Here is a compilation of top thirteen accounting problems on ratio analysis with its relevant solutions.

Problem 1:

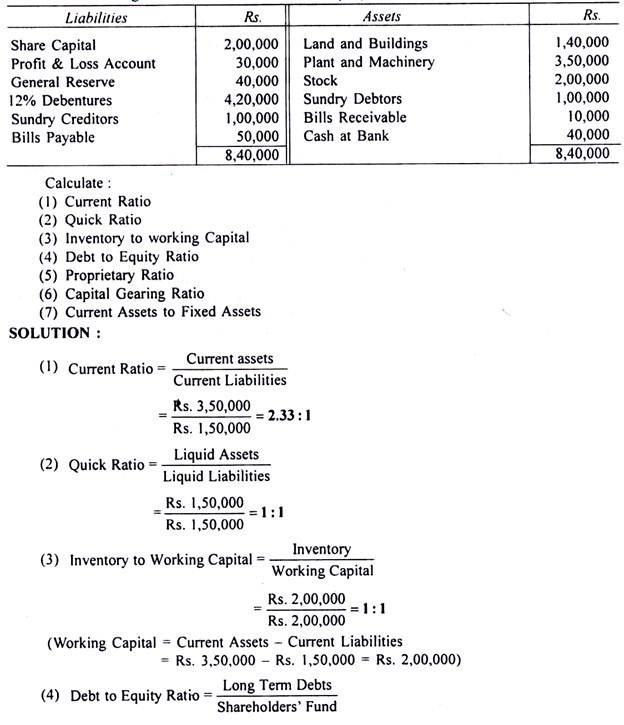

The following is the Balance Sheet of a company as on 31st March:

Problem 2:

From the following particulars found in the Trading, Profit and Loss Account of A Company Ltd., work out the operation ratio of the business concern:

Problem 3:

ADVERTISEMENTS:

The following is the summarised Profit and Loss Account of Taj Products Ltd. for the year ended 31st December:

Problem 4:

From the following Balance Sheet and additional information, you are required to calculate:

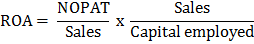

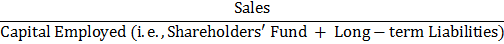

(i) Return on Total Resources

ADVERTISEMENTS:

(ii) Return on Capital Employed

(iii) Return on Shareholders’ Fund

Problem 5:

ADVERTISEMENTS:

A company has capital of Rs. 10, 00,000; its turnover is 3 times the capital and the margin on sales is 6%. What is the return on investment.

Problem 6:

ADVERTISEMENTS:

Ram & Company supplies you the following information regarding the year ended 31st December:

Significance:

ADVERTISEMENTS:

A high Inventory turnover ratio is better than a low ratio. A high ratio implies good inventory ‘management and an indication of under-investment. It will adversely affect the ability of a firm to meet customers’ demand. At the same time, a higher ratio reflects efficient business activities.

A low inventory turnover ratio is dangerous. It is an indication of excessive inventory and over investment in inventory. A low ratio may be result of inferior quality goods, stock of un-saleable and absolute goods. A lower ratio reflects dull business and suggests that some steps should be taken to push up sales.

Problem 7:

The following is the Profit and Loss Account of Burn Ltd.

= Rs. 60,000 + Rs. 6, 00,000

ADVERTISEMENTS:

= Rs. 5, 90,000

Problem 8:

Calculate Debtors Velocity from the following details:

Opening Balance of Debtors Rs. 10,000

Credit Sales during the year Rs. 20,000

Sales Returns Rs. 1,000

Discount on Sales Rs. 50

Cash collected from Debtors during the year Rs, 5,000

Bad Debts Rs. 500

Bad Debt Provision at 10%

Note:

Bills Receivable from the buyer of fixed assets, should be excluded.

Bad and doubtful debts and their provisions are not deducted from the total debtors in order to avoid the impression that a larger amount of receivables have been collected.

Significance:

A turnover ratio of 8 signifies that debtors get converted into cash 8 times in a year. The average collection period of 1.5 months implies that debtors are collected in 45 days. The average collection period ratio measures the quality of debtors since it indicates the rapidity or slowness of their collectability. The shorter the average collection period, the better the quality of debtors.

The higher the Turnover Ratio and the shorter the average collection period, the better the trade credit management and the better the liquidity of debtors. That is, high Turnover Ratio and short collection period imply prompt payment on the part of debtors. On the other hand, low Turnover Ratio and long collection period reflects that payments by debtors are delayed.

Problem 9:

The Capital of a Company is as follows:

Problem 10:

Assume that a firm has owners’ equity of Rs. 1, 00,000. The ratios for the firm are:

Problem 11:

With the following ratios and further information given below, prepare a Trading, Profit and Loss Account and Balance Sheet:

Problem 12:

Extract from financial accounts of X, Y, Z Ltd. are:

Problem 13:

Following is the summarised Balance Sheet of a concern as at 31st December:

Comments:

1. Liquidity and Solvency Position:

Current Ratio is 2.9. It means current assets of Rs.2.90 are available against each rupee of current liability. The position is satisfactory on the basis of current ratio. However, the Liquid Ratio is 0.65: 1. It means greater part of current assets constitute stock; the stock is slow-moving. Therefore, the liquidity position is not satisfactory.

2. Credit Terms:

The collection system is faulty because debtors enjoy a credit facility for 96 days, which is beyond normal period. The performance of Debt Collection Department is poor.

3. Profitability:

Gross Profit Ratio is 20% which is a healthy sign. But the Net Profit Ratio is only 5%. It means operating expenses are higher.

4. Investment Structure:

Debt-Equity Ratio is 0.34: 1. It means the firm is not dependent on outside liabilities. The position is satisfactory. Capital Gearing Ratio is also satisfactory. However, the fixed assets to proprietorship ratio reveals that the entire fixed assets were not purchased by the proprietors’ equity. It means the firm depends on outside liabilities. It is not desired.

5. Return on Proprietors’ Fund:

5% of the sales is net profit and are available for the proprietors. The state of low return is not desirable.

Stock Turnover Ratio and Turnover to fixed assets indicate an unhealthy sign. Fixed assets are not used properly. It is a sign of under trading. The economic condition of the firm is not sound. The firm can increase the rate of return on investment by increasing production.