The law permits payment of commission to managerial personnel on net profit calculated before taking into account the commission. If the profits are, for example Rs 7,20,00,000, a managing director (if there is only one) can receive up to 5% of Rs 7,20,00,000 or Rs 36,00,000 as his remuneration (the exact amount depends upon the Articles or the appropriate resolution of the company).

If there are two or more than two whole-time directors, the total remuneration to all of them cannot exceed Rs 72,00,000, i.e., 10% of Rs 7,20,00,000. But the company may if it so desire, calculate the commission on profits remaining after charging such commission.

In such a case, the commission to a managing director (if there is no other whole-time director) will be Rs 7,20,00,000 x 5/105 or Rs 34,28,571 in the example given above.

If there is no whole-time director or manager, part-time directors put together can receive, apart from the fees for attending meetings, a commission of 3 per cent (maximum) of the net profits. Otherwise, the part-time directors may receive up to one per cent of the net profits.

ADVERTISEMENTS:

If there are two whole-time directors and others are part-time directors, the whole-time directors together can be paid up to 10 per cent of the net profits and part-time directors can be paid up to 1 per cent of the profits.

Moreover the remuneration paid to one need not be deducted from the profits for the purpose of calculating commission to the other. Suppose, the total profits are Rs 6,00,00,000. The two whole-time directors can get up to Rs 60,00,000 in all (10% of the profits) and the part-time directors can get up to Rs 6,00,000, i.e., 1% of Rs 6,00,00,000.

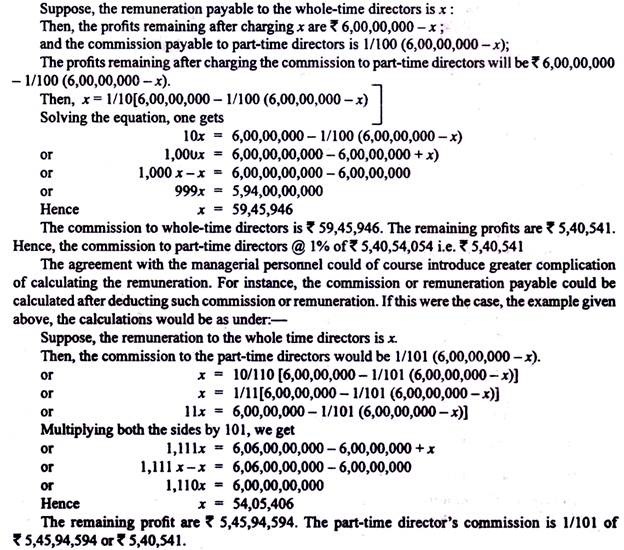

But a different arrangement is permissible—that the remuneration payable to the whole-time directors should be calculated on profits remaining after payment of commission to part-time directors and that the commission to part-time directors should be calculated after the remuneration to the whole-time directors has been deducted.

Taking the example given above, the calculation will be as follows:—

Illustration 1:

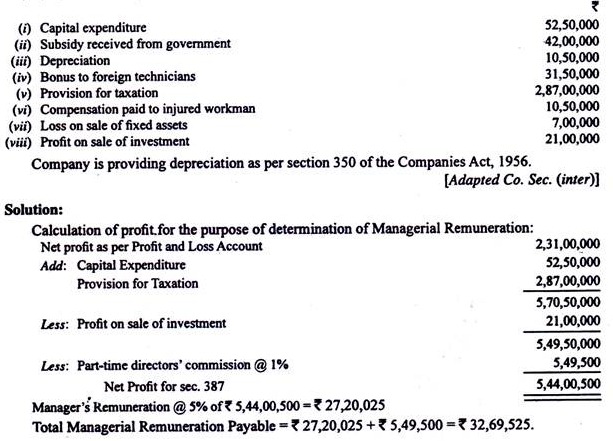

Determine the maximum remuneration payable to the part-time directors and manager of B Ltd. (a manufacturing company) under section 309 and 387 of the Companies Act, 1956 from the following particulars:

Before charging any such remuneration, the profit and loss account showed a credit balance of Rs 2,31,00,000 for the year ended 31st March, 2012 after taking into account the following matters:

Illustration 2:

ADVERTISEMENTS:

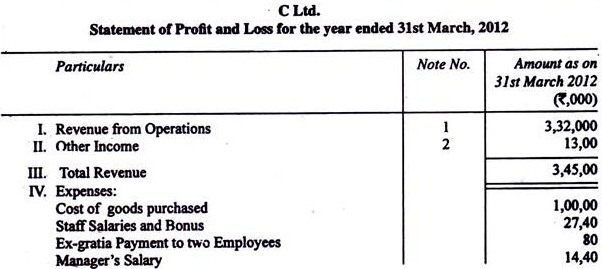

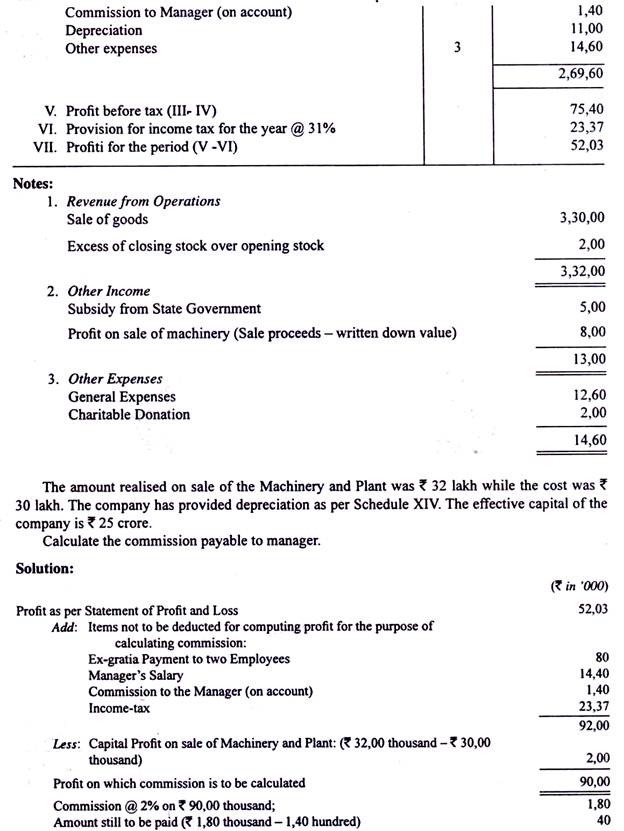

C Ltd. employs a manager who is entitled to a salary of Rs 1,20,000 per month, and in addition, to a commission of 2 per cent of the net profit of the company before such salary or commission.

The Profit and Loss Account for the company’s financial year ending 31st March, 2012 is as follows:

Commission Payable on Profits Available for Dividend:

“Profits available for dividend” would mean profits remaining after taxation and appropriations which have to be made compulsorily. But in the absence of any agreement to the contrary, appropriation of profits, such as transfer to the reserve funds, which are at the discretion of the directions should not be deducted.

Taxes must be computed after charging all remuneration, including the commission to the staff. Thus, commission to Staff and taxes would be inter-related. If profits are x, T is tax and c is commission, then c would be based on x-1 and t would be based on x-c. In other words, one has to be deducted from the profits before the other can be calculated.

ADVERTISEMENTS:

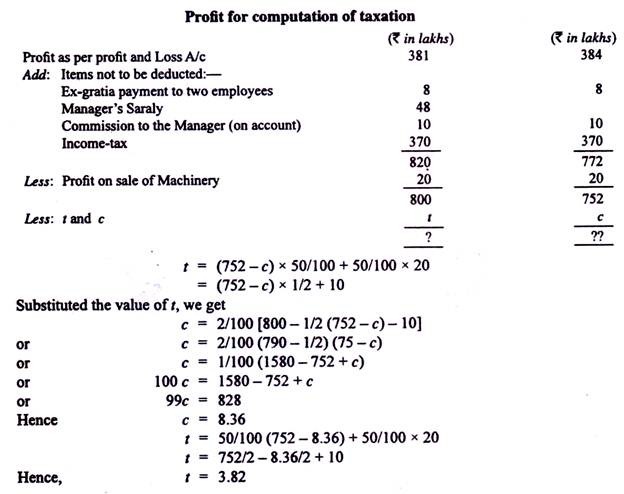

Taking the above illustration again, suppose the manager is entitled to a commission on profits remaining after taxation and that the rate of income-tax is 50% on ordinary profits and again 50% on capital profits. The calculation would be as under:

Assume commission is c and taxation is t.

Taxation:

ADVERTISEMENTS:

It has been accepted by the various accountancy bodies that income-tax or tax on profits is a charge against revenue even though the amount payable clearly depends on uncertain factors like the views of the Finance Minister and though there will be no liability if there is no profit.

Since the actual amount payable will be known long after the preparation of the Profit and Loss Account, the liability for taxes has to be estimated and provided for on that basis. The amount has to be debited to the Profit and Loss Account (above the line) and credited to the Provision for Taxation Account.

Sales Tax should normally be deducted from Sales Account if not already recorded separately; but if an extraordinary amount, not recovered from customers, is payable, it should be debited to the Profit and Loss Account.

In the balance sheet, the provision for taxation should contain only those accounts in respect of which assessment has not been made. If the tax payable for a period has been determined, the amount, if unpaid, should be shown as a liability under current liabilities. The amount of the tax paid in advance may be either shown as advance on the assets side or deducted from the provision for taxation on the liabilities side.

ADVERTISEMENTS:

Any adjustment on account of previous years should be debited or credited to the Profit and Loss Account — as otherwise the Profit and Loss Account will not disclose a figure of profit or loss fully relevant to the current year.

Suppose, in 2011-2012 the Provision for Taxation stood at Rs. 1,65,000 and the liability for 2011-2012 comes to only Rs 1,29,00,000. Then, Rs 36,00,000 should be credited to statement of profit and loss in Balance Sheet.

Dividends:

Dividends to shareholders will be considered in detail a little later. Here it will be sufficient to say that dividends represent appropriation of profits to statement of Profit and Loss in Balance Sheet. Provision for Dividend Distribution Tax has also to be made on dividends proposed or declared and should be shown under surplus in the Balance Sheet.

Other appropriation items like transfer to General Reserve or to Sinking Fund for Redemption of Debentures (or other liability) or anything that represents division of profits should also be shown in the Statement of Profit and Loss in the Balance Sheet. Any withdrawal of material amounts from provisions or reserves created in previous years should be separately shown in Balance Sheet.

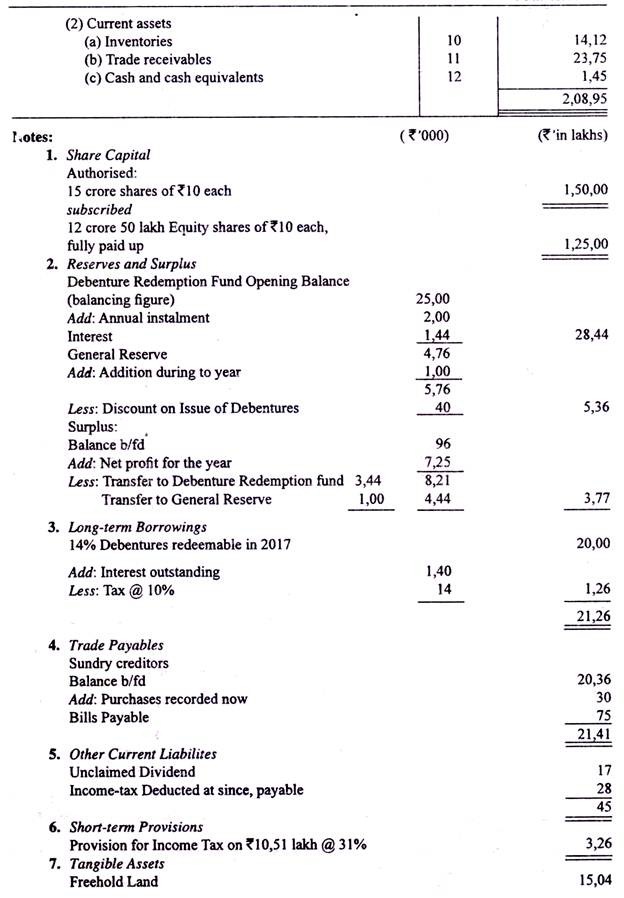

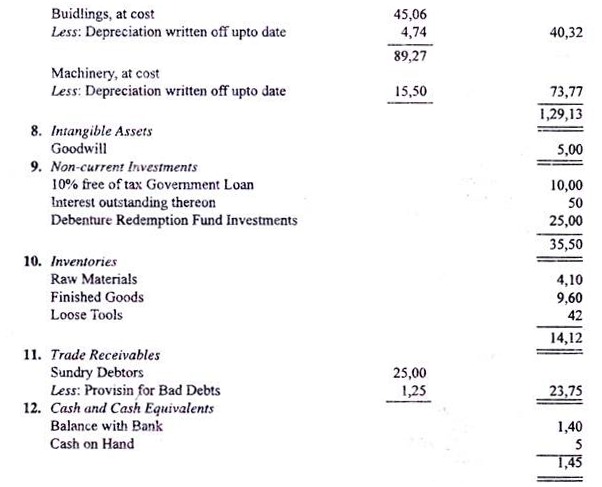

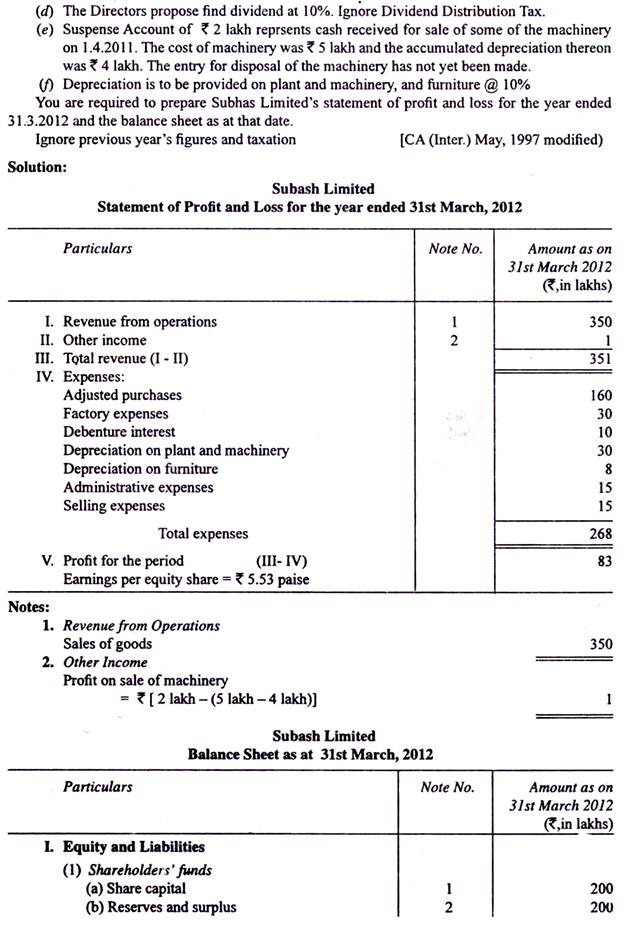

Illustration 3:

ADVERTISEMENTS:

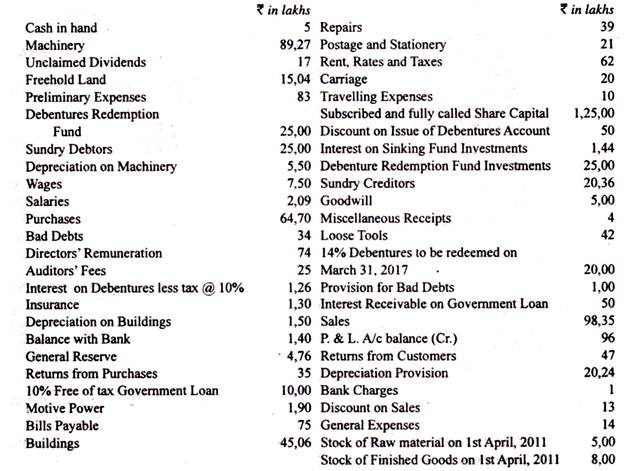

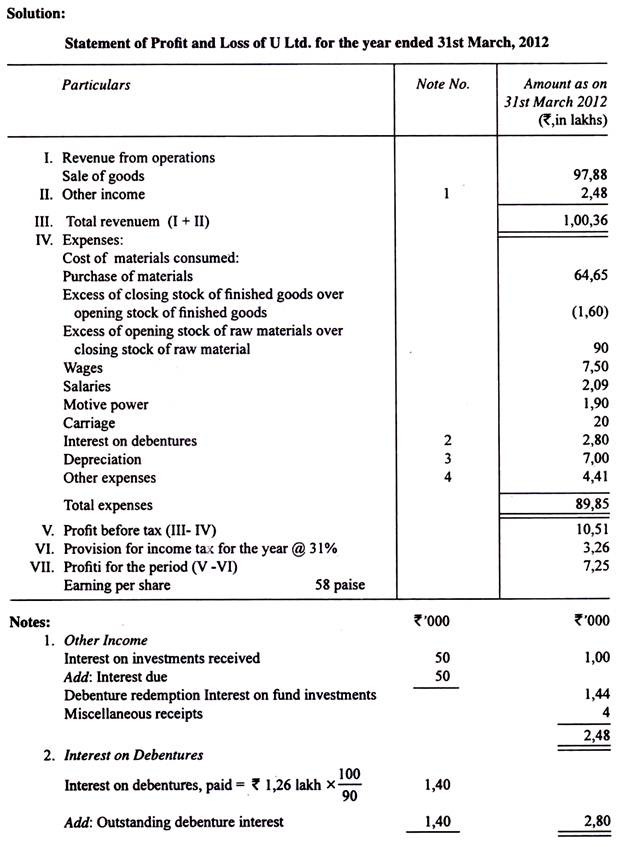

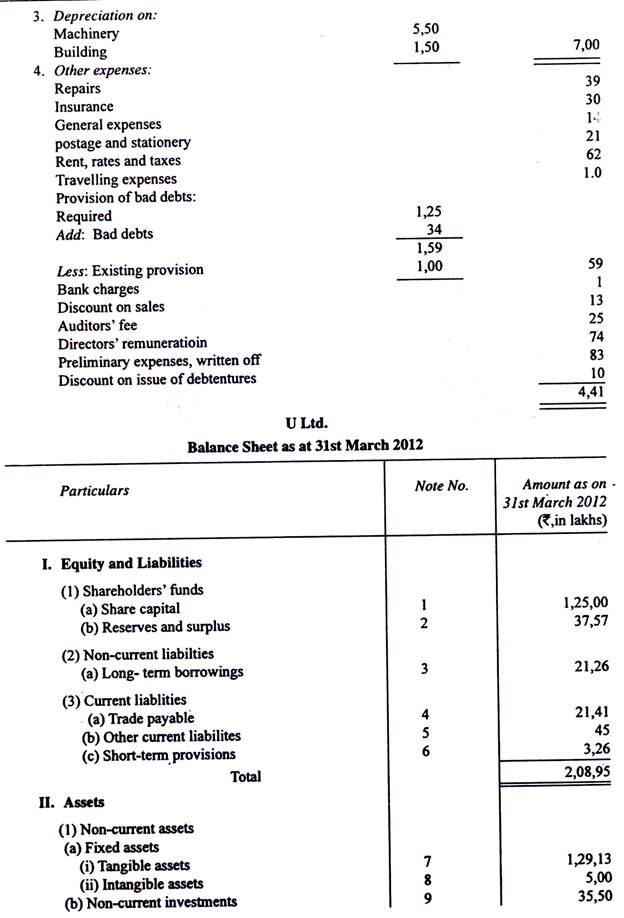

From the following figures taken from the books of U Ltd., prepare the Profit and Loss Statement for the year ended on 31st March, 2012 and the Balance Sheet as on that date.

Adjustments:

1. Provision for bad debts is to be maintained at 5% on sundry debtors.

2. Write off the whole of the preliminary expenses and one-fifth of the balance of Discount on issue of Debentures Account.

3. Rs 200 lakh is the annual installment for the Sinking Fund for Redemption of Debentures.

4. On 31st March, 2012 the stock of finished goods was Rs 9.60 lakh while that of raw materials was Rs 4.10 lakh which included raw material worth Rs 30 lakh received on the last day and for which entries had not been passed.

5. The authorised capital of the company is Rs 150 crore divided into 15 crore shares of Rs 10 each.

6. Make a provision for income tax @ 31% of net profits.

7. Transfer Rs 1,00 lakh to General Reserve.

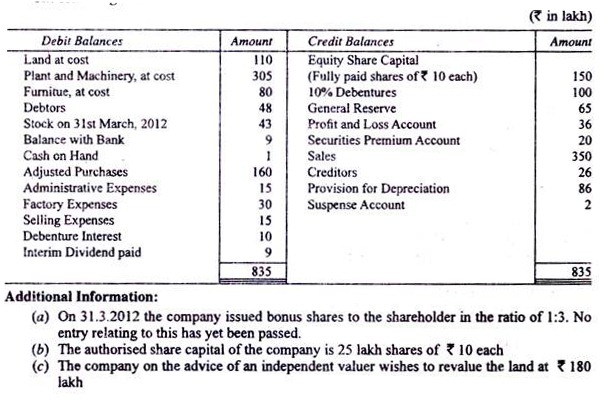

The following is the trail balance of Subhash Ltd. as on 31st March, 2012: