In this article we will discuss about the purchase method adopted for reporting business combinations.

The Purchase Method of Reporting Business Combinations (SFAS 141):

SFAS 141R replaces SFAS 141, “Business Combinations.” Beginning in 2009, the acquisition method will be used to account for new business combinations. However, for decades, most consolidated financial reports reflected the purchase method to account for business combinations. From 2002 through 2008 financial statements exclusively reflected the purchase method for business combinations. Although the pooling of interests method provided an alternative reporting method for pre-2002 combinations, the purchase method has been dominant throughout the history of business combinations.

Because SFAS 141R requires prospective application, the SFAS 141 purchase method will remain relevant for many years. Literally tens of thousands of past business combinations will continue to be reported in future financial statements under the purchase method. For example, the acquisitions by Google. Sprint, and Procter & Gamble, all were accounted for under the purchase method. By establishing a cost-based valuation basis for business combinations, the purchase method dictates the allocation of such costs to income through time, thus affecting future financial statement valuations.

The Purchase Method (SFAS 141) and the Cost Principle:

Prior to the recent emphasis on fair values, a basic principle was to record the purchase cost to the new owners as a basis for future accountability? In a business combination, the acquisition cost to the new owners provided the valuation basis for the net assets acquired. For example, several years ago MGM Grand. Inc., acquired Mirage Resorts, Inc., for approximately $6.4 billion. This purchase price then served as the basis for valuing Mirage Resorts’ assets and liabilities in the preparation of MGM Grand’s consolidated financial statements.

ADVERTISEMENTS:

The purchase method had several accounting implications that reflected a strict application of the cost principle. The following items represent primary examples of how the cost-based purchase method differs from the fair-value based acquisition method.

i. Direct combination costs.

ii. Contingent consideration.

iii. Bargain purchases.

ADVERTISEMENTS:

We next briefly discuss the accounting treatment for these items, followed by discussions comparing acquired in-process research and development and acquisition-date allocations across the new and previous standards.

i. Direct Combination Costs:

Almost all business combinations employ professional services to assist in various phases of the transaction. Examples include target identification, due diligence regarding the value of an acquisition, financing, tax planning, and preparation of formal legal documents. Previously, SFAS 141 included direct combination costs in the cost basis for the acquired firm. The acquisition method considers these costs as payments for services received, not part of the fair value exchanged for the business. Thus, direct combination costs are expensed as incurred.

ii. Contingent Consideration:

ADVERTISEMENTS:

Often business acquisition negotiations result in agreements to provide additional payments to former owners if they meet specified future performance measures. SFAS 141 accounted for such contingent consideration obligations as post-combination adjustments to the purchase cost (or stockholder’s equity if the contingency involved the parent’s equity share value) upon resolution of the contingency. The acquisition method treats contingent consideration obligations as a negotiated component of the fair value of the consideration transferred, consistent with the fair value measurement attribute.

The purchase method application that perhaps stands in greatest contrast to the acquisition method involves bargain purchases. Under SFAS 141, a bargain purchase occurred when the sum of the individual fair values of the acquired net assets exceeded the purchase cost. To record a bargain purchase at cost, the purchase method required that certain long-term assets be recorded at amounts below their assessed fair values. SFAS 141 required firms to recognize an extraordinary gain on purchase, but only after these long-term assets were recorded at zero value.

In a bargain purchase, the acquisition method embraces the fair value concept and discards the consideration transferred as a valuation basis for the business acquired. Instead, the acquirer measures and recognizes the fair values of each of the assets acquired and liabilities assumed at the date of combination, regardless of the consideration transferred in the transaction.

ADVERTISEMENTS:

As a result. (1) No assets are recorded at amounts below their assessed fair values as is the case with bargain purchases under SFAS 141 and (2) a gain on bargain purchase is recognized at the acquisition date. Bargain purchases in acquisitions represent an exception to the general rule of valuing an acquisition at the consideration transferred by the acquirer.

Acquired In-Process Research and Development (IPR&D):

FASB Interpretation 4 Application of FASB Statement No. 2 to Business Combinations Accounted for under the Purchase Method required the immediate expensing of acquired IPR&D. Expensing acquired IPR&D was view as consistent with the accounting treatment for a firm’s ongoing research and development costs. SFAS 141R, however, requires that the tangible and intangible assets acquired in a business combination to be used in a particular research and development activity, including those that may have no alternative future use, to be recognized and measured at fair value at the acquisition date.

These capitalized research and development costs will be reported as intangible assets with indefinite lives subject to periodic impairment reviews. Moreover, because the acquirer identified and paid for the IPR&D, SFAS 141R assumes an expectation of future economic benefit and therefore recognizes an asset.

ADVERTISEMENTS:

Acquisition-Date Cost Allocation:

In a business combination, the application of the cost principle was complicated because literally hundreds of separate assets and liabilities often were acquired. Accordingly, for asset valuation and future income determination, firms needed a basis to allocate the total acquisition cost among the various assets and liabilities received in the bargained exchange.

Similar to the acquisition method, the cost allocation procedure employed by the purchase method was based on the acquisition-date fair values of the acquired assets and liabilities. Also similar to the acquisition method, any excess of cost over the sum of the net asset fair values was attributed to goodwill.

Comparisons of Purchase Method and Acquisition Method:

To illustrate some of the differences across the purchase and acquisition methods, assume that on January 1, Archer, Inc., acquires Baker Company in exchange for 10,000 shares of its $1.00 par common stock having a fair value of $ 1,200,000 in a transaction structured as a merger.

ADVERTISEMENTS:

In connection with the acquisition, Archer paid $25,000 legal and accounting fees. Also, Archer agreed to pay the former owners additional consideration contingent upon the completion of Baker’s existing contracts at specified profit margins. The current fair value of the contingent obligation was estimated to be $150,000. Exhibit 2.8 provides Baker’s acquisition-date book values and fair values.

Purchase Method Applied:

ADVERTISEMENTS:

According to the SFAS 141 purchase method, Archer’s valuation basis for its acquisition of Baker is computed as follows:

Next, assuming use of the purchase method, Archer prepares the following entry on its books to record the Baker acquisition:

Note the following characteristics of the purchase method from the above entry:

i. The valuation basis is cost and includes direct combination costs, but excludes the contingent consideration.

ii. The cost is allocated to the assets acquired and liabilities assumed based on their individual fair values (unless a bargain purchase occurs and then the long-term items may be recorded as amounts less than their fair values).

ADVERTISEMENTS:

iii. Goodwill is the excess of cost of the fair values of the net assets acquired.

iv. Acquired in-process research and development is expensed immediately at the acquisition date.

Acquisition Method Applied:

According to the SFAS 141R acquisition method.

Archer’s valuation basis for its acquisition of Baker is computed as follows:

Next, assuming use of the acquisition method, Archer prepares the following entry on its books to record the Baker acquisition:

Note the following characteristics of the acquisition method from the above entry:

i. The valuation basis is fair value of consideration transferred and includes the contingent consideration, but excludes direct combination costs.

ii. The assets acquired and liabilities assumed are recorded at their individual fair values.

iii. Goodwill is the excess of the consideration transferred over the fair values of the net assets acquired.

iv. Acquired in-process research and development is recognized as an asset.

v. Professional service fees to help accomplish the acquisition are expensed.

Purchase Method Applied for a Bargain Purchase:

Under the purchase method, business combinations were recorded at cost. Although the assets acquired and liabilities assumed were usually recorded at their individual fair values, an exception occurred in the case of a bargain purchase. When the cost was less than the fair value of the net assets acquired, the purchase method required that certain long-term assets (excluding most financial assets) be recorded at less than their fair values in order to force the valuation to cost.

For example, again assume the information in Exhibit 2.8 but that Archer issues stock with a fair value of $880,000 to the former owners of Baker for all of their shares. Again, Archer also pays $25,000 in legal and accounting fees.

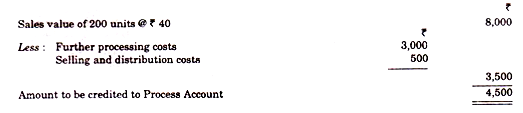

The excess fair value over cost is computed as follows:

To enable the combination to be recorded at cost, the total fair values of the individual assets and liabilities must somehow decrease from $1,005,000 to $905,000. The purchase method solution was to reduce the values assigned to long-term assets based on their proportionate fair values. Long-term assets were selected for reduction because presumably fair value estimates for these items were less reliable than those for current assets and liabilities. According to Exhibit 2.8, these items totaled $1,000,000.

Therefore, Archer would have recorded the combination under the purchase method as follows:

Because the purchase price was $100,000 less than the fair values of the acquired net assets, long-term assets (including IPR&D) were recorded collectively at $100,000 less than their total fair values. Consequently, the Internet Domain Name account bears 30 percent of the $100,000 excess fair value and is recorded at $270,000 instead of its fair value of $300,000. Similarly, Archer recorded the Licensing Agreements and IPR&D after proportionately reducing their respective fair values. All other assets and liabilities were consolidated at their fair values.

Acquisition Method Applied for a Bargain Purchase:

To complete the comparison for bargain purchases across the purchase and acquisition methods, We next show Archer’s entry assuming now that the acquisition method is applied:

Note that the SFAS 141R acquisition method discards the cost principle and elects to record a “gain on bargain purchase” instead of reducing the fair values assigned to assets. This treatment is in line with the principle of reporting all assets acquired and liabilities assumed at their fair values.