Are you looking for problems and solutions of final accounts of the companies? You are at the right place! In this article we have compiled top five accounting problems on final accounts of the companies with its relevant solutions.

Contents:

- Preparation of Profit and Loss Account, Profit and Loss Appropriation Account and Balance Sheet of a Company

- Preparation of Balance Sheet, Profit and Loss Account in Accordance with the Requirements of Companies Act, 1956

- Preparation of Final Accounts of a Company Ignoring Previous Year’s Figure

- Preparation of Final Accounts of a Company According to Requirements of Schedule VI of the Companies Act, 1956

- Preparation of Final Accounts of a Company When Additional Information is Given

Problems on Final Accounts of the Companies

1. Preparation of Profit and Loss Account, Profit and Loss Appropriation Account and Balance Sheet of a Company:

The Trial Balance of T.V. Limited [having an authorised capital of Rs. 8,00,000] at 31st December 1996 was as under:

Further information:

ADVERTISEMENTS:

(1) Of the shares allotted 2,000 shares worth Rs. 2,00,000 were allotted as fully paid to vender from where a running business was acquired.

(2) Of the Debtors Rs. 10,000 were outstanding but are considered good except a debt of Rs 5,000 doubtful to be provided.

(3) A provision of Rs. 25,000 is to be made for Income Tax.

ADVERTISEMENTS:

(4) The market value of Government securities on the date of the Balance Sheet was Rs. 93,000 and that of equity shares was 1,60,000.

(5) Auditor’s fee Rs. 3,000 should be provided for. Included in General Expenses is six month’s insurance Rs. 1,500 paid for the year to end on 30th June 1997.

(6) Interest on Debentures issued and on Investment in Government Securities should be taken into account.

(7) Depreciation is to be provided for @ 6% original cost of Machinery and 2% on the original cost of Land and Building.

ADVERTISEMENTS:

(8) Provide for a dividend of 5% on shares.

Prepare Profit and Loss Account, Profit and Loss Appropriation Account and the Balance Sheet as on 31.12.1996.

2. Preparation of Balance Sheet, Profit and Loss Account in Accordance with the Requirements of Companies Act, 1956:

ADVERTISEMENTS:

The following balances and particulars are extracted from the books of Pant Co. Pvt. Ltd. for the year ended 31st December 1994:

Further information:

ADVERTISEMENTS:

(a) Rate of depreciation — Furniture 10%; Office Equipment’s 15%; Motor Car 20%

(b) M. D. is entitled to a commission @ 10% of net profit after providing for such commission subject to maximum of Rs. 36,000 p.a.

(c) Debtors include Rs. 1,50,000 outstanding for more than 6 months, out of this Rs. 20,000 is considered doubtful for which provision is to be made in the accounts.

(d) Tax liability for 1994 is estimated at Rs. 2,00,000 for which provision is to be made.

ADVERTISEMENTS:

(e) Transfer to General Reserve Rs. 50,000 out of net profits and Proposed Dividend is @ 6% on equity shares.

Prepare the Balance Sheet, Profit and Loss Account for the year ended 31st December 1994 in accordance with the requirements of Companies Act, 1956.

3. Preparation of Final Accounts of a Company Ignoring Previous Year’s Figure:

ADVERTISEMENTS:

The following Trial Balance has been drawn up from the books of RED CIRCLES Ltd. as on 31st March 1999:

The following further particulars are available:

(1) Liabilities for expenses include the last quarter’s interest due on unsecured loan.

ADVERTISEMENTS:

(2) Payment to auditors include Rs. 2,000 paid for taxation work.

(3) Market value of Trade Investment is Rs. 85,000.

(4) Provision for Taxation is to be made at 45%.

(5) Secured loan is from the company’s bankers obtained against charge of all the assets of the company.

(6) No adjustment has been made for the sale of Old Plant of Rs. 3,000. It is ascertained that the original cost and depreciation provided on this item were Rs. 8,000 and Rs. 4,000, respectively.

(7) Unsecured loan is from a director carried forward from last year, interest payable at 6% p.a. falling due on quarterly basis at the end of each quarter.

You are required to prepared the Profit and Loss Account for the year ended 31st March 1999 and a Balance Sheet as on that date ignoring previous year’s figure.

4. Preparation of Final Accounts of a Company According to Requirements of Schedule VI of the Companies Act, 1956:

Depreciation is to be charged for the year on written-down value at 10% on Plant and Machinery and Furniture and Fixtures and at 20% on Motor Car.

(iii) The unsecured loan was taken on 1.1.2000 at 18% interest. Interest is payable half-yearly and necessary provisions are to be made in the accounts.

(iv) Office administration expenses include Auditor’s fee Rs. 4,000 (including fee for taxation services, Rs. 800) and Director’s Fees, Rs. 2,400.

(v) Provision for taxation is to be made for Rs. 2,80,000.

(vi) Preliminary Expenses are to be written-off.

(vii) The Directors have proposed a final dividend of 15% on share capital in addition to interim dividend already declared.

Prepare Profit and Loss Account of ESSBEE Ltd. for the year ended 31st March 2000 and Balance Sheet as at that date according to requirements of Schedule VI of the Companies Act, 1956.

5. Preparation of Final Accounts of a Company When Additional Information is Given:

Given below is the trial balance and additional information relating to Bharat Implements Ltd., as at the end of their financial year 1999-2000. Prepare the final accounts in proper form.

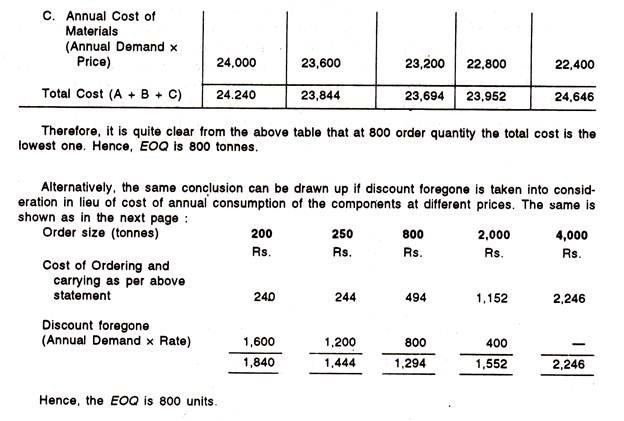

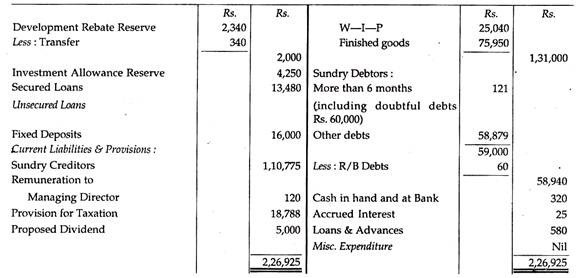

(d) Sundry Debtors include Rs. 121 thousand due for more than six months out of which provision has been made for doubtful debts at Rs. 45 thousand during the year.

(e) Included in other expenses are:

(i) Fees to auditors Rs. 65 thousand, out of which Rs. 15 thousand are in other capacities; and

(ii) Interest on fixed loans Rs. 620 thousand, and other interest Rs. 1,000 thousand.

(f) Rs. 340 thousand are to be re-transferred from development rebate reserve account.

(g) Provisions are to be made for managing director’s remuneration at 5% of net profits as provided under law, subject to a maximum of Rs. 120 thousand per annum.

(h) Balance of profit is to be transferred to general reserve after providing for dividend at 25% on capital.

(i) The authorised capital of the company is 20 lakhs Equity Shares of Rs. 10 each.