After reading this article you will learn about Inventory Management:- 1. Meaning of Inventory Management 2. Objectives of Inventory Management 3. Techniques 4. Inventory Valuation.

Meaning of Inventory Management:

‘Inventory refers to the stockpile of the product a firm is offering for sale and the components that make up the product.’ In short, inventory is such type of assets which will be disposed of in future in the ordinary course of the business.

In other words, ‘Inventory” is used to designate the aggregate of those items of tangible assets which are:

(i) Held of sale in ordinary course of the business;

ADVERTISEMENTS:

(ii) In the process of production for such sale; or

(iii) To be currently consumed in the production of goods or services to be available for sale.

Thus, it means and includes:

(i) Raw Materials & Stores — (Consumable):

ADVERTISEMENTS:

It contains items which are purchased by the firm from others.

(ii) Work-in-Progress — (Convertible):

It consists of items which are currently used in the production process. These are semi-finished goods that are held at various stage of production in multi-stage production process.

(iii) Finished goods — (Saleable):

ADVERTISEMENTS:

It represents final or completed products which are available for sale.

In financial management, however, inventory is defined as the sum total of raw materials, work-in-progress and finished products although it depends largely upon the type of business.

For example, in case of manufacturing concern, inventory will mean and include all the three groups stated above while, in case of a trading concern, it will represent only the finished goods. Manufacturing concerns hold inventories to give flexibility between production and sales.

That is why, it is the duty of the financial manager to see whether increase in inventories results in increased earnings and to minimize the level of inventories, as well. As such, if inventories are reduced as a result of sale, the funds so generated may be used for different purposes.

ADVERTISEMENTS:

Need to Hold Inventories:

Holding of inventories involves tying up funds of the company and storage and handling costs.

There are three general motives for holding inventories:

(i) The Transactions Motive:

ADVERTISEMENTS:

It expresses the need to maintain inventories to facilitate production and sales operation smoothly.

(ii) The Precautionary Motive:

It necessitates holding of inventories to guard against the risk of unpredictable change in demand and supply forces.

(iii) The Speculative Motive:

ADVERTISEMENTS:

It influences the decision to increase or reduce inventory levels to take advantages of price fluctuations. In order to maintain an uninterrupted production it becomes necessary to hold adequate stock of materials since there is a time lag between the demand for materials and its supply due to some unavoidable circumstances.

Besides, there are two other motives for holding of inventories — viz., to receive the benefit of quantity discount on account of bulk purchases and to avoid the anticipated rise in price of raw material.

The work-in-progress builds up since there is production cycle. Actually, the stock of work-in-progress is to be maintained till the production cycle completes. Similarly, stock of finished goods has also to be held since there is a time lag between the production and sales.

When goods are demanded by the customers, it cannot immediately be produced and as such, for a continuous and regular supply of goods, minimum stock of finished goods is to be maintained. Stock of finished goods should also be maintained for sudden demands from customers and for seasonal sales.

ADVERTISEMENTS:

Therefore, the primary objectives of holding raw materials are:

(i) To separate purchase and production activities and for holding finished goods there should be a separate production and sales activities;

(ii) To obtain quantity discount against bulk purchases, and

(iii) To avoid interruption in production.

At the same time, work-in- progress inventory is necessary since production is not instantaneous and finished goods should also be maintained for: (i) serving customer on a continuous basis; (ii) meeting the fluctuating demands.

Objectives of Inventory Management:

Efficient inventory management should result in the maximization of the owner’s wealth. For this purpose, a firm should neither hold excessive inventories nor hold inadequate inventories, i.e., it should hold the optimum level of inventory. The optimum level of inventory investment lies between the point of excessive and inadequate levels.

ADVERTISEMENTS:

In other words, there must not be an over investment or under investment in inventories.

The dangers of over investment in inventories are:

(i) Funds of the firm are tied-up unnecessarily;

(ii) It creates loss of profit;

(iii) Excessive carrying cost and risk of liquidity increases.

As such, the opportunity cost and carrying costs (viz., cost of storage, handling, insurance etc.) increase proportionately. No doubt, these costs will impair the profitability of the firm. Excessive investment in raw materials will prove the same result except at the time of inflation and scarcity.

Similar results may also be noticed for the over investment in work-in-progress since it is very difficult to sell. Similarly, many difficulties will appear to dispose of excessive finished goods since time lengthens (viz., the goods may be sold at low price etc.).

Moreover, for carrying excessive inventory physical deterioration of the same may occur while in storage. From the above, it becomes crystal clear that there must not be an over investment in inventories.

Similarly, inadequate level of inventories is not also free from snags.

The consequences are:

(i) Production may shut-down;

(ii) Commitment for the delivery may not be possible;

(iii) Inadequate raw material and work-in-progress will create frequent production interruption;

(iv) Customers may shift to the competitor if their demands are not met up regularly, etc.

Thus, the objective of inventory management is to maintain its optimum level in the following manner:

(a) To ensure a continuous supply of materials to facilitate uninterrupted production.

(b) To maintain sufficient stocks of raw materials during short-supply;

(c) To maintain sufficient finished goods for efficient customer service;

(d) To minimise the carrying cost; and

(e) To maintain the optimum level of investment in inventories.

Cost of Holding Inventory:

It has been highlighted above that the object of inventory management is to maintain the optimum level of inventory.

This optimum level depends on the following costs:

(i) Ordering/Acquisition/Set-up Costs, and

(ii) Carrying Costs.

(i) Ordering/Acquisition/Set-up Costs:

These are the variable costs of placing an order for the goods Orders are placed by the firm with suppliers to replenish inventory of raw materials. Ordering costs include the cost of requesting, purchasing, ordering, transporting, receiving, inspecting and storing. The ordinary costs vary in proportion to the number of orders placed.

They also include clerical costs and stationery costs (That is why it is called a set-up cost) Although, these costs are almost fixed in nature, the larger the order placed, or the more frequent the acquisition of inventory made, the higher are such costs. Similarly, the fewer the orders, the lower the order cost will be for the firm. Thus, the ordering/acquisition costs are inversely related to the level of inventory.

(ii) Carrying Cost:

These are the expenses of storing goods, i.e., they are involved in carrying inventory.

The cost of holding inventory may be divided into:

(i) Cost of Storing the Inventory and

(ii) Opportunity Cost of Funds.

(i) Cost of Storing the Inventory:

This Include:

(a) Storage Cost (i.e., tax, depreciation, insurance, maintenance of building etc.);

(b) Insurance (for fire and theft);

(c) Obsolescence and Spoilage;

(d) Damage or Theft;

(e) Serving Costs (i.e., clerical, accounting costs etc.).

(f) Cost of running out of goods.

(ii) Opportunity Cost of Funds:

This includes the expenses in raising funds (i.e. Interest on Capital) which are used for financing the acquisition of inventory.

The level of inventory and the carrying costs are positively related and move in the same direction, i.e., if inventory level decreases, the carrying costs also decrease and vice-versa.

Techniques of Inventory Management:

In order to maximize the owner’s wealth, the financial manager should aim at the optimum level of inventory on the basis of trade-off between cost and benefit.

There are two techniques which may be advocated for the purpose:

(a) Traditional Techniques to Inventory Management.

(b) Scientific Techniques to Inventory Management.

(a) Traditional Techniques to Inventory Management:

Under this method, comparison may be made between firms belonging to same industry or within the same firm for a particular period or over a period of time for establishing the standard by which efficient inventory management or otherwise may be determined.

For the purpose the following ratios are commonly used :

(i) Materials Turnover:

Average Materials in Stores/Average Daily Consumption

(ii) Work-in-Progress Turnover:

Average W-I-P/Average Factory Cost of Production

(iii) Finished Goods Turnover:

Average F.G. in Stores/Average Cost of Production

The above ratios are used for testing whether the raw materials are over purchased or not, production control is effective or ineffective and finished goods are slow moving or not Therefore, an important indication of efficiency can be noticed with the help of these ratios.

Although, the rapidity of turnover depends on the nature of business, the higher the turnover ratio, the shorter will be the time period. So, the quicker the turnover, the greater will be the profitability and vice-versa. Since, the ratios are not free from snage, the next approach, i.e. Scientific Techniques to Inventory Management may be applied

(ii) Scientific Techniques to Inventory Management:

The major problems comprise the heart of inventory control which are:

a) The Classification Problem;

b) The Order Quantity Problem (how much to order);

c) The Order Point Problem (when to order); and

d) Safety Stock

(a) The Classification Problem:

ABC Analysis:

This widely-used classification technique recognizes different items of inventory for the purpose of inventory control which is based on the assumption that a firm should not exercise equal attention on all items of inventory since a firm has to maintain various types of inventories.

It, therefore, should pay maximum attention to those items that are:

(i) Most costly, and (or)

(ii) Slow moving.

On the contrary, inventories which are less expensive should be given less control effort. Thus, the firm should be selective in its approach towards the inventory control management. This analytical approach is known as ABC Analysis Approach which tends to measure the relative cost significance of each component of inventories.

According to this system, various items are grouped into three distinct categories:

(a) ‘A’ — Items:

Which involves the highest/largest-investment and as such, would be under the tightest control, i.e., the most sophisticated inventory control techniques should be applied.

(b) ‘C’ — Items:

Which involves relatively least value and as a result, need not require any special attention and control.

(c) ‘B’ — Items:

Which stands in between items ‘A’ and ‘C’. It desires less attention than A but more attention than C, or, it requires reasonable attention of the management.

Since the above items are classified according to importance of their relative value, it is also known as Proportional Value Analysis (PVA).

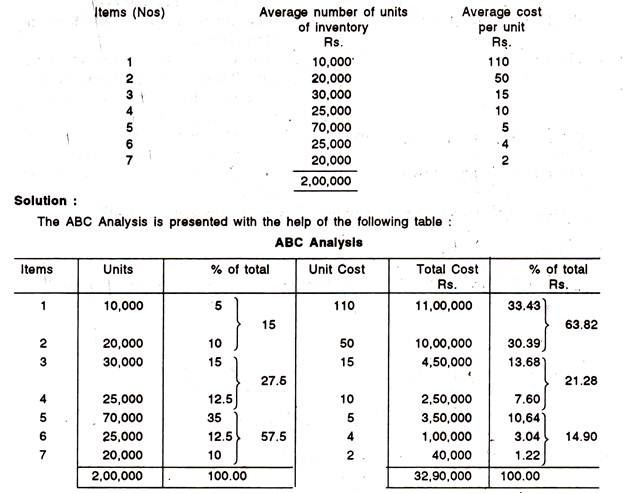

The following table which is presented on the basis of physical quantities and value, will make the principle clear:

The above graphic presentation indicates that Item ‘A’ forms a minimum proportion but represents the highest value, viz., 70% of the cost. On the contrary, Item ‘C’ represents 65% of the total units but 10% of the cost. And Item ‘B’ occupies the middle place.

Thus, Item ‘A’ and Item ‘B’ jointly represent 35% of the total units but 90% of the total investment whereas Item ‘C’ forms more than half of the total units against 10% of the total investment. So, the highest control should be exercised on Item ‘A’ for maximizing profitability.

Illustration:

Firm X has 7 different items in its inventory. The average number of units in inventory together with their average cost per unit is presented below. Suggest a break-down of the items into ABC classification assuming that the firm wants to introduce ABC Inventory system.

No doubt, the ABC analysis is a very useful technique. But it should be used with care for example, an item of inventory may be very inexpensive but at the same time may be very critical to the production process and which may not be easily available.

As such, as per ABC analysis, it would be classified into Item ‘C’ which requires least attention. But because of its special importance to the production process, it deserves special attention of the management.

(b) The Order Quality Problem:

Economic Order Quantity (EOQ):

How much inventory should be added when inventory is replenished is a major problem in inventory management, i.e., how much to buy or produce at a time is really a problem to the management. If bulk quantities are purchased, the cost of carrying will be high and on the contrary, if small quantities are purchased at frequent intervals, ordering cost will be high.

Therefore, the quantity to be ordered at a given time should be economic, taking mainly two factors into account, viz., ordering costs and carrying costs.

In short, it represents the most favourable quantity to be ordered at the reorder level EOQ is a problem of balancing the two conflicting kinds of costs — cost of carrying (arising out of balance purchases) and cost of not carrying (arising out of frequent purchases in small lots).

To sum up, EOQ is determined at the point where the carrying costs are approximately equal to the cost of not carrying (the ordering costs), where the total cost is minimum.

However, the natures of the above costs are discussed below:

Cost of Carrying:

1. Handling and transportation

2. Clerical.

3. Rent, Insurance and other Costs of storage

4. Interest on capital blocked.

5. Pilferage and normal loss of holding.

Cost of not Carrying:

1. Extra cost of purchasing, handling and transportation

2. Frequent stock-outs resulting in disruption of production schedules and consequently extra costs of overtime setups, hiring and training.

3. Foregone quantity discounts and contribution margins on lost sales.

4. Additional cost of uneconomic production runs.

5. Loss of customer goodwill.

6. Risk of obsolescence.

The EOQ model is illustrated below with the help of the following diagram:

In the above diagram, the ordering costs, inventory carrying cost and the total costs are plotted The diagram shows that the carrying costs vary directly with the size of the order whereas ordering costs vary inversely with the size of the order. The total cost (i.e., the sum of two costs) curves at first go downwards due to the fact that at this stage the fixed costs of ordering are spread over many units.

But at the next stage, this curve goes upward because of the fact that at this stage, decrease in average ordering costs is more than what is offset by the additional inventory carrying costs. The point P denotes the optimum order where the total cost is the minimum. There- fore, UP units are considered as the EOQ.

It should be remembered that the EOQ is not a stock level. It lies between the Maximum Stock Level and Minimum Stock Level. However, the EOQ will be determined in such a way as would help in earning the advantages of bulk purchases on the one side, and would keep the other costs (such as interest on capital) as minimum as possible on the other.

The above principle can be illustrated with the help of the following formula:

where, I = the annual consumption, i.e., annual quantity used in units.

P = the ordering cost/cost per purchase order.

S = the annual cost of carrying one unit in stock for one year i.e., carrying cost percentage × cost of one unit

The above model is based on the following assumptions:

(i) The supply position of the materials will be in such a way as will enable a firm to place as many order as it desires,

(ii) Cost of materials or finished goods remains constant during the year;

(iii) Quantity-discount is not allowed;

(iv) Production and/or sales are evenly distributed over the period under consideration; and

(v) Variable inventory carrying cost per unit and ordering cost per order remain constant throughout the year.

Illustration:

Calculate the EOQ from the following particulars under:

(i) Equation Method, and

(ii) Tabular Method:

Solution:

Illustration:

Solution:

(c) The Order Point Problem:

Re-Order Point:

It indicates that level of stock at which the store-keeper initiates purchase requisition for fresh supplies of the materials for replenishing the stock, i.e., when to place order for replenishment of inventories. Needless to mention that this level is fixed somewhere between the maximum and the minimum levels.

In short, this level is fixed in such a manner so that sufficient quantity will remain in the stores in order to meet the normal and abnormal situations up to a certain period till the fresh supplies are received.

In order words, the size of the order should be equivalent to the EOQ However, this fixation depends on:

(i) The maximum delivery period and,

(ii) The maximum rate of consumption and,

(iii) The minimum or safety stock level.

Re-order point may be calculated under conditions of certainty in the following manner:

(a) With Safety Stock

Re-order point = (Average Usage of Inventory × Lead time) + Safety Stock.

(b) No Safety Stock

Re-order point = Average Usage of Inventory × Lead time

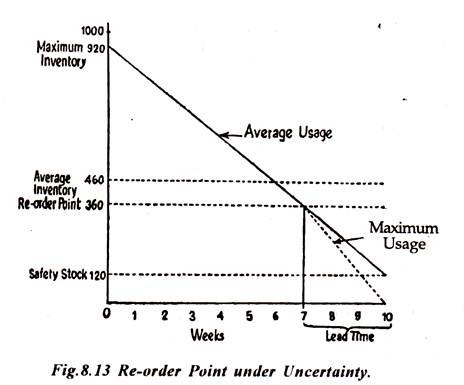

The following illustration will make the principle clear with the help of a diagram:

EOQ = 800 units.

Lead Time = 3 weeks.

Average Usage = 80 units per week.

Therefore, the EOQ 800 units are quite sufficient for 10 weeks (800 + 80). As such, if there is no lead time or the delivery of inventory is instantaneous, the new order will be placed at the end of 10th week immediately when the EOQ is exhausted or reaches zero level. But, since there is a lead time for 3 weeks, order should be placed at the end of 7th week.

Because, at that moment only 240 units will remain for the next three weeks, i.e., during the lead time So, when the lead time ends, level of inventory will reach at zero and first inventory for 800 units will arrive Thus, the re-order point is 240 unit (80 × 3).

This principle is illustrated with the help of the following diagram:

The above diagram shows that the order should be placed at the end of 7th week where there are 240 units for the lead time. At the end of 10th week, when there is no stock, first supply of 800 units will arrive. As such, if there is no lead time, the re-order point will be zero level of inventory.

(d) Safety Stock:

The EOQ and the Re-order point have been explained so far on the assumption of certainly conditions, i.e., on the assumption that there is constant or fixed usage/ requirement of inventory and instantaneous replenishment of inventory. But in reality, the same is not always possible since there is uncertainty.

For example, the demand for inventory is likely to fluctuate from time to time, particularly, the demand may exceed the anticipated level at certain points. In short, a discrepancy may arise between the expected usage and the actual usage of inventory.

Besides, the receipt of fresh inventory from the supplies may be delayed due to some abnormal situations, e.g., strikes, flood, transportation and so on, which is beyond the expected lead time.

Therefore, there will be a shortage of inventory either due to increase usage or due to slower delivery, i.e., the firm will have to face a stock-out situation which may disrupt the production schedule. As a result, it is advantageous on the part of the firm to maintain a sufficient safety margin by having surplus additional inventory against such stock-out position.

These stocks are known as Safety Stocks which will act as a buffer against the possible shortage of inventory. The safety may be defined as the ‘minimum additional inventory to serve as a safety margin or buffer or cushion to meet an unanticipated increase in usage resulting from an unusually high demand and/or an uncontrollable late receipt of incoming inventory.

Now, the question arises how do we determine the safety stock? It should be remembered that safety stock requires two types of costs, viz., stock-out costs and carrying costs.

Therefore, appropriate level of safety stocks depends on the basis of trade-off between these two costs:

Stock-Out Costs:

These relate to the costs which are associated with the shortage, of inventory. It may be considered as an opportunity cost since the firm would be deprived of certain benefits due to the shortage of inventory, viz., the loss of profits which the firm could have earned if there was no shortage of inventory and damage the relationship with the customers.

Carrying Costs:

These costs are associated with the maintenance of inventory. Additional carrying costs are involved since the firm is to maintain additional inventory in excess of normal usage.

Practically, the above two costs are counterbalancing. That is, the larger the safety stock, the larger will be the carrying costs or smaller will be the stock-out costs. In short, if carrying costs are minimized, there will be an increase in stock-out costs and vice-versa.

Therefore, the duty of the financial manager will be to have the lowest total costs, (i.e., carrying cost + stock-out costs). In other words, the appropriate level of safety stock is determined by the trade-off between the stock-out and the carrying costs.

Assume in the previous example, the reasonable expected stock-out is 40 units per week. The firm should maintain a safety stock of (40 x 3) 120 units. So, the Re-order point will be 240 + 120 = 360 units. As such, the maximum inventory will be equal to EOQ plus the safety stock, i.e., 800 units + 120 = 920 units.

Illustration:

Calculate the re-order point from the following particulars:

Annual Demand — 1,04,000 units.

Lead time — 5 weeks.

Safety Stock may be assumed to be 1,000 units.

(Sales will be made evenly through-out the period).

Solution:

1.04.000

Weekly usage/sales = 1,04,000/52 = 2,000 units.

Lead time — 5 weeks.

Re-order Level:

(i) When there is no safety stock:

2,000 units × 5 = 10,000 units.

(ii) When there is safety stock of 1,000 units:

= 10,000 + 1,000

= 11,000 units.

Problem:

Your factory buys and uses a component for production at Rs. 10 per piece. Annual requirement is 2,000 numbers Carrying cost of inventory is 10% p a. and ordering cost is Rs. 40 per order.

The purchase manager argues that as the ordering cost is very high, it is advantageous to place a single order for the entire annual requirement. He also says that if we order 2,000 at a time we can get a 3% discount from the supplier. Evaluate the proposal and make your recommendation.

Solution:

Before taking any decision, we are to find out the EOQ number which is nothing but the optimum ordering quantity where the total costs are minimum.

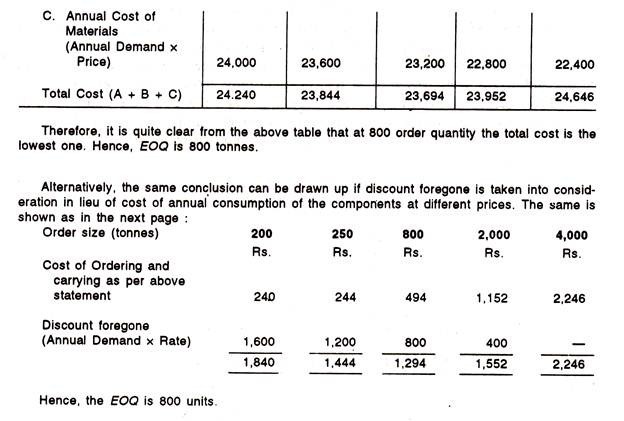

The same can be understood from the table presented below:

(After discount @ 3%)

Hence, it is justified to purchase 400 units at a time.

Problem:

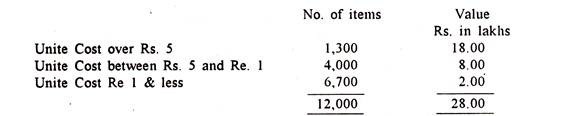

In a factory, stock verification costs work out to about 3% on inventory values and the discrepancies revealed are about 0.6% on an average.

The following table shows a breakdown of the inventory:

The management feels that verification costs are excessive. Give your opinion regarding the proposed verification.

Solution:

Before taking the actual decision on verification of inventories, the cost of verification

verification should be done in relation to the items where the latter exceeds the former

The following table is necessary for the purpose:

Inventory Valuation:

Reasons for too much emphasis on Inventory Valuation:

The following three seem to be the important reasons for too much emphasis on inventory valuation:

(i) Inventory constitutes the major bulk of current assets and it represents the major current assets investment. As such, its valuation should be made in such a way so that the profit or income is determined accurately and the Balance Sheet can exhibit a true and fair position at a particular date,

(ii) Since the inventory has a direct impact on profit, proper determination of the latter depends on the proper valuation of the former. In other words, if closing inventory is undervalued, profit will be understated or vice-versa. Besides, if the ending inventory is overvalued and is shown in the Balance Sheet, the same amounts to a case of ‘window-dressing’ which will exhibit a wrong picture about the liquidity position of a firm.

Therefore, inventory should always be valued properly so that the short term liquidity must not suffer, i.e., creditors must not be misleded. If inventory is valued properly. Balance Sheet will exhibit a true and fair view of the financial position of a firm.

(iii) The next one involves the fluctuation in commodity prices. It again seems to be a greater appreciation of the effects of these changes on the individual firm and the business community as a whole.

In the words of Paul, Garner, S.:

“It became common knowledge that the income of some enterprises for specific years was tremendously influenced by the accounting procedure adopted for handling the fluctuations in the market value of the inventory consumed in operations or sold. Many firms began to indicate in their published statements the income (or loss) before and after the ‘inventory adjustment’, as they called it. These adjustments were quickly impressed on the mind of the public with the result that increasing attention was devoted to the matter not only by accountants, but also by the students of finance, banking credit, taxation and others”.

Cost Elements:

The presentation of inventory in the annual financial statement on the basis of historical cost system of valuation is widely accepted although there are some other methods which are used for certain special cases. Historical cost of inventories is the sum total of cost of purchases including costs of conversion and certain other costs which are incurred in order to be a finished product:

Cost of Purchase:

It includes purchase price together with import duties, other purchase taxes, transport and handling costs and any other costs which are directly attributable to prime cost after deducting rebate and discounts etc.

Cost of Conversion:

It includes cost of purchases plus the production overhead (both fixed and variable overhead) which are incurred during production. But certain other costs are to be excluded from the cost of conversion, e.g., waste-material of exceptional amounts, cost of idle plant etc.

Production Overhead:

It relates to the costs of production other than the cost of direct materials and direct labours, e.g., indirect materials, indirect labours, factory expenses etc.

Other Expenses:

It includes costs which are necessary for the inventories in order to be a finished/marketable product, e.g., expenditures which are incurred in designing product for specific customers etc. The conventional method of valuation of inventories, of course, which is universally applicable at present is historical cost price or the market price value’ whichever is lower ‘.

The term ‘market price/ value’ is used to designate the ‘replacement price/value’ and ‘net realizable value’.

As such, at present inventories are valued at the lowest of:

(i) Historical cost,

(ii) Net realisable value and

(iii) Replacement price/ value.

If this method is used as a method of valuation of inventories. Profit and Loss Account will automatically be adjusted when historical cost will be more than the net realisable or replacement value.

However, market value is to be determined on the following two bases:

1. ‘Net Realisable Value’ Basis, and

2. ‘Replacement Value’ Basis.

1. Net Realisable Value Basis:

Under this concept, ‘market prices value’ is considered as the ‘net realisable value’ which is equal to the estimated selling price in the ordinary course of business minus the cost of completion. This method of valuation of inventories particularly followed where the inventories are damaged or partially obsolete.

In this case, inventories are to be valued below the historical cost since the selling price of the same items will be reduced.

As a result, historical cost for the items will not be realised and the difference will, however, be adjusted in Profit and Loss Account by writing down the inventories to the net realisable value. That is why, value of inventories must not be shown at a higher figure than its expected realisable value in future.

It should be remembered that the estimated realisable value must not be determined on the basis of temporary fluctuation of prices but on the basis of most reliable evidence.

2. Replacement Value Basis:

Under this concept, the market value is considered to be the current replacement cost which is equal to the current cost of acquisition either by purchases or by production together with the incidental and acquisition cost. This basis usually applies more appropriately to materials or purchased merchandise since calculation of replacement cost of work-in-progress or finished goods will not be an easy task.

Current cost of each element of total cost of inventory will be determined. However, current cost of raw materials and labour should be determined (with tolerable precision) by incorporating current rate of wages and materials to be multiplied by actual quantity of material or labour related to finished or semi-finished product.

It may be noted that there is a difference between replacement value and realisable value. The former represents a sacrificial value whereas the latter represents a beneficial value. At the same time, historical cost represents a sacrificial value and realised value is a beneficial value. Sometimes, market value on reproduction basis should be determined on the basis of market price of raw materials, labour and overheads.

However, the AICPA has approved certain limits for inventory valuation which have been stated by the Committee on Accounting Procedure, Bulletin 29, as under:

‘As used in the phrase ‘lower of cost or market the term ‘market’ means current replacement cost (by purchase or by production, as the case may be) except that:

(i) Market should not exceed the net realisable value (i.e. estimated selling price in the ordinary course of business less reasonably predictable costs of completion and disposal), and

(ii) Market should not be less than net realisable value reduced by an allowance for an approximately normal profit margin’

From the above, exception (ii) states not to reduce value until there is a clear apparent loss. The AICPA prefers to use ‘market value’ only to the ‘replacement or reproduction value’ and ‘net realisable value’ is treated as a separate item.

But, the Institute of Chartered Accountants of England and Wales prefers to use, lower of cost and net realisable value, ‘at the lowest of cost, net realisable value and replacement including reproduction price’ or ‘at cost less provision to reduce the net realisable value’.

Therefore, after considering the recommendations of both the Institutes, valuation should be made on the basis of the lowest of the three (stated above), with one exception imposed by AICPA. That is, if market price is found to be so lower than the net realisable value less normal profit, the latter should be considered.

Methods of Valuation of Inventory – Based of Historical Cost:

Valuation of inventory is made on a conservative basis i.e., expected profits are not to be considered whereas possible losses are to be provided for. As such, it is valued at the lowest of (i) historical cost; (ii) net realisable value and (iii) replacement price/value. The term ‘cost’ usually refers to designate the historical cost, i.e., outlay of cash or its equivalent in the acquisition of a particular item of inventory.

In other words, it is the sum total of the price paid along with all expenditures and charges directly or indirectly incurred in bringing inventory to its existing condition and’ location. Therefore, in case of materials and supplies, the price paid including freight and carriage represents their cost and sometimes a part of the storage expenditure is also included.

In case of work-in-progress, however, cost represents the sum total of direct material cost, direct wages and direct expenses including manufacturing and factory overhead.

The elements making up cost of finished goods or stock-in-trade are incurred in bringing:

(i) The purchase price of goods, stores, and in case of processed stock, materials used in manufacture,

(ii) All direct expenditures (e.g. direct wages, cost of tools, design etc.) incurred in bringing stock-in-trade to its existing condition and location; and

(iii) Indirect or overhead expenditure incidental to the class of stock-in-trade concerned.

As the production and sales cycle is a continuous and repetitive process, cost which are incurred during as accounting period at different times in order to bring an article to its existing condition and location, varies due to certain factors, viz., the seasonal effects, the efficiency of the workers, the attitude of management etc.

This variation, no doubt, creates the difficulty of identification of cost of inventories for the purpose of their valuation. Of course, the said difficulties may be overcome by certain arbitrary assumptions and, as such, different bases are generally adopted.

Some of them are enumerated below:

(a) First-in-First-out:

Under this method, materials which are received first are also issued first. In other words, the pricing of the issue of the first lot is done at the cost at which that lot was acquired. As such, the closing inventories are valued at latest purchase price and thus it will represent current condition as far as possible.

That is, closing inventories are always out of the latest lots acquired or purchased or manufactured. The same leads to represent replacement price. This method is particularly applicable where prices do not fluctuate very frequently and the materials are not fast moving.

Illustration:

In a factory, stores are issued and accounted for on FIFO method. If the stock of a particular material on 1st Jan. 1992 is 1,000 units valued at Rs. 5 per unit and the particulars of purchases and issues during the month of Jan. 1992 are as follows, prepare a statement showing how the value of issues should be arrived at:

Solution:

(b) Last-in-First Out:

Under this method, it is assumed that the materials purchased are issued in the reverse order to FIFO, i.e., the last receipt is the first issue or the latest lots of inventories are exhausted first. In short, inventories are valued at earlier purchase price.

Illustration:

In a factory, stores are issued and accounted for on LIFO method. If the stock of a particular material on 1st Jan. 1992 is 1,000 units valued at Rs. 5 per unit and the particulars of purchases and issues during the month of Jan. 1992 are as follows, prepare a statement showing how the value of issues should be arrived at:

Solution:

Average Cost Method:

Under this method, all items in the stores are mixed up in such a way that consumption of materials or sale of finished goods cannot be recognized from any particular lot of purchases. As a result, closing inventories are valued at the average cost of all the lots acquired under each type during a particular period.

The average cost may be:

(i) Simple Average Cost; and

(ii) Weighted Average Cost

(i) Simple Average Cost:

Under this method, averages of different prices are only considered without having regard to the quantities involved. The simple average cost is calculated by adding the different prices and thereafter divided by the total number of purchases. This method is applicable where there is a wide fluctuation in prices.

Illustration:

In a factory, stores are issued and accounted for on Simple Average Method. If the stock of a particular material on 1st Jan. 1992 is 1,000 units valued at Rs. 5 per unit and the particulars of purchases and issues during the month of Jan. 1992 are as follows, prepare a statement showing how the value of issues should be arrived at:

Solution:

Notes:

1st Issue Price = (Rs. 5 + Rs. 5.50)/2 = Rs. 5.25

2nd Issue Price = (Rs. 5.50 + Rs. 6)/2 = Rs. 5.75

3rd Issue Price = (Rs. 6 + Rs. 6.50)/2 = Rs. 6.25

(ii) Weighted Average Method:

Under this method, rate of average cost is calculated by taking into consideration both the prices and quantities acquired at such prices, i.e., the total value of materials in stock at the time of issue is divided by the total quantity of materials in stock in order to find out the weighted average rate.

It is superior than the ordinary Simple Average Method since it takes into account both the prices and the quantities. This method proves very useful where there is a heavy fluctuation in the prices of inventories as it tends to smooth out fluctuations in prices by taking the average cost of different lots acquired at different time. But, under this method, cost of goods sold does not represent the actual cost.

Illustration:

In a factory, stores are issued and accounted for on Weighted Average Method. If the stock of a particular material on 1st Jan. 1992 is 1,000 units valued at Rs. 5 per unit and the particulars of purchases and issues during the month of Jan. 1992 are as follows, prepare a statement showing how the value of issues should be arrived at:

Solution:

Base Stock Method:

Under this method, it is assumed that every firm has to maintain a certain minimum amount of inventory (in the form of raw materials, work-in-progress and finished goods) throughout the year. The same will have to be maintained for meeting emergency needs, such as, undue delay in supply of raw materials, excessive consumption etc.

This minimum level of inventory goes by the name of Base Stock or Safety Stock. ‘Base-Stock’ serves as the signal below which the inventory level of a firm is never allowed to fall. (Therefore, inventory, to the extent of ‘Base Stock’, though basically a class falls within the category of current assets, assumes, for all practical purposes, the character of fixed assets)

Generally, there may not be any wide variation between the volume of closing and opening inventory unless there is a remarkable change in the scale of operation and other factors. This ‘Base Stock’ level is usually created out of the first lot of the materials purchased or goods manufactured at beginning of the period and as such, it is valued at the cost price of the first lot.

Therefore, under this method, closing inventories are generally taken to be equal to the ‘Base-stock’ level and hence they are valued at the values allotted to the respective ‘Base-stock’. However, if there is any excess (over base stock level), the same should be valued either on the basis of FIFO or LIFO methods.

It should be remembered that this method is generally used with FIFO or LIFO method. There is, however, difference of opinion among the accountants as to the principles to be followed for valuation of inventories when this method is adopted.

For example, Finney and Miller suggest that ‘Base Stock’ may be valued at lowest cost experienced and valuation of closing inventory, (when it goes below base stock) should be made by deducting the value of the deficient quantity calculated at the current cost from the value of the normal quantity of base stock calculated at the base price.

Further, Yourston, Smyth and Brown suggest that ‘the difference between the replacement price and the fixed price of the basic stock is deducted from the total value of the stock on hand computed at the base price’.

This method usually is operated either in conjunction with FIFO or LIFO method. It may be observed that the objective of pricing inventories on the basis of this method is to apply the current prices to issue. So, this objective will be fulfilled only when LIFO method is adopted as a method of combination’.

Illustration:

In a factory, stores are issued and accounted for on Base Stock Method. If the stock of a particular material on 1st Jan. 1992 is 1,000 units valued at Rs. 5 per unit and the particulars of purchases and issues during the month of Jan. 1992 are as follows, prepare a statement showing how the value of issues should be arrived at:

Solution:

(e) Specific Identification Cost/Unit Cost or Actual Cost:

This method of valuation is adopted where each item of inventories and its actual cost is identifiable. It attributes certain specific costs to the identified items of inventory where each such item and its cost are identifiable. That is, this method of valuation can easily be applied where the closing inventory items can correctly be identified with specific lots.

But this method suffers from the following limitations:

(i) Where there is bulk quantities of inventories, partly finished goods or finished goods, and where individual units of inventories lose their identity.

(ii) Where there are innumerable units of inventories, keeping records for each of them becomes expensive as well as time consuming.

Other Methods of Valuation of Inventory:

– Other than those based on Historical Cost:

Some of the important methods of valuation of inventory (other than those based on historical cost) are noted below:

(a) Standard Cost Method;

(b) Inflated Cost Method,

(c) Reverse Cost Method;

(d) Replacement Cost Method, and

(e) Realisable Market Value Method.

(a) Standard Cost:

Under this method, closing inventories are valued at pre-fixed standard rates. This method is found suitable where the manufacturing units are engaged in production on a large scale. But this method cannot reveal the true value of inventory when production is completed after passing through several processes or where manufactured products are of different varieties.

At the same time, if there is a slight error in fixing the single standard rate the same will affect the measure of all items of inventory.

Illustration 6:

Follow Standard Price/Cost Method assuming that the Standard price is fixed at Rs. 5.5 per unit.

Solution:

(b) Inflated Cost Method:

Under this method, closing inventories are valued at a cost per unit which is higher than the actual cost per unit to provide for the normal loss due to certain inherent in them, e.g., loss due to evaporation, shrinkage etc.

(c) Reserve Cost Method:

Under this method, inventories are valued at an estimated cost which is determined by deducting an amount equivalent to the normal profit margin and the estimated cost of disposal from the current selling prices. This method is also referred to as ‘Adjusted Selling Price’.

(d) Replacement Cost Method:

Under this method, each closing item of inventory is valued at cost which is to be incurred for purchasing/procuring the said item from the open market on the date of valuation, i.e., they are valued at the replacement cost as on that date. This cost of replacement should be determined in relation to the current market price of similar items.

(e) Realisable Market Value:

Under this method, each closing item of inventory is valued at its estimated net realisable value. The net realisable value, i.e., prospective selling price less all prospective costs to be incurred in conditioning and selling the goods, may be adopted suitably for the purpose of valuation.

Determining the More Appropriate Method:

This method of valuation of inventory discussed so far are suitable to specific circumstances, i.e., all methods are not applicable in all cases. The method which is most suitable to the specific case should be adopted. The Recommendations of the Institute of Chartered Accountants of England and Wales are helpful in this context.

According to them, ‘No particular basis of valuation is suitable for all types of business but whatever the basis adopted, it should be applied consistently year after year.

But before applying the same, the following points should be considered:

(i) In what way does the product actually (Physically) flow into production and sales, that is, are the oldest units disposed of first, or are the newest units disposed of first, or are the items acquired at different times mixed together in such a way as to make them indistinguishable from the standpoint of disposal priority?

(ii) Which method or methods, have the tendency to ‘smooth out’ the reported periodic progress figures for the individual business firm?

(iii) Which method provides the most conservative (lowest in amount) inventory figure for the end-of-period Balance Sheet?

(iv) Which method provides the most useful type of cost of production and cost of sales figures for control and internal management purposes?

(v) What method provides the most useful figure for aid in determining selling prices in so far as selling prices may be influenced by expired costs and expense?

(vi) Which method conies closest to carrying out the concept of historical accounting?

Some accountants prefer to use ‘Unit Cost’ or ‘FIFO’ method for valuation while others are favouring ‘LIFO’ method. The ‘Average Cost’ method may also be suggested by some other accountants.

In making a selection between FIFO and LIFO, it becomes necessary to decide first whether current costs should be applied to the inventory (under FIFO method) or the same should be matched against current revenues (under LIFO method). That is, FIFO method places emphasis on the Balance Sheet while LIFO method places emphasis on Profit and Loss Account.

During periods of changing costs and prices, more meaningful statements of profits are produced if current costs are applied to current sales, thus achieving a better matching of costs and revenues. On the contrary, if LIFO method is followed, the closing inventory will be valued at replacement price.

Therefore, like FIFO, it does not lead to a misstatement of working capital position in the Balance Sheet. Although the LIFO advocates contend that achieving a more appropriate matching of costs against revenues is such an important objective as it offsets the ‘incorrect’ Balance Sheet result, the fact remains that, conceivably inventory qualities might eventually be priced at such ‘old’ costs as to produce a misstatement of working capital position that would be seriously misleading.

The average cost method may be applied during periods of price fluctuations and the same is most suitable where several production process are involved in manufacturing concerns. However, whatever method a firm adopts, the same should be applied consistently year after year.