression to understand the cost variability.

Y = a + b X

Y = Overhead,

X = Output units.

We mean to say that overhead is dependent variable value of which depends upon output units. Value of the intercept (a) will give you the fixed cost and value of the slope (b) will give you the variable cost.

How to derive value of ‘a’ and ‘b’, It is very easy if you use the excel functions.

Factory Overhead:

Find = SLOPE (B3:B14, E3:E14) = 0.21

Find = INTERCEPT (B3: B14, E3:E14) = 1.45

Find = CORREL (B3: B14, E3:E14) = 0.90

Find r2 = 0.81

Comment:

1. Factory Overhead:

Coefficient of determination is 0.81 which is very high. There exists relationship between factory overhead and production. Its variable component is Re. 0.21 per unit and fixed component is Rs.1.45 lacs.

2. Administrative Overhead:

Coefficient of determination is 0.18 which is low. There may not exist relationship between administrative overhead and production. It should be treated as purely fixed. Therefore, latest administrative overhead (adjusted for any known change) may be taken as projected cost.

3. Marketing and distribution overhead:

Coefficient of determination is 0.80 which is very high. There exists relationship between factory overhead and production. Its variable component is Re. 0.22 per unit and fixed component is Rs.0.399 lacs.

4. Prime cost:

Coefficient of determination is 1.00 which reflects perfect correlation between prime cost and production. Per unit prime cost is Rs.11.20.

Cost planning and pricing:

Cost variability analysis helps to understand costs at different level of production. As production level increases, fixed costs gets distributed with larger number of units. Therefore, per unit cost comes down. The company has the choice at higher production level to cut price and achieve still higher sales volume.

Illustration 2:

On the basis of cost analysis carried out in Illustration 1, find the cost, sales and profit between 8000 – 10000 units of production level. In the Table below we have assumed selling price of Rs.90 per unit.

Influencing Cost Structure to Manage the Risk -Return Trade off at Amazon(dot)com:

a) Building up too many fixed costs can be hazardous to a company’s health.

b) Because fixed costs, unlike variable costs, do not automatically decrease as volume declines, companies with too many fixed costs can lose considerable amount of money in lean times.

c) The Amazon(dot)com, the internet retailer, began with a virtual business model.

d) It placed order with book wholesaler, which shipped the book directly to the customers.

e) The “virtual” in Amazon’s business model referred to the fact that it could sell books from website without having to invest in warehouse or inventory.

f) Amazon created essentially a variable cost structure. Without warehousing and inventory costs, Amazon avoided being stuck with costs if businesses were slow.

g) But this low risk strategy came at a price.

h) Guess the price:

Purchasing books from wholesaler cost significantly than purchasing directly from the publishers.

Barnes & Noble: A Threat to Amazon:

a) Barnes and Noble is one of the largest ‘bricks and mortar’ based book retailer.

b) It opened an online store.

c) It already had a large chain of distribution in the form of ‘bricks and mortar’ stores.

d) It had planned to use the same warehouse for delivery online orders. Also it could place orders in economic quantity.

e) Barnes & Noble claimed it would offer ‘the lowest everyday prices of any on line bookseller’ as well as clock better delivery time.

f) Barnes & Noble had high fixed costs and low variable cost.

g) Amazon had low fixed cost high variable costs.

h) At higher volume levels, Barnes & Noble could beat Amazon

Ratio by Comparing Sales and Profit:

Since fixed cost remains unchanged, P/V ratio can be determined by taking the ratio of

Creation of Internal Production Facilities: A Case Problem:

Illustration 3:

A company is manufacturing table fans. Investment for this project is Rs.30 lacs. It sales 5000 fans @ Rs.1000 per piece. Fixed cost Rs.1500000,variable cost Rs.500 per unit. The company’s P/V ratio is 50%, BEP 3000 units, Return on Investments 20%.

Presently, the company purchases steel fan frame from a vendor @ Rs.40 per unit. The production department wants to manufacture it internally at an investment of Rs.800000. The variable cost of the frame is Rs.10 pu and fixed cost is Rs.100000.

Should the company create internal production facilities?

Solution:

It reduces the variable cost but increases the fixed cost.

How much variable cost get reduced ? Rs.40 – Rs.10 = Rs.30 pu

How much fixed cost increases = Rs.100000 + Return on investment on Rs.800000 @ 20%. = Rs.100000 + Rs.160000 = Rs.260000.

What it saves is Rs. 40.

40 × A = A × 10 + 260000

30 A = 260000

A = 260000/30 = 8667

Since the company produces only 5000 units, creation of facilities to manufacture frame is not justifiable. Once the demand increases above the breakeven level (8667 units) stated and expected to remain stable there or grow further, the company can create additional facilities.