The following points highlight the top four incentive schemes for efficient workers. The schemes are: 1. Differential Piece Rate 2. Premium Bonus Scheme 3. Group Incentive Plans 4. Bonus Schemes for Indirect Workers.

Incentive Schemes for Efficient Workers:

- Differential Piece Rate

- Premium Bonus Scheme

- Group Incentive Plans

- Bonus Schemes for Indirect Workers

Incentive Scheme # 1. Differential Piece Rate:

Under this system efficient workers are rewarded with higher wages for their increased output. This system aims at the maximisation of output which has a direct bearing on reduction of cost per unit.

ADVERTISEMENTS:

This system can be suitably applied in the following circumstances:

(i) Where the nature of the work is repetitive and the methods of working, as also equipment can be standardised.

(ii) Where the output of each worker can be measured.

(iii) Where the standard time for each job can be set separately.

ADVERTISEMENTS:

(iv) Where fixed overhead is high in comparison with direct wages.

Differential piece work systems are complicated and very expensive to operate. They are very difficult for the workers to understand. The labour cost per unit of production increases with the increase in production efficiency since it involves high rate of wages. A stage of production is reached where the advantages of increased production and reduced overhead cost may not neutralize the rising labour cost.

Some of the well-known systems of payment of wages by results are discussed below:

a. Taylor’s differential Piece Work System:

ADVERTISEMENTS:

Under this system two wage rates prevail—higher wage rate for above-standard performance and lower wage rate for output below standard. This system encourages the workers to increase their production to earn higher rate of wages. This system discourages the below average workers by providing no guaranteed hourly wage.

b. Merrick’s differential Piece Rate:

This system is also known as Multiple Piece Rate System. This is an improvement over the Taylor system. Like Taylor’s system this system does not guarantee time rate.

ADVERTISEMENTS:

It has a three- tier system having the following rates of remuneration:

Incentive Scheme # 2. Premium Bonus Scheme:

Premium Bonus Plan:

ADVERTISEMENTS:

Under time rate system of wage payment all the gains contributed by the efficient workers benefit the employer while, under piece rate system, it is the workers who gain or lose. Under premium bonus system, the gains are shared by the employer and employees in agreed ratio. Apart from the minimum guaranteed wages, the efficient workers get bonus depending on the time saved.

Under this system a standard time is fixed for performing a job. If a worker can perform the job within the time less than standard time, he is eligible to get bonus at his specific rate of wages for a percentage of time saved. Standard time in determined on the basis of time and motion study.

The object of a premium plan is to increase production by giving inducement in the form of bonus as a reward of a worker’s efficiency. The incentive wage payment plans are useful both for employees and employers. Employees are benefited by increased earnings while the employer gets the benefit of cost reduction.

The difference between premium bonus and efficiency bonus is that the former is a system of initial remuneration of a direct labour who completes the job in less than the allotted time while efficiency bonus is the additional remuneration which may be paid to both direct and indirect workers.

ADVERTISEMENTS:

Fundamentals of Good Premium Bonus plan:

1. Standard time should be fixed on the basis of careful time and motion study.

2. Standard time should be guaranteed.

3. The plan should be simple and easily understandable to the workers.

ADVERTISEMENTS:

4. It should appear reasonable both to the employer and employees.

5. The workers should be rewarded generously for increased output.

6. The incentive should be sufficiently high for the more efficient worker.

7. The standard one fixed should not be unnecessarily altered.

8. The employees’ earnings should not be affected by the matters beyond his control. He should be compensated for break-downs and other hold-ups for which he is not responsible.

9. The scheme should be coupled with a sound routine of inspections to ensure that workers are paid only for good production.

ADVERTISEMENTS:

10. The scheme should facilitate supervision and assist in production control. If possible, it should provide a basis for budgetary control and standard costing.

11. The main aim of the scheme should Influence the worker’s morale. Every effort should be made to promote workers’ understanding of the scheme and their support for it.

12. The scheme must take account of any relevant national or local trade agreement.

13. The scheme should provide for worthwhile and attainable objectives, with standards of performance not beyond the capabilities of the average worker.

Limitations of Premium Bonus Plan:

1. It is the common belief among .the workers that the scheme in operation is complicated

2. Generally the workers are of opinion that the standard time set for performing a job is unfair and standards are set by using fast workers underrating efforts.

3. A belief among workers exists that workers are treated as commodities. They feel that their opinions and feelings are not considered at the time of making time study.

4. The incentive wage system becomes successful only when the workers have confidence in Company’s management.

5. Workers believe that incentive schemes are so formulated so as to confuse them and exploit their ignorance.

The following are some of the important Premium Bonus Schemes:

(i) Halsey Plan;

(ii) Halsey-Weir Plan;

(iii) Rowan Plan;

(iv) Bedaux Point Scheme; and

(v) Emerson’s Efficiency Scheme.

1. Halsey Plan:

This scheme was originated by F. A. Halsey in 1891. In this plan time rate is guaranteed. A standard time is fixed for the performance of a particular job. If a worker can complete the job before standard time, he is paid bonus for the time saved at a fixed percentage. The percentage varies from 30% to 70%. Generally, the worker is paid bonus @ 50% of standard time saved.

Total wages = Time taken x Rate +50/100 of Time saved x Rate per hour.

Under the Halsey Premium Plan, with time wages guaranteed up to standard, the employee receives time wages until he produces in less than standard time. For production above standard, the employee’s remuneration is increased by the addition of a bonus, but as the savings are shared with the employer the rate of increase is lower than under straight piecework.

Labour cost falls sharply as output increases up to standard, in the same way as it does with straight time rates. The cost per unit continues to fall when output exceeds standard, but it does not do so as rapidly as before.

Advantages of Halsey Plan:

1. Simplicity:

This scheme is simple to operate. It is also easily understandable to all workers. The worker knows the method of calculating the premium.

2. Efficiency is rewarded:

Individual efficiency of workers is taken care of and rewarded.

3. Benefit of time saved:

Benefit of time saved is equally shared by the employer and employee.

4. Increased labour productivity:

Since worker is motivated in a better way, his earnings increase which leads to increased productivity.

5. Feeling of security:

As the plan assures a minimum hourly rate or guaranteed wage, it helps to create a feeling of security among workers. Moreover, if a worker fails to perform his job well, he is not penalized.

6. Reduction in fixed overhead:

Fixed overhead cost per unit comes down because of increased production.

Disadvantages:

1. Not scientific:

The plan is not scientific since it is difficult to fix standard time for a particular job.

2. Quality deteriorates:

As the workers are attracted by higher income they complete the job in hurry as a result of which quality may suffer.

3. More labour cost:

If the standard time cannot be properly fixed, the amount of bonus payable to workers may involve a large amount of money.

4. More wastage, spoilage, defectives etc:

As the workers do the work hastily to earn more, there are possibilities of more wastage and defective goods resulting in high labour cost per unit.

2. Halsey -Weir Plan:

The Halsey plan was modified by Weir. This is based on 33 1/3 %: 66 1/3-% sharing plan.

Worker’s earning = Time taken x Rate per hour + (33 1/3% of time saved x Rate per hour.)

Problem 1:

Standard Time = 12 hours

Time taken = 8 hours

Time Rate = Rs.5.00 per hour.

Compute the total earnings under Halsey and Halsey-Weir Plans.

Solution:

Earnings under Halsey Plan:

Total Earnings = T x R + 50% of time saved x R. = 8 x 5 + (50/100 x 4 x 5)

= Rs.40 + Rs.10 = Rs.50.

Under Halsey-Weir Plan:

Earnings = T x R + (33 1/3 % of time saved x R) = 8 x 5 + (1/3 x 4 x 5 = Rs.40 + Rs.6.67 = Rs.46.67.

Rowan Plan:

Games Rowan was the first to introduce the scheme in 1898. This scheme is similar to Halsey Plan. Under this scheme bonus is calculated as the proportion of time taken which the time saved bears to the time allowed.

The bonus is paid at time rates. The Rowan Scheme protects the employer from loose rate-fixing by reducing the bonus at high production levels. For this reason this scheme of bonus is unpopular with the workers. The important features of this plan are (i) there is guaranteed day wage and (ii) the incentive is based on time worked compared with the standard time for completing the job.

Calculation of bonus:

Problem 2:

A worker takes 10 hours to complete a job on daily wages and 6 hours on a scheme of payment by results. His day rate is Rs.5.00 an hour. The material cost of the product is Rs.10 and the overheads are recovered at 150% of the total direct wages. Calculate the factory cost of the product under Rowan Plan.

Advantages of Rowan Plan:

1. Increased production is one of the important advantages of Rowan Plan.

2. The benefit arising out of increased production is shared also by the employer.

3. Up to 50% of the time saved the rate of bonus is higher than that under Halsey Plan. So, relatively slow workers enjoy good incentive.

4. It protects the employer against loose rate-setting.

5. As the premium increases at a decreasing rate above 50% of time saved, the employees do not complete the job quickly, so wastage and defective goods are less.

6. This scheme encourages the employer to better the working conditions.

7. The system is encouraging to beginners and learners.

Disadvantages:

1. It is a complicated system which the workers do not understand easily.

2. At higher level of production, the incentive becomes lower. So, above a point of higher production, the efficient workers feel discouraged to produce more since there is a ceiling of bonus above a certain level Of production,

3. If the standard of Plant and Machinery, Tools, Materials and Working condition cannot be maintained, the scheme will fail to serve any useful purpose.

Production-Pieces per Hour:

(Time rate 48p pr hour. Time allowed 1 hour per 100. + Production level for normal 2

incentive earnings 166 2/3 per hour.)

It will be seen that the Rowan plan provides a better bonus than the Halsey 50-50 scheme until the job is performed in half standard time, when the bonus is the same under both schemes. When the job is completed in less than half the standard time the Rowan bonus is smaller than the Halsey one.

It will also be seen that on the basis of the above figures 84p, or time plus 40 per cent is being paid under the Rowan scheme when the job is performed at normal incentive speed.

It has been shown that the bonus under the Rowan scheme rises faster than that under the Halsey until the job is performed in half the standard time. As the bonus is an increasing proportion of a reducing number of hours the increase in earnings beyond this point is relatively small and wages can never be doubled.

The Rowan scheme is used extensively where it is difficult to set accurate standard times. It provides a good incentive while protecting the employer against a claim of unreasonably high wages.

Points of Distinction between the Halsey Plan and the Row an Plan:

The following are the points of distinction between Halsey and Rawan Plan of Wage payment:

(i) Under the Halsey Plan the rate of bonus varies between 33 1/3 % and 66 2/3% of the wages of time saved. But under Rowan Plan premium rate is fixed and is calculated as follows:

S – T/ S x T x R

(ii) Under Halsey Plan the rate of premium is usually 50% which does not serve as a strong incentive for relatively more efficient worker. On the other hand, under the Rowan Plan, bonus is paid on the basis of ratio of time saved and standard time in relation to time taken. So, it provides a strong incentive to more efficient worker.

(iii) The effective labour rate per hour in the Rowan Plan is higher up to 50% of the time saved and fall thereafter. Under Halsey Plan, the effective labour rate per hour is lower up to 50% of the time saved and can be doubled thereafter. For this reason, workers who cannot save 50% of standard time prefer Rowan Scheme.

(iv) Under Halsey Plan, quality of work does suffer because to earn more bonus the workers go for quantity rather than for quality. But this does not happen in case of Rowan Plan because bonus increases at a diminishing rate at higher level of efficiency.

Bedaux Point Plan:

Under this Plan an hourly guaranteed rate is paid until standard production is attained. Additional wage is paid for units in excess of standard. The workers are paid the basic time wages and wages @ 75% of time saved, the remaining 25% of time saved is paid to personnel who help to attain the standard.

The formula for calculation of earnings is:

W = T x R +75/100 x B’s x R/60, where

W = Total wages; T = time worked; R = time rate, B’s = Number of points (B’s) saved. (Note: Number of points means time units. The time unit is one minute, which is known as B. Thus, where the standard time is one hour for a job, it consists of 60B’s.).

Problem 3:

Standard points (B’s) for a job are 360 and actual number of points earned are 400. If the hourly rate is Rs.6.00, calculate the wages under the Bedaux Plan.

Solution:

W = T x R+ 75/100 x B’s x R/60

= W = 6 hours x 6 + (75/100 x 40 x 6/60) =W = Rs.36.00 + Rs.3.00 = Rs.39.00

Emerson Efficiency Plan:

Under the Emerson Efficiency Plan minimum daily wage is guaranteed. A standard time for each job is determined. This plan is a combination of time and piece rates. The features of this plan are :

1. A standard output or time is fixed which serves as a yardstick of measuring efficiency of each worker.

2. Actual performance is compared with the standard to ascertain the amount of bonus.

3. Minimum basic time wage is guaranteed to all types of workers.

Calculation of bonus:

Efficiency of each worker is determined by dividing actual hours into the standard time for the units produced. Emerson suggested that bonus should be paid if a worker attains 66 2/3 % efficiency of the standard set and, thereafter, a graded scale of bonus has been suggested. He used 2 differentials so that each worker can enjoy the maximum benefit.

Incentive Scheme # 3. Group Incentive Plans:

Group Bonus system is employed in cases where the ultimate production is dependent on the efficiency of a group of workers. In some cases a job is divided into different operations, each of which is performed by a different worker but the operations are very much interlinked in such a manner that the whole work is completed by the collective efforts of a group of persons.

The important feature of this system is that a man’s work depends on the work done by one or more of his colleagues. The workers forming a group is treated as a unit and the combined output of the unit is measured for the purpose of wage payment.

Advantages:

Group system of payment enjoys the following advantages:

(i) It encourages the sense of cooperation and team-work among the workers. This leads to increased productivity and has positive impact on labour relations which is very much needed for increased production.

(ii) This system discourages absenteeism.

(iii) A less efficient worker can be identified by the efficient co-workers of the team. This reduces supervision cost.

(iv) It involves less clerical work and the use of stationery is reduced because the production of the individual worker is not recorded, the production of the group only is recorded. As a result, costing record becomes simple and less complicated.

(v) It helps to achieve maximum production at minimum cost by reducing spoilage, idle time etc.

Disadvantages:

(i) Careful selection of workers who are to constitute the group is necessary. If the composition of the group is heterogeneous, with variations of skill, efficiency and seniority of individual workers, there may arise some discontent.

(ii) An efficient worker is economically penalized for his efficiency for he has to share the reward with other inefficient, if any, co-workers.

(iii) Rivalry among the members of the group may defeat the very object of the system.

(iv) Calculation of wages becomes complicated.

Area of Application:

Group bonus scheme can generally be employed:

(i) Where individual output cannot be measured;

(ii) When the output of a product depends on the combined efforts of a group;

(iii) Where management wishes to encourage team spirit. The following problem will clarify the method.

Problem 4:

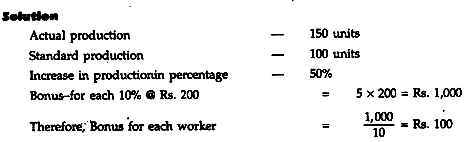

Following cost information is available for a week. Standard production – 100 units per work. No. of workers in a group – 10. Bonus – for every 10% increase in production a bonus of Rs.200 will be shared prorata among the workers of the group. Actual production 150 units.

Calculate bonus payable to each member of the group.

Solution:

The important group bonus schemes are:

(i) Budgeted expense bonus,

(ii) Cost deficiency bonus, and

(iii) Priest-man System.

Incentive Scheme # 4. Bonus Schemes for Indirect Workers:

Introduction of Incentive schemes for indirect workers is essential for increasing efficiency of service they provide to direct labour or to induce the supervisory staff in the factory to increase the efficiency of the department concerned and thereby to reduce overhead costs.

Since it is very difficult to measure the output of indirect workers it becomes necessary to group indirect workers with the group of direct workers with whom they are directly associated. This will facilitate the computation of bonus on the basis 6f the output of the direct workers.

In order to determine the suitable scheme for giving bonus to indirect workers, they may be grouped as follows:

(i) Those who are directly associated with the direct workers and,

(ii) Those who render some general services e.g., maintenance workers, ambulance men, canteen workers, sweepers etc.

Bonus to Foremen and Supervisors:

Supervisors and foremen are paid bonus which is based upon:

(i) Output of the department;

(ii) Quality of the product;

(iii) Saving in time;

(iv) Reduction of waste, spoilage, defective goods;

(v) Reduction in labour turnover.

Bonus to the Executives and the Clerical Staff:

Bonus for executives and clerical staff is paid out of profit of the concern. Bonus is fixed on the basis of efficiency in performance of each department.

Bonus to Repairs and Maintenance Staff:

Group bonus system can be introduced on the basis of performance of the department i.e. reduction in the number of complaints or reduction in breakdown of machinery, vehicle etc..