At the core of a governmental reporting entity’s comprehensive annual financial report are the general purpose financial statements. These statements are made up of government-wide financial statements and fund-based financial statements. Government-wide statements present financial information for both governmental activities and business-type activities. These statements measure economic resources and utilize accrual accounting.

The fund-based statements separately present the governmental funds, the proprietary funds, and the fiduciary funds. At the fund level, the measurement focus and the method of accounting depend on the fund in question. For governmental funds, the current financial resources measurement focus is used with modified accrual accounting. However, both proprietary funds and fiduciary funds use accrual accounting to measure economic resources.

However, now that a deeper understanding of government accounting has been established, these same statements as well as several other fund-based statements can be examined in more detail. Having an appreciation for the end result of the accounting process helps to show how the diverse elements of government accounting fit together into a complete reporting package.

Hundreds, if not thousands, of actual financial statements are readily available. An Internet search will locate the home page of virtually any U.S. city or county of significant size. On that site, a search of “CAFR” or “financial report” should locate the latest statements. Understanding is greatly enhanced by reviewing such statements.

Statement of Net Assets—Government-Wide Financial Statements:

ADVERTISEMENTS:

Exhibit 17.1 presents the June 30, 2004, statement of net assets for the City of Sacramento, California. As a government-wide financial statement, it is designed to report the economic resources of the government as a whole (except for the fiduciary funds, which are not included because those assets must be used for a purpose outside the primary government).

Several aspects of this statement of net assets should be noted specifically:

i. The measurement focus is the economic resources controlled by the government. Thus, all assets including capital assets are reported. Long-term liabilities are presented for the same reason.

ADVERTISEMENTS:

ii. Capital assets other than land, land improvements, inexhaustible artworks, and construction in progress are reported net of accumulated depreciation because depreciation is required on the government-wide statements. Newly acquired infrastructure assets are included within the capital assets.

The remaining historical cost basis of previously acquired infrastructure, if major and acquired or renovated since 1980, has been estimated and capitalized. Infrastructure depreciation is omitted if the modified approach is used. However, the City of Sacramento did not choose to use the modified approach.

iii. The primary government is divided into governmental activities and business-type activities. Governmental funds are reported as governmental activities whereas enterprise funds comprise most, if not all, of the business-type activities. Even though recorded within the proprietary funds, internal service funds are normally included within the governmental activities because those services are rendered primarily for the benefit of activities within the governmental funds. However, if a particular internal service fund predominantly serves an enterprise fund, that internal service fund should be included as a business-type activity.

iv. The internal balances shown in the asset section come from receivables and payables between the governmental activities and the business-type activities. The internal balances reported on this statement offset each other (except for a small $563,000 balance that may well be owed to one of the fiduciary funds) so that there is no effect on the totals shown for the primary government.

ADVERTISEMENTS:

v. Investments are reported at fair value rather than historical cost.

vi. Discretely presented component units are grouped and shown to the far right side of the statement so that the reported amounts do not affect the primary government figures. However, if any blended component units exist, those balances are included, as appropriate, within either the governmental activities or the business-type activities as if they were individual funds.

According to the notes to the City of Sacramento’s financial statements, there were three discretely presented component units including the Sacramento Regional Arts Facilities Financing Authority as well as three blended component units such as the Sacramento Housing and Redevelopment Agency.

vii. Because this is a statement of net assets, the format is not structured to stress that assets are equal to liabilities plus equities as is found in a typical balance sheet. Rather, the assets ($3.77 billion for the primary government) less liabilities of $1.42 billion indicated net assets of $2.35 billion.

ADVERTISEMENTS:

viii. As the Net Assets section shows, several amounts have been restricted for capital projects, debt service, and the like. Restrictions are reported in this manner only if usage of the assets has been specified by external parties such as creditors, grantors or other external party, or because of laws passed through constitutional provisions or enabling legislation.

ix. Although not restricted, the amount of net assets tied up in capital assets less any related debt is reported as a separate figure within the Net Assets section. Such amounts are not readily available.

Statement of Activities—Government-Wide Financial Statements:

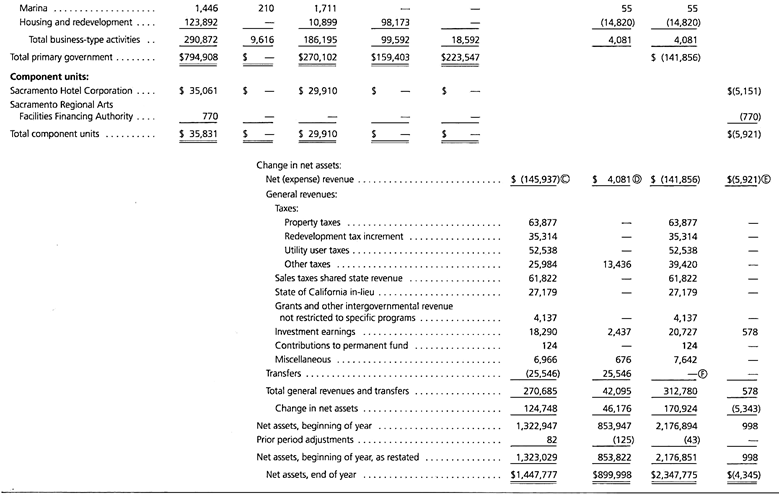

The statement of activities is one of the most important governmental financial statements because of the wide array of information that it presents. As the statement for the City of Sacramento, California, in Exhibit 17.2 shows, the same general classification system of governmental activities, business-type activities, and component units used in Exhibit 17.1 provides the structural basis for reporting revenues and expenses. However, the format here is more complex and requires close analysis.

i. Operating expenses are presented in the first column. They are not classified according to individual causes such as salaries, rent, depreciation, or insurance. Instead, all expenses are shown by function, which is more relevant to readers- general government, police, fire, public works, and the like. As GASB Statement 14 states, “as a minimum, governments should report direct expenses for each function. Direct expenses are those that are specifically associated with a service, program, or department and, thus, are clearly identifiable to a particular function.”

ii. Interest expense on general long-term debt is normally viewed as an indirect expense because it benefits many government operations. However, due to its size, informational value, and difficulty of allocation, this expense frequently is shown as in Exhibit 17.2 as a separate “function.”

iii. After operating and indirect expenses have been determined for each function (governmental activities, business-type activities, and component units), related program revenues are reported in the next three columns. Program revenues are those revenues derived from the function itself or from outsiders seeking to reduce the government’s cost.

As Exhibit 17.2 shows, program revenues are classified as:

ADVERTISEMENTS:

1. Charges for Services:

For example, a monthly charge is normally assessed for water service; therefore, this first business-type activity shows more than $45.9 million in program revenues. In contrast, most government functions generate only relatively small amounts of monetary charges such as parking meter revenues, fines for speeding tickets, concessions at parks, and the like.

2. Operating Grants and Contributions:

This column reports amounts received from grants and similar sources that were designated for some type of operating purpose. For example, $25.9 million in operating grants and contributions is shown for housing and redevelopment.

ADVERTISEMENTS:

3. Capital Grants and Contributions:

This column shows grants and similar sources when the resources were designated for capital asset additions.

i. After expenses have been assigned to each function along with related program revenues, a net (expense) or revenue figure can be determined. This net figure provides a measure of the financial cost (or benefit) of the various government functions. As explained in GASB Statement 14, “an objective of using the net (expense) revenue format is to report the relative financial burden of each of the reporting government’s functions on its taxpayers.” For example, in Exhibit 17.2, the police department had more than $106 million in operating expenses but was able to generate program revenues of only $17 million from charges for services and operating grants and contributions.

Thus, as disclosed on this statement, the taxpayers of that city had to bear the financial burden for police protection of more than $89 million (see point A). The amount of that cost should be important information to any citizen reading these statements. In contrast, the water system reported operating and indirect expenses of $48 million, but its charges, grants, and contributions totaled $56 million. Thus, this business-type activity generated net revenues of approximately $8 million (see point B) as a financial benefit for the government during this period.

ii. Net expenses and revenues can be determined in total for each category of the government. In this example, all governmental activities combined to report net expenses of more than $145 million (see point C) while the business-type activities generated net revenues of approximately $4 (see point D) million. The component units reported net expenses of almost $6 million (see point E).

iii. Again, the internal service funds have been combined with the governmental activities (or with the business-type activities if that is more appropriate). The revenues and expenses should be assigned to the appropriate functions. For example, the cost of work done by an internal service fund created to assist the work of economic development should be assigned to that function.

ADVERTISEMENTS:

iv. General revenues are reported at the bottom of the statement as additions to either the governmental activities, business-type activities, or component units. All taxes are general revenues because they do not reflect a charge for services; they are obtained from the population as a whole. In addition, inflows such as unrestricted grants and investment income fall under this same category.

v. Transfers of $25,546,000 during the year between governmental activities and business- type activities are also shown under the general revenues, but they offset, so they create no impact on the total that the primary government reports (see point F).

Balance Sheet—Governmental Funds—Fund-Based Statements:

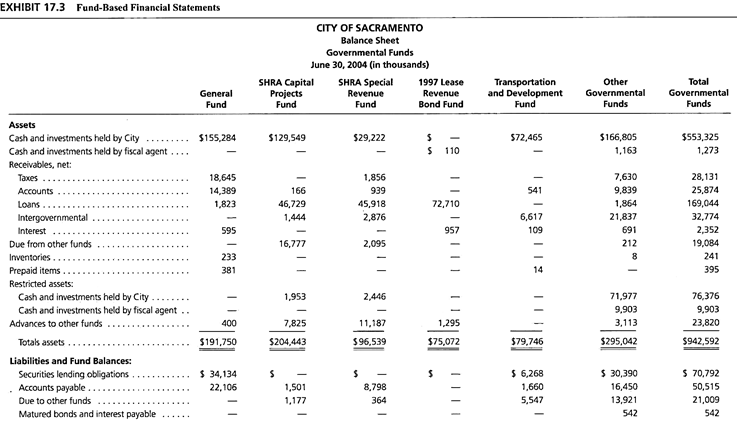

Switching now to the fund-based financial statements, Exhibit 17.3 presents the balance sheet for the governmental funds reported by the City of Sacramento. This statement measures only current financial resources and uses modified accrual accounting for timing purposes. No proprietary funds, component units, or fiduciary funds are included; this fund-based statement reflects just the governmental funds.

Several parts of this statement should be noted:

i. A separate column must be shown for the General Fund and any other major fund monitored within the governmental funds. The city has identified four funds as major including both the Capital Projects Fund and the Special Revenue Fund associated with the Sacramento Housing and Redevelopment Agency (SHRA). The government can classify any fund as major if officials believe it is particularly important to statement users.

However, a fund is considered major and must be reported separately if it meets two criteria:

1. Total assets, liabilities, revenues, or expenses/expenditures of the fund are at least 10 percent of the corresponding total for all such funds.

2. Total assets, liabilities, revenues, or expenses/expenditures of the fund are at least 5 percent of the corresponding total for all governmental funds and enterprise funds combined.

All funds that are not considered to be major are combined and reported as “Other Governmental Funds.”

i. This balance sheet reports no capital assets or long-term debts because only current financial resources are being measured.

ii. Totals for the governmental funds appear in the final column. However, internal balances such as “due from other funds” (a receivable) and “due to other funds” (a liability) have not been offset. The governmental totals are just mathematical summations, not consolidated balances.

iii. In the Fund Balances section of this balance sheet, both “reserved” and “designated” amounts are shown. The word reserved indicates that some portion of the assets being reported cannot be spent for legal reasons or because of its nature (such as inventory). In contrast, designated figures disclose tentative plans by officials for the usage of some assets of the fund, but those plans are subject to change in the future.

iv. The total Fund Balances figure for the governmental funds of $590.1 million (point G) is significantly different from the $1,447.8 million in total net assets reported for governmental activities as a whole in the statement of net assets (Exhibit 17.1). To help understand that large discrepancy, a reconciliation is included along with the balance sheet (titled Reconciliation of the Balance Sheet to the Statement of Net Assets—Governmental Funds).

According to this reconciliation, the four largest items that formed the link between the totals shown for the governmental activities of the government-wide financial statements and those of the governmental funds of the fund-based financial statements are:

1. More than $1.2 billion of capital assets reported by the governmental activities on the government-wide financial statements (Exhibit 17.1) were omitted on the comparable fund-based financial statement (Exhibit 17.3).

2. Revenue transactions of $170 million had not been recognized in the fund-based statements because the resulting financial resources were not viewed as being available in the current period.

3. Only the government-wide financial statements reported long-term liabilities (of approximately $655 million) because they did not represent claims to current financial resources.

4. Internal service funds with net assets of $44 million were included in the governmental activities although, for fund-based financial statements, they were classified as proprietary funds rather than governmental funds.

Statement of Revenues, Expenditures, and Changes in Fund Balances—Governmental Funds—Fund-Based Statements:

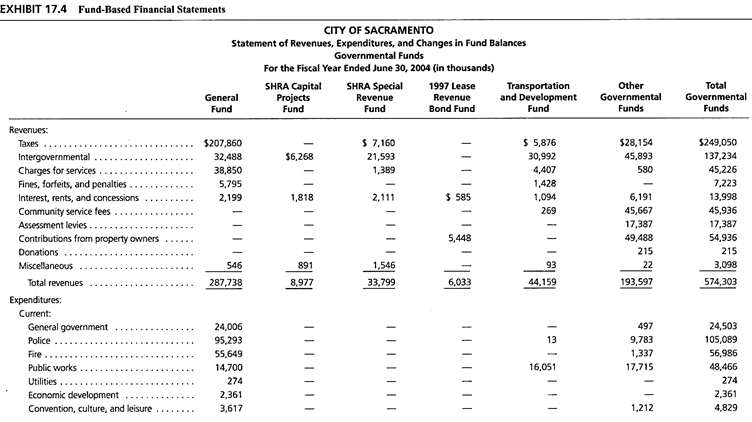

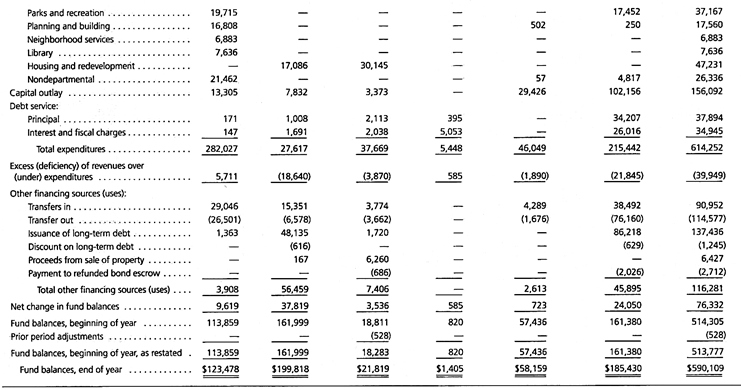

Exhibit 17.4 presents the statement of revenues, expenditures, and changes in fund balances for the governmental funds of the City of Sacramento. Once again, the General Fund is detailed in a separate column along with each of the major funds identified in Exhibit 17.3. Figures for all remaining non-major funds are then accumulated and shown together.

In examining Exhibit 17.4, note each of the following:

i. Because the current financial resources measurement focus is being utilized, expenditures rather than expenses are being reported. For example, Capital Outlay is presented here as a reduction in resources but on the government-wide statements would have been capitalized. In the same way, Debt Service—Principal is reported on the statement in Exhibit 17.4 as an expenditure but would decrease liabilities on government-wide statements.

ii. Because the modified accrual method of accounting is used for timing purposes, reported amounts will be different than those shown before. For example, total expenditures for interest and fiscal charges are listed on Exhibit 17.4 as $34,945,000 whereas interest on long-term debt disclosed in Exhibit 17.2 is $29,306,000. The first figure measures expenditures during the period using modified accrual accounting and the second figure is the amount of expense recognized according to accrual accounting.

iii. Exhibit 17.4 presents other financing sources and uses to reflect the issuance of long-term debt, the sale of property, and transfers made between the funds. Because the fund-based statements are designed to present individual fund activities rather than government-wide figures, no elimination of the transfers is made.

iv. A reconciliation should be shown between the ending change in governmental fund balances (an increase of $76,332,000) in Exhibit 17.4 and the ending change in net assets for governmental activities in Exhibit 17.2 (an increase of $124,748,000). Because of space considerations, that reconciliation is not presented here although it would be required in the general purpose external financial statements.

For the City of Sacramento, the major differences listed on this reconciliation involved the acquisition of capital assets, the recording of depreciation, the recording of revenues that did not provide current financial resources, the issuance of long-term debt, and the repayment of long-term debt.

Statement of Net Assets—Proprietary Funds—Fund-Based Statements:

The assets and liabilities of the City of Sacramento’s proprietary funds, as reported in the fund- based financial statements, are presented in Exhibit 17.5. This statement shows individual information about six enterprise funds, with a single column for the summation of all other enterprise funds.

In addition, the statement provides a total for all of these business-type activities. Specific information is available for the water fund, sewer fund, storm drainage fund, solid waste fund, community center fund, and SHRA enterprise fund as well as the total for all enterprise funds.

In examining Exhibit 17.5, a considerable amount of significant information should be noted:

i. This statement combines and exhibits the internal service funds because they are all proprietary funds. However, government-wide financial statements usually report these same internal service funds as part of the governmental activities.

ii. Because the proprietary funds utilize accrual accounting to measure economic resources, the totals for the business-type activities (for the enterprise funds) in Exhibit 17.5 agree in most ways with the total figures in Exhibit 17.1. The amount of detail, however, is more extensive in the fund-based financial statements. For example, the statement in Exhibit 17.1 uses only two accounts to describe capital assets whereas Exhibit 17.5 uses seven.

iii. The Internal Balance amounts (interactivity receivables and payables) of $43,054,000, which were reported in Exhibit 17.1 within the Assets section so that they could be offset, are reported separately in Exhibit 17.5 in the Assets section as Due from Other Funds and Advances to Other Funds and in the Liabilities section as Due to Other Funds and Advances from Other Funds.

However, none of these four figures is eliminated; all are reported in the Total column. That is the reason that total assets and total liabilities reported in Exhibit 17.1 for the business-type activities differ from the reported figures shown in Exhibit 17.5 for the enterprise funds.

iv. Restricted cash and investments of more than $41 million are listed under Noncurrent assets. An external source or specific laws must have designated the use of this money in some manner.

Statement of Revenues, Expenses, and Changes in Fund Net Assets—Proprietary Funds—Fund-Based Statements:

Just as the statement of net assets in Exhibit 17.5 provides individual information about specific enterprise funds (and totals for the internal service funds), the statement of revenues, expenses, and changes in fund net assets in Exhibit 17.6 gives the revenues and expenses for those same funds. As an example, in Exhibit 17.2, operating and indirect expenses of the water fund totaled $47,843,000.

Exhibit 17.6 delineates this amount more completely within several categories: employee services, $14,970,000; services and supplies, $15,310,000; depreciation, $7,155,000; interest expense, $10,307,000; and amortization of deferred charges, $101,000. Because this statement reflects all changes in the activity’s net assets, it also reports both capital contributions and transfers.

Statement of Cash Flows—Proprietary Funds—Fund-Based Statements:

One of the most unique aspects of the fund-based financial statements is the statement of cash flows for the proprietary funds (see Exhibit 17.7). Because a proprietary fund operates in a manner similar to a for-profit business, information about cash flows is considered as vital as it is for Intel and Coca-Cola.

As compared to a for-profit business, the statement of cash flows shown here for the proprietary funds has four sections rather than just three:

1. Cash flows from operating activities.

2. Cash flows from noncapital financing activities.

3. Cash flows from capital and related financing activities.

4. Cash flows from investing activities.

i. The presentation of cash flows from operating activities is very similar to that prepared by a for-profit business. However, rather than being an optional method of presentation, as with for-profit accounting, the direct method of reporting operating activities is required.

ii. Cash flows from noncapital financing activities should include-(1) proceeds and payments on debt not attributable to the acquisition or construction of capital assets and (2) grants and subsidies not restricted for capital purposes or operating activities.

iii. Cash flows from capital and related financing activities focus on the amounts spent on capital assets and the source of that funding. Exhibit 17.7 shows typical examples- proceeds from issuance of debt, capital contributions (from the governmental funds), acquisition and construction of capital assets, principal payments on capital debt, and the like.

iv. Cash flows from investing activities disclose amounts paid and received from investments.