Here is a compilation of top six accounting problems on debentures with its relevant solutions.

Illustration 1:

AB Ltd. purchased assets worth Rs. 6, 80,000 and took over liabilities of Rs. 80,000. It was agreed to pay the purchase price of Rs. 6,40,000 by issuing debentures valued Rs. 4,40,000 of Rs. 100 each at a premium of 10% and balance in cash. Journalise the transaction in the books of purchasing company.

Solution:

ADVERTISEMENTS:

Illustration 2:

You are required to pass journal entries for the issue of following debentures:

(a) 120 10% Rs. 1,000 Debentures are issued at 5% discount and are repayable at par.

ADVERTISEMENTS:

(b) Another 150 7% Rs. 1,000 Debentures are issued at 5% discount and repayable at 10% premium.

(c) Further 80 9% Rs. 1,000 Debentures are issued at 5% premium.

(d) In addition, another 400 8% Rs. 100 Debentures are issued as collateral security against a loan of Rs. 40,000. (ICWA Inter)

Solution:

Illustration 3:

B.K. Ltd. issued at Rs 1, 00,000 10% Debenture at 95%. Subscriptions are payable as to Rs 20,000 on application and balance on allotment. Expenses of the issue are Rs 500.

ADVERTISEMENTS:

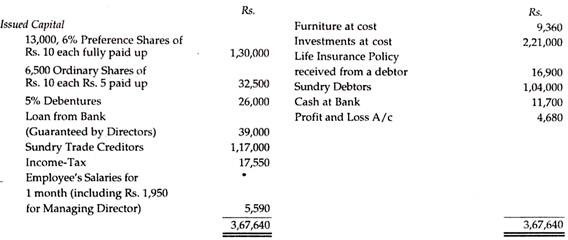

Show the journal entries and the Balance Sheet of the Company.

Solution:

Illustration 4:

ADVERTISEMENTS:

In the Balance Sheet of a Company, the discount on debentures shows a debit balance of Rs 15,000. Every year Rs 5,000 is charged off to Profit and Loss Account. How will you show the Discount on Debentures Account at the end of the First Year and Second Year in the Balance Sheet of the Company?

Illustration 5:

A Company issued Rs 2, 00,000 10% Debentures of Rs 100 each at par, repayable at the end of 5 years at a premium of 5%. In terms of the Trust Deed, a Sinking Fund was to be created for the purpose of accumulating sufficient funds for the purpose. Investments were made yielding 5% interest received at the end of each year. All investments, including reinvestments of interest received, were made at the end of the year. All the investments were sold in the fifth year for Rs 1, 63,805.

ADVERTISEMENTS:

You are required to show for 5 years the journal entries and ledger accounts.

Note:

Rs 2.71462 invested at the end of each year at 5% compound interest will amount to Rs 15 at the end of 5 years.

Calculation may be done to the nearest rupee.

Solution:

Illustration 6:

On 1st January, 1993 a company issued 10,000 6% Debentures of Rs 100 each redeemable at par after 15 years. The terms of issue, however provided that the debentures could be redeemed by giving 6 months’ notice at any time after 5 years at a premium of 4% either by payment in cash or by allotment of preference shares and/or other debentures according to the option of the debenture-holders.

On 1st April, 2004 the company informed the debenture-holders to redeem the debentures on 1st October, 2004, either by payment in cash or by allotment of 8% Preference shares of Rs 100 each at Rs 130 per share or 7% 2nd Debentures of Rs 100 each at Rs 96 per debenture.

Holders of 4,000 debentures accepted the offer of 8% preference shares, holders of 4,800 debentures accepted the offer of 7% 2nd Debenture and the rest demanded cash. Give journal entries recording the above redemption.