In this article we will discuss about the capital structure and value of firm.

Meaning and Definition of Capital Structure and Value of Firm:

A firm mobilizes funds which, depending upon their maturity period, can be classified as long-term and short-term sources. The former consists of capital, reserves and term loans raised from public and financial institutions, while the latter is made up of current liabilities and provisions. Financing decisions involve raising funds for the firms. It is concerned with formulation and designing of capital structure or leverage.

While investment decisions are related to the asset side of the balance sheet, financing decisions are related to the liabilities and equity side. Capital structure ordinarily implies the proportion of debt and equity in the total capital of a company.

Since a company may tap any one or more of the different available sources of funds to meet its total financial requirement. The total capital of a company may, thus, be composed of all such tapped sources. The term ‘structure’ has been associated with the term ‘capital’. The term ‘capital’ may be defined as the long-term funds of the firm.

ADVERTISEMENTS:

Capital is the aggregation of the items appearing on the left hand side of the balance sheet minus current liabilities. In other words, capital may also be expressed as total assets minus current liabilities. Further, capital of a company may broadly be categorized into ‘equity’ and ‘debt’.

Equity consists of the following:

Equity share capital + Preference share capital + Share premium + Free reserves + Surplus profits + Discretionary provisions for contingency + Development rebate reserve

Debt consists of the following:

ADVERTISEMENTS:

All borrowings from Government, Semi-Government, Statutory financial corporations and other agencies + Term loans from banks, financial institution etc. + Debentures + All deferred payment liabilities.

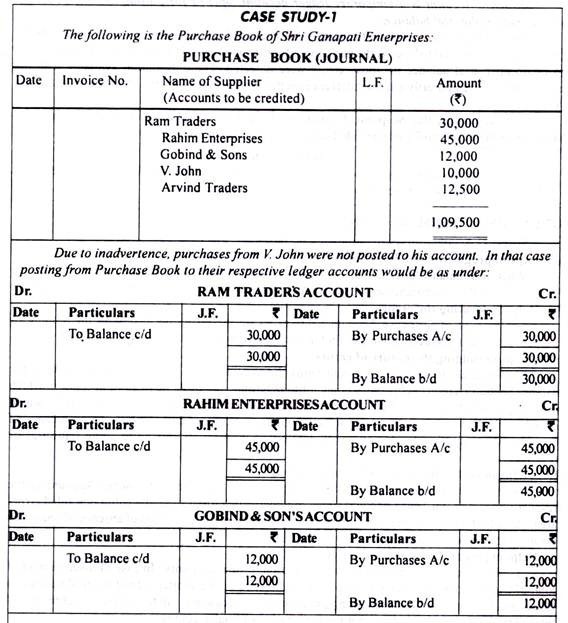

The total capital structure of a firm is represented in figure 27.1:

‘Financial structure’ in the entire left hand side of the company’s balance sheet which includes current liabilities (equivalent to asset structure). While ‘capital structure’ refers to sources of long- term funds. The term ‘total capital structure’ denotes mix of owners’ funds and outsiders’ funds or it is proportionate relationship of firm’s permanent long-term financing represented by equity and debt.

ADVERTISEMENTS:

Ordinarily, increase in debt in the capital structure i.e., improvement of debt-equity ratio implies greater amount of interest payment than before. So, the company must have to be sure enough of getting steady return so as to bear the additional burden of interest. Likewise, profitability depends, inter alia, on cost of capital.

Actually, a negative correlation should always exist between cost of capital and profitability. So, increase in cost of capital means decrease in profitability. Since acceptance of more and more debt means payment of greater amount of interest, the company must have to think twice about its effect on profitability.

If due to acceptance of debt, profitability decreases Le., a negative correlation results, such debt acceptance will not be advantageous to the company. On the other hand, if any change in the capital structure by way of increasing the proportion of debt can have favourable effect on profitability, then such change i.e., increase in debt may be considered beneficial to the company.

Optimum Capital Structure:

The optimum capital structure is that capital structure or combination of debt and equity that leads to the maximization of the value of the firm. The capital structure decision is important to the firm, the optimum capital structure minimizes the firm’s overall cost of capital and maximizes the value of the firm.

ADVERTISEMENTS:

The use of debt funds in capital structure increases the EPS as the interest on debt is tax deductible, which leads to increase in share price. But higher levels of debt funds in capital structure result in greater financial risk and it leads to higher cost of capital and depress the market price of company’s share.

Therefore, the firm should try to achieve and maintain the optimum capital structure keeping in view value maximization objective of the firm. Sometimes, the optimum capital structure is also referred as ‘appropriate capital structure’ and ‘sound capital structure’. Ordinarily infant companies (or new companies) cannot collect sufficient debt as per their requirements so easily because they are yet to establish their creditworthiness in the market.

Naturally, they have to depend on equity very much. But established companies generally have track record of their profit earning capacity, which helps them to create their creditworthiness. The lenders feel safe to invest their funds in this type of companies. Naturally, there is ample scope for this type of companies to collect debt. But a company cannot accept debt freely i.e., without having any limit.

The company must have to chalk out a plan to collect debt in such a way that the acceptance of debt becomes beneficial for the company in terms of increase in EPS, profitability and value of the firm. If the cost of capital is greater than the return, it will have an adverse effect on company’s profitability, value of the firm and its EPS.

ADVERTISEMENTS:

Similarly, if company is unable to repay the debt within the scheduled period (may be due to some other reasons) it will affect the goodwill of the company in the credit market and consequently may create problems in future for collecting further debt. Other factors remaining constant, the company should select its appropriate capital structure with due consideration.

Advantages of Debt -The main advantages of debt capital are as follows:

(a) The administrative and issuing costs are normally lower than raising equity capital.

(b) The pre-tax rate of interest is invariably lower than the return required by the equity capital suppliers.

ADVERTISEMENTS:

(c) Cost advantage due to the ability to set debt interest against profit for tax purposes.

Factors Determining Capital Structure:

In reality the following factors have great practical implications for capital structure:

i. Control:

The management control over the firm is one of the major determinants of capital structure decisions. The equity shareholders are considered as the real owners of the company, since they can participate in decision making through the elected body of representatives called ‘board of directors’.

ADVERTISEMENTS:

The policy decisions are taken in general meetings of the equity shareholders and the day to day working will be supervised through board of directors. The preference shareholders and debenture holders cannot participate in decision making. The financial institutions and banks who provide term loans can participate in management through the nominee directors, by having covenant in the loan agreement.

The preference shareholders can exercise voting power in general meetings if the company fails to pay preference dividends for two consecutive years. When the promoters do not wish to dilute their control, the company will rely more on debt funds. Any fresh issue of shares will dilute the control of the existing shareholders.

ii. Risk:

In capital structure decisions, two elements of risk viz., (i) business risk and (ii) financial risk are considered. Business risks are influenced by demand, price, input costs, fixed costs, business cycles, competition etc. The business risk of a firm is determined by the accumulated investments the firm makes over time. A firm with high business risk prefer to have low levels of debt, since the volatility of its earnings is more.

A firm with low level of business risk can have higher debt component in capital structure, since the risk of variations in expected earnings is lower. Financial risks representing the risks from financial leverage.

It refers to the additional variability per share and the increased probability of insolvency that arises when a firm uses fixed cost source of funds i.e., term loans, debentures and bonds. The higher proportion of debt increases the commitments of the company with regard to fixed charges and repayment of principal amount in time.

ADVERTISEMENTS:

iii. Income:

Increase of return on equity shareholders depends on the method of financing and its impact on EPS and ROE. If the levels of EBIT is low from EPS point of view, equity is preferable to debt. If the EBIT is high from EPS point of view, debt financing is preferable to equity. If the ROI is less than the cost of debt, financial leverage depress ROE. When the ROI is more than cost of debt, financial leverage enhances ROE.

iv. Tax Consideration:

Under the provisions of the Income-tax Act, the dividend payable on equity share capital and preference share capital are not deductible, causing the high cost of equity funds. Interest paid on debt is deductible from income and reduces a firm’s tax liabilities. The tax saving on interest charges reduces the cost of debt funds.

The debt has tax advantage over equity. By increasing the debt component in the capital structure, a firm can increase its earnings available to shareholders. The flotation costs of debt and equity are deductible over a period of 10 years. Premium on redemption can be deductible during the maturity period.

v. Cost of Capital:

Cost of different components of capital will influence the capital structuring decisions. A firm should posses earning power to generate revenues to meet its cost of capital and finance its future growth. Generally the cost of equity is higher than the cost of debt, since the debt holders are assured of fixed rate of return and repayment of principal amount after the maturity period.

Firms that adjust their capital structure in order to keep the riskiness of their debt and equity reasonable, should have a lower cost of capital. A firm with high level of gearing, its ability to meet fixed interest payments out of current earnings diminishes. This increases the probability of bankruptcy and as a result, the cost (risk premium) of both debt and equity raises.

vi. Trading on Equity:

The basic of objective of Financial Management is to enhance the wealth of the firm by increasing the market value of the share. The firm’s wealth is increased, if after tax earnings are increased. A company raises debt at low cost with a view to enhance the earnings of the equity shareholders.

The cost of debt is lower due to tax advantage. A fixed rate of return is payable on debt funds. Any excess earnings over cost of debt will be added up to the equity shareholders. Capital structure decisions should always aim at having debt component in total component in order to increase the earnings available for equity shareholders.

vii. Investors’ Attitude:

In a segmented market, different sets of investors measure risk differently or simply charging different rates on the capital that they invest. By choosing the instrument that taps the cheapest market, firms lower their cost of capital. However, the trade-off in terms of availability of funds always exists.

viii. Flexibility:

It is more important consideration with the raising of debt is flexibility. As and when the funds required, the debt may be raised and it can be paid off and when desired. But in case of equity, once the fund raised through issue of equity shares, it cannot ordinarily be reduced except with the permission of the court and compliance with lot of legal provisions.

Hence, debt capital, has got the characteristic of greater flexibility than equity capital, which will influence the capital structure decisions. A firm maintains its borrowing power to enable it raise debt to meet unforeseen contingencies.

ix. Timing:

The time at which the capital structure decision is taken will be influenced by the boom or recession conditions of the economy. In times of boom, it would be easier for the firm to raise equity, but in times of recession, the equity investors will not show much of interest in investing. Then the firm is to rely in raising debt.

x. Legal Provisions:

Legal provisions in raising capital will also play a significant role in planning capital structure. Raising of equity capital is more complicated than raising debt.

xi. Profitability:

A company with higher profitability will have low reliance on outside debt and it will meet its additional requirement through internal generation.

xii. Growth Rate:

The growing companies will require more and more funds for its expansion schemes, which will be met through raising debt. The fast growing companies will have to rely on debt than on equity or internal earnings.

xiii. Government Policy:

The government policies and capital market regulation is a major determinant in capital structure. For example, increase in lending rates may cause the companies to raise finances from capital market. Rigid capital market policies may cause to raise finances from banks and financial institutions. Monetary and fiscal policies of the government will also affect the capital structure decisions.

xiv. Marketability:

The balancing of debt and equity is possible when the marketability is created for the company’s securities. The company’s ability to market its securities will affect the capital structure decisions.

xv. Company Size:

The companies with small capital base will rely more on owner’s funds and internal earnings. But large companies have to depend on capital market and can tap finances by issue of different varieties of securities and instruments.

xvi. Manoeuverability:

The balancing of capital structure is drawn when the firm has manoeuverability on funds raised by expanding and contracting the outstanding balances to the funds requirement of the firm. By having different types of securities with different maturity periods, recall provisions, the company can optimize its capital structure and enhance its borrowing power.

xvii. Financing Purpose:

The capital structure decisions are taken in view of the purpose of financing. The long-term projects are financed through long-term sources and in the form of equity. The short-term projects are financed by issue of debt instruments and by raising of term loans from banks and financial institutions.

The projects for productive purpose can be financed from both equity and debt. But the non-productive projects are financed by using the internal generated earnings.

Theories on Optimum Capital Structure:

The basic objective of financial management is to maximize the wealth of shareholders. To achieve the objectives, the company will raise funds basically in two forms – (a) equity, and (b) debt. The cost of equity and cost of debt are the consideration required to be offered to the providers of equity and debt funds. The cost of equity is normally higher than the cost of debt, and the debt funds carry the financial risk.

Basic Assumptions:

A study of the following basic assumptions is necessary, before we study the capital structure theories under traditional and modern views:

(i) The company distributes all its earnings as dividends to its shareholders and no consideration of dividend and retention policies.

(ii) The taxation and its effect on cost of capital is ignored.

(iii) Business risk is treated constant at different levels of capital structure of a company.

(iv) There are no transaction costs and a company can alter its capital structure without any transaction costs.

(v) The continuous and perpetual earning of profits to the expectations of the stockholders.

The following theories study about finding out an optimum capital structure by balancing various costs of financing and financial risks:

Debt-Equity Ratio Analysis:

Different studies, so far conducted, fail to reach unanimity as to the appropriate debt-equity ratio, but commonly suggested standard debt-equity ratio is 2:1. The standard ratio may vary depending on the nature of the company. Low debt-equity ratio does not necessarily mean such dependence on collecting funds by equity issues. It may also be so due to increase in the retained earnings component of ‘equity’.

Again, it is equally pertinent to note that a highly profitable company may keep aside a sizeable portion of its profit in the reserve fund. It may help the company not to rely on external debt to meet further requirement of the funds and accordingly debt-equity ratio may appear to be at a low level.

The following points should be considered before selecting the firm’s debt-equity ratio as a measure for determining the capital structure:

(a) There is an optimal capital structure where the marginal tax benefit is equal to the marginal cost of anticipated financial distress.

(b) The debt-equity ratio depends on both the level and volatility of cash flows.

(c) Survival of the firm is the top priority of any firm and hence the lower debt-equity ratio is preferable for high risk business firms.

(d) The trade cycles and industry cycles and other reasons may sometimes cause financial distress to the firm and hence the debt-equity ratio should be selected keeping in view the distress conditions which may occur in future.

(e) In balancing debt-equity ratio, the first step always should be the increase of equity which gives more financial flexibility.

(f) Increasing equity can be used as a base to justify and sustain more debt.

The debt-equity ratio affects the firm’s cost of capital when a debt-equity ratio of a firm increases, its cost of capital will decline and vice versa. When a firm depends on higher debt, result in payment of interest to the suppliers of loan capital which will lower the amount of tax payable by the company, and simultaneously its overall cost of capital will also decrease. But, any non-payment of principal and interest payments of the loans outstanding may result in bankruptcy costs.

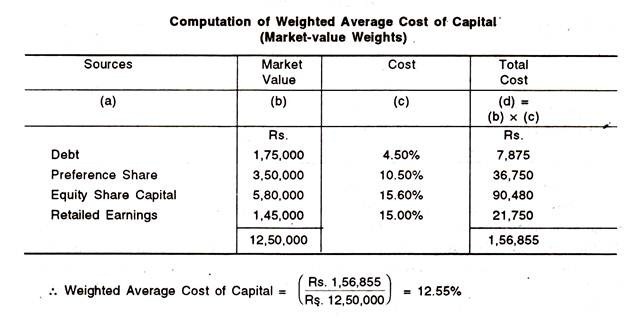

The impact of debt-equity composition on cost of capital is explained in the illustration given below:

Illustration 1:

Analysis:

From the analysis of the above we can observe that when the debt-equity ratio is 1:3, the composite cost of capital stands at 15.6%. When the debt-equity ratio altered to 3 : 1, the firms cost of capital has drastically reduced to 10.8%. This is due to the advantage of tax shield and the supply of debt at cheaper cost than the equity capital.

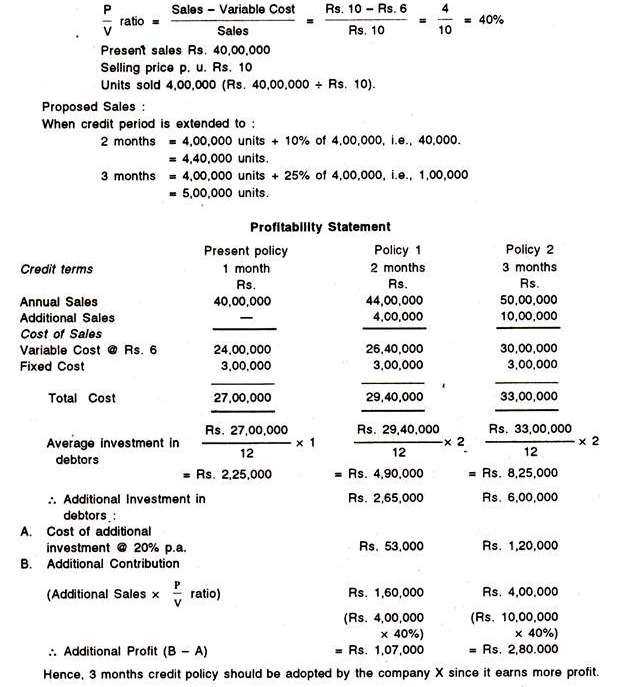

EBIT-EPS Analysis:

It is one of the basic objectives of Financial management to design an appropriate capital structure which can provide the highest EPS over the firm’s expected range of EBIT. EPS is a yard stick to evaluate the firm’s performance for the investors. The level of EBIT varies from year to year shows how successful the firm’s operation are. EBIT-EPS approach is an important tool for designing the optimal capital structure framework of the firm.

EBIT-EPS analysis is widely used by Finance manager because it provides a simple picture of the consequences of alternative financing methods, however more sophisticated techniques are available.

Financial Break-Even:

It is the minimum level of EBIT needed to satisfy all fixed financial charges i.e., interest and preference dividends. It denotes the level of EBIT for which the firm’s EPS just equals zero. If EBIT is less than financial break-even point, then EPS will be negative. But if the expected level of EBIT exceeds than that of break-even point, more fixed costs financing instruments can be inducted in the capital structure. Otherwise the use of equity would be preferred.

Financial Indifference Point:

When two alternative financial plans do produce the level of EBIT where EPS is the same, this situation is referred to as ‘in different point’. In case, the expected level of EBIT exceeds the indifference point, the use of debt financing would be advantageous to maximize the EPS. The indifference point may be defined as the level of EBIT beyond which the benefits of financial leverage begins to operate with respect to earnings per share.

The indifference point between the two financing alternatives can be ascertained as follows:

Where, EBIT = Earnings before interest and taxes

T = Corporate rate of tax

I1 = Interest charges in Financing alternative 1

N1 = Number of equity shares in Financing alternative 1

I1 = Interest charges in Financing alternative 2

N2 = Number of equity shares in Financing alternative 2

Illustration 2:

American Express Ltd. is setting up a project with a capital outlay of Rs. 60,00,000.

It has the following two alternatives in financing the project cost:

Alternative 1: 100% Equity finance

Alternative 2: Debt-equity ratio 2: 1

The rate of interest payable on the debt is 18% p.a. The corporate rate of tax is 40%. Calculate the indifference point between two alternative methods of financing.

Solution:

Alternatives in financing and its financial charges

(1) By issue of 6,00,000 equity shares of Rs. 10 each amounting Rs. 60 lakhs. No financial charges involved, (or)

(2) By raising the funds in the following way: Debt = Rs. 40 lakhs

Equity = Rs. 20 lakhs (2,00,000 equity shares of Rs. 10 each)

Interest payable on debt = Rs. 40,00,000 x 18/100 = Rs. 7,20,000

Now we can calculate the indifference point of the above two financing alternatives as follows:

(in lakhs)

6 2 0.60 EBIT x 2 = (0.6 EBIT x 6) – [(0.6 x 7.2) x 6]

0.60 x 7.2 x 6 = (0.60 EBIT x 6) – (0.60 EBT x 2)

25.92 = 3.6 EBIT-1.2 EBIT

2.4 EBIT = 25.92

EBIT = 25.92/2.4 = 10.80 say Rs. 10,80,000

The EBIT at indifference point explains that the EPS for two methods of financing is equal.

Illustration 3:

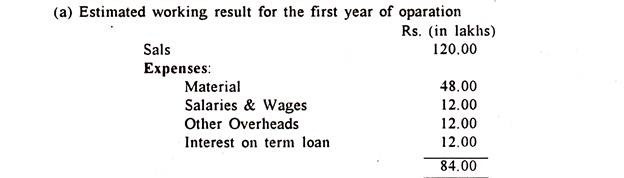

Paramount Produces Ltd. wants to raise Rs. 100 lakhs for a diversification project. Current estimate of earnings before interest and taxes (EBIT) from the new projects is Rs. 22 lakhs per annum.

Cost of debt will be 15% for amounts up to and including Rs. 40 lakhs; 16% for additional amounts up to and including Rs. 50 lakhs; and 18% for additional amounts above Rs. 50 lakhs.

The equity shares (face value Rs. 10) of the company have a current market value of Rs. 40. This is expected to fall to Rs. 32 if debts exceeding Rs. 50 lakhs are raised.

The following options are under consideration of the company:

Determine the earning per share (E.P.S.) for each option and state which option the company should exercise. Tax rate applicable to the company is 50%.

Solution:

Financial and NEDC Risks Trade-off:

The firm’s decision to use or otherwise debt in the capital structure affects two types of risks, namely, Financial risk (FR) and risks arising out of non-employment of debt capital, called ‘NEDC risks’. The former risk arises out of the use of the debt capital, while the latter is the outcome of the use of only equity or more of equity and less of debt in the capital mix. A detailed description of these two risks and their graphical presentation are given in figure 27.3.

Assumptions:

The optimum capital structure based on financial and NEDC risks trade-off is based on the following assumptions:

(a) There are only two sources of funds, namely debt and equity.

(b) The total assets are constant.

(c) The total financing of the company is given.

(d) EBIT/Operating Profits are constant.

(e) Investors are rational.

(f) Servicing cost per share is higher than per debenture and both remain constant.

(g) Issue cost per share is higher than per debenture and both remain constant.

(h) Market price and face value remain constant.

Financial Risk:

The financial risk arises on account of the use of debt in the capitalization plan. The debentures carry fixed obligations as to return on capital. Lack of ability to honour these fixed obligations increases the risk of liquidation. In addition, the use of debt also increases the variability of earnings available to equity holders.

NEDC Risks:

The financial executives have to manage not only financial risk but also risks arising out of non-employment of debt capital in the capital structure, called ‘NEDC Risks’. These risks vary inversely with the ratio of Debt to Total Capital (D/C Ratio).

The greater the value of D/C ratio, the lower will be the NEDC risks and vice versa, other things being equal. The optimum capital structure is there at that point where the total risk/cost is minimum. Figure 27.4 depicts the trade-off between financial and NEDC risks in setting optimum capital structure.

The components of NEDC risks are as follows:

(i) The excessive reliance on equity source leads to the sacrifice of the opportunity of earning higher EPS on account of beneficial effects of financial leverage.

(ii) Financial plan should be compatible with retaining control. Existing managements are allergic to the very idea of loosing control over the affairs. The risk of loss of control increases with the increase in the proportion of equity to total capital and vice versa.

(iii) Generally the cost of floating debt is less than the cost of floating an equity issue. Flotation costs minimising firms should think of issuing less of equity and more of debt.

(iv) Between debt and equity, the latter is more inflexible in nature. Equity shares cannot be redeemed during the life time of the company while debentures are redeemed at the end of maturity period.

(v) Between debt and equity, the latter is more expensive to serve. Servicing costs are the costs incurred in distributing dividend/interest cheques, distribution of audited reports, meeting expenses etc. The total servicing cost varies with the amount of equity issue. Greater the amount of equity issue, higher would be the servicing costs.

In determining the optimum level of debt-equity combination, the Finance manager has to balance the financial and NEDC risks by minimising the total risk/costs.

Net Income Approach:

This approach is given by ‘Durand David’. According to this approach, the capital structure decision is relevant to the valuation of the firm. As such a change in the capital structure causes an overall change in the cost of capital and also in the total value of the firm. A higher debt content in the capital structure means a high financial leverage and this results in decline in the overall or weighted average cost of capital.

This results in increase in the value of the firm and also increase in the value of the equity shares. In an opposite situation, the reverse conditions prevails. Durand (1952) advocated this approach, according to him the average cost of capital will reduce with greater use of debt and the equity shareholders will not insist for higher return with increased levels of gearing caused by the use of increasing level of debt component.

It is also assumed that the lenders will also not insist for higher return with increasing levels of debt. Hence, the average cost of capital falls until the level of debt is reached since there is no upturn in the cost either equity or debt. The position of the above view is represented in figure 27.5.

Assumptions:

There are usually three basic assumptions of this approach:

(a) Corporate taxes do not exist.

(b) Debt content does not change the risk perception of the investors.

(c) Cost of debt is less than cost of equity i.e., debt capitalisation rate is less than the equity capitalisation rate.

According to net income approach, the value of the firm and the value of equity are determined as given below:

Value of Firm (V) = S + B

Where, S = Market Value of Equity

B = Market Value of Debt

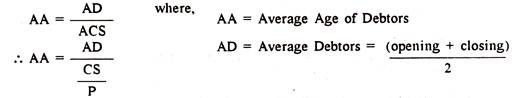

Market Value of Equity (S) = NI/Ke

Where, NI = Net income available for equity shareholders

Ke = Equity capitalization rate

Illustration 4:

Glamour Ltd. earned a profit of Rs. 20 lakhs before providing for interest and tax.

The company’s capital structure is as follows:

(i) 4,00,000 Equity shares of Rs. 10 each and its market capitalisation rate is 16%.

(ii) 25,000 14% Secured redeemable debentures of Rs. 150 each.

You are required to calculate the value of the firm under ‘Net Income Approach’. Also calculate the overall cost of capital of the firm.

Solution:

Value of the Firm (V) = S + B

Where, S = Market value of equity

B = Market value of debt

Market Value of Equity (S)

S = NI/ Ke

Where,

NI = Net income available for equity shareholders Le. Rs. 14,75,000

Ke, = Equity capitalisation rate Le. 16% or 0.16

S = Rs. 14,75,000/0.16 = = Rs. 92,18,750

Now, we can Calculate the Value of the Firm

V = S+B

= Rs. 92,18,750 + Rs. 37,50,000 = Rs. 1,29,68,750

Calculation of Overall Cost of Capital

Ke = EBIT/V = Rs. 20,00,000/Rs. 1.29.68.750 x 100 = 15.42%

Net Operating Income Approach:

According to ‘Net Operating Income Approach (NOI)’, value of the firm is independent of its capital structure. It assumes that the weighted average cost of capital is unchanged irrespective of the level of gearing.

The underlying assumption behind this approach is that the increase in the employment of debt capital increases the expected rate of return by the stockholders and the benefit of using relatively cheaper debt funds is offset by the loss arising out of the increase in cost of equity.

A change in proportion of various sources of finance cannot alter the weighted average cost of capital and as such, the value of firm remains unaltered for all degrees of leverage. Under this approach, optimal capital structure does not exist as average cost of capital remains constant for varied types of financing mix. NOI approach is opposite to the NI approach.

According to this approach, the market value of the firm depends upon the net operating profit or EBIT and the overall cost of capital, weighted average cost of capital (WACC). The financing mix or the capital structure is irrelevant and does not affect the value of the firm.

Assumptions:

The NOI approach is based on certain assumptions:

(a) The investors see the firm as a whole and thus capitalise the total earnings of the firm to find the value of the firm as a whole.

(b) The overall cost of capital, (Ko), of the firm is constant and depends upon the business risk which also is assumed to be unchanged.

(c) The cost of debt, (Kd) is also constant.

(d) There is no tax.

(e) The use of more and more debt in the capital structure increases the risk of the shareholders and thus results in the increase in the cost of equity capital (Ke).

The NOI approach believes that the market values of the firm as a whole for a given risk complexion. Thus, for a given value of EBIT, the value of the firm remains the same irrespective of the capital composition, and instead depends on the overall cost of the capital.

Value of Firm (V) = EBIT/Ko

Where, EBIT = Earnings before interest and tax

Ko = Overall cost of capital

Value of Equity (S) = V-B

Where, V = Value of Firm

B = Value of debt

Thus, financing mix is irrelevant and does not affect the value of the firm. The value remains same for all types of debt-equity mix. Since there will be change in risk of the shareholders due to change in debt-equity mix, therefore, Ke will be changing linearly with change in debt proportions.

The NOI approach can be illustrated in figure 27.6 shows that the cost of debt and the overall cost of capital are constant for all levels of leverage. As the debt proportion or the financial leverage increases, the risk of the shareholders also increases and thus the cost of equity capital also increases. However, the increase in cost of equity capital does not affect the overall value of the firm and it remains same.

It is to be noted that an all-equity firm, the cost of equity capital is just equal to WACC. As the debt proportion is increased, the cost of equity also increases. However, the overall cost of capital remains constant because increase in cost of equity is just sufficient to offset the benefit of cheaper debt financing. The NOI approach believes that leverage has no effect on the WACC and the value of the firm. Hence, every capital structure is optimal.

Illustration 5:

Jupiter Constructions Ltd. has earned a profit before interest and tax Rs. 5 lakhs. The company’s capital structure includes 20,000 14% Debentures of Rs.100 each. The overall capitalisation rate of the firm is 16%. Calculate the total value of the firm and the equity capitalisation rate.

Solution:

Value of Firm (V)

V = EBIT /K

Where,

EBIT = Earning before interest and tax i.e., Rs. 5,00,000

K = Overall capitalization rate i.e., 16% or 0.16

V = 5,00,000/0.16 = Rs. 31,25,000

Value of Equity (S)

S = V-B

Where, V = Value of firm

B = Value of debt

S = 31,25,000-20,00,000 = Rs. 11,25,000

Equity Capitalisation Rate (Ke)

Ke = EBIT/V-B x 100

Verification

The NOI approach can be verified by calculating the overall cost of capital of the firm as follows:

Illustration 6:

Summer Ltd. and Winter Ltd. are identical in all respects including risk factors except for debt/equity mix. Summer Ltd. having issued 12% debentures of Rs. 30 lakhs, while Winter Ltd. issued only equity capital. Both the companies earn 24% before interest and taxes on their total assets of Rs. 50 lakhs. Assuming the corporate effective tax rate of 40% and capitalisation rate of 18% for an all-equity company.

Compute the value of Summer Ltd. and Winter Ltd. using (i) Net Income approach and (ii) Net Operating Income approach.

Solution:

Market Value of Equity (S)

S = NI/kE

Where, NI = Net income available to equity shareholders

Ke = Equity capitalisation rate

Summer Ltd. = 5,04,000/0.18 = Rs.28,00,000

Winter Ltd. = 7,20,000/0.18 = Rs.40,00,000

Market Value of Firm (V)

V = S + B

Where, S = Value of equity

B = Value of debt

Summer Ltd. (V) = 28,00,000 + 30,00,000 = Rs. 58,00,000

Winter Ltd. (V) = 40,00,000 + 0 = Rs. 40,00,000

Weighted Average Cost of Capital Approach (Traditional View):

The cost of capital is interdependent on the degree of leverage. The lowest component in the cost of capital relates to the fixed interest bearing investments. Traditionally, optimal capital structure is assumed at a point where weighted average cost of capital (WACC) is minimum.

For a project evaluation, this WACC is considered as the minimum rate of return required from project to pay off the expected return of the investors and as such WACC is generally referred to as the ‘required rate of return’. WACC is defined as the weighted average of the cost of various sources of finance.

Weight being the market value of each source of finance outstanding, cost of various sources of finance refers to the return expected by the respective investors. The debt component should be raised upto the level where the WACC of the firm is at the lowest which is called ‘optimum cost of capital’.

Till the optimum level reaches a firm can rise its debt component to minimise WACC and for increasing returns to the equity holders. After the optimum level, any further increase in debt increases the risk to the equity holders. Figure 11.6 shows that the cost of debt is lower than the cost of equity.

Firms can borrow at low rate of interest in the beginning. With the increase in leverage, lenders being to worry about the repayment of interest and principal and security available to them. The interest rate will be higher on additional loans. Therefore, average cost of debt begins to rise. Simultaneously, when the equity holders will not much bother when the debt levels of the company are lower.

But with increasing leverage, the equity holders are much concerned about the level of interest payments affecting the volatility of cash flow for equity. Then the equity holders demand for more rates of return for taking an additional risk. Thus, a combination of both the sources of finance, with the increase in leverage, the overall cost of capital will also start raising after the optimum level of gearing as shown in figure 27.7.

WACC is undoubtedly an important tool in determining optimal capital structure. To minimise the value of the firm as well as the market value of the stock, the firm should strive to minimise WACC. Thus considerable weight is placed on WACC for achieving the ultimate objective of increasing the stockholders worth by choosing an appropriate capital mix.

Other conditions, likely cash flow, ability of the firm to meet fixed charges, degree of leverage, fluctuations of EBIT and its likely impact on EPS for alternative methods of financing etc. should also be taken into consideration with due weightage for the purpose.

Figure 27.8 shows the impact of leverage on value of the firm. The value of the firm is maximum where the level of gearing for each firm at which the cost per unit of capital is at its lowest point. Therefore, a firm should identify and maintain capital structure at this optimum level.

Modigliani and Miller Theory (Modern View):

The traditional view of capital structure as explained in ‘weighted average cost of capital’ is rejected by the proponents Modigliani and Miller (MM) 1958. According to them cost of capital is independent of capital structure and there is no optimal value.

According to them, under competitive conditions and perfect markets, the choice between equity financing and borrowing does not affect a firm’s market value because the individual investor can alter investment to any mix of debt and equity the investor desires.

MM argues that a company’s WACC remains unchanged at all levels of gearing, implying that no optimal capital structure exists for a particular company. MM supported their argument that capital structure was irrelevant in determining the market value of a company by using ‘arbitrage theory’.

According to them, a change in debt-equity ratio does not affect the cost of capital and the market value of the firm. The theory is based on perfect market conditions and without considering the corporate and personal taxation.

Assumptions:

The MM theory is based on the following assumptions:

(a) The capital market is assumed to be perfect. The existence of perfect capital market implies that both individuals and investors can borrow unlimited amounts at the same rate of interest. There are no limits of borrowing.

(b) The investors are free to buy and sell securities and are well informed about the risk and return involved in different securities. All securities are infinitely divisible.

(c) There are no transaction costs. There are no brokerage or other transaction charges.

(d) The debt is less expensive than equity. Increase in debt level will cause to increase the cost of debt. The increased debt will increase the financial risk of the firm and expectations of the equity holders will be more. Thus the average cost of capital will remain constant for all levels of leverage.

(e) There is no benefit to debt financing other than reduction in corporate income taxes due to tax shield of interest payments of debt.

(f) Interest rates are equal between borrowing and lending, firms and individuals.

(g) The capital markets are efficient. The information is cost less and readily available to all investors.

(h) There are no personal taxes and corporate income taxes.

(i) All investors are only price takers. No individual can influence the market price of security by the scale of transactions.

(j) The firm’s investment schedule and cash-flows are assumed to be constant and perpetual.

(k) The firms can be grouped into ‘homogeneous risk classes’, such that the market seeks the same return from all member firms in each group. All the firms within that group will have the same business or systematic risk at different levels of gearing.

(l) The stock markets are perfectly competitive.

(m) The investors are rational and expect other investors to behave rationally.

(n) Investors formulate similar expectations about future earnings, which are described by a normal probability distribution.

(o) The average expected future operating earnings of a firm are represented by a subjective random variable. It is assumed that the expected values of the probability distributions of all investors are the same.

(p) The dividend payout ratio is 100% Le. there are no retained earnings.

MM Theory: No Taxation:

The debt is less expensive than equity. An increase in debt will increase the required rate of return on equity. With the increase in the levels of debt, there will be higher level of interest payments affecting the cashflow of the company. Then equity shareholders will demand for more returns. The increase in cost of equity is just enough to offset the benefit of low cost debt, and consequently average cost of capital is constant for all levels of leverage as shown in figure 27.9.

In MM theory, the following symbols and their expressions are used:

Vu = Market Value of Ungeared Company i.e., Company with 100% equity financing.

Veg = Market Value of the Equity in a Geared Company.

D = Market Value of Debt in a Geared Company.

Vg = Veg+ D

Ku = Cost of Equity in an Ungeared Company.

Kg = Cost of Equity in Geared Company.

Kd = Cost of Debt

MM Theory: Proposition I:

The first proposition of MM theory on capital structure reads as ‘the market value of any firm is independent of its capital structure, changing the gearing ratio cannot have any effect on the company’s annual cash flow’. It is determined by the assets in which the company has invested and not how those assets are financed.

The total market value of the firm and its cost of capital are independent of its capital structure. The total market value of a firm is given by capitalising the expected stream of operating earnings at a discount rate appropriate for its risk class.

The value of the geared company is as follows:

Vg = Vu

Vg = Profit before interest/WACC

Vu = Vg = Earnings in ungeared company/Ku

WACC is independent of the debt/equity ratio and equal to the cost of capital which the firm would have with no gearing in its capital structure.

MM Theory: Proposition II:

The second proposition of MM theory asserts that ‘the rate of return required by shareholders increases linearly as the debt/equity ratio is increased i.e., the cost of equity rises exactly in line with any increase in gearing to precisely offset any benefits conferred by the use of apparently cheap debt’. MM went on arguing that the expected return on the equity of a geared company is equal to the return on a pure equity stream plus a risk premium dependent on the level of capital structure.

The equity holders of a geared firm expect a return equal to the expected return from the identical ungeared firm, plus a premium that is directly proportional to the level of gearing. There is no optimum level of gearing. WACC will be identical at all levels of gearing. The rise in cost of equity due to increased level of gearing will precisely offset the low cost debt, at all levels of gearing.

The WACC of a geared company is identical to the cost of equity of an ungeared company which is financed entirely by equity funds, which is determined by the risk free return plus premium for business risk of the company. The premium for financial risk can be calculated as debt/equity ratio multiplied by the difference between the cost of equity for an ungeared company and the risk-free cost of debt.

The cost of equity of a geared firm is calculated as follows:

By introducing debt in capital structure, the cost of equity raises linearly to offset the lower cost of debt directly giving a constant weighted average of capital irrespective of the level of gearing.

Illustration 7:

ABC Ltd. has financed its project with 100% equity with a cost of 21%. This also the weighted average cost of capital of the company. XYZ Ltd. another company identical to ABC Ltd., has financed its capital structure with 2: 1 debt-equity ratio. The cost of debt is 14%. Calculate the cost of equity of XYZ Ltd.

Solution:

As per Proposition II of MM theory, the cost of equity in the geared company Kg, is the cost of equity in the ungeared company Ku plus a premium for financial risk.

The WACC of geared company is same as the WACC of ungeared company.

MM Theory: Proposition III:

MM theory’s third proposition asserts that ‘the cut-off rate for new investment will in all cases be average cost of capital and will be unaffected by the type of security used to finance the investment’. The cut-off rate for investment purposes is completely independent of the way in which an investment is financed. This implies a complete separation of investment and financing decisions of the firm.

Illustration 8:

XYZ Ltd. intends to set up a project with capital cost of Rs. 50,00,000. It is considering the three alternative proposals of financing.

Alternative 1 = 100% equity financing

Alternative 2 = Debt-equity 1: 1

Alternative 3 = Debt-equity 3: 1

The estimated annual net cash inflow is @ 24% Le. Rs. 12,00,000 on the project. The rate of interest on debt is 15%. Calculate the weighted average cost of capital for three different alternatives and analyse the capital structure decision.

Solution:

WACC = (Cost of Equity x % Equity) + (Cost of Debt x % Debt).

Note:

It can be observed from the above illustration that at different levels of leverage, the WACC is same and the value of firm will also be same.

MM Theory: Arbitrage:

The process of buying an asset or security in one market and selling the same in another market to derive benefit from the price differential is referred to as ‘arbitrage’. The word ‘arbitrage’ is a technical term referring to a situation where two identical commodities are selling in the same market for different prices, then the market will reach equilibrium by the dealers start buy at the lower price and sell at the higher price, thereby making profit.

The increase in demand will force up the price of the lower priced goods and increase in supply will force down the price of the high priced commodities. MM argue that the process of arbitrage will prevent the different market values for equivalent firms, simply because of capital structure differences.

If two firms with same level of business risk but different levels of gearing sold for different values, then shareholders would move from over-valued firm to the under-valued firm and adjust their level of borrowing through the market to maintain financial risk at the same level.

The shareholders would increase their income through this method while maintaining their net investment and risk at the same level. This process of arbitrage would derive the price of the two firms to a common equilibrium total value.

In arbitrage process the shareholders of a firm with low WACC will sell their shares and purchase shares of a company with higher WACC, by borrowing or lending, to maintain the same level of risk-return before and after. These transactions of arbitrage will bring in equilibrium which are temporarily out of equilibrium.

The arbitrage transactions are cost free. Through these cost less transactions, investors can increase their return without increasing their risk. The arbitrage in MM theory show that the investors will move quickly to take advantage and will make profit in an equilibrium capital market, then this would represent an arbitrage opportunity. In arbitrage process the security prices adjust as market participants search for arbitrage profits. The security price will be in equilibrium, when the opportunity for arbitrage profits is exhausted.

Illustration 9:

Mr. D could increase his income by Rs. 16,000 (i.e., Rs. 82,000 – Rs. 66,000) while maintaining total risk at the same level.

Criticism:

The MM theory is criticised for the following reasons:

(a) In the real world, transaction costs exist. It is unrealistic to assume that broker commission, transfer fees and other transaction costs does not exist in trading of securities.

(b) The existence of efficient and perfect capital markets is only hypothetical. But in reality the capital markets operate in weak and semi-strong form due to asymmetric information.

(c) One of the important assumptions of MM theory is that corporate cost of borrowing does not increase with the level of gearing. But the debt providers demand for increased cost of debt for accepting higher levels of financial risk.

(d) MM theory assumes that interest rates are equal between individuals and corporates. But in practice, the debt funds available to corporate at cheaper rates as compared to individuals.

(e) The borrowing and lending rates cannot be equal. It depends upon the risk-return perception of the lenders.

(f) MM theory ignores the important aspect of financing through retained earnings. In real world, corporates will not payout the entire earnings in the form of dividends.

(g) MM theory assumed that there are no bankruptcy costs. But the firm has to incur costs like legal expenses, loss of investment opportunities, if the company fails to meet its financial obligations.

(h) A part of the corporate debt would be in the form of term loans from banks and financial institutions, and the investors cannot undo excessive leverage.

(i) Investors will not show much interest in purchase of low rated bonds issued by highly geared firms.

(j) Corporate leverage and home-made leverage are not perfect substitutes from the view of individual investor who is borrowing funds.

(k) MM theory was much criticised for the reason that it ignores the corporate taxation and personal taxation.

MM Theory: Corporate Taxation:

In our previous discussion, MM theory has ignored the tax relief on debt interest. MM has further modified their theory by considering tax relief available to a geared company when the debt component is existing in the capital structure.

The tax burden on the company will lessen to the extent of relief available on interest payable on the debt, which makes the cost of debt cheaper which reduces the weighted average capital of the firm to the lower where capital structure of a company has debt component. This MM theory adjusted to taxation is shown in figure 27.10.

Weighted Average Cost of a Geared Firm

Ke= (Cost of Equity x % of Equity) + (1-T) (Cost of Debt x % of Debt)

Illustration 10:

Corporate tax rate is 40%. The cost of equity is assumed to be 24%. Calculate the weighted average cost of capital of the company.

Solution:

Ke, = (24% x 0.333) + (1 – 0.40) (16% x 0.667) = 8% + 6.4% =14.4%

Under the assumption of tax relief being available on debt interest, the total market value of the company is increasing function of the level of gearing.

Cost of Equity of Geared Company:

Kg = Ku + (1-T) (Ku -Kd) x D/Veg

Where, T = Corporate tax rate

Kd = Pre-tax cost of debt

Now, refer back to the Illustration 27.7 to adjust the WACC to allow for corporate tax. Let us assume the corporate tax is 40%.

The WACC adjusted to corporate tax of a geared firm is as follows:

Kg = 21% + (1-0.40) (2196-1496) x 2/1

= 21% + (0.60) (14%) = 21%+ 8.4% = 29.4%

MM theory assumes that the value of the geared company will always be greater than an ungeared company with similar business risk, but only by the amount of debt-associated tax saving of the geared company.

Value of Geared Company

Vg = Vu+ DT

When corporate taxation is introduced, the tax deductibility of debt interest creates value for shareholders via the tax shield, but this is a wealth transfer from taxpayers. The value of a geared company equals the value of an equivalent ungeared company plus the tax saving.

With corporate taxation, the rate of return required by the geared company’s shareholders is less than that in the all equity company, reflecting the tax benefits. A further effect of corporate taxation is to lower WACC, which will fall continuously as gearing increases.

MM Theory: Personal Taxation:

MM theory considered only corporate taxes. It was left to a subsequent analysis by Miller (1977) to include the effects of personal, as well as, corporate taxes. He argued that the existence of tax relief on debt interest but not on equity dividends, would make debt capital more attractive than equity capital to companies.

The market for debt capital under the laws of supply and demand, companies would have to offer a higher return on debt in order to attract greater supply of debt. When the company offers an after personal tax return on debt at least as equal to the after personal tax return on equity, the equity supply will switch over to supply debt to the company.

It is assumed that, from the angle of the company, it will be indifferent between raising debt or equity as the effective cost of each will be the same and there is no advantage to gearing. Miller analysed the total supply and demand for debt by a corporate sector. The corporate sector as a whole would be prepared to issue debt upto the point where the extra interest paid is exactly compensated for by the tax shield on the debt interest.

Suppliers of funds would be prepared to take up debt provided that they were compensated by a high return so that the after tax return on debt was at least equal to the after tax return on equity.

Under the modern view of capital structure decisions, the favourable tax implications of borrowing will help reduce of average cost of capital even the levels of leverage increases. It is based on the assumption that interest payments on debt are allowed as a tax deduction whereas dividends on equity capital are not allowed for tax deduction.

Static Trade-Off Theory:

The horizontal base line in figure 27.12 expresses Modigliani and Miller’s idea that market value of firm (V) is the aggregate of market value of all its outstanding securities and should not depend on leverage when assets, earnings and future investment opportunities are held constant.

The static trade-off theory says that the value of firm depends on the tax deductibility of interest payments which induces the firm to borrow to the margin where the present value of interest tax shields is just offset by the value of loss due to agency costs of debt and the possibility of financial distress. Most business people agree that borrowing saves taxes and that too much debt can lead to cost trouble i.e., financial distress.

The static trade-off theory suggests the strong inverse correlation between profitability and financial leverage. Generally, high profits mean low debt. But the static trade-off theory would predict just the opposite relationship. Higher profits mean more amount available for debt service and more taxable income to shield. They should mean higher target debt ratios. The theory sounds in theory, but in practice business would prefer to avoid financial distress and situations of bankrupting.

Financial Distress and Agency Costs:

The assumption is that when firm has very high level of borrowing they are more likely to run into the costs of financial distress and costs of bankruptcy. When the leverage of the firm is extremely high, then it is very likely that at some stage it will not be able to make annual interest payments and loan repayments.

Dividends for shareholders can be bypassed but failure to pay interest on loans often gives the lender the right to claim on the firms operating assets thereby preventing the firm’s continuity of activity. The value of a levered firm, considering the tax shield, financial distress costs, bankruptcy costs and agency costs is represented in figure 27.13.

The market value of levered firm can expressed as follows:

Market Value of Levered Firm = (Market value of Unlevered firm + P.V. of Tax-shield) – (P.V. of Financial costs + P.V. of Agency costs)

Financial Distress and Bankruptcy Costs – As firm increases its debt level, the providers of debt may demand for higher rates of interest to compensate for accepting greater financial risk. Due to high cost of debt, the firm may forgo acceptable projects, which constitutes an opportunity cost.

The following illustrative list of activities which may cause increase in costs of the firm:

(a) Successive borrowing beyond the company’s target debt-equity ratio

(b) Borrowing higher levels of interest

(c) Skip-off or cut in dividend which may cause the fall of market rate of shares

(d) Loss of trade credit from suppliers

(e) Distress sale of highly profitable instruments

(f) Abandonment of promising new projects.

(g) Reduced credit period resulting in loss of business

(h) Corporate image may be tarnished

(i) Demand for withdrawal of loans made to the firm previously

(j) Reduction in stock levels result in reduction in sales etc.

Bankruptcy costs can be classified into direct and indirect costs. The direct costs include costs paid to debtors in the bankruptcy and restructuring process. The indirect costs are associated with loss of customers, suppliers and key employees. It includes the managerial effort extended to manage the firm in its distressed condition.

Agency Costs:

Agency theory models a situation in which a principal (a superior) delegates decision making authority to an agent (the subordinate) who receives reward in return for performing some activity on behalf of the principal.

The outcome of the agents effects the principals welfare in some way, for example sales revenue, output or contribution margin. The principal attempts to combine a reward system with an information system, in order to motivate the agent to choose the action which maximises the principal’s welfare.

In respect of debt finance, the suppliers of debt are much concerned, about their investment in the company, about the risks involved in financing debt to the company. In order to minimise the risks in debt finance, the suppliers of loan will impose restrictive conditions in loan agreements that restricts management’s freedom of action and it is known as ‘agency costs’.

The more money the suppliers of debt lend to the company – then the more constraints they are likely to impose on the management’s freedom in order to secure their investments. Therefore, agency costs are more in highly geared firms. Van Home (1988) admitted that a firm could enhance the market price of share through the judicious use of leverage.

At the same time, he mentioned that bankruptcy costs work to the disadvantage of extreme leverage. However he affirmed that a combination of the net tax effect with bankruptcy costs will result in an optimal capital structure.

Pecking Order Theory:

The Pecking Order Theory was first proposed by Donaldson in 1961. The theory was further developed by Myers in 1984. According to the theory, a firm may not have a particular target or optimal capital structure.

The theory asserts that a company’s capital structure is more dependent on internal cashflows, cash dividend payments and acceptable investment opportunities (i.e., NPV > 0). According to the theory, a firm will link its dividend policy with its capital gearing and investment decisions. The theory emphasises costs involved in raising of funds for investment.

The major assumptions of the theory are summarised below:

(a) There are no costs involved in using internally generated funds, since there are no issue costs involved in using retained profits.

(b) It is expensive to raise external funds.

(c) Raising of debt is relatively cheaper than raising of equity funds.

(d) Raising of term loans from banks and financial institutions is cheaper than issuing debt securities for raising finances.

(e) Issue of equity capital involves relatively high issue cost.

(f) Servicing of debt funds is cheaper than servicing of equity funds.

The theory suggests that when a company is looking to finance its long-term investments, it has well defined order of preference with respect to the sources of finance it uses. Initially the firm will prefer to use internally generated funds rather than externally raised finances.

If the internal funds are insufficient to meet its investment requirements, then it will prefer to raise external funds in the form of term loans and then in the form of non-convertible debentures and bonds and then in the form of convertible debt instruments. After exhausting all the previous sources, the company would opt for raising finances in the form of new equity capital.

The pecking order theory of capital structure says that:

(i) Dividend policy is ‘sticky’.

(ii) Firms prefer internal to external financing. However, they seek external financing if necessary to finance real investments with a positive net present value (NPV).

(iii) If firms do require external financing, they will issue the safest security first, that is, they will choose debt before equity financing.

(iv) As the firms seeks more external financing, it will work down the pecking order of securities from safe to risky debt, perhaps to convertibles and quasi-equity instruments, and finally to equity as a last resort.

Modified Pecking Order Theory:

Myers (1984) suggested that the firm will follow a ‘modified pecking order’ in their approach to financing. He suggested that the order of preference stemmed from the existence of asymmetry of information between the company and markets.

Myers suggested asymmetric information as a reason for heavy reliance on internally generated funds. Due to asymmetry of information, the firm’s projects may be undervalued by the market, therefore the managers would prefer to finance its projects with internal finances and the market finally sees the true value of the project and then the existing shareholders will benefit.

If internal funds are insufficient to finance firm’s projects, it will choose to raise funds in the form of debt, since due to asymmetric information the project may be undervalued by the market and issue of new equity shares is interpreted by the market as bad news. If the managers considers that project is over-valued by the market, they will tend to issue new shares at what they consider to be the over-valued price.

Myer argued that a levered firm mostly takes sub-optimal investment decision because of the existence of fixed interest obligation. At the initial stage of the project the expected cash inflows may not be sufficient to meet the interest charges when the stockholders interest would be adversely affected.

The probability of earning less than what is required to protect the existing stockholders restrains the firm to accept the project whose estimated initial inflows is relatively lower though the same may yield an ultimate positive NPV. Considering this situation he pointed out that optimal capital structure is attained at a point where the expected value of tax shield on additional debt is equal to the expected value of investment opportunity given up.