Are you looking for problems and solutions of final accounts of the companies? You are at the right place! In this article we have compiled top five accounting problems on final accounts of the companies with its relevant solutions.

Contents:

- Final Accounts Including the Computation of Depreciation, Managing Director’s Remuneration and Provision for Taxation

- Final Accounts Including the Preparation of Consignor’s Account

- Final Accounts Including the Computation of Share Capital of a Company

- Final Accounts Including the Detailed Schedules for the Company’s Share Capital, Reserves and Surplus and Fixed Assets

- Preparation of Final Accounts of a Company (Ignoring Taxation)

Problems on Final Accounts of the Companies

1. Final Accounts Including the Computation of Depreciation, Managing Director’s Remuneration and Provision for Taxation:

The Directors of Biswakarma Ltd. ask you to prepare the Profit and Loss Account for the year ended 31st March 1998 and Balance Sheet as on that date from the following information:

The following further information are available:

(i) Depreciation is to be charged on the written-down value of Plant @ 10% and Land & Building @ 5%.

(ii) The directors proposed to recommend a dividend of 12% on Equity Shares.

ADVERTISEMENTS:

(iii) Provision for taxation is to be made @ 40%.

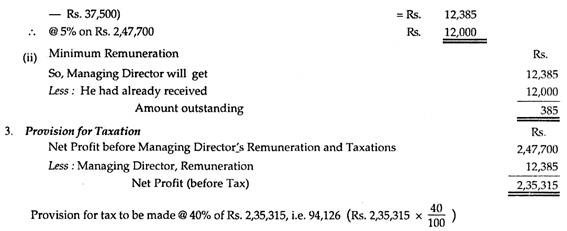

(iv) The Managing Director is entitled to 5% of the net profits subject to a minimum of Rs. 12,000 per annum as his remuneration.

(v) A sum of Rs. 15,000 is to be transferred to Dividend Equalisation Reserve.

4. Income Tax paid for previous year amounting to Rs. 6,000 (not yet provided for) cannot be considered as an expenses of the current year. It has been adjusted against Profit and Loss Appropriation Section since no amount was provided for it in the last year.

2. Final Accounts Including the Preparation of Consignor’s Account:

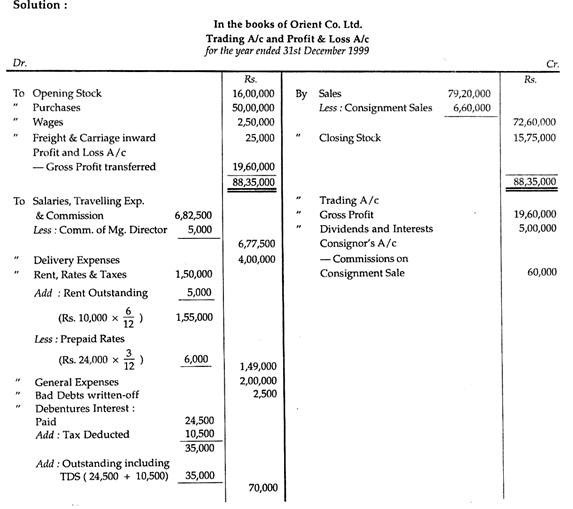

The authorised capital of Orient Co. Ltd. is Rs. 50,00,000 consisting of 2,50,000, 6% cumulative preference Shares of Rs. 10 each and 2,50,000 Equity Shares of Rs. 10 each.

ADVERTISEMENTS:

The balances appearing in the books on 31.12.99 were as shown below:

Prepare Trading and profit and Loss Account for the year ended 31st December 1999 and Balance Sheet as on that date, after taking into consideration the following:

(a) The value of the stock on 31st December 1999, was Rs. 15,75,000 and in addition, these stocks unsold in store ex-Sundry Consignment invoiced proforma at Rs. 2,00,000.

ADVERTISEMENTS:

(b) The Directors are entitled Rs. 60,000 p.a. remuneration; Directors’ Fees of Rs. 10,000 were paid by the subsidiary company and, in addition, the Managing Director was paid the sum of Rs. 5,000 due under his employment agreement with the company.

(c) Bills receivable for Rs. 12,000, maintaining after 31st December 1999, had been discounted with the Bank.

(d) Rent of Warehouse at Rs. 10,000 a year had been paid for the half-year to 30th June, 1999; and rent amounting to Rs. 24,000 paid for the year to 31st March 2000.

(e) A provision of 5% of Trade Debtors is to be created for bad and doubtful debts.

ADVERTISEMENTS:

(f) Depreciation of Furniture & Fixtures is to be provided @ 10% on the written-down value.

(g) Tax is to be provided on the 1999 profits Rs. 45,000 and on Debenture interest Rs. 10,500.

(h) Rs. 15,000 is to be written-off Commission on issue of Debentures Account.

Workings:

1. It has been assumed that amount of Consignment sales would be Rs. 6,60,000 out of which Rs. 6,00,000 has been paid to consignor and Rs. 60,000 was received as Commission on Consignment transaction. The amount of such sales has wrongly been included in Sales Account.

For consignment transaction only the Consignor’s Account should be prepared as under (without considering the other balances)

2. The Unsold stock of consignment is not to be considered at all since the goods belong to the consignor.

ADVERTISEMENTS:

3. Taxation amount is assumed to be the excess provisions made after paying the Income-Tax in the current year relating to the previous year.

4. Payment of Preference Dividend:

The following is the trial balance of Ema Ltd. as on 31st March 1997:

The following additional information is provided to you:

(i) On 31st March, 1997, the issued share capital consists of 50,000 equity shares of Rs. 10 each fully paid-up. Share reissue account represents discount allowed at the time of reissue of 1,000 forfeited equity shares which were earlier forfeited for the non-payment of the final call.

(ii) Subsequent to the above the preference share capital was redeemed out of profits otherwise available for dividend; the directors deciding to pay a premium of 10% to the preference shareholders. The company also issued bonus shares to equity shareholders in the ratio of 2: 5 out of capital redemption reserve account. Both the redemption of preference shares and the issue of bonus shares have not been recorded in the books except that the amount paid to the preference shareholders has been debited to the Capital Redemption Account.

(iii) Provision for tax is required at 50%.

(iv) The Board of Directors has proposed a final dividend of 20% on equity shares after appropriating profits as per law.

(v) The Board of directors has decided to record the revaluation of fixed assets by 25%.

(vi) Rs. 2,000, out of discount on debentures account, is yet to be written-off against the profit for the current year.

You are required to prepare the Profit and Loss Account of the company for the year ended 31st March, 1997 and its Balance Sheet as on that date after incorporating the above.

Workings:

1. The Share Forfeiture Account amounting to Rs. 6,000 and share Re-issue Account amounting to Rs. 2,000 should be cancelled as all the shares are fully paid. So., the differences between the two (i.e. Rs. 6,000 – Rs. 2,000) Rs. 4,000 should be transferred to Capital Reserve Account.

2. Since preference shares were redeemed at a premium of 10%, the following entries have already been passed:

3. Fixed Assets were revalued by 25% i.e. Rs. 2,50,000 (Rs. 10,00,000 x 25/100 which should be transferred to Capital Reserve Account.

4. Transfer to General (Statutory) Reserve

Since the rate of dividend is 20% i.e. @ 10% of current year’s profit should be transferred to Reserve Fund.

The following is the Trial Balance of Subhash Limited as on 31.3.97:

Additional Information:

(a) On 31.3.97 the company issued bonus shares to the shareholders on 1: 3 basis. No entry relating to’ this has yet been made.

(b) The authorised share capital of the company is 25,000 shares of Rs. 10 each.

(c) The company on the advice of independent valuer wish to revalue the land at Rs. 1,80,000.

(d) Proposed final dividend 10%.

(e) Suspense Account of Rs. 2,000 represents cash received for the sale of some of the machinery on 1.4.96. The cost of the machinery was Rs. 5,000 and the accumulated depreciation thereon being Rs. 4,000.

(f) Depreciation is to be provided on Plant and Machinery at 10% on cost.

You are required to prepare Subhash Limited’s Profit & Loss Account for the year ended 31.3.97 and a Balance Sheet as on that date in vertical form as per the provisions of Schedule VI of the Companies Act, 1956.

Your answer to include detailed schedules only for the following:

(1) Share Capital

(2) Reserves & Surplus

(3) Fixed Assets.

Ignore previous year’s figures & taxation

5. Preparation of Final Accounts of a Company (Ignoring Taxation):

Following is the abridged Balance Sheet of the Everest Co. Ltd. as at 31st March 1999:

From the following information, you are required to prepare Profit and Loss Account and Balance Sheet as at 31st March 2000:

(a) The composition of the total of the ‘Liabilities’ side of the company’s Balance Sheet as at 31st March 2000 (the paid-up share capital remaining the same as at 31st March 1999) was:

The Debentures were issued on 1st April, interest being paid on 30th September 1999 and 31st March 2,000.

(b) During the year ended on 31st March 2000, Additional Plant and Machinery has been bought and a further Rs. 25,000 depreciation written-off. Freehold property remained unchanged. The total fixed assets then constituted 60 per cent of total fixed and current assets.

(c) The current ratio was 1.6: 1. The quick assets ratio was 1: 1.

(d) The Debtors (four-fifths of the quick assets) to sales ratio revealed a credit period of two months.

(e) Gross Profit was at the ratio of 15 per cent of selling price and Return on Net worth, as at 31st March, 2000, was 10 per cent.

Ignore Taxation.

Workings:

1. Since Share Capital is Rs. 5,00,000 which is 50% of total liabilities, i.e. total of the liabilities sides of the Balance Sheet will be Rs. 10,00,000, out of which Profit and Loss Account, Debentures and Creditors will be @ 15%, 10% and 25%, respectively, viz. Profit and Loss Account will be Rs. 1,50,000 (i.e. Rs. 10,00,000 x 15%); Debenture @ 10%, i.e. Rs. 1,00,000 and Creditors @ Rs. 2,50,000.

2. Since total of the assets sides must be equal to total of liabilities sides of the Balance Sheet, hence total of the asset side must be Rs. 10,00,000 out of which 60% belongs to Fixed Assets, i.e. Rs. 6,00,000, Against, as value of freehold property is Rs. 4,00,000, so, net value of Plant and Machinery must be Rs. 2,00,000 Total depreciation written-off is Rs. 1,00,000, viz. Rs. 75,000 + Rs. 25,000. Thus, the gross block of Plant and Machinery must be Rs. 3,00,000 (i.e. Rs. 2,00,000 WDV + Rs. 1,00,000 Depreciation).