We will now concentrate on the mechanical aspects of the consolidation process when an outside ownership is present. More specifically, we examine consolidations for time periods subsequent to the date of acquisition to analyze the full range of accounting complexities created by a noncontrolling interest. As indicated previously, this discussion centers on the acquisition method as required under generally accepted accounting principles.

The acquisition method focuses on incorporating in the consolidated financial statements 100 percent of the subsidiary’s assets and liabilities at their acquisition-date fair values.

Note that subsequent to acquisition, changes in fair values for assets and liabilities are not recognized. Instead, the subsidiary assets acquired and liabilities assumed are reflected in future consolidated financial statements using their acquisition-date fair values net of subsequent amortizations (or possibly reduced for impairment).

The presence of a noncontrolling interest does not dramatically alter the consolidation procedures. The unamortized balance of the acquisition-date fair-value allocation must still be computed and included within the consolidated totals. Excess fair-value amortization expenses on these allocations are recognized each year as appropriate. Reciprocal balances are eliminated. Beyond these basic steps, the valuation and recognition of four non- controlling interest balances add a new dimension to the process of consolidating financial information.

ADVERTISEMENTS:

The parent company must determine and then enter each of these figures when constructing a worksheet:

i. Noncontrolling interest in the subsidiary as of the beginning of the current year.

ii. Noncontrolling interest in the subsidiary’s current year income.

iii. Noncontrolling interest in the subsidiary’s dividend payments.

ADVERTISEMENTS:

iv. Noncontrolling interest as of the end of the year (found by combining the three balances above).

To illustrate, assume that King Company acquires 80 percent of Pawn Company’s 100,000 outstanding voting shares on January 1, 2009, for $9.75 per share or a total of $780,000 cash consideration. Further assume that the 20 percent noncontrolling interest shares traded both before and after the acquisition date at an average of $9.75 per share.

The total fair value of Pawn to be used initially in consolidation is thus as follows:

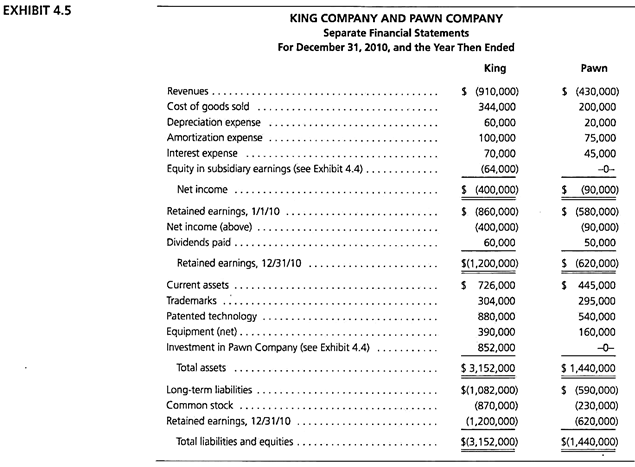

Exhibit 4.2 presents the book value of Pawn’s accounts as well as the fair value of each asset and liability on the acquisition date.

Pawn’s total fair value is attributed to Pawn’s assets and liabilities as shown in Exhibit 4.5. Annual amortization relating to these allocations also is included in this schedule. Although expense figures are computed for only the initial years, some amount of amortization is recognized in each of the 20 years following the acquisition (the life assumed for the patented technology).

Exhibit 4.3 shows first that all identifiable assets acquired and liabilities assumed are adjusted to their full individual fair values at the acquisition date. The noncontrolling interest will share proportionately in these fair-value adjustments. Exhibit 4.3 also shows that any excess fair value not attributable to Pawn’s identifiable net assets is assigned to goodwill. Because the controlling and noncontrolling interests’ acquisition-date fair values are identical at $9.75 per share, the resulting goodwill is allocated proportionately across these ownership interests.

Consolidated financial statements will be produced for the year ending December 31, 2010. This date is arbitrary. Any time period subsequent to 2009 could serve to demonstrate the applicable consolidation procedures. Having already calculated the acquisition-date fair-value allocations and related amortization, the accountant can construct a consolidation of these two companies along the lines. Only the presence of the 20 percent noncontrolling interest alters this process.

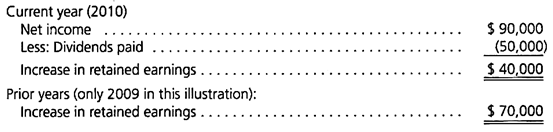

To complete the information needed for this combination, assume that Pawn Company reports the following changes in retained earnings since King’s acquisition:

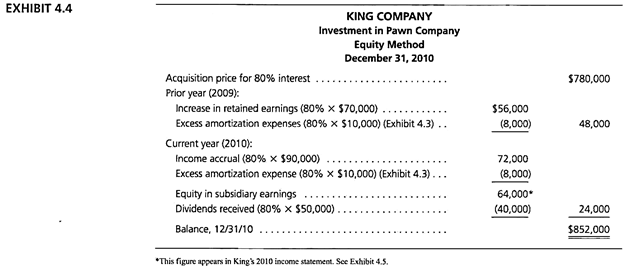

Assuming that King Company applies the equity method, the Investment in Pawn Company account as of December 31, 2010, can be constructed as shown in Exhibit 4.4. Note that the $852,000 balance is computed based on applying King’s 80 percent ownership to Pawn’s income (less amortization) and dividends. Although 100 percent of the subsidiary’s assets and liabilities will be combined in consolidation, the internal accounting for King’s investment in Pawn is based on its 80 percent ownership.

ADVERTISEMENTS:

This technique facilitates worksheet adjustments that allocate various amounts to the noncontrolling interest. Exhibit 4.5 presents the separate financial statements for these two companies as of December 31, 2010, and the year then ended based on the information provided.

Although the inclusion of a 20 percent outside ownership complicates the consolidation process, the 2010 totals to be reported by this business combination can nonetheless be determined without the use of a worksheet:

ADVERTISEMENTS:

i. Revenues = $1,340,000. The revenues of the parent and the subsidiary are added together. The acquisition method includes the subsidiary’s revenues in total although King owns only 80 percent of the stock.

ii. Cost of Goods Sold = $544,000. The parent and subsidiary balances are added together.

iii. Depreciation Expense = $79,000. The parent and subsidiary balances are added together along with the $1,000 reduction in equipment depreciation as indicated in Exhibit 4.3.

iv. Amortization Expense = $181,000. The parent and subsidiary balances are added together along with the $6,000 additional patented technology amortization expense as indicated in Exhibit 4.3.

ADVERTISEMENTS:

v. Interest Expense = $120,000. The parent and subsidiary balances are added along with an additional $5,000. Exhibit 4.3 shows Pawn’s long-term debt reduced by $40,000 to fair value. Because the maturity value remains constant, the $40,000 represents a discount amortized to interest expense over the remaining eight-year life of the debt.

vi. Equity in Subsidiary Earnings = -0-. The parent’s investment income is eliminated so that the subsidiary’s revenues and expenses can be included in the consolidated totals.

vii. Consolidated Net Income = $416,000. The consolidated entity’s total earnings before allocation to the controlling and noncontrolling ownership interests.

viii. Noncontrolling Interest in Subsidiary’s Income = $16,000. The outside owners are assigned 20 percent of Pawn’s reported income of $90,000 less $10,000 total excess fair- value amortization. The acquisition method shows this amount as an allocation of consolidated net income.

ix. Net Income to Controlling Interest = $400,000. The acquisition method shows this amount as an allocation of consolidated net income.

x. Retained Earnings, 1/1 = $860,000. The parent company figure equals the consolidated total because the equity method was applied. If the initial value method or the partial equity method had been used the parent’s balance would require adjustment to include any omitted figures.

ADVERTISEMENTS:

xi. Dividends Paid = $60,000. Only the parent company balance is reported. Eighty percent of the subsidiary’s payments were made to the parent and are eliminated. The remaining distribution was made to the outside owners and serves to reduce the balance attributed to them.

xii. Retained Earnings, 12/31 = $1,200,000. The balance is found by adding the controlling interest’s share of consolidated net income to the beginning Retained Earnings balance and then subtracting the dividends paid to the controlling interest. Because the equity method is utilized, the parent company figure reflects the total for the business combination.

xiii. Current Assets = $1,171,000. The parent’s and subsidiary’s book values are added.

xiv. Trademarks = $659,000. The parent’s book value is added to the subsidiary’s book value plus the $60,000 allocation of the acquisition-date fair value (see Exhibit 4.3).

xv. Patented Technology = $1,528,000. The parent’s book value is added to the subsidiary’s book value plus the $120,000 excess fair-value allocation less two years’ excess amortizations of $6,000 per year (see Exhibit 4.3).

xvi. Equipment = $542,000. The parent’s book value is added to the subsidiary’s book value less the $10,000 acquisition-date fair-value reduction plus two years’ expense reductions of $1,000 per year (see Exhibit 4.3).

xvii. Investment in Pawn Company = -0-. The balance reported by the parent is eliminated so that the subsidiary’s assets and liabilities can be included in the consolidated totals.

xviii. Goodwill = $25,000. The original allocation shown in Exhibit 4.3 is reported.

xix. Total Assets = $3,925,000. This balance is a summation of the consolidated assets.

xx. Long-Term Liabilities = $1,642,000. The parent’s book value is added to the subsidiary’s book value less the $40,000 acquisition-date fair-value allocation net of two years’ amortizations of $5,000 per year (see Exhibit 4.3).

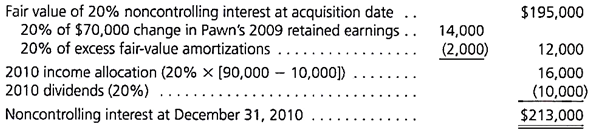

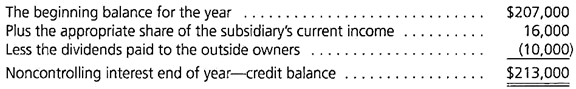

xxi. Noncontrolling Interest in Subsidiary = $213,000.

The outside ownership is 20 percent of the subsidiary’s year-end book value adjusted for any unamortized excess fair value attributed to the noncontrolling interest:

xxii. Common Stock = $870,000. Only the parent’s balance is reported.

xxiii. Retained Earnings, 12/31 = $1,200,000. Computed above.

xxiv. Total Liabilities and Equities = $3,925,000. This total is a summation of consolidated liabilities, noncontrolling interest, and equities.

Alternative Calculation of Noncontrolling Interest at December 31, 2010:

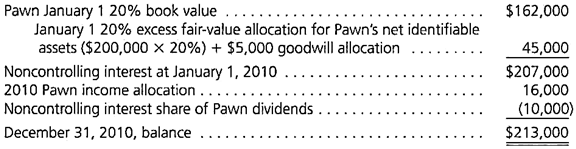

The acquisition method requires that the noncontrolling interest be measured at fair value at the date of acquisition. Subsequent to acquisition, however, the noncontrolling interest value is simply adjusted for its share of subsidiary income, excess fair-value amortizations, and dividends. The following schedule demonstrates how noncontrolling interest’s acquisition-date fair value is adjusted to show the ending consolidated balance sheet amount.

As can be seen in the above schedule, the fair-value principle applies only to the initial non- controlling interest valuation.

Worksheet Process—Acquisition Method:

The consolidated totals for King and Pawn also can be determined by means of a worksheet as shown in Exhibit 4.6. The presence of a noncontrolling interest does not create a significant number of changes in the consolidation procedures.

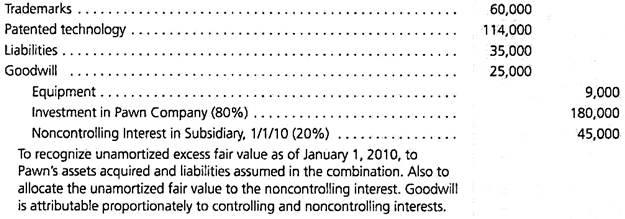

The worksheet still includes elimination of the subsidiary’s stockholders’ equity accounts (Entry S) although, as explained next, this entry is expanded to record the beginning noncontrolling interest for the year. The second worksheet entry (Entry A) recognizes the excess acquisition-date fair-value allocations at January 1 after one year of amortization with an additional adjustment to the beginning noncontrolling interest. Intercompany income as well as dividend payments are removed also (Entries I and D) while current year excess amortization expenses are recognized (Entry E).

In addition, a separate Noncontrolling Interest column is added to the worksheet to accumulate these components to form the year-end figure to be reported on the consolidated balance sheet. Noncontrolling Interest—Beginning of Year Under the acquisition method, the noncontrolling interest shares proportionately in the fair values of the subsidiary’s identifiable net assets as adjusted for excess fair-value amortizations.

On the consolidated worksheet, this total net fair value is represented by two components:

1. Pawn’s stockholders’ equity accounts (common stock and beginning Retained Earnings) indicate a January 1, 2010, book value of $810,000.

2. The January 1, 2010, acquisition-date fair value net of previous year’s amortizations (in this case 2009 only).

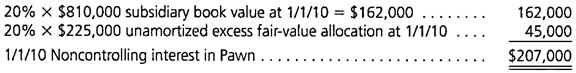

Therefore, the January 1, 2010, balance of the 20 percent outside ownership is computed as follows:

This balance is recognized on the worksheet through Entry S and Entry A:

Consolidation Entry S:

Consolidation Entry A:

The total $207,000 balance assigned here to the outside owners at the beginning of the year is extended to the Noncontrolling Interest worksheet column (see Exhibit 4.6).

Noncontrolling Interest—Current Year Income:

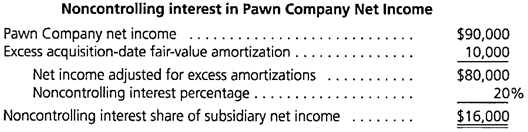

Exhibit 4.6 shows the noncontrolling interest’s share of current year earnings is $16,000. The amount is based on the subsidiary’s $90,000 income (Pawn Company column) less excess acquisition-date fair-value amortizations.

Thus, King assigns $16,000 to the outside owners computed as follows:

In effect, 100 percent of each subsidiary revenue and expense account (including excess acquisition-date fair-value amortizations) is consolidated with an accompanying 20 percent allocation to the noncontrolling interest. The 80 percent net effect corresponds to King’s ownership.

Because $16,000 of consolidated income accrues to the noncontrolling interest, this amount is added to the $207,000 beginning balance assigned (in Entries S and A) to these outside owners. The noncontrolling interest increases because the subsidiary generated a profit during the period.

Although we could record this allocation through an additional worksheet entry, the $16,000 is usually shown, as in Exhibit 4.6, by means of a columnar adjustment. The current year accrual is simultaneously entered in the Income Statement section of the consolidated column as an allocation of consolidated net income and in the Noncontrolling Interest column as an increase. This procedure assigns a portion of the combined earnings to the outside owners rather than to the parent company owners.

Noncontrolling Interest—Dividend Payments:

The $40,000 dividend paid to the parent company is eliminated routinely through Entry D, but the remainder of Pawn’s dividend was paid to the noncontrolling interest. The impact of the dividend (20 percent of the subsidiary’s total payment) distributed to the other owners must be acknowledged. As shown in Exhibit 4.6, this remaining $10,000 is extended directly into the Noncontrolling Interest column on the worksheet as a reduction. It represents the decrease in the underlying claim of the outside ownership that resulted from the subsidiary’s asset distribution.

Noncontrolling Interest—End of Year:

The ending assignment for these other owners is calculated by a summation of:

The Noncontrolling Interest column on the worksheet in Exhibit 4.6 accumulates these figures. The $213,000 total is then transferred to the balance sheet where it appears in the consolidated statements.

Consolidated Financial Statements:

Having successfully consolidated the information for King and Pawn, the resulting financial statements for these two companies are produced in Exhibit 4.7. These figures can be computed directly or can be taken from the consolidation worksheet.

Consolidated Financial Statement Presentations of Non-Controlling Interest:

Prior to SFAS 160, the placement of the noncontrolling interest on the consolidated balance sheet varied across reporting entities. Some firms reported their noncontrolling interests as “mezzanine” items between liabilities and equity. Others reported noncontrolling interest as liabilities or as stockholders’ equity.

SFAS 160 will now require that noncontrolling interests in the equity of subsidiaries be reported in the owners’ equity section of the consolidated statement of financial position. The amount should be clearly identified, labeled, and distinguished from the parent’s controlling interest in its subsidiaries. SFAS 160 also requires allocations of consolidated net income (or loss) and each component of other comprehensive income to the controlling and’ noncontrolling interests.

Exhibit 4.7 shows first the consolidated statement of income. Consolidated net income is computed at the combined entity level as $416,000 and then allocated to the noncontrolling and controlling interests. The statement of changes in owners’ equity provides details of the ownership changes for the year for both the controlling and noncontrolling interest shareholders. Finally, note the placement of the noncontrolling interest in the subsidiary’s equity squarely in the consolidated owners’ equity section.

Alternative Fair-Value Specification—Evidence of a Control Premium:

To illustrate the valuation implications for an acquisition involving a control premium, again assume that King Company acquires 80 percent of Pawn Company’s 100,000 outstanding voting shares on January 1, 2009. We also again assume that Pawn’s shares traded before the acquisition date at an average of $9.75 per share.

In this scenario, however, we assume that to acquire sufficient shares to gain control King pays $11.00 per share or a total of $880,000 cash consideration for its 80 percent interest. King thus pays a control premium of $1.25 ($11.00 – $9.75) per share to acquire Pawn. King anticipates that synergies with Pawn will create additional value for King’s shareholders. Finally, following the acquisition, the remaining 20 percent non- controlling interest shares continue to trade at $9.75.

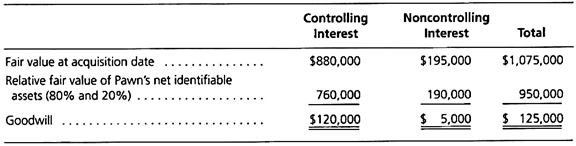

The total fair value of Pawn to be used initially in consolidation is thus recomputed as follows:

In keeping with the acquisition method’s requirement that identifiable assets acquired and liabilities assumed be adjusted to fair value.

King allocates Pawn’s total fair value as follows:

Note that the identifiable assets acquired and liabilities assumed are again adjusted to their full individual fair values at the acquisition date. Only the amount designated as goodwill is changed to $125,000 from $25,000 in the original fair-value allocation example as shown in Exhibit 4.3.

In this case, King allocates $120,000 of the $125,000 total goodwill amount to its own interest as follows:

The initial acquisition-date fair value of $195,000 for the noncontrolling interest includes only a $5,000 goodwill allocation from the combination. Because the parent paid an extra $ 1.25 per share more than the fair value of the noncontrolling interest shares, more goodwill is allocated to the parent.

Exhibit 4.8 shows the consolidated worksheet for this extension to the King and Pawn example.

The new goodwill amount of $125,000 is allocated in the worksheet as follows:

Consolidation Entry A:

The worksheet calculates the December 31, 2010, noncontrolling balance as follows:

Note that the $45,000 January 1 excess fair-value allocation to the noncontrolling interest includes the noncontrolling interest’s full share of the identifiable assets acquired and liabilities assumed in the combination but only $5,000 for goodwill. Because King Company paid a $100,000 control premium (80,000 shares × $1.25), the additional $100,000 is allocated entirely to the controlling interest.

By comparing Exhibits 4.6 and 4.8 we can assess the effect of the separate acquisition-date valuations for the controlling and noncontrolling interests. The presence of King’s control premium affects the goodwill component in the consolidated financial statements and little else.

Because King paid an additional $100,000 for its 80 percent interest in Pawn, the initial value assigned to the Investment account increases and current assets (i.e., additional cash paid for the acquisition) decreases by $100,000. The extra $100,000 then simply increases goodwill on the consolidated balance sheet. Note that the noncontrolling interest fair value remains unchanged at $213,000 across Exhibits 4.6 and 4.8.

Effects Created by Alternative Investment Methods:

In the King and Pawn illustration, the parent uses the equity method and bases all worksheet entries on that approach. King incorporated the initial value method or the partial equity method, a few specific changes in the consolidation process would be required although the reported figures would be identical.

Initial Value Method:

Because it employs a cash basis for income recognition, the initial value method ignores two accrual based adjustments. First, the parent recognizes dividend income rather than an equity income accrual. Thus, the parent fails to accrue the percentage of the subsidiary’s income earned in past years in excess of dividends (the increase in subsidiary retained earnings). Second, the parent does not record amortization expense under the initial value method and therefore must include it in the consolidation process if proper totals are to be achieved.

Because neither of these figures is recognized in applying the initial value method, an Entry C is added to the worksheet to convert the previously recorded balances to the equity method. The parent’s beginning Retained Earnings is affected by this adjustment as well as the Investment in Subsidiary account.

The exact amount is computed as follows:

Conversion to Equity Method from Initial Value Method (Entry C) Combine:

1. The increase (since acquisition) in the subsidiary’s retained earnings during past years (income less dividends) times the parent’s ownership percentage, and

2. The parent’s percentage of total amortization expense for these same past years.

The parent’s use of the initial value method requires an additional procedural change. Under this method, the parent recognizes income from its subsidiary only when it receives a dividend. Entry (I) removes both intercompany dividend income and subsidiary dividends paid to the parent. Thus, when the initial value method is used. Entry D is unnecessary.

Partial Equity Method:

Again, an Entry C is needed to convert the parent’s retained earnings as of January 1 to the equity method. In this case, however, only the amortization expense for the prior years must be included. Under the partial equity method, the income accrual is appropriately recognized each period by the parent company so that no farther adjustment is necessary.