Learn about the comparison between p/v ratio, break even point and margin of safety.

In order to see the effect of certain changes on P/V ratio, breakeven point and margin of safety, the following data is assumed:

From the above it is clear that if:

ADVERTISEMENTS:

(i) There is increase in selling price per unit it will increase the P/V ratio reduce the breakeven point and increase the margin of safety. If there is reduction in price per unit, it will decrease the P/V ratio, increase the breakeven point and shorten the margin of safety.

(ii) There is increase in variable cost per unit, it will decrease the P/V ratio, increase the breakeven point and shorten the margin of safety.

(iii) There is increase in total fixed costs, there wills no effect on P/V ratio, increase the breakeven point and shorten the margin of safety.

(iv) There is increase in no. of units sold, it will have no effect on P/V ratio and breakeven point but will increase the margin of safety.

ADVERTISEMENTS:

Illustration 1:

Your company manufacturing a single product sells it at a price of Rs.80 per unit. The variable cost per unit is Rs.48 and the annual fixed cost amounts to Rs.18 lakhs.

Based on these data, you are required to work out the following:

(i) Present P/V ratio and break-even sales.

ADVERTISEMENTS:

(ii) Increase in the volume of sales required if the profit is sought to be increased by Rs.3.6 lakhs.

(iii) Percentage increase/decrease in sales volume:

a. To offset an increase of Rs.4 per unit in variable cost; and

b. An increase in selling price by 10% without affecting the quantum of existing profit.

ADVERTISEMENTS:

Solution:

Illustration 2:

Supreme Ltd. which manufactures the component EXCEL has achieved a turnover of Rs.6, 00,000 for the calendar year 2009. The manager of the company has informed that the company has worked at a profit ratio of 25% and margin of safety of 20%.

ADVERTISEMENTS:

But he feels due to severe competition, the selling price is to be reduced to maintain the same volume of sales for the year 2010. He does not expect any change in variable costs. He expects that due to cost reduction programme, the profit volume ratio and margin of safety will be 20% and 30% respectively and considerable saving in fixed cost for 2010.

Even if the company prefers to shut down its operations for 2010, it expects to incur Y minimum fixed cost of Rs.60,000. You are expected to:

(i) Present the comparative statement for the year 2009 and 2010 showing under margin costing.

(ii) What will minimum sales be required, if it decides to shut down its unit in 2010 ?

ADVERTISEMENTS:

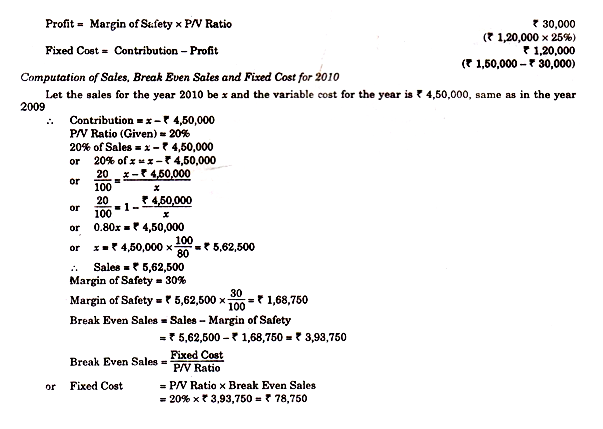

Solution: